PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846326

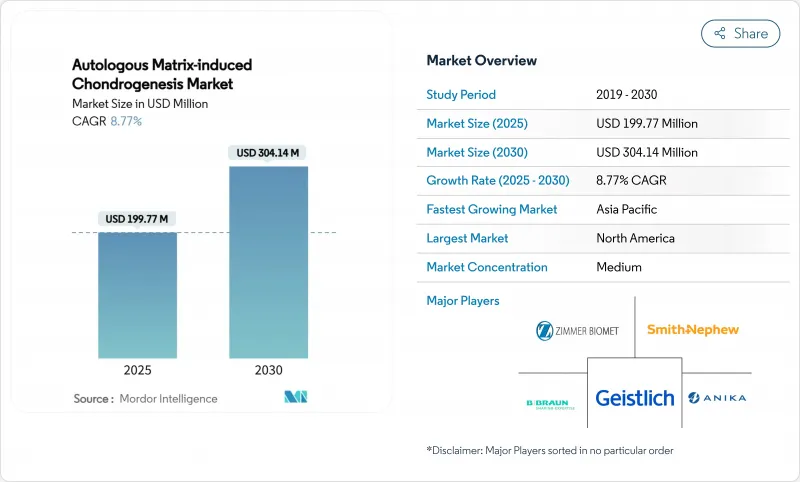

Autologous Matrix-induced Chondrogenesis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Autologous Matrix-induced Chondrogenesis market stands at USD 199.77 million in 2025 and is forecast to climb to USD 304.14 million by 2030, advancing at an 8.77% CAGR.

Momentum comes from surgeons seeking a single-stage bridge between conventional microfracture and complex cell-based implants, a niche that AMIC fills by pairing bone-marrow stimulation with a protective scaffold. Rapid uptake of minimally invasive orthopedic techniques, rising outpatient surgery volumes, and continuing FDA clearances sustain demand. Hyaluronic-acid scaffolds remain the preferred material, but chitosan platforms are outpacing rivals as innovation unlocks bioactive, drug-delivering hydrogels. North America retains leadership thanks to reimbursement alignment and strong clinical evidence, while Asia-Pacific records the fastest expansion on the back of infrastructure investments and growing sports participation.

Global Autologous Matrix-induced Chondrogenesis Market Trends and Insights

Rising Prevalence of Osteoarthritis & Cartilage Injuries

Global life expectancy is rising, and with it the number of people living long enough to develop degenerative joint disease. Osteoarthritis now affects 27 million Americans, and post-traumatic cases represent another 10-12% of the total, underscoring the unmet clinical need for durable cartilage repair options.Against this backdrop, single-stage AMIC procedures appeal to surgeons because they avoid expensive cell-expansion steps while still improving tissue quality. Mid-term evidence shows patients treated with advanced implants experience an 87% lower risk of total knee arthroplasty within four years, strengthening the procedure's value-based argument. Health systems facing budget pressure see AMIC as a way to delay or even avert joint replacements, which carry higher downstream costs. As populations continue to age and remain active, the steady flow of cartilage lesions should keep demand for single-stage solutions on an upward trajectory.

Growing Sports-Related Trauma Cases Worldwide

Participation in organized sports is rising across youth, amateur, and professional levels, creating a wider injury funnel for orthopedic care. Between 2014 and 2023, U.S. emergency departments recorded more than 843,000 soccer-related lower-extremity injuries, of which ankle issues accounted for 36.39%. Professional basketball mirrors that burden, with musculoskeletal problems making up 65.54% of all health events and the knee alone representing nearly one quarter. AMIC's minimally invasive approach returns 80.8% of talus-lesion athletes to sport within roughly 43 months, a statistic that resonates with players and teams focused on rehabilitation speed. Surgeons therefore view AMIC as a pragmatic bridge between conservative management and joint-replacement extremes. Continued growth in global sports participation-especially in Asia-Pacific-will enlarge the candidate pool for cartilage-preserving technologies.

Uncertain Long-Term Clinical Outcomes Beyond 10 Years

Five-year survivorship for AMIC reaches 85% in the knee and 89% in the ankle, yet most payers and guideline panels demand 15-year durability before revising standard-of-care recommendations. Younger, highly active patients may therefore be steered toward treatments with longer historical datasets even if early AMIC outcomes appear superior. Technique heterogeneity-ranging from scaffold composition to fixation strategy-complicates pooled analysis and blunts the power of meta-studies. Inconsistent rehabilitation protocols add further variability, making it harder for insurers to model lifetime cost-effectiveness. Until long-term registries mature, conservative reimbursement policies will continue to cap procedure volumes.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Demand for Minimally Invasive Orthopedic Procedures

- Development of Next-Gen Photo-Cross-Linked HA Scaffolds Enabling Single-Stage Repair

- Limited Surgeon Proficiency Outside Tier-1 Orthopedic Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hyaluronic-acid constructs held 41.23% of Autologous Matrix-induced Chondrogenesis market share in 2024. Their innate presence in synovial fluid supports cellular adhesion and protects against degradation, a blend of benefits that keeps surgeons loyal. The segment has also produced the highest volume of peer-reviewed evidence, reducing regulatory friction in key markets. Nevertheless, chitosan's 11.73% CAGR shows buyers value its antimicrobial traits, mesenchymal-cell compatibility, and tunable degradation. Novel formulations embed mesoporous silica nanoparticles to drive chondrogenesis, positioning chitosan as the likely next frontier. Manufacturers are scaling multizonal constructs that mirror cartilage-subchondral gradients, a development that broadens indications.

In parallel, collagen membranes retain a substantial installed base thanks to long clinical familiarity and versatile handling. PEG and PLGA designs meet niche needs where mechanical strength or slow resorption is mandatory. The Autologous Matrix-induced Chondrogenesis market size for hyaluronic-acid products is forecast to reach USD 128 million by 2030, whereas chitosan is set to deliver the fastest absolute gains. As cost pressures rise, suppliers capable of lowering unit prices without sacrificing bioactivity will secure a decisive foothold.

Autologous Matrix-Induced Chondrogenesis Market Report is Segmented by Material (Hyaluronic Acid, Collagen, Polyethylene Glycol, Poly Lactic-Co-Glycolic Acid and More), Application (Knee Cartilage, Hip Cartilage, and More), End User (Hospitals, Ambulatory Surgery Centers and More) and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the Autologous Matrix-induced Chondrogenesis market with a 36.77% share in 2024. The region benefits from clear FDA pathways, growing ASC penetration, and outcome-based payment models rewarding joint-preservation strategies. Recent MACI Arthro and RejuvaKnee approvals further validate the technology pipeline, giving surgeons confidence to broaden indications. Commercial payers increasingly bundle reimbursement for single-stage repairs, reducing the financial uncertainty once tied to scaffold use.

Europe follows closely, propelled by strong university-industry collaboration and a tradition of regenerative-medicine research. CE-marked scaffolds such as Chondro-Gide maintain wide adoption, and national health systems evaluate AMIC in cost-utility studies that may unlock broader coverage. Meanwhile, Latin America continues to invest in sports-injury clinics and public-private orthopedic centers, presenting growth opportunities for suppliers willing to offer tiered pricing and onsite training.

Asia-Pacific is the fastest-expanding territory at a 10.98% CAGR. Governments are channeling resources into hospital build-outs, while aging populations push elective-joint workloads higher. China champions domestic scaffold manufacturing and has begun reimbursing select cartilage procedures, lowering entry barriers for global brands through joint ventures. Japan leverages its robotics ecosystem to refine hip and ankle arthroscopy, while India's National Medical Devices Policy supports local production of cost-effective implants. Southeast Asian nations, once reliant on medical tourism, are installing ASC networks that favor single-stage cartilage repair. Rising youth-sports injury rates-37.5% knee injuries among school footballers in some regions-underscore latent demand.

Collectively, these dynamics will lift regional contributions and diversify revenue streams, reducing the Autologous Matrix-induced Chondrogenesis market's historical reliance on mature Western economies.

- Geistlich Pharma

- Smiths Group

- Zimmer Biomet

- CartiHeal

- Anika Therapeutics

- Arthrex

- Conmed

- B. Braun

- Matricel

- JRI Orthopaedics

- Vericel

- CO.DON AG

- BioTissue AG

- Stryker

- Johnson & Johnson

- BioPoly LLC

- Tissue Regenix Group

- Orthocell

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Osteoarthritis & Cartilage Injuries

- 4.2.2 Growing Sports-Related Trauma Cases Worldwide

- 4.2.3 Accelerating Demand For Minimally-Invasive Orthopedic Procedures

- 4.2.4 Expanded Reimbursement For Knee Cartilage Repair

- 4.2.5 Surge In Outpatient Ambulatory Surgery Centers Adopting AMIC

- 4.2.6 Development Of Next-Gen Photo-Cross-Linked HA Scaffolds Enabling Single-Stage Repair

- 4.3 Market Restraints

- 4.3.1 Uncertain Long-Term Clinical Outcomes Beyond 10 Years

- 4.3.2 Limited Surgeon Proficiency Outside Tier-1 Orthopedic Hubs

- 4.3.3 High Procedure & Scaffold Costs Vs. Microfracture

- 4.3.4 Regulatory Lag For Novel Biomaterials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Material

- 5.1.1 Hyaluronic Acid

- 5.1.2 Collagen

- 5.1.3 Polyethylene Glycol (PEG)

- 5.1.4 Poly Lactic-co-glycolic Acid (PLGA)

- 5.1.5 Chitosan & Other Materials

- 5.2 By Application

- 5.2.1 Knee Cartilage

- 5.2.2 Hip Cartilage

- 5.2.3 Elbow Cartilage

- 5.2.4 Ankle & Talus Cartilage

- 5.2.5 Other Joints

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Orthopedic & Sports Medicine Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Geistlich Pharma AG

- 6.3.2 Smith+Nephew

- 6.3.3 Zimmer Biomet Holdings

- 6.3.4 CartiHeal

- 6.3.5 Anika Therapeutics

- 6.3.6 Arthrex

- 6.3.7 CONMED Corporation

- 6.3.8 B. Braun SE

- 6.3.9 Matricel GmbH

- 6.3.10 JRI Orthopaedics

- 6.3.11 Vericel Corp.

- 6.3.12 CO.DON AG

- 6.3.13 BioTissue AG

- 6.3.14 Stryker Corp.

- 6.3.15 Johnson & Johnson

- 6.3.16 BioPoly LLC

- 6.3.17 Tissue Regenix Group

- 6.3.18 Orthocell Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment