PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910498

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910498

North America Dietary Supplement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

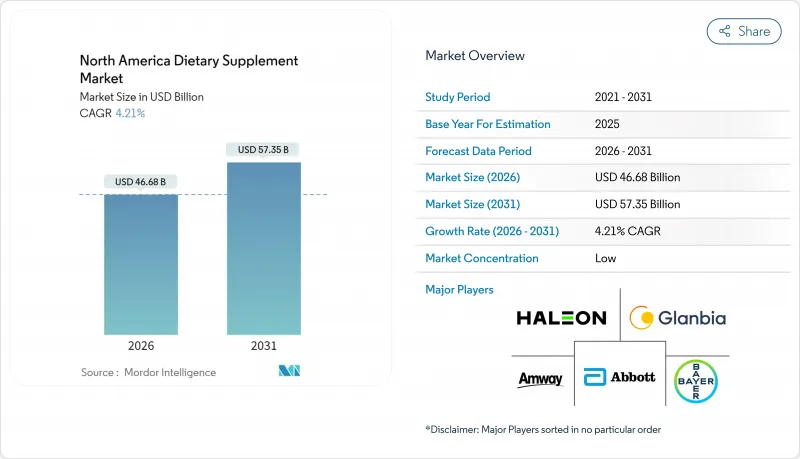

The North America dietary supplements market was valued at USD 44.79 billion in 2025 and estimated to grow from USD 46.68 billion in 2026 to reach USD 57.35 billion by 2031, at a CAGR of 4.21% during the forecast period (2026-2031).

As the market matures, growth opportunities are increasingly tied to innovations in delivery formats, condition-specific blends, and personalized offerings tailored to individual health needs. The demand for vitamins and minerals continues to dominate revenue generation; however, botanicals are experiencing the fastest growth due to a rising consumer preference for holistic, plant-based solutions. Mexico, supported by a growing middle class and improved retail access, is expanding at a faster pace compared to the United States and Canada, contributing significantly to the region's overall growth. At the same time, regulatory tightening by the U.S. FDA and stricter retailer quality mandates are driving up compliance costs. These changes are pushing brands to adopt higher transparency standards and focus on science-backed claims to maintain consumer trust and market competitiveness.

North America Dietary Supplement Market Trends and Insights

High Health Consciousness Driving Consistent Use of Supplements

Increasing health consciousness among consumers is a significant driver of consistent supplement usage. The growing awareness of the benefits of dietary supplements, such as improved immunity, enhanced energy levels, and overall well-being, has led to a surge in demand. According to the Council for Responsible Nutrition Survey 2023, nearly 74% of adults in the United States reported using dietary supplements, with multivitamins being the most commonly consumed. This trend is further supported by government initiatives, such as the Dietary Guidelines for Americans, which emphasize the importance of meeting nutritional needs through a combination of food and supplements when necessary. Additionally, the U.S. Food and Drug Administration (FDA) regulates dietary supplements to ensure safety and accurate labeling, further boosting consumer confidence. As consumers increasingly prioritize preventive healthcare and holistic wellness, the consistent use of dietary supplements is expected to remain a key factor driving market growth during the forecast period.

Supplements Targeting Women Consumers Fueling Growth

The increasing demand for dietary supplements targeting women is significantly driving the growth of the market. Women-specific supplements, including prenatal vitamins, calcium, and iron supplements, are gaining traction due to rising awareness about women's health and wellness. According to the Office on Women's Health (OWH), a division of the U.S. Department of Health and Human Services, women have unique nutritional needs at different life stages, such as during pregnancy, lactation, and menopause . This has led to a growing emphasis on tailored dietary supplements to address these specific requirements. Additionally, the increasing prevalence of lifestyle-related health issues among women, such as osteoporosis and anemia, further boosts the demand for these products. The trend is supported by government initiatives promoting women's health and nutrition, which are expected to sustain market growth during the forecast period.

Counterfeit Products Hindering Growth

The surge of counterfeit dietary supplements, especially via online platforms, jeopardizes both market expansion and consumer confidence. In the North American Dietary Supplements Market, counterfeit products have emerged as a critical restraint, undermining the credibility of genuine brands and creating significant challenges for regulatory authorities. The ease of access to counterfeit goods through e-commerce channels has further exacerbated the issue, making it difficult for consumers to differentiate between authentic and fake products. This not only impacts the revenue of legitimate manufacturers but also raises concerns about consumer safety, as counterfeit supplements often fail to meet quality and safety standards. Furthermore, the presence of counterfeit goods dilutes brand loyalty and trust, which are essential for the sustained growth of the dietary supplements market. Addressing this issue requires stringent regulatory measures, increased consumer awareness, and collaboration between stakeholders to safeguard the market's integrity. Governments and regulatory bodies in North America are increasingly focusing on implementing advanced tracking and tracing technologies, such as blockchain, to ensure product authenticity.

Other drivers and restraints analyzed in the detailed report include:

- Strong Fitness and Wellness Culture Boosts Sports Supplement Sales

- Prevalence of Chronic Disease Propelling the Market Growth

- Growing Preference for Whole Foods Over Supplements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vitamins and minerals accounted for 31.02% of the market share in 2025, driven by their widespread acceptance among physicians and the proven efficacy of standardized doses. These products remain a cornerstone of the market, offering consumers reliable and trusted options for their nutritional needs. However, the market is also witnessing a notable shift, as herbal and botanical supplements gain traction. These products are projected to grow at a robust CAGR of 6.28% through 2031, outpacing the overall market growth. This surge is fueled by increasing consumer interest in holistic health solutions, prompting brands to innovate with adaptogens like ashwagandha and functional mushrooms, which are now integral to immune and stress support blends.

Another significant trend shaping the market is the diversification of supplement delivery formats. While capsules remain the dominant choice for vitamin delivery due to their convenience and familiarity, newer formats such as tinctures, shots, and gummies are driving innovation in the botanical segment. These alternative formats cater to consumer preferences for flavor variety and portability, making them particularly appealing for on-the-go lifestyles. This shift reflects the growing demand for products that combine functionality with convenience, allowing consumers to seamlessly integrate dietary supplements into their daily routines. As a result, brands are increasingly focusing on developing products that align with these evolving preferences. Ingredient suppliers are also playing a crucial role in supporting this market transformation.

In 2025, women accounted for 55.63% of all buyers, a trend fueled by the availability of targeted SKUs specifically designed to address their health needs. These SKUs include products enriched with iron, folate, collagen, and hormonal balance supplements, catering to various life stages and health concerns. This focus on women's health has driven significant engagement in the dietary supplements market, highlighting the importance of tailored solutions. Meanwhile, the children's segment, although smaller in size, is projected to grow at an impressive 5.41% CAGR through 2031, surpassing the growth rate of the overall market. This growth is largely attributed to the increasing popularity of gummies fortified with essential nutrients like calcium and DHA, which make daily dosing more convenient and appealing for children. These products address the nutritional gaps in children's diets while ensuring ease of consumption, which is a key factor for parents.

Digital health platforms are playing a pivotal role in enhancing the adoption of dietary supplements for children. By partnering with pediatricians, these platforms provide dosing reminders and educational resources that help parents make informed decisions about their children's health. This collaboration fosters trust among parents, encouraging repeat purchases and long-term brand loyalty. For women, the demand for prenatal and menopausal supplement ranges continues to dominate the market. These ranges include clinically validated formulations such as calcium-magnesium complexes and phytoestrogen supplements, which are positioned as effective non-prescription options. These products are designed to support lifelong bone density and alleviate symptoms associated with menopause, addressing critical health concerns for women. The emphasis on clinically studied ingredients further reinforces consumer confidence, driving sustained growth in this segment.

The North America Dietary Supplement Market is Segmented by Product Type (Vitamins, Minerals, and More), Form (Tablets, Capsules & Softgels, and More), Source (Plant-Based, and More), Consumer Group (Men, and More), Health Application (General Health & Wellness, and More), Distribution Channel (Supermarkets/Hypermarkets, and More), Geography (United States and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Amway Corp.

- Glanbia PLC

- Haleon PLC

- Bayer AG

- Nestle S.A.

- Herbalife Nutrition Ltd.

- NOW Foods

- Church & Dwight Co. (Vitafusion)

- Pharmavite LLC

- USANA Health Sciences

- GNC Holdings

- Nature's Way

- Nutraceutical International Corp.

- Jamieson Wellness

- SmartyPants Vitamins

- Plexus Worldwide

- Thorne Research

- Carlson Labs

- Standard Process Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High health consciousness driving consistent use of supplements

- 4.2.2 Supplements Targeting Women Consumers Fueling Growth

- 4.2.3 Strong fitness and wellness culture boosts sports supplement sales

- 4.2.4 Aging baby boomer population fuels demand for targeted nutrition

- 4.2.5 Prevalence of Chronic Diseases Propelling the market Growth

- 4.2.6 Increased Focus on Immune Health Driving the Market Growth

- 4.3 Market Restraints

- 4.3.1 Counterfeit Products Hindering Growth

- 4.3.2 Growing preference for whole foods over supplements

- 4.3.3 Rising scrutiny over unregulated or mislabeled products

- 4.3.4 Regulatory Compliance Challenges for Exports

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vitamins

- 5.1.2 Minerals

- 5.1.3 Fatty Acids

- 5.1.4 Protein and Amino Acids

- 5.1.5 Prebiotic & Probiotic Supplements

- 5.1.6 Herbal Supplements

- 5.1.7 Enzymes

- 5.1.8 Blended Supplements

- 5.1.9 Others

- 5.2 By Form

- 5.2.1 Tablets

- 5.2.2 Capsules & Softgels

- 5.2.3 Powders

- 5.2.4 Gummies

- 5.2.5 Liquids

- 5.2.6 Others

- 5.3 By Source

- 5.3.1 Plant-based

- 5.3.2 Animal-based

- 5.3.3 Synthetic/Fermentation-derived

- 5.4 By Consumer Group

- 5.4.1 Mens

- 5.4.2 Womens

- 5.4.3 Kids/Childrens

- 5.5 By Health Application

- 5.5.1 General Health & Wellness

- 5.5.2 Bone and Joint Health

- 5.5.3 Energy and Weight Management

- 5.5.4 Gastrointestinal and Gut Health

- 5.5.5 Immunity Enhancement

- 5.5.6 Cardiovascular Health

- 5.5.7 Diabetes Management

- 5.5.8 Cognitive & Mental Health

- 5.5.9 Skin, Hair and Nail Care

- 5.5.10 Eye Health

- 5.5.11 Other Health Applications

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets & Hypermarkets

- 5.6.2 Specialty Stores

- 5.6.3 Online Retail Channels

- 5.6.4 Direct Selling

- 5.6.5 Other Distribution Channels

- 5.7 By Geography

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

- 5.7.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Abbott Laboratories

- 6.4.2 Amway Corp.

- 6.4.3 Glanbia PLC

- 6.4.4 Haleon PLC

- 6.4.5 Bayer AG

- 6.4.6 Nestle S.A.

- 6.4.7 Herbalife Nutrition Ltd.

- 6.4.8 NOW Foods

- 6.4.9 Church & Dwight Co. (Vitafusion)

- 6.4.10 Pharmavite LLC

- 6.4.11 USANA Health Sciences

- 6.4.12 GNC Holdings

- 6.4.13 Nature's Way

- 6.4.14 Nutraceutical International Corp.

- 6.4.15 Jamieson Wellness

- 6.4.16 SmartyPants Vitamins

- 6.4.17 Plexus Worldwide

- 6.4.18 Thorne Research

- 6.4.19 Carlson Labs

- 6.4.20 Standard Process Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK