PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846253

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846253

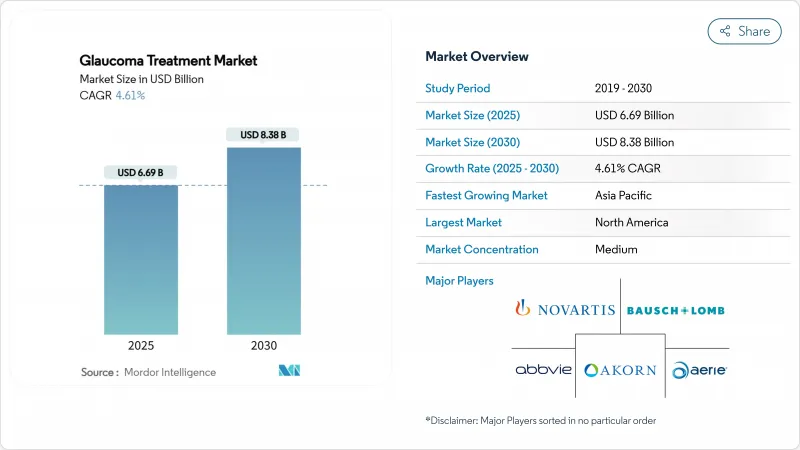

Glaucoma Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The glaucoma treatment market size stood at USD 6.69 billion in 2025 and is projected to reach USD 8.38 billion by 2030, registering a 4.61% CAGR over the forecast period.

The market is expanding because the aged share of the world's population is rising rapidly, while earlier and more accurate diagnosis is becoming routine in both developed and emerging health systems. Selective laser trabeculoplasty (SLT) is shifting first-line practice patterns, and sustained-release implants are transforming adherence economics. Meanwhile, artificial-intelligence (AI) screening networks, minimally invasive glaucoma surgery (MIGS) devices and pharmacogenetic tools are creating additional adoption curves that reinforce demand for both procedural and pharmaceutical solutions.

Global Glaucoma Treatment Market Trends and Insights

Increasing prevalence of glaucoma

Glaucoma incidence climbed to 23.46 per 10,000 person-years among adults aged 40-79 in 2024, with rates peaking at 64.36 in the 75-79 cohort. Urbanization-driven myopia now accelerates risk in Asia-Pacific, where projected case counts may reach 80 million by 2040. Sub-Saharan Africa continues to register the highest regional prevalence yet struggles with late-stage presentation that limits therapeutic effectiveness. Collectively, these demographic and epidemiological forces build a sustained demand floor for the glaucoma treatment market.

Rising awareness & screening initiatives

AI-enabled fundus image analysis achieves 93.52% sensitivity and 95% specificity, allowing reliable mass screening in settings where ophthalmologists are scarce. Smartphone-based cameras tethered to offline algorithms support rural outreach programs with minimal connectivity requirements. National tele-ophthalmology platforms aligned with WHO Vision 2020 extend diagnostic reach in low-resource geographies. These initiatives raise detection rates and funnel new patients into the glaucoma treatment market.

Adverse ocular & systemic side-effects

Pharmacovigilance reviews of the FDA Adverse Event Reporting System show conjunctival hyperemia and periorbital pigmentary changes as prominent signals for prostaglandin analogs. Netarsudil's median onset of ocular inflammation occurs within 1 day, with incident rates skewing higher in the older population. Dry-eye disease prevalence among glaucoma patients ranges from 5% to 50% and is frequently aggravated by benzalkonium-chloride preservatives. Systemic beta-blocker exposure can trigger cardiovascular and respiratory complications in susceptible individuals. These safety issues exert downward pressure on the glaucoma treatment market CAGR by driving discontinuations and regulatory scrutiny.

Other drivers and restraints analyzed in the detailed report include:

- Technological advancements in ophthalmology

- Sustained-release implants improve adherence

- Stringent & lengthy regulatory approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Open-angle glaucoma commanded 71.51% of the 2024 glaucoma treatment market share, underpinning the dominant clinical focus because most screening programs identify this form earliest. Segment revenues benefit from a full continuum of care, including topical drugs, SLT, MIGS and sustained-release implants that escalate therapy in graduated steps. Over the forecast horizon, incremental uptake of neuroprotective agents is expected to reinforce value capture in this broad indication.

Secondary glaucoma is expanding at a 9.25% CAGR, driven by better recognition of steroid-induced, pseudoexfoliative and trauma-related etiologies. Higher disease complexity often necessitates combination therapy and specialist procedures, generating above-average revenue per patient and boosting the glaucoma treatment market size for advanced segments.

The Glaucoma Treatment Market Report is Segmented by Indication (Open-Angle Glaucoma, Closed-Angle Glaucoma, Secondary Glaucoma, and More), Drug Class (Prostaglandin Analogs, Beta Blockers, Alpha Agonists, Carbonic Anhydrase Inhibitors, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 37.32% of 2024 sales, reflecting universal insurance coverage for first-line pharmaceuticals and wide procedural reimbursement. SLT adoption is mainstream, and MIGS growth accelerates as Medicare coverage stabilizes, though branded drop volumes are plateauing amid generic erosion. Canada mirrors U.S. practice patterns but exercises tighter cost-effectiveness thresholds, while Mexico's fast-growing private insurance market shifts demand toward premium implants. Overall, the region remains a high-value anchor for the glaucoma treatment market but is not the fastest-growth engine.

Asia-Pacific is projected to deliver an 8.17% CAGR, the highest regional pace, as China liberalizes drug-approval timelines and India scales AI-enabled screening infrastructure. Japan sustains MIGS uptake through robust post-marketing surveillance, whereas South Korea's national-insurance reimbursement unlocks early adoption of sustained-release devices. Australia demonstrates the template for primary-care AI triage, which is expected to ripple through other health systems. The region's mixture of high unmet need and accelerating technology adoption underpins its outsized contribution to future glaucoma treatment market growth.

Europe delivers steady growth through universal access and strong preference for preservative-free formulations. National payers encourage cost-effective SLT and generic options but also reimburse MIGS when incremental evidence supports long-term value. The Middle East is allocating oil-driven health budgets to expand ophthalmology centers, while Sub-Saharan Africa's high prevalence collides with fiscal constraints, limiting penetration of premium implants despite international aid programs. South America advances selectively: Brazil's public system validated SLT cost-effectiveness, and private chains are testing sustained-release implants.

- Aerie Pharmaceutical

- Abbvie

- Akorn

- Alcon

- Bausch + Lomb

- Glaukos

- Inotek (Rocket)

- Ivantis

- Johnson & Johnson

- Merck

- New World Medical

- Nicox

- Novartis

- Pfizer

- Santen

- Sun Pharmaceuticals Industries

- Teva Pharmaceutical Industries

- Valeant (Bausch Health)

- Glenmark Pharmaceuticals

- Acadia Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Increasing Prevalence Of Glaucoma

- 4.1.2 Rising Awareness & Screening Initiatives

- 4.1.3 Technological Advancements In Ophthalmology

- 4.1.4 Sustained-Release Implants Improve Adherence

- 4.1.5 Adoption Of Minimally Invasive Glaucoma Surgery (MIGS) Devices

- 4.1.6 Pharmacogenetic-Led Precision Therapy

- 4.2 Market Restraints

- 4.2.1 Adverse Ocular & Systemic Side-Effects

- 4.2.2 Stringent & Lengthy Regulatory Approvals

- 4.2.3 Reimbursement Gaps For Premium Implants & MIGS

- 4.2.4 SLT & Laser Therapies Cannibalising Drug Demand

- 4.3 Porter's Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Indication

- 5.1.1 Open-Angle Glaucoma

- 5.1.2 Closed-Angle Glaucoma

- 5.1.3 Secondary Glaucoma

- 5.1.4 Congenital Glaucoma

- 5.1.5 Others

- 5.2 By Drug Class

- 5.2.1 Prostaglandin Analogs

- 5.2.2 Beta Blockers

- 5.2.3 Alpha Agonists

- 5.2.4 Carbonic Anhydrase Inhibitors

- 5.2.5 Fixed-Dose Combinations

- 5.2.6 Rho-Kinase / NO-Donating PGAs

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Aerie Pharmaceuticals

- 6.3.2 AbbVie (Allergan)

- 6.3.3 Akorn, Inc.

- 6.3.4 Alcon Inc

- 6.3.5 Bausch + Lomb

- 6.3.6 Glaukos

- 6.3.7 Inotek (Rocket)

- 6.3.8 Ivantis

- 6.3.9 Johnson & Johnson

- 6.3.10 Merck & Co. Inc

- 6.3.11 New World Medical

- 6.3.12 Nicox

- 6.3.13 Novartis AG

- 6.3.14 Pfizer Inc

- 6.3.15 Santen

- 6.3.16 Sun Pharma

- 6.3.17 Teva

- 6.3.18 Valeant (Bausch Health)

- 6.3.19 Glenmark

- 6.3.20 Acadia Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment