PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846174

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846174

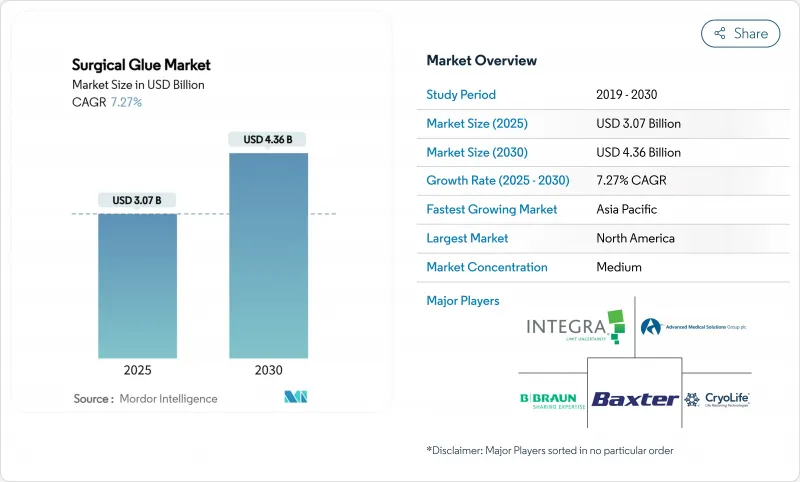

Surgical Glue - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical glue market size stands at USD 3.07 billion in 2025 and is forecast to reach USD 4.36 billion by 2030, advancing at a 7.27% CAGR.

Robust growth follows rising procedure volumes, continual formulation breakthroughs, and the shift toward faster wound closure methods that align with robotic-assisted surgery requirements. Hospitals accelerate product uptake as they standardize protocols that limit infection risk and shorten operating room time. Synthetic and semi-synthetic products penetrate high-value specialties where engineered consistency outperforms biologic predecessors. North American leadership rests on efficient regulatory pathways, while Asia-Pacific expansion reflects health-system investments that widen access to advanced adhesives. Competitive intensity rises as incumbents and start-ups integrate sensor-enabled dispensers and develop bio-resorbable variants that address sustainability targets.

Global Surgical Glue Market Trends and Insights

Rising Surgical Procedure Volumes

Global procedure counts exceed pre-pandemic levels as health systems clear backlogs and expand capacity. Ageing populations in developed economies undergo more complex interventions that favour adhesive solutions over sutures due to shorter closure times and reduced needle-related trauma. Medicare spending on ambulatory surgical center procedures rose 5.7% to USD 6.8 billion in 2024, underscoring a shift toward outpatient care models that prioritise rapid turnover. Synthetic cyanoacrylate and hydrogel brands benefit because providers seek standardized performance across specialties. In emerging markets, growth in orthopaedic and trauma surgeries adds incremental volume that sustains double-digit regional demand. Suppliers that maintain broad regulatory clearances capture volume wherever procedure mix widens.

Growing Preference for Faster Wound Closure & Lower Infection Risk

Clinical evidence shows contemporary adhesives shorten operating room time by up to 30% compared with sutures, which frees staff and reduces anaesthesia exposure. Products like the DERMABOND PRINEO system form waterproof microbial barriers that help lower surgical site infection rates. Financial models confirm that shorter stays and lower complication rates improve margins in value-based reimbursement frameworks. Cosmetic and paediatric surgeons adopt glues to enhance aesthetic outcomes and avoid needle marks. Payors recognise the downstream savings and increasingly reimburse premium closure kits that demonstrate cost-effectiveness. This environment accelerates uptake of next-generation cyanoacrylate blends and polymeric hydrogels that deliver rapid set times and secure microbial seals.

Shift Toward Minimally-Invasive & Suture-Free Devices

Energy-based closure tools such as ultrasonic sealers and staple-free laparoscopic clips lessen reliance on adhesives in certain gastrointestinal and thoracic procedures. Device OEMs market these alternatives on claims of faster application and zero chemical residue. In response, glue suppliers engineer sprayable formats and extend cannula lengths to suit reduced port sizes. Partnerships with trocar manufacturers aim to keep adhesives embedded within evolving minimally invasive workflows. Success will depend on demonstrating comparable or better leak rates than staple-free devices under real-world conditions.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Cyanoacrylate & Hydrogel Formulations

- Adverse Reactions & Cytotoxicity of Some Synthetic Glues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural biomaterials dominated surgical glue market share at 59.51% in 2024, reflecting clinician familiarity with fibrin and collagen compositions that align with innate healing pathways. Their leadership is visible in neurosurgery, where fibrin sealants achieved 92.1% watertight closure versus 38% for sutures. Nonetheless synthetic and semi-synthetic lines are on course to expand at a 13.25% CAGR to 2030, driven by cyanoacrylate blends that bond rapidly and hydrogels that swell to fill irregular voids. Polyurethane and elastomeric chemistries capture specialised cardiothoracic niches where elastic modulus must match beating tissue. Polymeric hybrid platforms further narrow the performance gap by embedding biologic peptides within synthetic scaffolds. As these materials gain clinical validation, the surgical glue market size attributed to synthetic products is expected to overtake biologics in high-acuity service lines after 2028.

Natural glues retain an edge in regulatory clearance due to extensive safety histories, which simplifies hospital value analysis committee reviews. They also fit green procurement policies, because manufacturing leverages renewable raw materials. Conversely, synthetic suppliers tout batch-to-batch consistency and longer shelf stability that appeal to large integrated delivery networks. Guidance from the PMDA encourages dual sourcing to ensure continuity during plasma shortages. Vendors that masterfully blend bio-resorbability with tensile strength will consolidate leadership positions in this intensifying duel between nature and chemistry.

The Surgical Glue Market Report is Segmented by Product Type (Natural [Fibrin, and More], Synthetic and Semi Synthetic [Cyanoacrylate, and More]), Application (Cardiovascular Surgery, Orthopedic Surgery, General Surgery, Cosmetic Surgery, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the global landscape with 39.32% surgical glue market share in 2024. High procedure volumes within United States academic medical centres, favourable CMS coverage, and FDA clearance of innovations such as Cutiva PLUS in August 2024 underpin the region's primacy. Canadian health systems adopt similar adhesives through reciprocal regulatory pathways, while Mexico expands private hospital capacity that sources technology via cross-border distributors. Market leaders co-locate clinical research units near U.S. teaching hospitals to accelerate post-market studies and guideline inclusion.

Asia-Pacific is projected to post the fastest 9.61% CAGR through 2030. Japan's PMDA streamlined review process shortens approval cycles for high-risk medical devices including bio-resorbable glues, stimulating domestic R&D collaboration. China's hospital build-out raises demand for trauma sealants, and provincial governments allocate budgets for robotic suites that require precision adhesives. India's medical tourism growth spurs aesthetic and cardiac surgeries, fostering import demand. South Korea and Australia reinforce regional momentum via early adoption of sensor-guided dispensers in tertiary centres.

Europe remains a mature yet innovation-friendly environment. EMA harmonisation allows rapid multi-country launches of PEG hydrogels that prevent cerebrospinal leaks. Germany and France favour products that meet strict biocompatibility and sustainability criteria, catalysing interest in green-OR adhesives. The United Kingdom's NHS procurement consortia negotiate value-based contracts that bundle sealants with laparoscopic toolkits, thus shaping supplier margins. Middle East and Africa progress at varied paces; Gulf states invest in robotics-ready operating rooms, while sub-Saharan markets emphasise trauma adhesives for road-traffic injury response. South American growth concentrates in Brazil, where ANVISA alignment with ISO 10993 accelerates clearance of polyurethane and fibrin blends that serve orthopaedic and cardiothoracic procedures.

- Adhesys Medical

- Advanced Medical Solutions Group

- B. Braun

- Baxter

- Cardinal Health

- CryoLife

- Integra LifeSciences Corp.

- LifeBond Ltd.

- Medtronic

- Ethicon (Johnson & Johnson)

- Solventum Corporation

- Adhezion Biomedical

- Sealantis Ltd.

- Grifols

- Becton Dickinson & Co.

- Stryker

- Cohera Medical

- Polyganics BV

- Tissium SA

- Chemence Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Surgical Procedure Volumes

- 4.2.2 Growing Preference For Faster Wound Closure & Lower Infection Risk

- 4.2.3 Technological Advances In Cyanoacrylate & Hydrogel Formulations

- 4.2.4 Increasing Incidences Of Road Accidents

- 4.2.5 Adoption Of Robotic Surgery Demanding High-Precision Adhesives

- 4.2.6 Demand For Bio-Resorbable Green-OR Glues

- 4.3 Market Restraints

- 4.3.1 Shift Toward Minimally-Invasive & Suture-Free Devices

- 4.3.2 Adverse Reactions & Cytotoxicity Of Some Synthetic Glues

- 4.3.3 Plasma-Derived Glue Sterilization & Supply-Chain Bottlenecks

- 4.3.4 Reimbursement Caps On Premium Sealants In Ambulatory Settings

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Natural

- 5.1.1.1 Fibrin

- 5.1.1.2 Collagen

- 5.1.1.3 Gelatin

- 5.1.2 Synthetic & Semi-synthetic

- 5.1.2.1 Cyanoacrylate

- 5.1.2.2 Polymeric Hydrogel

- 5.1.2.3 Urethane-based Adhesive

- 5.1.1 Natural

- 5.2 By Application

- 5.2.1 Cardiovascular Surgery

- 5.2.2 Orthopedic Surgery

- 5.2.3 General Surgery

- 5.2.4 Cosmetic Surgery

- 5.2.5 Pulmonary Surgery

- 5.2.6 Central Nervous System Surgery

- 5.2.7 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Adhesys Medical

- 6.3.2 Advanced Medical Solutions Group plc

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 Baxter International Inc.

- 6.3.5 Cardinal Health Inc.

- 6.3.6 CryoLife Inc.

- 6.3.7 Integra LifeSciences Corp.

- 6.3.8 LifeBond Ltd.

- 6.3.9 Medtronic plc

- 6.3.10 Ethicon (Johnson & Johnson)

- 6.3.11 Solventum Corporation

- 6.3.12 Adhezion Biomedical

- 6.3.13 Sealantis Ltd.

- 6.3.14 Grifols International

- 6.3.15 Becton Dickinson & Co.

- 6.3.16 Stryker Corp.

- 6.3.17 Cohera Medical

- 6.3.18 Polyganics BV

- 6.3.19 Tissium SA

- 6.3.20 Chemence Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment