PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846156

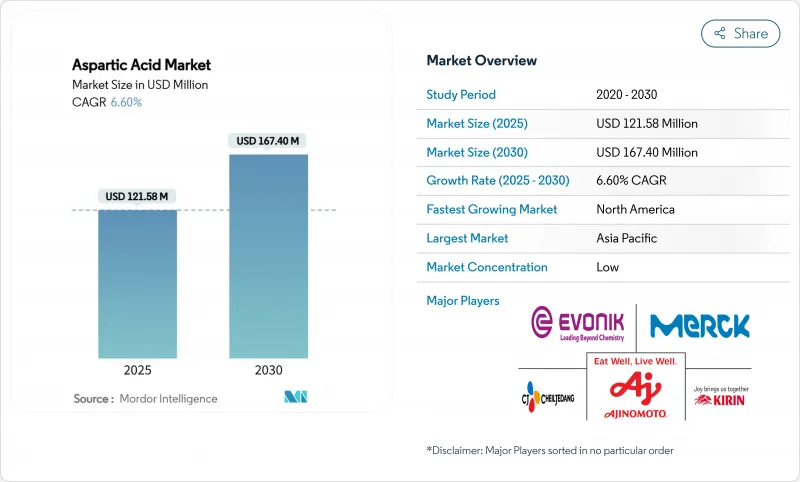

Aspartic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aspartic Acid market is valued at USD 121.58 million in 2025 and is expected to reach USD 167.40 million by 2030, registering a CAGR of 6.60%.

The market demonstrates consistent growth due to its essential applications across multiple industries. Aspartic Acid serves as a key component in food and beverage manufacturing, particularly in the production of artificial sweeteners like aspartame, which enables the development of sugar-free and low-calorie products aligned with consumer preferences. In pharmaceuticals, aspartic acid plays a vital role in medication and supplement formulations, supporting both therapeutic and nutritional needs. The market growth is also driven by its applications in sustainable industrial processes, including biodegradable polymers and phosphate-free detergents, which align with current environmental regulations. The increasing demand for performance nutrition and dietary supplements has enhanced aspartic acid usage in sports and wellness products. The expanding application range, coupled with improvements in bio-fermentation production techniques, establishes aspartic acid as an essential component in health-focused and sustainable solutions.

Global Aspartic Acid Market Trends and Insights

Increasing demand for Aspartic acid in Asian Detergent Additives

The aspartic acid market is experiencing substantial growth, primarily driven by its increasing incorporation in Asian detergent additives. This expansion is fundamentally shaped by evolving consumer preferences, stringent regulatory frameworks, and continuous product innovations across the region. In the Asia-Pacific region, heightened environmental awareness has significantly influenced consumer purchasing patterns toward eco-friendly laundry detergents. This trend is evidenced by data from the Ministry of Internal Affairs and Communications, which reported that Japanese households allocated an average of 4.5 thousand yen to laundry detergents in 2023 . In response to this market evolution, detergent manufacturers have strategically reformulated their product portfolios to include biodegradable and non-toxic components. Aspartic acid-derived polymers have emerged as a crucial ingredient in these formulations, offering dual benefits of environmental sustainability and superior performance as scale and halite inhibitors. This shift toward sustainable detergent additives in the Asian market continues to strengthen the global demand for aspartic acid, establishing a robust growth trajectory for the market.

Growing Demand for D-Aspartic Acid in Male-Fertility Sports Nutrition

The escalating demand for D-aspartic acid (DAA) in male fertility and sports nutrition is a key growth driver for the aspartic acid market, strongly supported by both demographic trends and market innovation. According to the Central Intelligence Agency (CIA) data for 2024, Taiwan and South Korea reported fertility rates of 1.11 and 1.12 children per woman, respectively, the lowest worldwide, highlighting a significant fertility challenge in East Asia. This demographic situation has intensified consumer and government attention on reproductive health solutions. The scientific validation of D-aspartic acid's role in enhancing sperm production and motility has increased its adoption in fertility supplements. Companies are introducing new products incorporating D-Aspartic Acid with complementary fertility-enhancing ingredients to address male reproductive health needs. These supplements target both fertility-focused consumers and sports nutrition users, marketed for their benefits in sperm quality improvement, hormonal regulation, and athletic performance enhancement. The convergence of fertility concerns and sports nutrition requirements continues to strengthen the market position of D-Aspartic Acid, indicating sustained growth potential in the aspartic acid market.

Stringent Labeling Rules on Long-Term D-Aspartate Supplementation

Regulatory requirements for D-aspartic acid (DAA) supplementation labeling constrain the aspartic acid market by affecting product formulation, marketing, and consumer acceptance. Health Canada and the Food and Drug Administration (FDA) enforce comprehensive labeling requirements for dietary supplements, including cautionary statements, dosage limits, and health claim restrictions. The Food and Drug Administration (FDA)'s February 2025 aspartame review indicates increased scrutiny of amino acid supplements and their health claims. While these regulations protect consumers, they create challenges for manufacturers of high-dose or long-term D-aspartic acid supplements through compliance costs and reduced market potential. The requirement for scientific validation of safety and efficacy for new dietary ingredients like D-aspartic acid further complicates and delays product approvals. These regulatory requirements limit market expansion by creating obstacles for product development, marketing, and consumer confidence in D-aspartic acid supplements.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Subsidies for Green Amino-Acid Manufacturing

- Increase in the Adoption of Biodegradable Polyaspartic Super-Absorbents in Agriculture

- Shelf-Life Instability of Aspartic-Based Chelators in High-pH Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

L-Aspartic Acid dominates the market with a 71.16% share in 2024. This significant market position stems from its essential role across multiple industries. In the food sector, L-Aspartic Acid is essential for aspartame synthesis, a common artificial sweetener in food and beverage manufacturing, meeting the increasing demand for low-calorie and sugar-free products. The compound is also vital in pharmaceutical formulations as a component for drugs and supplements, and in industrial detergent manufacturing as a chelating agent that improves cleaning performance. The established production infrastructure and broad industrial applications of L-Aspartic Acid strengthen its market position.

D-Aspartic Acid represents the market's fastest-growing segment, with a projected CAGR of 7.93% from 2025 to 2030. This growth results from its increased use in performance nutrition and reproductive health supplements. The compound has gained recognition for supporting hormonal balance, particularly testosterone levels, making it valuable in sports nutrition products for athletes and fitness enthusiasts. Its role in male reproductive health has also increased its presence in fertility supplements. The combination of growing consumer interest in fitness, athletic performance, and reproductive health, along with research supporting D-Aspartic Acid's effectiveness, drives its market expansion in specialized health and nutrition products.

Bio-fermentation has established itself as the predominant production methodology for aspartic acid, commanding 59.36% of the market share in 2024 and exhibiting substantial growth potential with an 8.32% CAGR through 2030. This market dominance is attributed to its operational cost-effectiveness, production scalability, and environmental sustainability characteristics, rendering it particularly advantageous for large-scale industrial applications. The methodology employs specific microorganisms for the conversion of raw materials into aspartic acid, consequently minimizing environmental impact while addressing increasing market requirements for sustainable manufacturing protocols. The bio-fermentation process has gained significant traction in the food and beverage industry, where it serves as an essential component in the large-scale production of aspartic acid, particularly for sweetener applications such as aspartame, where production volume and quality consistency are paramount considerations.

Chemical synthesis methodologies maintain a substantial market presence in the aspartic acid industry, particularly in applications necessitating expedited processing capabilities, precise yield control, and consistent product specifications. The methodology encompasses the transformation of maleic anhydride or fumaric acid through established processes of ammonolysis or reductive amination, providing manufacturers with predictable cost structures and well-established industrial supply chain networks. This production approach remains particularly viable in geographical regions characterized by developed petrochemical infrastructure or areas experiencing limitations in fermentation feedstock availability. Furthermore, chemical synthesis facilitates the production of multiple aspartic acid variants, including L-aspartic acid and D-aspartic acid, thereby addressing increasing demand requirements within pharmaceutical and nutraceutical manufacturing applications.

The Aspartic Acid Market is Segmented by Product Type (L-Aspartic Acid, and D-Aspartic Acid), by Production Method (Bio-Fermentation, and More), by Purity Grade (Food Grade, Pharmaceutical Grade, and More), by Application (Food and Beverages, Nutraceuticals and Dietary Supplements, and More), and by Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 43.76% of the aspartic acid market, supported by its manufacturing infrastructure, feedstock availability, and increasing domestic demand across end-use sectors. China leads the regional production capacity through government and private sector investments in amino acid manufacturing facilities. The country's agricultural strength provides a significant advantage; the United States Department of Agriculture (USDA)'s Grain and Feed Update reports China's corn production reached 294.9 million metric tons in MY 2024/25, a 2% increase from the previous year . This corn production growth increases the availability of fermentation feedstocks, including glucose and starch derivatives, essential for L- and D-aspartic acid production through bio-fermentation. The region maintains its market leadership through an integrated production-to-consumption system, driven by urbanization, increasing incomes, and changing health preferences.

North America demonstrates the highest regional growth rate, with a projected CAGR of 8.91% from 2025 to 2030. This growth stems from increased demand in pharmaceutical and nutraceutical sectors, where aspartic acid is essential for amino acid therapies, dietary supplements, and hormone-regulating compounds. The United States and Canada excel in commercializing functional ingredients, backed by robust research and development infrastructure and a regulated market environment that supports innovation. The region's focus on sports nutrition, clinical nutrition, and clean-label formulations drives advanced applications of aspartic acid and its derivatives. The growth of contract manufacturers and biotechnology companies enables rapid production scaling to meet emerging health trends.

Europe maintains its market position through regulatory requirements and sustainability initiatives. The European Union's phosphate ban has increased the use of aspartic acid derivatives in detergents and water treatment applications as alternatives to phosphate-based chelating agents. The region's commitment to biodegradable solutions has increased the adoption of aspartic acid-based polymers in agricultural applications for water retention and nutrient delivery systems. The United Kingdom market demonstrates growth potential due to consumer preference for sugar-free alternatives and government support for environmentally friendly materials. Europe's pharmaceutical industry utilizes aspartic acid in drug formulations, contributing to the region's diverse application range and market stability.

- Ajinomoto Co. Inc.

- Evonik Industries AG

- Kirin Holdings Company

- CJ CheilJedang Corp.

- Merck KGaA

- DIC Corporation

- Alpspure Lifesciences Private Limited

- Iris Biotech GmbH

- Fengchen Group Co.,Ltd

- AnaSpec Inc.

- Simson Pharma Limited

- Bio-Techne Corporation

- Alpha Chemika

- Zhangjiagang Huachang Pharmaceutical Co.,Ltd.

- CDH Fine Chemical

- Kishida Chemical Co.,Ltd. Manufacturer

- Tokyo Chemical Industry Co.

- Anmol Chemicals Pvt.Ltd

- Aditya Chemicals Limited

- AvansChem Speciality Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Increasing demand for Aspartic acid in Asian Detergent Additives

- 4.1.2 Growing Demand for D-Aspartic Acid in Male-Fertility Sports Nutrition

- 4.1.3 Rise in Subsidies for Green Amino-Acid Manufacturing

- 4.1.4 Increase in the Adoption of Biodegradable Polyaspartic Super-Absorbents in Agriculture

- 4.1.5 Growing Demand for Aspartic-Based Chelating Agents owing to Phosphate Ban in EU

- 4.1.6 Increasing industrialization and disposable income in developing countries

- 4.2 Market Restraints

- 4.2.1 Stringent Labeling Rules on Long-Term D-Aspartate Supplementation

- 4.2.2 Shelf-Life Instability of Aspartic-Based Chelators in High-pH Systems

- 4.2.3 Competition from alternative amino acids and sweeteners in various applications

- 4.2.4 Price volatility of key raw materials impacts manufacturing costs and market stability

- 4.3 Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 L-Aspartic Acid

- 5.1.2 D-Aspartic Acid

- 5.2 By Production Method

- 5.2.1 Bio-fermentation

- 5.2.2 Chemical Synthesis

- 5.3 By Purity Grade

- 5.3.1 Food Grade

- 5.3.2 Pharmaceutical Grade

- 5.3.3 Industrial Grade

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.2 Nutraceuticals and Dietary Supplements

- 5.4.3 Pharmaceuticals

- 5.4.4 Cosmetics and Personal Care

- 5.4.5 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ajinomoto Co. Inc.

- 6.4.2 Evonik Industries AG

- 6.4.3 Kirin Holdings Company

- 6.4.4 CJ CheilJedang Corp.

- 6.4.5 Merck KGaA

- 6.4.6 DIC Corporation

- 6.4.7 Alpspure Lifesciences Private Limited

- 6.4.8 Iris Biotech GmbH

- 6.4.9 Fengchen Group Co.,Ltd

- 6.4.10 AnaSpec Inc.

- 6.4.11 Simson Pharma Limited

- 6.4.12 Bio-Techne Corporation

- 6.4.13 Alpha Chemika

- 6.4.14 Zhangjiagang Huachang Pharmaceutical Co.,Ltd.

- 6.4.15 CDH Fine Chemical

- 6.4.16 Kishida Chemical Co.,Ltd. Manufacturer

- 6.4.17 Tokyo Chemical Industry Co.

- 6.4.18 Anmol Chemicals Pvt.Ltd

- 6.4.19 Aditya Chemicals Limited

- 6.4.20 AvansChem Speciality Chemicals

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK