PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846189

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846189

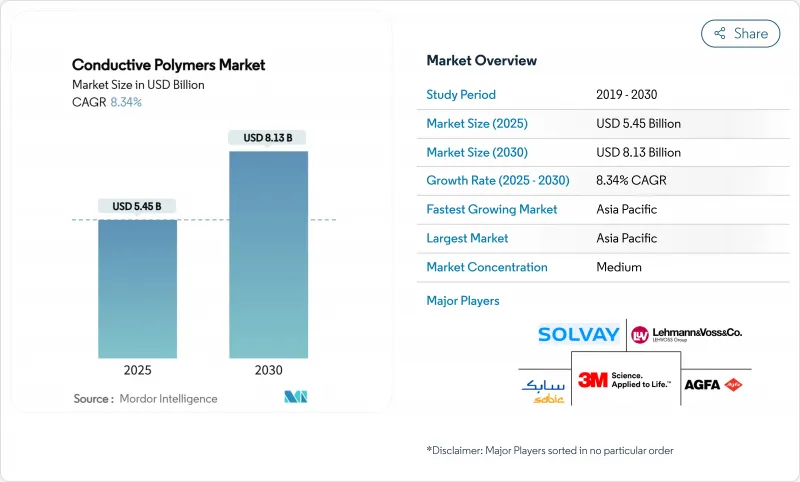

Conductive Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Conductive Polymers Market size is estimated at USD 5.45 billion in 2025, and is expected to reach USD 8.13 billion by 2030, at a CAGR of 8.34% during the forecast period (2025-2030).

The expansion is underpinned by the shift from metal conductors to lightweight polymers in next-generation electronics, the electrification of vehicles, and the rapid adoption of flexible devices. Automakers are replacing metal EMI shields with polymer alternatives to extend driving range, while electronics brands prioritise form-factor reduction without sacrificing signal integrity. Processing innovations that raise conductivity beyond 4,000 S/cm and retain flexibility have shortened development cycles, encouraging design engineers to specify conductive polymers at an earlier stage. At the same time, supply-chain localisation efforts in Asia Pacific have combined with government incentives for electric mobility to reinforce regional leadership in production and consumption. The cumulative effect of these drivers places the conductive polymer market on a resilient growth path despite raw-material price swings.

Global Conductive Polymers Market Trends and Insights

Lightweight EMI-Shielding Demand Surging in EV and Consumer Electronics

Electric vehicles emit higher electromagnetic interference than internal-combustion cars. Traditional metal shields add weight that curtails range, prompting OEMs to specify lightweight conductive polymers, which cut component mass by up to 28% while achieving comparable shielding effectiveness. In smartphones, 5G circuitry sits closer to antennas; thus, manufacturers select polymer shields that thin device walls without compromising signal quality. Asia Pacific benefits most because it hosts the bulk of global EV battery and handset assembly lines. European automakers are adopting similar solutions to meet fleet-emission targets. Design libraries created for consumer devices now transfer to automotive platforms, accelerating cross-sector adoption.

E-Commerce-Driven Uptake of Antistatic Packaging

Online fulfilment centres ship billions of electronics each year, heightening the need for static-safe packaging. Logistics providers report 37% fewer static-related product returns after adopting polymer-lined mailers, boosting demand in North America, where parcel volumes continue to rise. Asia Pacific exporters replicate these practices to satisfy buyer specifications, further expanding the conductive polymer market.

High Processing Cost and Limited Mechanical Robustness

Achieving metal-like conductivity in polymers typically requires post-treatment steps such as acid washing or solvent exchange, which lift production costs by as much as 23% relative to conventional plastics. Mechanical fatigue remains a challenge because highly doped structures can crack under repeated flexing. Automakers specify reinforcement additives, but these raise weight and erase some advantages. Research groups are exploring elastomeric matrices that encapsulate conductive domains to balance properties, yet mass-scale adoption hinges on cost-down roadmaps.

Other drivers and restraints analyzed in the detailed report include:

- Flexible Thermoelectric Wearables Adoption Post-2025

- Military-Grade Conformal Antennas Using Inherently Conductive Polymers

- Volatile Aniline and Specialty Monomer Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conductive plastics held 45.25% of the conductive polymer market size in 2024 because extrusion and injection-moulding assets are already amortised, allowing economic output at multi-kiloton scale. These polymers meet EMI standards for laptop housings and automotive sensor brackets, supporting expansion across mature applications. Inherently conductive polymers post the fastest 8.77% CAGR through 2030 as wearable healthcare devices and conformal antennas demand elevated conductivity per gram. Processing breakthroughs such as vapor-phase polymerisation lower defect density, narrowing the property gap with metals.

Inherently dissipative polymers maintain a niche in factory floors and semiconductor lines where rapid static bleed-off prevents micro-damage. Other polymer types include hybrid composites that marry nano-carbon fillers with thermoplastic polyurethane, enabling stretchable circuits. Continuous improvements suggest the conductive polymer market will gradually shift from commodity plastics toward higher-value ICP formulations while maintaining a broad base of price-sensitive applications.

Conjugated conducting polymers captured 40.66% of the conductive polymer market share in 2024 due to reliable synthesis protocols and stability under ambient conditions. They function as transparent electrodes in displays and as active layers in organic electrochemical transistors used for point-of-care diagnostics.

Despite their smaller base, ionically conducting polymers expand at a 9.01% CAGR because they carry both electronic and ionic charges, critical for biointerfaces and solid-state batteries. Charge-transfer polymers cater to sensors requiring specific redox potentials. Conductively filled polymers remain cost-competitive for antistatic trays where moderate conductivity suffices.

The Conductive Polymer Report is Segmented by Polymer Type (Inherently Conductive Polymers, Inherently Dissipative Polymers, and More), Class (Conjugated Conducting Polymers, Charge-Transfer Polymers, and More), Application (Product Components, Antistatic Packaging, Material Handling, and More), End-Use Industry (Electrical and Electronics, Automotive and E-Mobility, and More), and Geography (Asia-Pacific, North America, and More)

Geography Analysis

Asia Pacific held 46.11% share of the conductive polymer market in 2024 and is growing at a 9.34% CAGR through 2030, driven by its dense electronics manufacturing clusters and government subsidies for electric mobility. China commands bulk volume in smartphone assembly and EV battery packs, while Japan spearheads high-purity polymer research and development.

In North America the United States accelerates domestic EV production with federal tax incentives, creating upward demand for lightweight shield components. Defence spending channels funds into conformal antenna programmes that specify inherently conductive polymers. Canada's aerospace industry integrates stretchable circuits into cabin safety systems, while Mexico's EV assembly exports augment regional demand. Trade accords facilitating materials flow across borders support market coherence.

Europe exhibits steady uptake supported by stringent vehicle emission limits that reward weight reduction. Germany pioneers polymer-rich EMI solutions in premium EVs. France's aerospace sector demands high-performance grades for in-flight antennas. Nordic initiatives in circular economy favour recyclable conductive plastics. The EU's REACH framework incentivises low-VOC polymer processes. Eastern European electronics manufacturing hubs adopt antistatic flooring to meet global customer audits, expanding the conductive polymer market perimeter within the continent.

- 3M

- Agfa-Gevaert Group

- Arkema

- Cabot Corporation

- Celanese Corporation

- Covestro AG

- Dupont

- Eeonyx

- Heraeus Holding

- Lehmann&Voss&Co.

- Parker Hannifin Corp

- Parker Hannifin Corp.

- PolyOne Corporation

- Premix Group

- RTP Company

- SABIC

- Solvay

- The Lubrizol Corporation

- The Lubrizol Corporation

- Westlake Plastics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight EMI-Shielding Demand Surging in EV And Consumer Electronics

- 4.2.2 E-Commerce-Driven Uptake of Antistatic Packaging

- 4.2.3 Flexible Thermoelectric Wearables Adoption Post-2025

- 4.2.4 Military-Grade Conformal Antennas Using Inherently Conductive Polymers (ICPs)

- 4.2.5 Design Flexibility and Huge Scope of Innovation and Product Development Through Customization

- 4.3 Market Restraints

- 4.3.1 High Processing Cost and Limited Mechanical Robustness

- 4.3.2 Volatile Aniline and Specialty Monomer Prices

- 4.3.3 End-Of-Life Recycling Challenges of Hybrid Composites

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Polymer Type

- 5.1.1 Inherently Conductive Polymers (ICPs)

- 5.1.2 Inherently Dissipative Polymers (IDPs)

- 5.1.3 Conductive Plastics

- 5.1.4 Other Polymer Types

- 5.2 By Class

- 5.2.1 Conjugated Conducting Polymers

- 5.2.2 Charge-Transfer Polymers

- 5.2.3 Ionically Conducting Polymers

- 5.2.4 Conductively Filled Polymers

- 5.3 By Application

- 5.3.1 Product Components (e.g., EMI housings, sensors)

- 5.3.2 Antistatic Packaging

- 5.3.3 Material Handling (trays, totes)

- 5.3.4 Work-surface and Flooring

- 5.3.5 Others

- 5.4 By End-user Industry

- 5.4.1 Electrical and Electronics

- 5.4.2 Automotive and E-Mobility

- 5.4.3 Aerospace and Defense

- 5.4.4 Healthcare and Wearables

- 5.4.5 Others (Industrial Packaging and Logistics)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 NORDIC

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Agfa-Gevaert Group

- 6.4.3 Arkema

- 6.4.4 Cabot Corporation

- 6.4.5 Celanese Corporation

- 6.4.6 Covestro AG

- 6.4.7 Dupont

- 6.4.8 Eeonyx

- 6.4.9 Heraeus Holding

- 6.4.10 Lehmann&Voss&Co.

- 6.4.11 Parker Hannifin Corp

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 PolyOne Corporation

- 6.4.14 Premix Group

- 6.4.15 RTP Company

- 6.4.16 SABIC

- 6.4.17 Solvay

- 6.4.18 The Lubrizol Corporation

- 6.4.19 The Lubrizol Corporation

- 6.4.20 Westlake Plastics

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Growth in smart textiles and IoT devices fuels need for flexible, conductive materials.