PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846179

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846179

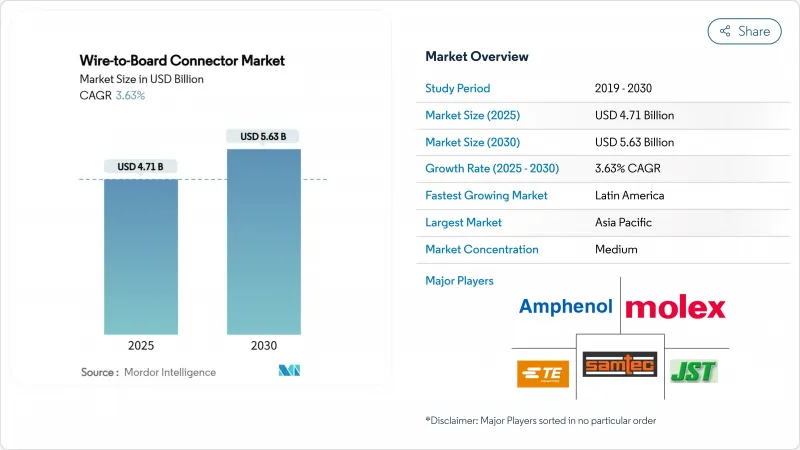

Wire-to-Board Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The wire-to-board connector market size stands at USD 4.71 billion in 2025 and is projected to reach USD 5.63 billion by 2030, reflecting a 3.63% CAGR over the forecast period.

Steady expansion stems from rising demand in electric vehicles (EVs), compact consumer devices, factory automation upgrades, and low-earth-orbit (LEO) satellites. Order growth of 7.0% and sales growth of 2.7% in 1H-2024 confirmed the industry's resilience despite supply-chain pressures. Surface-mount automation, sub-2 mm pitch adoption, and higher-current designs above 6 A continue to shape product roadmaps. Asia-Pacific retains manufacturing leadership while Latin America emerges as the fastest-growing region. On the competitive front, incumbents rely on miniaturization and thermal know-how rather than price to defend positions, and selective acquisitions such as TE Connectivity's USD 2.3 billion purchase of Richards Manufacturing signal ongoing consolidation.

Global Wire-to-Board Connector Market Trends and Insights

Ultra-compact Wearables Driving Sub-2 mm Pitch Demand in Asia

Sub-2 mm connectors now dominate shipments because fitness trackers and smartwatches require ever-smaller footprints. Molex's 0.175 mm pitch range illustrates how staggered contacts overcome soldering limits while keeping 0.35 mm pads. Metal Injection Molding supports mass production of microminiature housings with tight tolerances. Asia-Pacific manufacturers concentrate the necessary tooling, reinforcing the region's lead. As form factors shrink, cross-disciplinary teams address signal integrity and electromagnetic interference concurrently.

Rapid EV-Battery BMS Adoption Boosting High-Current Connectors

Battery management systems in EV packs increasingly specify connectors above 6 A, the fastest-growing current class of the wire-to-board connector market. TE Connectivity's HC-Stak cuts terminal size by up to 30% and supports aluminum cabling, easing vehicle mass targets. Specialized bushings such as PennEngineering's ECCB maintain low resistance despite aluminum oxidation. Rising EV volumes in China, Europe, and North America create demand clusters that influence supplier footprints.

PCB Real-Estate Shrink Limiting Landing Pads

Connector pads under 0.4 mm challenge pick-and-place accuracy and raise rework costs, depressing short-term growth. Denser layouts heighten crosstalk and thermal hotspots, forcing expensive high-Tg laminates that erode savings. Yield drops prompt some OEMs to delay next-gen layouts until assembly lines upgrade.

Other drivers and restraints analyzed in the detailed report include:

- Automation Retrofits in Brownfield Factories Raising Sensor Refresh

- LEO-Satellite Constellations Requiring Vibration-Resistant Connectors

- Solder-Joint Reliability at >125 °C Under-Hood

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sub-2 mm connectors captured 48% of 2024 revenue and anchor the wire-to-board connector market's miniaturization wave. The segment expands at a 3.7% CAGR to 2030 as smartphones, hearables, and implantables shrink boards further. The 2.1-4 mm class remains essential in automotive modules where mechanical robustness trumps size. Above-4 mm products cater to specialized high-current needs but steadily lose share.

Research prototyping 80 µm pitch contacts with <50 mΩ resistance hints at future disruption. Asia-Pacific fabs house most sub-2 mm tooling, reinforcing regional dominance. Designers must co-optimize signal integrity, thermal spread, and insertion force as pitches fall, making this slice of the wire-to-board connector market a nexus for cross-discipline collaboration.

Surface-mount connectors owned 57.3% of 2024 sales, reflecting automation's pull across consumer and industrial lines. Automated pick-and-place lowers cost per joint and limits PCB drilling, supporting a 3.6% CAGR. Through-hole remains critical for power electronics, where larger solder barrels aid heat dissipation and shock resistance.

Rework on dense surface-mount boards is costly because neighboring components block access. IPC/WHMA-A-620 calls for tighter process windows that many legacy lines struggle to meet. Asia-Pacific maintains the strongest surface-mount infrastructure, whereas some North American facilities still favor through-hole for rugged assemblies in the wire-to-board connector market.

The Wire-To-Board Connector Market Report is Segmented by Pitch Size (Up To 2 Mm, 2. 1 To 4 Mm, Above 4 Mm), Mounting Type (Surface-Mount, and Through-Hole), Current Rating (Up To 1 A, 1. 1 A To 3 A, and More), Orientation (Vertical, and Right-Angle), End-User Vertical (Consumer Electronics, IT and Telecommunication, Automotive, Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 46.7% of 2024 turnover owing to clustered PCB and final-assembly capacity in China, Japan, and South Korea. Incentives draw supplementary builds to India, widening the regional base. Southeast Asian nations lead semiconductor packaging, pulling high-density connectors into local supply chains. These fundamentals keep the wire-to-board connector market firmly anchored in the region for the forecast horizon.

North America combines automotive assembly in Mexico, advanced aerospace in the United States, and medical device exports across the zone. Reshoring initiatives and tariff exposure are nudging selected connector lines back from Asia, yet cost gaps persist. Canada's mining equipment sector adds pockets of demand for ruggedized variants of the wire-to-board connector market.

Europe aligns connector innovation with EV drivetrain rollouts and Industrie 4.0 upgrades. Germany spearheads high-current development for vehicles, while Nordic utilities integrate connectors into wind and grid-storage assets. Strict RoHS and REACH mandates drive global suppliers to adopt compliant chemistries. Latin America, led by Brazil's automotive growth, posts the fastest 5.2% CAGR as OEMs deepen local content to buffer currency risk. Small but rising African and Middle-Eastern projects in solar micro-grids round out global exposure.

- TE Connectivity Ltd.

- Molex LLC

- Amphenol ICC (Amphenol Corp.)

- J.S.T. Mfg. Co. Ltd.

- Samtec Inc.

- Hirose Electric Co. Ltd.

- Harting Technology Group

- Phoenix Contact GmbH and Co. KG

- Wago Kontakttechnik GmbH and Co. KG

- ERNI Deutschland GmbH

- Kyocera-AVX Components

- Wurth Elektronik GmbH and Co. KG

- Yazaki Corp.

- Luxshare Precision

- Foxconn Interconnect Technology

- JAE Electronics Inc.

- LEMO SA

- Harwin Plc

- Global Connector Technology (GCT)

- Omron Electronic Components

- Shenzhen Deren Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ultra-compact wearables driving sub-2 mm pitch demand in Asia

- 4.2.2 Rapid EV-battery BMS adoption boosting high-current WTB connectors

- 4.2.3 Automation retrofits in brownfield factories raising sensor-connector refresh

- 4.2.4 LEO-satellite constellation build-outs requiring vibration-resistant connectors

- 4.2.5 Open-compute server designs shifting to higher-speed mezzanine WTB formats

- 4.2.6 Medical disposables (single-use endoscopes) scaling volumes of low-cost micro-WTB

- 4.3 Market Restraints

- 4.3.1 PCB real-estate shrink limiting connector landing padsLess than 0.4 mm

- 4.3.2 Solder-joint reliability concerns at Above 125 °C under-hood environments

- 4.3.3 Trade-war tariffs inflating BOM pricing for U S importers

- 4.3.4 Supply-chain counterfeit risk for high-density connectors

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Materials RoHS/REACH compliance trends

- 4.5.2 Technology Snapshot - 112 Gbps PAM4 and 0.175 mm pitch road-maps

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Pitch Size

- 5.1.1 Upto 2 mm

- 5.1.2 2.1 - 4 mm

- 5.1.3 Above 4 mm

- 5.2 By Mounting Type

- 5.2.1 Surface-Mount

- 5.2.2 Through-Hole

- 5.3 By Current Rating

- 5.3.1 Up to 1 A

- 5.3.2 1.1 A - 3 A

- 5.3.3 3.1 A - 6 A

- 5.3.4 Above 6 A

- 5.4 By Orientation

- 5.4.1 Vertical

- 5.4.2 Right-angle

- 5.5 By End-User Vertical

- 5.5.1 Consumer Electronics

- 5.5.2 IT and Telecommunication

- 5.5.3 Automotive

- 5.5.4 Industrial Automation

- 5.5.5 Aerospace and Defense

- 5.5.6 Medical Devices

- 5.5.7 Others (Energy, Lighting)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TE Connectivity Ltd.

- 6.4.2 Molex LLC

- 6.4.3 Amphenol ICC (Amphenol Corp.)

- 6.4.4 J.S.T. Mfg. Co. Ltd.

- 6.4.5 Samtec Inc.

- 6.4.6 Hirose Electric Co. Ltd.

- 6.4.7 Harting Technology Group

- 6.4.8 Phoenix Contact GmbH and Co. KG

- 6.4.9 Wago Kontakttechnik GmbH and Co. KG

- 6.4.10 ERNI Deutschland GmbH

- 6.4.11 Kyocera-AVX Components

- 6.4.12 Wurth Elektronik GmbH and Co. KG

- 6.4.13 Yazaki Corp.

- 6.4.14 Luxshare Precision

- 6.4.15 Foxconn Interconnect Technology

- 6.4.16 JAE Electronics Inc.

- 6.4.17 LEMO SA

- 6.4.18 Harwin Plc

- 6.4.19 Global Connector Technology (GCT)

- 6.4.20 Omron Electronic Components

- 6.4.21 Shenzhen Deren Electronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment