PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846205

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846205

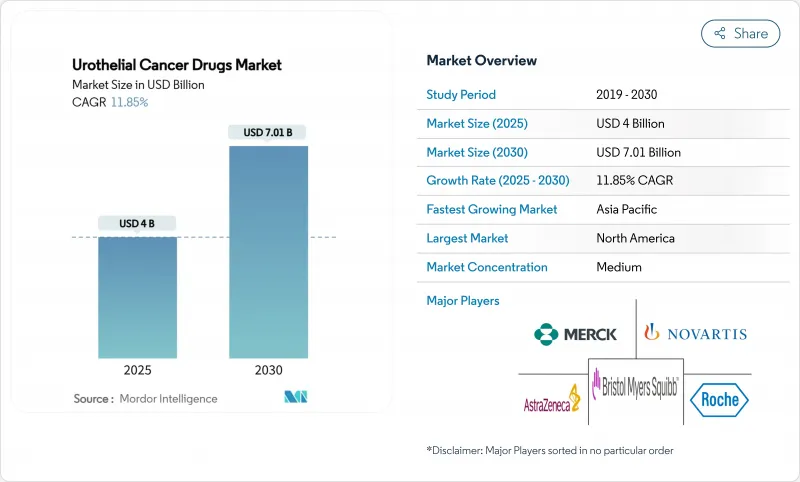

Urothelial Cancer Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The urothelial cancer drugs market size stood at USD 4.00 billion in 2025 and is forecast to reach USD 7.01 billion by 2030, expanding at an 11.85% CAGR during the period, underscoring vigorous demand for innovative therapies.

Escalating disease incidence, rapid uptake of immuno-oncology agents, and regulatory fast-tracking of antibody-drug conjugates (ADCs) are synchronizing to propel growth, while sustained investment in precision medicine is widening the patient base eligible for targeted treatment. Combination regimens that marry ADCs with checkpoint inhibitors are redefining first-line standards, even as biomarker-guided protocols improve therapeutic accuracy and extend survival outcomes. North America retains primacy through early technology adoption and generous reimbursement, whereas Asia-Pacific's vigorous screening initiatives and expanding oncology infrastructure drive the fastest regional gains. Persistent bacille Calmette-Guerin (BCG) shortages amplify opportunities for next-generation intravesical agents and gene therapies, yet simultaneously reveal supply-chain vulnerabilities that stakeholders must address.

Global Urothelial Cancer Drugs Market Trends and Insights

Rising Incidence Of Urothelial Cancer Cases Globally

Global bladder cancer diagnoses continue to climb, ranking among the top six malignancies in high-income nations and accelerating in emerging economies. Environmental carcinogens, aging demographics, and wider access to cystoscopic screening enlarge the addressable pool of candidates for novel therapeutics. Younger patient cohorts in Asia-Pacific increasingly present with aggressive disease phenotypes that demand prolonged, combination treatment regimens. Recognition of upper-tract urothelial carcinomas as a distinct clinical entity is spawning new therapeutic segments requiring tailored approaches. Health-system investment in dedicated uro-oncology centers streamlines diagnosis-to-treatment intervals and enlarges total market demand. The net effect is a durable rise in eligible patients, directly expanding revenue potential for stakeholders.

Uptake Of Immune-Checkpoint Inhibitors As First-Line Standard

Checkpoint inhibitors such as pembrolizumab and durvalumab secured broad first-line approvals across multiple disease stages in 2024, displacing cisplatin-based chemotherapy for eligible populations. Durvalumab's NIAGARA study confirmed overall survival gains, catalyzing guideline revisions and payer acceptance. Combination protocols-most prominently enfortumab vedotin plus pembrolizumab-are redefining best practice and intensifying revenue streams. Evolving biomarker algorithms exploiting PD-L1 expression and tumor mutational burden refine patient selection, thus elevating response rates. Subcutaneous formulations offer logistical convenience, supporting diffusion into community settings. Collectively these factors fortify the urothelial cancer drugs market's trajectory.

High Cost Of Immunotherapies & ADCs

Annual treatment outlays for combination regimens exceed USD 200,000 per patient in developed economies, straining payer budgets and imposing strict prior-authorization hurdles. Highly specialized infusion infrastructure and intensive monitoring inflate indirect costs, while limited insurance coverage constrains uptake in emerging regions. Pharmaceutical assistance programs generate selective relief yet remain insufficient for widespread access. Value-based contracts are gaining traction, conditioning reimbursement on real-world outcomes and compelling manufacturers to document pharmacoeconomic merit. Biosimilar competition may temper pricing for early checkpoint inhibitors, but complex ADC manufacturing dampens near-term generic entry, sustaining affordability pressures.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Fast-Tracking Of Antibody-Drug Conjugates (ADCs)

- Large Pharma Partnering Boosts Launch Velocity Of FGFR Inhibitors

- Immune-Related Adverse Events Curbing Long-Term Adherence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ADCs produced the fastest revenue climb, forecasting an 18.65% CAGR between 2025 and 2030 as enfortumab vedotin's EV-302 data reset survival benchmarks in untreated metastatic disease. Immunotherapy dominated 2024 with a 45.51% slice of the urothelial cancer drugs market, yet plateauing single-agent response rates motivate combination approaches that integrate ADC payloads for synergistic tumor kill. Platinum-based chemotherapy retains relevance for cisplatin-eligible patients, whereas gene therapy and chemohyperthermia fill intravesical niches amid persistent BCG scarcity.

Pipeline breadth ensures continued ADC momentum: next-wave conjugates seek novel antigens, optimized linkers, and enhanced drug-antibody ratios. These innovations, coupled with global regulatory support, are expected to lift the urothelial cancer drugs market size for ADCs well beyond historical norms. Pharmacies and payers will need to adapt inventory, reimbursement, and administration protocols as increasingly complex regimens become routine.

First-line regimens generated 56.53% of 2024 revenues, underscoring the economic significance of initial therapeutic choice. Maintenance therapy, paced by avelumab, owns momentum through a 12.85% CAGR outlook; its durability benefits resonate with both clinicians and payers seeking progression-free value.

Second-line spaces remain pivotal arenas where resistance emerges, inviting ADCs and targeted inhibitors to demonstrate superiority over traditional chemotherapies. Third-line and salvage settings, although smaller in volume, attract disruptive modalities such as oncolytic viruses that could unlock incremental share. The strategic sequencing of agents across lines is becoming an art informed by evolving real-world data, promising longer control horizons for the urothelial cancer drugs market.

The Urothelial Cancer Drugs Market Report is Segmented by Treatment Class (Chemotherapy, Immunotherapy, and More), Line of Therapy (First-Line, Second-Line, and More), Cancer Stage (Metastatic Urothelial Carcinoma, and More), Biomarker Status (FGFR2/3 Altered, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 43.15% of 2024 global revenue due to robust reimbursement, dense clinical-trial infrastructure, and early adoption of breakthrough designations. U.S. market evolution is closely tied to Medicare policy updates and private payer alignment, both of which now embrace value-based contracts that reward demonstrable survival gains. Canada's provincially funded systems negotiate collective procurement, fostering predictable uptake albeit at negotiated pricing. Cross-border treatment flows with Mexico supplement patient access, particularly in border states where oncology centers provide specialized infusion capability.

Europe presents a mature but methodical environment in which the European Medicines Agency coordinates approvals and national health-technology assessments (HTAs) adjudicate access. Germany's DRG payment reforms, the U.K.'s Cancer Drugs Fund, and France's ATU early-access scheme collectively accelerate entry for compelling agents, though list-price negotiations are stringent. Southern Europe faces fiscal constraints, delaying adoption but not eliminating demand; managed-entry agreements and outcomes-based rebates increasingly unlock budgetary headroom. Pan-EU collaboration on joint clinical assessment under the new Pharmaceutical Strategy promises to streamline evidence requirements, benefiting the urothelial cancer drugs market.

Asia-Pacific, registering a 12.35% CAGR, emerges as the most vibrant frontier, powered by national cancer control plans, insurance expansion, and improving diagnostic reach. China's volume-based procurement aims to tame prices without impeding innovation, while Japan's HTA process accelerates for oncology breakthroughs. India's tiered private-public system is embracing oral targeted agents through patient-assistance partnerships. Australia and South Korea leverage robust registries and real-world data to fast-track reimbursement for high-value medicines. Nonetheless, rural-urban disparities, limited biomarker testing, and uneven specialist density remain headwinds to uniform uptake across the region.

- Merck

- Roche

- Bristol-Myers Squibb

- AstraZeneca

- Novartis

- GlaxoSmithKline

- Sanofi

- Eisai

- Astellas Pharma

- UroGen Pharma Ltd.

- Pfizer

- Seagen

- Johnson & Johnson (Janssen Biotech)

- Gilead Sciences

- ImmunityBio Inc.

- CG Oncology

- QED Therapeutics Inc.

- BeiGene Ltd.

- Mirati Therapeutics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Urothelial Cancer Cases Globally

- 4.2.2 Uptake Of Immune-Checkpoint Inhibitors As First-Line Standard

- 4.2.3 Regulatory Fast-Tracking Of Antibody-Drug Conjugates (ADCs)

- 4.2.4 Large Pharma Partnering Boosts Launch Velocity Of FGFR Inhibitors

- 4.2.5 AI-Based Urine Biomarker Diagnostics Expanding Treatable Pool

- 4.2.6 Medicare & Private-Payer Reimbursement Expansions For ADC + IO Combos

- 4.3 Market Restraints

- 4.3.1 High Cost Of Immunotherapies & ADCs

- 4.3.2 Immune-Related Adverse Events Curbing Long-Term Adherence

- 4.3.3 Global BCG Manufacturing Shortages Prolonging NMIBC Regimens

- 4.3.4 Limited Access To Companion-Diagnostic Testing In Emerging Markets

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Treatment Class

- 5.1.1 Chemotherapy

- 5.1.1.1 Platinum-based

- 5.1.1.2 Non-platinum

- 5.1.2 Immunotherapy

- 5.1.2.1 PD-1 / PD-L1 Inhibitors

- 5.1.2.2 CTLA-4 Inhibitors

- 5.1.2.3 Oncolytic Viruses & Vaccines

- 5.1.3 Targeted Therapy

- 5.1.3.1 FGFR Inhibitors

- 5.1.3.2 HER2 / Nectin-4 ADCs

- 5.1.4 Antibody-Drug Conjugates

- 5.1.4.1 Enfortumab Vedotin

- 5.1.4.2 Sacituzumab Govitecan

- 5.1.4.3 Pipeline ADCs

- 5.1.5 Intravesical Therapy

- 5.1.5.1 BCG

- 5.1.5.2 Gene/Viral Therapy

- 5.1.5.3 Chemohyperthermia

- 5.1.1 Chemotherapy

- 5.2 By Line of Therapy

- 5.2.1 First-line

- 5.2.2 Maintenance / Consolidation

- 5.2.3 Second-line

- 5.2.4 Third-line & Beyond

- 5.3 By Cancer Stage

- 5.3.1 Non-Muscle Invasive Bladder Cancer (NMIBC)

- 5.3.2 Muscle Invasive Bladder Cancer (MIBC)

- 5.3.3 Metastatic Urothelial Carcinoma (mUC)

- 5.4 By Biomarker Status

- 5.4.1 FGFR2/3 Altered

- 5.4.2 PD-L1 High Expression

- 5.4.3 Nectin-4 High Expression

- 5.4.4 HER2 Positive

- 5.4.5 Biomarker Unselected

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Specialty Clinics

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Merck & Co., Inc.

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Bristol-Myers Squibb Company

- 6.3.4 AstraZeneca PLC

- 6.3.5 Novartis AG

- 6.3.6 GSK PLC

- 6.3.7 Sanofi SA

- 6.3.8 Eisai Co., Ltd.

- 6.3.9 Astellas Pharma Inc.

- 6.3.10 UroGen Pharma Ltd.

- 6.3.11 Pfizer Inc.

- 6.3.12 Seagen Inc.

- 6.3.13 Johnson & Johnson (Janssen Biotech)

- 6.3.14 Gilead Sciences Inc.

- 6.3.15 ImmunityBio Inc.

- 6.3.16 CG Oncology Inc.

- 6.3.17 QED Therapeutics Inc.

- 6.3.18 BeiGene Ltd.

- 6.3.19 Mirati Therapeutics Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment