PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846209

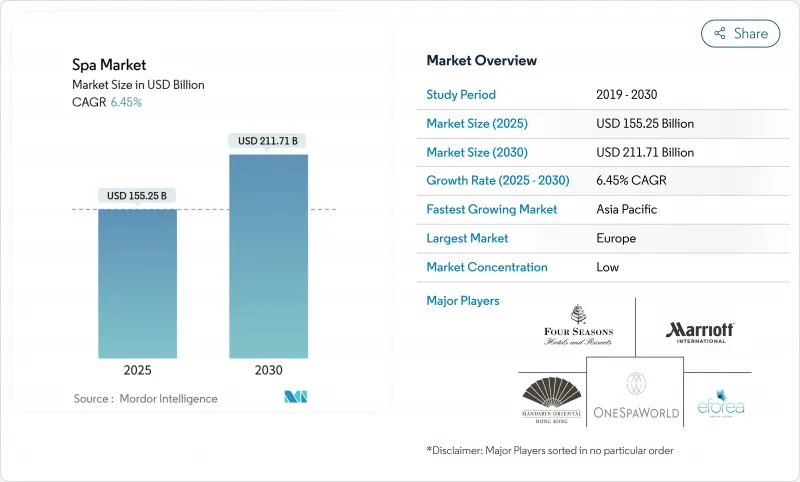

Spa - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spa market commands USD 155.25 billion in 2025 and is forecast to advance to USD 211.71 billion by 2030, reflecting a 6.4% CAGR.

Rising global health consciousness, a rebound in cross-border travel, and deeper integration of technology into wellness delivery underpin this expansion. Wellness tourists now spend 59% more than the average traveler, a dynamic that lifts per-visit revenues and pushes operators to introduce high-margin, experience-rich programs. Urban middle-income consumers in Asia-Pacific treat premium spas as preventative-care outlets, while European guests continue to view thermal bathing as an extension of public healthcare. Technology investments-ranging from AI-guided massage robots to cloud-based reservation tools-raise throughput and improve yield management, helping offset persistent labor shortages that have affected 70% of U.S. facilities.

Global Spa Market Trends and Insights

Rising Wellness Tourism and Experiential Travel

Wellness tourism has transformed from discretionary luxury to foundational trip purpose, with the category approaching USD 1 trillion in 2024. Ninety percent of wellness travelers now build spa sessions into their itineraries, lifting average trip spending to USD 1,639. Asia-Pacific hosts roughly 258 million wellness trips per year, while thermal-spa investments topping USD 550 million in Australia and New Zealand underscore the scramble for capacity. Operators weave "wellness-art-tainment" into treatment menus-blending multisensory light shows, local healing rituals, and digital bio-feedback-to boost dwell time and justify premium price points. As a result, the spa market finds an expansive growth corridor at the intersection of travel, culture, and health.

Increasing Disposable Income in Emerging Markets

Rising household earnings position Asia-Pacific consumers to access treatments once reserved for high-net-worth tourists. China illustrates the shift: more than 1,000 commercial hot-spring destinations attracted 60 million visitors in 2024, moving the category from rural health remedy to mainstream leisure. India, Vietnam, and Indonesia mirror this pattern through aggressive day-spa rollouts and tiered membership pricing, enabling operators to serve both value seekers and luxury clients under separate brand extensions. Up-market resorts continue to prosper, yet budget-friendly urban outlets capture the volume necessary to anchor the regional spa market's next growth phase.

High Operating and Labour Costs

Seven in ten U.S. spas report difficulty recruiting licensed therapists, forcing wage escalation and heavier reliance on contractors. Intensive onboarding for new graduates and the International Spa Association's verification protocols add compliance overhead . Although automation-such as AI check-in kiosks-improves front-desk efficiency, core treatments remain labor-intensive. Energy spikes and stringent sanitation rules further pressure operating margins, prompting many urban spas to adopt membership-subscription models that stabilize cash flow.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population Driving Health-Focused Spa Visits

- Corporate Wellness Program Integration

- Seasonality of Demand in Resort Locations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medical and medi-spa treatments represent the fastest-growing category with 9.22% CAGR, even as massage and body therapies retained the largest 37.48% spa market share in 2024. Rising demand for laser resurfacing, IV nutrient therapy, and regenerative modalities positions the sub-segment to command a premium within the overall spa market. Facial "tweakments" are forecast to rise 15.4% annually, while hydrotherapy circuits leverage Europe's long-standing balneotherapy tradition. AI-enabled skin analysis heightens personalization, elevating ticket sizes without eroding therapist capacity.

Second-tier services evolve in tandem. Beauty and grooming menus are simplified, emphasizing organic formulations and express services to capture time-poor urban patrons. Aromatherapy and Reiki broaden the holistic appeal, while collaboration with nutraceutical brands enables upselling of at-home regimens. These moves sustain double-digit revenue growth for hybrid facilities straddling leisure and clinical offerings.

Day and club spas captured 44.15% of revenue in 2024, yet medical spas are expanding at a 10.21% CAGR and are set to reshape the spa market landscape. The spa market size attributable to medical-grade facilities is projected to outpace resort formats over the next five years as guests pursue measurable health outcomes alongside relaxation. Steiner Leisure's footprint across 148 cruise ships and 45 resorts illustrates the scalability of contract-managed wellness operations . Thermal and mineral spring venues in France, valued at EUR 1 billion, reaffirm government-supported hydrotherapy as a resilient niche.

Subscription-based micro-spas emerge in dense urban cores, offering time-boxed sessions that fit lunch-break schedules. Membership outlets generate threefold revenue compared to pay-as-you-go counterparts, posting 9% annual growth in collections. This model yields predictable income, streamlines staffing, and creates a laboratory for data-led service innovation, all factors propelling medical spas to eclipse legacy resort-centric growth trajectories within the broader spa market.

The Spa Market is Segmented by Service Type (Massage and Body Treatments, Facials and Skin Care, and More), by Facility Type (Day / Club Spas, Destination and Resort Spas, and More), On-Site / Walk-In (On-Site / Walk-In, Online and Mobile App Bookings, and More), by End User (Women, Men, and More), by Region (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe anchored 36.62% of spa revenue in 2024, buoyed by Germany's 350+ medicinal baths and France's publicly supported thermalism infrastructure, where 65% of treatment costs remain reimbursable. The regional spa market size for balneotherapy is protected by healthcare policy, yet reimbursement reform nudges operators to add out-of-pocket longevity services such as hyperbaric oxygen therapy. Central and Eastern European destinations leverage lower wage structures to expand midscale resorts, inviting cross-border travelers and supporting a steady pipeline of wellness-themed real-estate projects.

Asia-Pacific is the growth engine, advancing at 9.21% CAGR to 2030 on the back of expanding middle-class affluence. China's 4,000+ hot-spring sites and substantial public investment underpin capacity growth, while Japan fuses onsen heritage with contemporary design to attract millennial tourists. Southeast Asia's medical-tourism corridors generate foreign-exchange inflows as visitors couple elective procedures with spa recuperation, reinforcing the region's stature in the global spa market. Regulations remain patchy, but governments increasingly highlight wellness tourism in national economic plans, providing infrastructural grants and streamlined licensing.

North America exhibits mature yet innovative characteristics. U.S. hotel spas logged USD 7,097 revenue per available room in 2025, up 12.6% from 2018, reflecting improved upselling strategies and higher occupancy. Franchise chains such as Massage Envy-operating over 1,000 outlets-demonstrate the scalability of recurring-membership economics, while Hand & Stone's expansion into skincare validates service-line diversification. Canadian wilderness retreats and Mexican thermal springs diversify North America's offering beyond urban day spas, appealing to experience-seeking travelers and raising cross-border visitor stays.

- Four Seasons Hotels & Resorts

- Marriott International (Heavenly Spa, Remede)

- Mandarin Oriental Hotel Group

- Hilton Worldwide (Eforea)

- Steiner Leisure (OneSpaWorld)

- Minor International (Anantara Spa)

- Accor Hotels (Fairmont & Sofitel Spas)

- Hyatt Corporation (Miraval, Exhale)

- Six Senses Hotels Resorts Spas

- Banyan Tree Holdings

- Canyon Ranch

- Champneys Health Resorts

- Lanserhof Group

- The Red Door by Elizabeth Arden

- Marriott Vacations Worldwide (Spa by JW)

- L'Occitane en Provence Spas

- Hand & Stone Massage and Facial Spa

- Massage Envy

- Planet Beach Spray & Spa

- Hot Springs Resort & Spa

- Shangri-La Hotels & Resorts (Chi Spas)

- ESPA International

- COMO Shambhala

- Nuffield Health Wellbeing & Beauty*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Wellness Tourism And Experiential Travel

- 4.2.2 Increasing Disposable Income In Emerging Markets

- 4.2.3 Ageing Population Driving Health-Focused Spa Visits

- 4.2.4 Corporate Wellness Program Integration

- 4.2.5 Ai-Powered Hyper-Personalised Treatment Protocols

- 4.2.6 Subscription-Based Urban Micro-Spa Models

- 4.3 Market Restraints

- 4.3.1 High Operating And Labour Costs

- 4.3.2 Seasonality Of Demand In Resort Locations

- 4.3.3 Shortage Of Certified Therapists In Key Regions

- 4.3.4 Data-Privacy Concerns Around Biometric Diagnostics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Massage and Body Treatments

- 5.1.2 Facials and Skin Care

- 5.1.3 Beauty and Grooming (Nails, Hair)

- 5.1.4 Hydrotherapy and Thermal/Mineral Springs

- 5.1.5 Medical / Medi-Spa Treatments

- 5.1.6 Others (Aromatherapy, Reiki, etc.)

- 5.2 By Facility Type

- 5.2.1 Day / Club Spas

- 5.2.2 Destination and Resort Spas

- 5.2.3 Hotel / Cruise-Ship Spas

- 5.2.4 Medical Spas

- 5.2.5 Thermal and Mineral Spring Facilities

- 5.3 By Booking Channel

- 5.3.1 On-site / Walk-in

- 5.3.2 Online and Mobile App Bookings

- 5.4 By End User

- 5.4.1 Women

- 5.4.2 Men

- 5.4.3 Couples

- 5.4.4 Family / Group

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.4.8 Russia

- 5.5.4.9 Rest of Europe

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Four Seasons Hotels & Resorts

- 6.4.2 Marriott International (Heavenly Spa, Remede)

- 6.4.3 Mandarin Oriental Hotel Group

- 6.4.4 Hilton Worldwide (Eforea)

- 6.4.5 Steiner Leisure (OneSpaWorld)

- 6.4.6 Minor International (Anantara Spa)

- 6.4.7 Accor Hotels (Fairmont & Sofitel Spas)

- 6.4.8 Hyatt Corporation (Miraval, Exhale)

- 6.4.9 Six Senses Hotels Resorts Spas

- 6.4.10 Banyan Tree Holdings

- 6.4.11 Canyon Ranch

- 6.4.12 Champneys Health Resorts

- 6.4.13 Lanserhof Group

- 6.4.14 The Red Door by Elizabeth Arden

- 6.4.15 Marriott Vacations Worldwide (Spa by JW)

- 6.4.16 L'Occitane en Provence Spas

- 6.4.17 Hand & Stone Massage and Facial Spa

- 6.4.18 Massage Envy

- 6.4.19 Planet Beach Spray & Spa

- 6.4.20 Hot Springs Resort & Spa

- 6.4.21 Shangri-La Hotels & Resorts (Chi Spas)

- 6.4.22 ESPA International

- 6.4.23 COMO Shambhala

- 6.4.24 Nuffield Health Wellbeing & Beauty*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment