PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846215

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846215

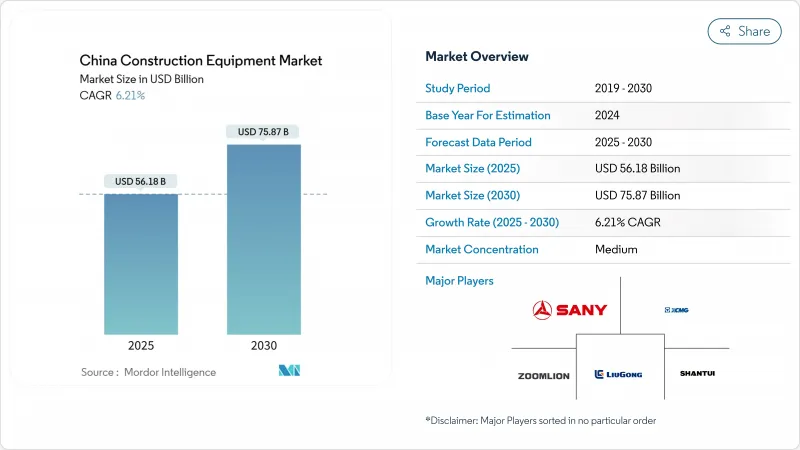

China Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China construction equipment market is estimated at USD 56.18 billion in 2025 and is forecast to advance to USD 75.87 billion by 2030, reflecting a 6.21% CAGR.

Sustained public-sector spending on railway, highway, and urban transit links, paired with a strong policy push for electric and smart machinery, underpins demand even as residential real-estate activity cools. Large-scale projects such as the 180,000 km national railway build-out, for which CNY 590 billion was earmarked in 2025, keep order books healthy and favor high-capacity earth-moving and lifting equipment. At the same time, electrification is moving from pilot projects to scaled deployment as cost parity with diesel narrows and subsidies offset capital outlays. Export momentum offers an additional cushion: overseas shipments have overtaken domestic deliveries, signaling that Chinese original-equipment manufacturers (OEMs) can lean on foreign infrastructure cycles to balance local slowdowns.

China Construction Equipment Market Trends and Insights

Government Infrastructure Investment and Belt Road Initiative

China's infrastructure investment surge represents the primary growth catalyst, with the Yangtze River Delta region alone allocating CNY 140 billion for railway construction in 2024, marking a record high that surpasses the previous year's CNY 125.3 billion. The National Development and Reform Commission's 2025 equipment update policy expands support across industrial, energy, transportation, and agricultural sectors, emphasizing high-end, intelligent, and green technologies with enhanced loan interest subsidies to reduce financing costs. This policy framework creates sustained demand beyond traditional construction cycles, as infrastructure projects typically require 3-5 year equipment lifecycles with predictable replacement patterns. The Belt and Road Initiative's international dimension amplifies domestic manufacturers' export opportunities, with 70% of Chinese excavator exports directed to BRI countries in 2022, creating a virtuous cycle where domestic production scale enables competitive international pricing. Railway network expansion to 180,000 km by 2030, including 60,000 km of high-speed rail, necessitates specialized construction equipment for tunneling, bridge construction, and track laying, segments where Chinese manufacturers have developed technological advantages through domestic project experience.

Equipment Modernization and Electrification Policies

The government's equipment modernization mandate creates replacement demand independent of new construction activity, with the Ministry of Industry and Information Technology's 2024 Major Technological Equipment Guidance Catalog prioritizing advanced construction machinery. Electric construction equipment adoption accelerates through direct subsidies and operational cost advantages, with Chinese manufacturers achieving cost parity between electric and diesel versions in certain applications, fundamentally altering total cost of ownership calculations. The Green Technology Promotion Directory (2024 Edition) includes 112 advanced technologies across seven sectors, with construction equipment featuring prominently in energy-efficient and environmental protection categories. Equipment-as-a-service models gain traction as operators seek to minimize capital expenditure while accessing latest technology, with integrated installation-dismantling services improving safety compliance and operational efficiency. The policy creates a two-tier market where premium electric and smart equipment commands higher margins while conventional diesel equipment faces pricing pressure, benefiting manufacturers with strong R&D capabilities and technology portfolios.

Real Estate Sector Deleveraging and Construction Slowdown

The real estate sector's deleveraging process creates temporary demand disruption as developers reduce new project starts and equipment purchases, particularly affecting compact machinery and residential construction equipment segments. However, government urban renewal initiatives and affordable housing programs provide alternative demand sources, with major cities prioritizing infrastructure upgrades and public facility construction over speculative development. Market differentiation emerges between state-owned enterprises maintaining stable operations and private developers facing financial constraints, creating opportunities for equipment leasing and flexible financing models that reduce capital requirements for construction firms.

Other drivers and restraints analyzed in the detailed report include:

- Export Market Expansion and International Competitiveness

- Digitalization and Smart Construction Technology Adoption

- Trade Tensions and Tariff Barriers in International Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earth-moving machinery such as excavators controlled 55.28% of China construction equipment market share in 2024, cementing their role across earthwork, mining and metro tunnelling projects. Rising infrastructure outlays and export demand keep delivery volumes elevated, while electric excavators record a 12.15% CAGR to 2030 as subsidies and falling battery costs erode diesel's lifetime cost advantage. Forklifts, telescopic handlers and aerial platforms gain steady traction from warehouse automation linked to e-commerce fulfilment. Road-building machines benefit from maintenance cycles for an expanding 177,000 km national highway grid, with autonomous rollers and pavers proving headline features on high-profile expressway upgrades.

Technology convergence defines future competition. Excavators now ship with standard telematics, semi-autonomous dig algorithms, and factory-installed quick couplers that cut attachment changeover time. Concrete mixers and pumps integrate IoT sensors to optimize slump quality and dispatch logistics, ensuring on-time pours in dense urban cores. China construction equipment market size for excavators alone is projected to approach USD 37 billion by 2030, providing scale economies for OEMs investing in proprietary battery packs and control software. As interoperability standards mature, component suppliers with open-architecture controllers will gain bargaining power, reshaping the value chain toward software-centric ecosystems.

Internal Combustion Engine (Diesel) still powered 92.64% of units sold in 2024, supported by established fueling infrastructure, long duty cycles, and lower upfront pricing. However, full-electric options post a 37.85% CAGR through 2030, signaling a decisive phase-change. The China construction equipment market size for battery-electric models is set to cross USD 8 billion by 2030, thanks to zero-emission mandates in Beijing, Shanghai, and Shenzhen that restrict new diesel purchases for municipal works. Hybrid drivetrains offer a bridge solution, trimming fuel burn by 20-25% on duty cycles involving frequent idling.

Cost parity hinges on battery density, charging logistics, and resale values. OEM finance arms now bundle charging depots and solar-powered micro-grids into equipment leases, giving contractors guaranteed kilowatt-hour pricing over project lifetimes. Meanwhile, state grid operators trial vehicle-to-grid schemes that monetize idle machinery batteries during off-shift hours, adding an ancillary revenue stream. Diesel's role will remain pronounced in extreme-temperature mines and remote Belt and Road corridors without grid access. Still, its share will erode fastest in metropolitan civil works segments where noise and emissions rules bite hardest.

The China Construction Equipment Market Report is Segmented by Machinery Type (Earth-Moving Machinery, Material-Handling Machinery, and More), Drive Type (Internal-Combustion, Hybrid, and More), Sales Channel (OEM Direct Sales, and Authorized Dealer Sales), and Application (Building Construction, Infrastructure Construction, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sany Group

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Caterpillar Inc.

- Zoomlion Heavy Industry

- LiuGong Machinery

- Komatsu Ltd.

- Hitachi Construction Machinery

- AB Volvo (Volvo CE)

- Liebherr Group

- Shantui Construction Machinery

- Tadano Ltd.

- J.C. Bamford Excavators Limited

- Doosan Bobcat Ltd.

- Hyundai Construction Equipment Ltd.

- Yanmar Holdings Co. Ltd.

- Terex Corporation

- China Railway Construction Heavy Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt. 'New Infrastructure 2025-30' pipeline

- 4.2.2 Carbon-neutral mandate spurring electric machinery

- 4.2.3 OEM export push enables domestic economies of scale

- 4.2.4 Belt and Road back-orders for component suppliers

- 4.2.5 Provincial carbon-credit markets favouring hybrids

- 4.2.6 Digital equipment-rental platforms unlocking SME demand

- 4.3 Market Restraints

- 4.3.1 Prolonged real-estate downturn

- 4.3.2 Domestic price wars from over-capacity

- 4.3.3 Tight credit to SME contractors

- 4.3.4 Inverter and BMS chip shortages for e-equipment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Machinery Type

- 5.1.1 Earth-moving Machinery

- 5.1.1.1 Excavators

- 5.1.1.2 Loaders

- 5.1.1.3 Dozers

- 5.1.2 Material-Handling Machinery

- 5.1.2.1 Cranes

- 5.1.2.2 Fork-lifts

- 5.1.2.3 Telescopic Handlers

- 5.1.3 Road-Construction Machinery

- 5.1.3.1 Motor Graders

- 5.1.3.2 Rollers/Compactors

- 5.1.3.3 Pavers

- 5.1.4 Concrete Equipment

- 5.1.4.1 Concrete Mixers

- 5.1.4.2 Concrete Pumps

- 5.1.1 Earth-moving Machinery

- 5.2 By Drive Type

- 5.2.1 Internal-Combustion (Diesel)

- 5.2.2 Hybrid

- 5.2.3 Full-Electric

- 5.3 By Sales Channel

- 5.3.1 OEM Direct Sales

- 5.3.2 Authorized Dealer Sales

- 5.4 By Application

- 5.4.1 Building Construction

- 5.4.2 Infrastructure Construction

- 5.4.3 Energy and Natural Resources

- 5.4.4 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sany Group

- 6.4.2 Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- 6.4.3 Caterpillar Inc.

- 6.4.4 Zoomlion Heavy Industry

- 6.4.5 LiuGong Machinery

- 6.4.6 Komatsu Ltd.

- 6.4.7 Hitachi Construction Machinery

- 6.4.8 AB Volvo (Volvo CE)

- 6.4.9 Liebherr Group

- 6.4.10 Shantui Construction Machinery

- 6.4.11 Tadano Ltd.

- 6.4.12 J.C. Bamford Excavators Limited

- 6.4.13 Doosan Bobcat Ltd.

- 6.4.14 Hyundai Construction Equipment Ltd.

- 6.4.15 Yanmar Holdings Co. Ltd.

- 6.4.16 Terex Corporation

- 6.4.17 China Railway Construction Heavy Industry Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment