PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846180

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846180

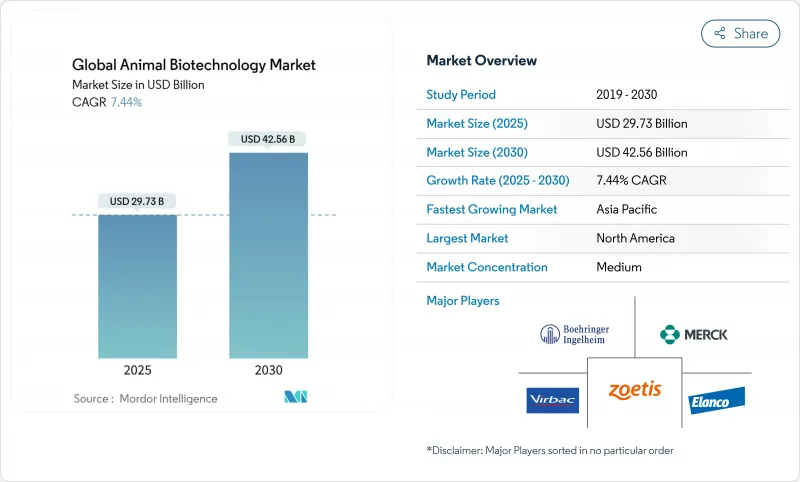

Global Animal Biotechnology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The animal biotechnology market stood at USD 29.73 billion in 2025 and is forecast to reach USD 42.56 billion in 2030, advancing at a 7.44% CAGR.

Demand originates from precision gene-editing breakthroughs, AI-guided breeding programs, and rapid in-clinic molecular tests that shorten disease-response times. Regulatory green lights, typified by the FDA's first approval of PRRS-resistant pigs, validate commercial paths for engineered livestock while cutting avoidable swine losses valued at USD 1.2 billion. North America's clear rules and deep R&D capacity keep the region in front, yet Asia-Pacific, propelled by China's brisk vaccine expansion, is closing the gap fastest. Competitive intensity is moving from traditional drugs toward platform technologies that merge diagnostics, vaccines, and data analytics, giving scale players new tools and start-ups novel entry points.

Global Animal Biotechnology Market Trends and Insights

Surge in CRISPR/Cas-Based Gene-Edited Livestock Programs

The FDA's 2025 clearance for PRRS-resistant pigs cemented CRISPR's shift from lab to farm, carving a proof-of-concept path that cuts recurring swine disease losses and trims antibiotic use by 5%. Expanded interest spans biopharma protein production via transgenic cattle that secrete human insulin. Gene-edited organs for xenotransplant trials further blur the lines between animal health and human medicine. Regional rules differ, but scale developers with compliance budgets secure first-mover advantages that reinforce the animal biotechnology market.

Expansion of AI-Enabled Precision-Breeding Platforms

Genomic algorithms now guide embryo selection, milk-yield optimization, and climate-resilience traits in dairy and beef herds. Proprietary databases widen predictive gaps between incumbents and entrants. When coupled with gene-editing toolkits, artificial intelligence (AI) reorients breeding from iterative selection toward engineered outcomes. Data access hurdles may entrench existing breeders, yet cross-border data alliances are forming to level input depth, sustaining growth in the animal biotechnology market.

Heightened Public Opposition to Gene-Edited Food Animals

Consumer sentiment skews cautious, more so in Europe. Retail bans arrive faster than formal regulations. Surveys show higher acceptance when edits cut antibiotic reliance or boost welfare, yet distrust lingers. Industry transparency campaigns aim to rebuild confidence and thus protect the animal biotechnology market.

Other drivers and restraints analyzed in the detailed report include:

- Rising R&D Spending by Tier-1 Animal-Health Companies

- Growth in Point-of-Care Molecular Diagnostics for Zoonoses

- Complex, Fragmented Global Approval Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Biologics held 34.48% of the animal biotechnology market share in 2024. Investor attention is shifting to reproductive and genetic technologies, the fastest-rising group at a 9.12% CAGR. Their surge reflects gene-editing platforms that compress development cycles and lift return profiles beyond vaccine economics. Diagnostics lines profit from clinic-based molecular tools, whereas conventional drugs face pressure from tighter antimicrobial rules. Hybrid offerings, such as SEQUIVITY's RNA particle-plus-adjuvant combo, blur historical product labels and elevate platform depth as the new competitive yardstick.

Second-order effects include rising feed-additive ventures exploring synthetic biology proteins. Agency approvals for plant-expressed porcine enzymes spark curiosity from feed majors that seek cost-competitive nutrition gains. Expect biologics to retain top-line heft, yet genetic solutions will account for an outsized slice of incremental animal biotechnology market revenue.

Preventive programs anchored 74.37% of the animal biotechnology market revenue share in 2024, a testament to vaccine efficacy and producer economics that prefer prevention to cure. Disease diagnosis, however, records a brisk 7.93% CAGR and chips into traditional revenue mixes. Point-of-care devices close testing loops, making early detection financially rational for mid-size farms. R&D applications benefit when gene-editing advances shorten product timelines. The animal biotechnology market size attributable to research clients could climb further as public-private consortia back translational studies.

Uptake of cloud-linked diagnostic platforms creates network effects. Data improves model accuracy, which then refines vaccine strain matching, underscoring a virtuous circle between detection and prevention that strengthens overall animal biotechnology market resilience.

The Animal Biotechnology Market Report is Segmented by Product Type (Biologics, Diagnostics, and More), Application (Disease Diagnosis and More), Animal Type (Livestock Animals [Cattle and More] and Companion Animals [Dogs and More]), End-User (Laboratories and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.52% share of the animal biotechnology market in 2024 and is growing at 7.07% CAGR. A science-focused regulator, deep venture funding, and consolidated vet networks create smooth tech diffusion. FDA nods for gene-edited pigs and early xenotransplant trials set policy precedents. U.S. veterinary service outlays reached USD 66 billion and are on pace for USD 70 billion by 2029, widening the spending base for biotech upgrades.

Asia-Pacific logs the fastest 8.14% CAGR and enlarges its slice of the animal biotechnology market on the back of soaring protein demand, burgeoning pet ownership, and aggressive vaccine rollouts. China's animal-vaccine sales rose 26% annually as producers chase herd-health coverage. Regulatory maturity is uneven, but manufacturing capacity and cost advantages foster an emerging production hub, provided patent safeguards keep pace.

Europe appears steady with a 7.36% CAGR, yet wrestles with public skepticism toward genetic edits. Strong biologics pipelines and research clusters from Denmark to Germany keep the region relevant. However, precautionary rules could push breakthrough launches to North America first, delaying European benefit capture from the animal biotechnology market. South America and Middle East & Africa remain niche but show consistent adoption where export-oriented livestock sectors modernize. Brazil's experiments with insulin-producing cows highlight regional innovation potential, while Gulf states fund camel health programs amid rising dairy diversification. These pockets add incremental depth to the global animal biotechnology market without yet altering leadership ranks.

- BioChek B.V.

- Bio-Rad Laboratories

- Boehringer Ingelheim

- Ceva Sante Animale S.A.

- Elanco

- Genus plc

- Heska

- IDEXX

- Indical Bioscience

- Innovative Diagnostics SAS (IDVet)

- Intervet

- Medgene

- Merck

- Phibro Animal Health

- Precigen, Inc.

- Randox Laboratories

- Recombinetics, Inc.

- Thermo Fisher Scientific

- Trans Ova Genetics, LC

- Vetoquinol

- Virbac S.A.

- Zoetis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in CRISPR/Cas-Based Gene-Edited Livestock Programs

- 4.2.2 Expansion of AI-Enabled Precision-Breeding Platforms

- 4.2.3 Rising R&D Spending by Tier-1 Animal-Health Companies

- 4.2.4 Growth in Point-of-Care Molecular Diagnostics for Zoonoses

- 4.2.5 Demand for Thermostable Synthetic-Biology Vaccines

- 4.2.6 Regulatory Fast-Track Incentives for Antibiotic Alternatives

- 4.3 Market Restraints

- 4.3.1 Heightened Public Opposition to Gene-Edited Food Animals

- 4.3.2 Complex, Fragmented Global Approval Pathways

- 4.3.3 High Bioreactor CAPEX in Emerging Markets

- 4.3.4 Insurance Liability Risks for Transgenic Animal Leaks

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Biologics

- 5.1.2 Diagnostics

- 5.1.3 Drugs

- 5.1.4 Nutrition

- 5.1.5 Reproductive & Genetic

- 5.2 By Application

- 5.2.1 Disease Diagnosis

- 5.2.2 Preventive Care & Treatment

- 5.2.3 Research & Development

- 5.3 By Animal Type

- 5.3.1 Livestock Animals

- 5.3.1.1 Cattle

- 5.3.1.2 Swine

- 5.3.1.3 Poultry

- 5.3.1.4 Other Livestock Animals

- 5.3.2 Companion Animals

- 5.3.2.1 Dogs

- 5.3.2.2 Cats

- 5.3.2.3 Equine

- 5.3.2.4 Other Companion Animals

- 5.3.1 Livestock Animals

- 5.4 By End-User

- 5.4.1 Laboratories

- 5.4.2 Point-of-care testing

- 5.4.3 Veterinary Hospitals & Clinics

- 5.4.4 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BioChek B.V.

- 6.4.2 Bio-Rad Laboratories, Inc.

- 6.4.3 Boehringer Ingelheim

- 6.4.4 Ceva Sante Animale S.A.

- 6.4.5 Elanco Animal Health Incorporated

- 6.4.6 Genus plc

- 6.4.7 Heska Corporation

- 6.4.8 IDEXX Laboratories, Inc.

- 6.4.9 INDICAL Bioscience GmbH

- 6.4.10 Innovative Diagnostics SAS (IDVet)

- 6.4.11 Intervet Inc.

- 6.4.12 Medgene

- 6.4.13 Merck & Co., Inc.

- 6.4.14 Phibro Animal Health Corporation

- 6.4.15 Precigen, Inc.

- 6.4.16 Randox Laboratories Ltd.

- 6.4.17 Recombinetics, Inc.

- 6.4.18 Thermo Fisher Scientific Inc.

- 6.4.19 Trans Ova Genetics, LC

- 6.4.20 Vetoquinol S.A.

- 6.4.21 Virbac S.A.

- 6.4.22 Zoetis Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment