PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846316

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846316

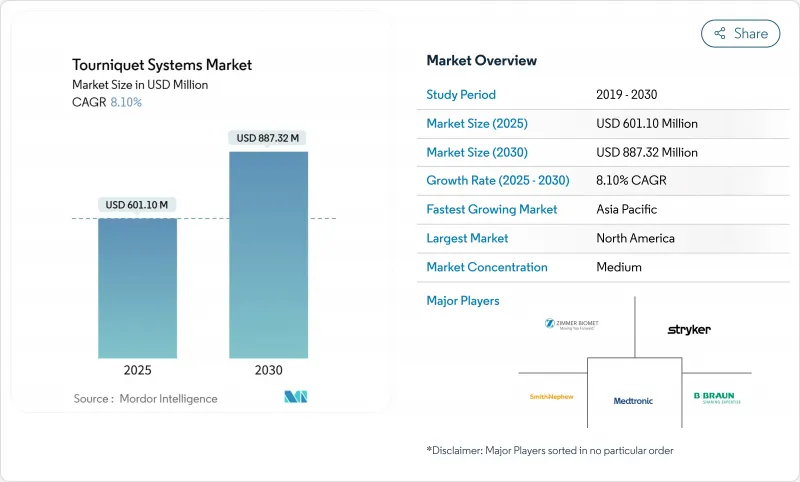

Tourniquet Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The tourniquet systems market reached a value of USD 601.10 million in 2025 and is projected to climb to USD 887.32 million by 2030, registering an 8.10% CAGR.

Robust orthopedic procedure growth, sustained military demand and the transition to smart limb-occlusion-pressure (LOP) devices underpin this expansion. Hospitals continue to account for most unit placements, yet ambulatory surgical centers (ASCs) are accelerating purchases as same-day joint replacements and hand surgeries migrate into outpatient settings. On the technology front, automatic pressure calibration and cloud-connected data capture are reshaping procurement criteria, while material upgrades toward latex-free silicone and advanced thermoplastic elastomers support infection-control and patient-comfort targets. Competitive intensity remains moderate; leading suppliers leverage AI-driven compression algorithms, domestic manufacturing investments and selective acquisitions to defend share as regional specialist entrants target lower-price pneumatic niches.

Global Tourniquet Systems Market Trends and Insights

Surging Orthopedic & Trauma Surgeries Worldwide

Elective and trauma-based orthopedic volumes continue to climb, buoyed by aging populations and sports-medicine demand. Same-day hip and knee arthroplasties moved from 1% in 2017 to 30.5% in 2021, compressing average stays to 0.94 days and lifting reliance on reliable limb exsanguination tools. The global hip-knee implant sector grew 7.2% year-on-year to USD 18.5 billion in 2023, with robotic guidance amplifying the need for clear operative fields. Geographic variability remains stark; emergency lower-extremity amputation rates ranged from 3.7% to 90% across U.S. zip codes, signaling under-served segments that require efficient tourniquet deployment. Collectively, these procedure trends bolster annual replacement cycles for cuffs and drive upgrades to micro-processor pumps, sustaining the tourniquet systems market.

Rapid Adoption of Limb-Occlusion-Pressure Smart Tourniquet Systems

Smart devices shift practice from empirical values toward patient-specific pressures. Stryker's SmartPump 2.0 demonstrates lower occlusion thresholds while auto-documenting perioperative data streams . Zimmer Biomet's A.T.S. 5000 offers Personalized Pressure Technology that tailors inflation to limb morphology, reducing post-operative pain scores . Comparative testing showed Delfi's surgical-grade algorithms delivering 100% autoregulation accuracy versus variable performance among consumer devices. These capabilities resonate with hospital quality metrics and regulatory calls for safer pressure windows, positioning smart pumps as the fastest rising unit segment within the tourniquet systems market.

Higher Post-Operative Complication Risk (Nerve/Ischemia)

Nerve palsy remains the primary adverse event linked to excessive tourniquet pressure or duration. A global scoping review identified ischemic pain, thromboembolic events and post-tourniquet syndrome as additional concerns, though incidence drops sharply when evidence-based protocols are followed. European trauma guidelines now highlight time limits and real-time monitoring to curb paralysis risk. AORN's 2025 practice advisory mandates limb girth measurement, cuff fit checks and continuous pressure readouts, prompting facilities to reassess reusable cuff policies. Fear of litigation and higher insurance premiums can delay capital purchases among budget-sensitive hospitals, moderating the tourniquet systems market growth pace.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Military Procurement Amid Prolonged Conflicts

- Rising Prevalence of Diabetes-Related Amputations

- Shortage of Skilled Staff for Pressure Calibration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tourniquet cuffs generated 88.75% of 2024 revenue, anchoring the tourniquet systems market as the consumable element most directly tied to procedure counts. Recurring replacement, single-use infection-control policies and varied limb-specific configurations lock cuffs into purchasing budgets. Smart pump adoption, while currently niche, is advancing at a 9.25% CAGR, and bundled contracts increasingly pair adaptive pumps with proprietary cuff lines to lock in post-sale consumable income.

Hospital value analyses repeatedly highlight the sterilization labor and quality-variation risks linked to reusable fabrics, steering procurement toward latex-free disposable nylon or silicone cuffs. During 2024 supply constraints, the FDA endorsed limited cuff reuse, which temporarily propped up older stock yet underscored the fragility of single-source chains. Smart systems integrate digital auto-pressure sensors that log each cycle to the EMR, supporting audit trails and preventive maintenance. As these data credentials influence payer audits, the component mix is expected to shift, but cuffs will remain the revenue cornerstone, sustaining the long-term outlook for the tourniquet systems market.

Lower-extremity surgeries contributed 68.35% of 2024 procedures and USD 411.4 million of tourniquet systems market size, leveraging higher pressure thresholds and longer inflation times compared with arm applications. Arthroplasty growth, battlefield trauma and diabetic amputations converge to keep demand high, with each driver exhibiting durable multi-year trends.

Upper-limb procedures, although smaller in absolute numbers, are forecast to expand at 9.42% CAGR through 2030, outpacing market average as minimally invasive wrist and elbow work rises. Cost analyses show elastic straps saving USD 28.27 per hand surgery versus pneumatic alternatives without compromising field clarity. Such findings propel niche adoption of inexpensive mechanical loops, especially in ASCs. Elsewhere, EMS trauma kits and hybrid vascular cases fall into the "other" bucket that maintains a steady share as emergency clinicians integrate portable quick-release bands. Together, these segments keep the tourniquet systems market balanced between high-volume lower-limb and high-growth upper-limb niches.

The Tourniquet Systems Market Report is Segmented by Component Type (Tourniquet Instruments, Tourniquet Cuffs), Application (Lower-Limb Surgery, Upper-Limb Surgery, Others), End-User (Hospitals, and More), Material (Nylon, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America booked 45.45% of 2024 revenue, reflecting dense orthopedic procedure volumes, broad insurance coverage and early adoption of LOP pumps. U.S. hospital consolidation and centralized purchasing contracts further anchor supplier footprints, while domestic manufacturing subsidies bolster capacity resiliency. Canada mirrors many of these drivers but exhibits faster uptake of single-use cuffs due to provincial infection-control guidelines.

Europe maintained steady growth on the back of rigorous CE branding and pan-regional orthopedic registries that promote evidence-based device selection. Germany and the Nordic countries exhibit higher penetrations of smart pumps, whereas Southern Europe favors cost-sensitive pneumatic bundles. The region is also seeing incremental demand from defense stockpiles as NATO members replenish tactical kits.

Asia-Pacific represents the fastest growing cluster, posting a 10.35% CAGR projection as procedure backlogs clear and private insurance penetration rises. China's county-level trauma network expansion and India's surge in road-traffic injuries catalyze cuff consumption. Japanese orthopedic societies are piloting AI-linked pressure algorithms, while Australia's defense-driven R&D spills into civilian tenders. Middle East & Africa and South America trail in absolute size but offer double-digit growth pockets; Brazil's move to universal digital health records and Saudi Arabia's Vision 2030 hospital build-outs both embed smart tourniquet procurement clauses. Geo-specific product adaptations, such as battery-free pneumatic units for power-unstable regions, enable suppliers to extend the tourniquet systems market footprint.

- Delfi Medical Innovations Inc.

- Zimmer Biomet

- Hammarplast Medical

- Stryker

- Anetic Aid Ltd.

- Ulrich Medical

- OHK Medical Devices

- Rudolf Riester

- Dessillons & Dutrillaux

- VBM Medizintechnik

- B. Braun

- Smiths Group

- Medtronic

- North American Rescue LLC

- SAM Medical

- RevMedx Inc.

- TyTek Medical

- C.A.T Resources

- Tactical Medical Solutions Inc.

- Dunlap Medical Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Orthopedic & Trauma Surgeries Worldwide

- 4.2.2 Rapid Adoption Of Limb-Occlusion-Pressure (LOP) Smart Tourniquet Systems

- 4.2.3 Increasing Military Procurement Amid Prolonged Conflicts

- 4.2.4 Rising Prevalence Of Diabetes-Related Amputations

- 4.2.5 Growth Of Outpatient & Asc Orthopedic Procedures

- 4.2.6 Emergence Of Low-Cost Pneumatic Units For Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Higher Post-Operative Complication Risk (Nerve/Ischemia)

- 4.3.2 Shortage Of Skilled Or Staff For Pressure Calibration

- 4.3.3 Sterilization Concerns With Reusable Cuffs

- 4.3.4 Regulatory Scrutiny Over Hazardous Pressure Thresholds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Component Type

- 5.1.1 Tourniquet Instruments

- 5.1.2 Tourniquet Cuffs

- 5.1.2.1 Pneumatic

- 5.1.2.2 Non-pneumatic

- 5.2 By Application

- 5.2.1 Lower-limb Surgery

- 5.2.2 Upper-limb Surgery

- 5.2.3 Others

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 By Material

- 5.4.1 Nylon

- 5.4.2 Silicone & Rubber

- 5.4.3 Velcro & Textile

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Delfi Medical Innovations Inc.

- 6.3.2 Zimmer Biomet Holdings Inc.

- 6.3.3 Hammarplast Medical AB

- 6.3.4 Stryker Corporation

- 6.3.5 Anetic Aid Ltd.

- 6.3.6 Ulrich Medical

- 6.3.7 OHK Medical Devices

- 6.3.8 Rudolf Riester GmbH

- 6.3.9 Dessillons & Dutrillaux

- 6.3.10 VBM Medizintechnik GmbH

- 6.3.11 B. Braun Melsungen AG

- 6.3.12 Smith & Nephew plc

- 6.3.13 Medtronic plc

- 6.3.14 North American Rescue LLC

- 6.3.15 SAM Medical

- 6.3.16 RevMedx Inc.

- 6.3.17 TyTek Medical

- 6.3.18 C.A.T Resources

- 6.3.19 Tactical Medical Solutions Inc.

- 6.3.20 Dunlap Medical Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment