PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846225

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846225

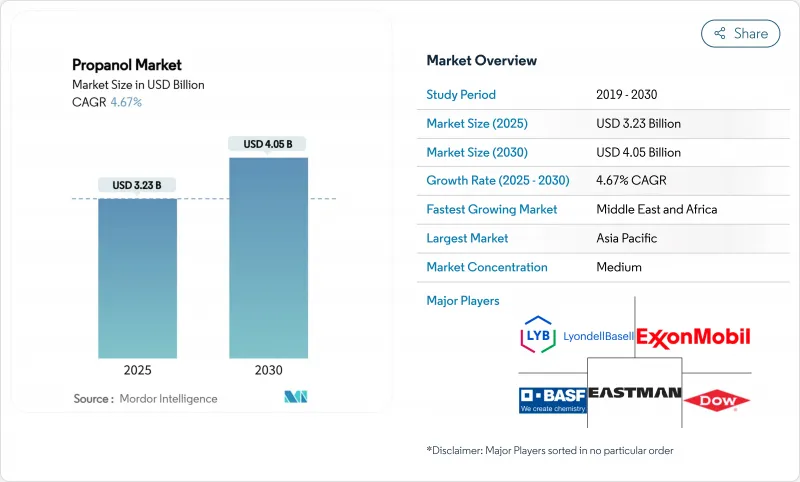

Propanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Propanol Market size is estimated at USD 3.23 billion in 2025, and is expected to reach USD 4.05 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

Moderate expansion stems from rising adoption in semiconductor cleaning, sustainable aviation fuel pathways, and pharmaceutical synthesis, even as regulatory pressures reshape solvent formulations. High-purity isopropanol demand for 5 nm and below chip fabrication, new API production hubs in Asia, and alcohol-to-jet projects in North America collectively underpin steady volume gains. Feedstock volatility and evolving VOC limits temper momentum, but continuous oxo-alcohol integration and investment in purification technologies help producers defend margins. Integrated petrochemical players therefore retain cost advantages, while bio-based entrants carve out growth niches within the wider propanol market.

Global Propanol Market Trends and Insights

High-purity IPA Demand in Electronics Cleaning

Ultra-high-purity isopropanol exceeding 99.999% purity has become indispensable for advanced node semiconductor fabrication. ExxonMobil is upgrading its Baton Rouge unit to supply this grade by 2027, ensuring secure domestic supply for United States chipmakers. Contamination at parts-per-trillion levels can impair wafer yields, pushing device makers to specify ever-cleaner solvents. Electronics cleaning consequently grows faster than the overall propanol market, and suppliers are installing additional distillation columns, filtration trains, and real-time analytics to certify product purity. The resulting price premiums partly offset feedstock volatility, allowing integrated producers to protect spreads while meeting stringent customer audits.

Construction-led Solvent Demand in Paints & Coatings

Strong residential and commercial construction in Asia Pacific and the Middle East is driving demand for architectural coatings that rely on propanol-based co-solvents to balance viscosity, open time, and film formation. Regulators in the United States and Europe continue tightening VOC thresholds, spurring formulation shifts toward waterborne systems that still require controlled levels of propanol for flash-off control. The U.S. Environmental Protection Agency has extended aerosol coating compliance deadlines to January 2027, giving manufacturers critical runway to redesign products while maintaining performance. Continuous solvent innovation helps coatings producers satisfy durability criteria without breaching emission limits, supporting incremental consumption across the propanol market.

Stricter VOC Rules for Solvent Formulations

The U.S. National VOC Emission Standards impose lower allowable limits on consumer and commercial coatings, forcing reformulation to meet January 2027 deadlines. Similar policies are unfolding in the European Union, compelling users to substitute or reduce traditional solvent volumes. Compliance costs, additional testing, and certification requirements slow demand growth in legacy coatings, inks, and adhesives application areas, dampening part of the propanol market's potential.

Other drivers and restraints analyzed in the detailed report include:

- Rising Pharma API Output in Asia Pacific

- Emerging Bio-propanol for Low-carbon Aviation Fuel

- Scale-up Hurdles for Bio-propanol Fermentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isopropanol accounted for 54.77% of the propanol market in 2024, leveraging its quick evaporation rate, antimicrobial efficacy, and versatile solvency for pharmaceuticals, personal care, and industrial cleaning. Semiconductor manufacturers are sharpening this dominance by contracting supply of 99.999% grades, and ExxonMobil's upcoming Baton Rouge line illustrates capital commitment toward ultra-high-purity batches. N-propanol maintains a niche but reliable presence in specialty inks and chemical intermediates, benefiting formulators requiring slower evaporation and distinct reactivity. Bio-based propanol delivers the steepest growth curve at 6.89% CAGR, aided by policy incentives targeting sustainable aviation fuel. USA BioEnergy's investment has increased confidence that offtake agreements can underwrite scale-up, positioning renewable producers for entry into the broader propanol market.

Isopropanol's extensive global distribution network and mature manufacturing footprint underpin reliable supply, yet escalating semiconductor demand is pressuring logistics and quality-control capacity. Producers are updating purification trains with ion-exchange, ultrafiltration, and advanced gas chromatography to verify part-per-trillion impurity thresholds. Conversely, bio-based output must overcome fermentation productivity limits and variable feedstock availability. Over the forecast horizon, the faster growth of renewable grades narrows the gap, but the absolute propanol market size for isopropanol remains well ahead, illustrating the inertia of entrenched production assets and customer familiarity.

The Propanol Market Report is Segmented by Product Type (n-Propanol, Isopropanol, Bio-Based Propanol), End-Use Industry (Pharmaceutical, Chemicals, Personal Care & Cosmetics, Printing Inks, Paints & Coatings, Electronics Cleaning, Adhesives & Sealants, Others), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific leads the propanol market with 40.24% share in 2024. Government programmes like India's PLI scheme and Bulk Drug Parks funnel investment into API synthesis lines that consume pharmaceutical-grade propanol. China remains the largest chemical producer globally, commanding 50% share of world output and driving solvent needs across paints, inks, and electronics assembly. High-purity demand is amplified by advanced node semiconductor activity in Japan and South Korea, where fabs stipulate stringent contamination thresholds. Growing integration between refineries and chemical complexes in Southeast Asia further stabilizes regional feedstock supply.

North America exhibits mature but resilient consumption. The United States exported USD 345 million of propanol in 2023 while importing USD 128 million, a sign of domestic self-sufficiency coupled with specialized grade requirements. ExxonMobil's plan to produce 99.999% purity isopropanol in Louisiana aligns with the domestic semiconductor incentive framework, reducing dependence on imported high-spec material. Concurrently, USA BioEnergy's Texas SAF project elevates the region's renewable propanol profile, signaling diversification of demand.

Europe faces cost-side pressure from energy prices and stricter environmental norms. BASF saw a 21% sales decline in 2023, emblematic of subdued industrial output, yet specialty grades for pharmaceuticals and personal care protect pockets of profitability. The Middle East and Africa region holds the highest forward CAGR potential. Advanced Petrochemical and SK Gas are constructing an isopropanol plant at Jubail, harnessing local propylene surpluses and integrated infrastructure. South America registers moderate growth, with Brazil's push toward SAF via sugarcane waste and biomethane unlocking future bio-propanol demand.

- BASF SE

- Deepak Fertilisers & Petrochemicals

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- HiMedia Laboratories

- Honeywell International Inc.

- INEOS

- LCY

- LyondellBasell Industries N.V.

- Mitsui Chemicals Inc.

- Moeve

- Sasol Limited

- Shell plc

- Solvay

- Solventis

- Tokuyama Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High-purity (isopropyl alcohol) IPA demand in electronics cleaning

- 4.2.2 Construction-led solvent demand in paints and coatings

- 4.2.3 Rising pharma API output in Asia Pacific

- 4.2.4 Emerging bio-propanol for low-carbon aviation fuel

- 4.2.5 Cost cuts via continuous oxo-alcohol integration

- 4.3 Market Restraints

- 4.3.1 Volatile propylene feedstock prices

- 4.3.2 Stricter VOC rules for solvent formulations

- 4.3.3 Scale-up hurdles for bio-propanol fermentation

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 n-Propanol

- 5.1.2 Isopropanol

- 5.1.3 Bio-based Propanol

- 5.2 By End-use Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Chemicals (Solvents and Intermediates)

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Printing Inks

- 5.2.5 Paints and Coatings

- 5.2.6 Electronics Cleaning

- 5.2.7 Adhesives and Sealants

- 5.2.8 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacifc

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Deepak Fertilisers & Petrochemicals

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 HiMedia Laboratories

- 6.4.7 Honeywell International Inc.

- 6.4.8 INEOS

- 6.4.9 LCY

- 6.4.10 LyondellBasell Industries N.V.

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Moeve

- 6.4.13 Sasol Limited

- 6.4.14 Shell plc

- 6.4.15 Solvay

- 6.4.16 Solventis

- 6.4.17 Tokuyama Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Substituting Gasoline as Fuel