PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846351

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846351

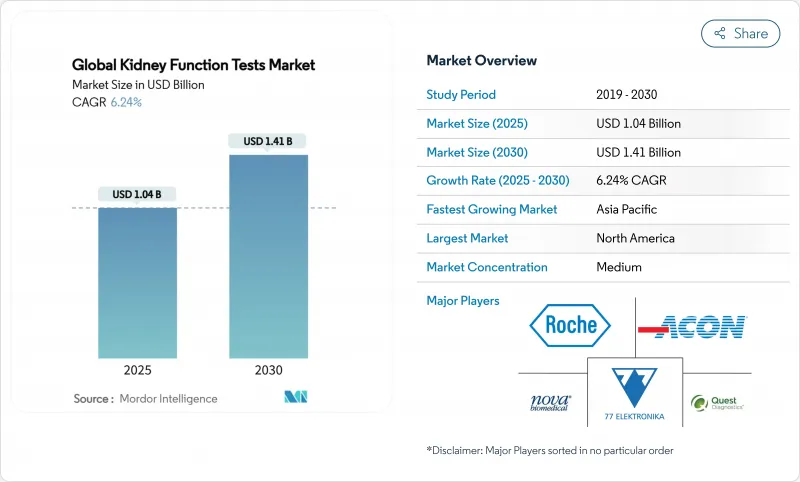

Global Kidney Function Tests - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The kidney function test market size reached USD 1.04 billion in 2025 and is forecast to climb to USD 1.41 billion by 2030, translating into a 6.24% CAGR.

This growth links directly to a worldwide chronic kidney disease (CKD) burden that already exceeds 850 million people, with diabetes and hypertension acting as the principal catalysts. Point-of-care (POC) diagnostics, artificial-intelligence (AI) decision support, and home-based monitoring are reshaping test demand by moving assessments closer to patients. Government-backed screening initiatives such as expanded Medicare coverage for home dialysis and inclusion of oral-only drugs in the End-Stage Renal Disease (ESRD) bundle are reinforcing the shift toward decentralized testing models. Asia-Pacific exhibits the fastest regional momentum, while North America retains scale leadership because of comprehensive reimbursement and advanced diagnostic infrastructure. Against this backdrop, consolidation among conventional diagnostics firms and rapid entry by smartphone-based platforms are intensifying competition and forcing suppliers to differentiate through automation, multi-analyte panels, and clinical-decision software.

Global Kidney Function Tests Market Trends and Insights

Rising prevalence of chronic kidney disease (CKD)

CKD now affects 13.4% of the global population, and health systems are scaling screening to stem dialysis demand. The Philippines extended its ACT NOW program to 12 provinces, providing more than 1 million free urine albumin-creatinine ratio tests. In India, the CITE study uncovered a 32% CKD prevalence among people living with type 2 diabetes, with risk increasing sharply after age 60 and a 10-year disease duration. Such evidence is pushing both high-income and emerging markets to adopt scalable, low-cost kidney function testing outside traditional laboratories. The kidney function tests market therefore benefits from predictable demand as public health agencies standardize screening protocols.

Growing diabetes & hypertension burden

The American Diabetes Association's 2024 clinical guidance recommends annual albuminuria and estimated glomerular filtration rate (eGFR) evaluations for every adult with type 2 diabetes. Alignment with quality measures such as HEDIS and MIPS is rewarding providers who systematically test high-risk patients. Proteomics International commercialized PromarkerD in Australia, a blood test that flags diabetic kidney disease up to four years before symptom onset. These policies and tools channel patients toward proactive monitoring, ensuring steady growth in the kidney function tests market.

High cost of analyzers & consumables

Annual medical expenses for renal replacement therapy in Asia range from USD 2,901 to USD 18,668, while hemodialysis averages USD 23,358 per patient, underlining the need for cost-effective screening. The FDA warned in March 2025 of bloodline shortages for hemodialysis equipment that could persist through early fall 2025. Ugandan clinicians cite price barriers, supply shortages, and weak infrastructure as primary obstacles to CKD testing. High capital costs thus impede analyzer placement in low-resource facilities, tempering uptake of some advanced platforms in the kidney function tests market.

Other drivers and restraints analyzed in the detailed report include:

- Government-backed CKD screening programs

- Automation & POC technology advances

- Stringent regulatory & reimbursement hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dipsticks contributed 54.74% of kidney function tests market share in 2024 due to their low price, ease of use, and compatibility with routine urinalysis workflows. Demand spans hospital wards, outpatient clinics, and school health programs, anchoring baseline volumes. Reagents, however, are projected to expand at a 7.36% CAGR through 2030 as laboratories migrate toward automated, high-throughput chemistry platforms that cut technician time and improve analytical precision. The kidney function tests market size for reagents is forecast to increase alongside adoption of microfluidic cartridges and multi-analyte chemistry packs that bundle albumin, cystatin C, and B2-microglobulin into single runs. Disposables sit between these poles, benefiting from higher test counts yet experiencing price competition from generic suppliers.

Innovation revolves around reagent chemistry. Siemens Healthineers introduced an albumin-creatinine ratio test that delivers quantitative results within minutes and can process small urine volumes, making it suitable for pediatric and geriatric use. Multi-omics research has identified 32 circulating proteins linked to CKD progression, driving demand for specialized reagent panels able to detect multiplexed biomarkers. Procurement teams increasingly prioritize supplier packages that pair analyzers with proprietary reagent kits to guarantee calibration integrity. This bundling fortifies switching costs and sustains revenue visibility across the kidney function tests market.

Urine-based assays represented 62.36% of kidney function tests market size in 2024, reflecting their non-invasive nature and entrenched clinical guidelines. Micro-albumin testing is becoming a routine annual check for patients with diabetes or hypertension, while dipstick urinalysis remains the first-line screen in occupational and military health programs. Blood-based assays are forecast to grow 7.06% CAGR, underpinned by micro-sample technologies that require only finger-stick volumes. BD's capillary collection device delivers sample integrity comparable with venous draws, helping laboratories integrate creatinine and cystatin C into comprehensive metabolic panels.

Serum creatinine remains central to eGFR calculations, yet cystatin C is gaining traction for older adults because it is less influenced by muscle mass. Research covering 675 serum and 542 urine metabolites significantly associated with renal function indicates looming expansion beyond classical markers. For suppliers, multi-analyte kits that combine both fluids offer cross-selling synergies, pushing margin growth in the kidney function tests market.

The Kidney Function Tests Market is Segmented by Product Type (Dipsticks, Disposables, Reagents), by Test Type (Urine Tests [Urine Protein Tests, Creatinine Clearance Tests, and More], Blood Tests [Serum Creatinine Tests, and More]), by End User (Hospitals and Clinics, Diagnostic Laboratories, and More), by Testing Setting (Central-Lab Based, Point-Of-Care), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America held 43.64% kidney function tests market share in 2024 on the back of mandated annual kidney health evaluations for adults with diabetes under CMS quality programs. Payers in the region reimburse both central-lab and POC assays, anchoring predictable revenue for suppliers. The United States also spearheads wearable diagnostics; prototype artificial-kidney belts leverage bioimpedance sensors and AI to produce real-time GFR estimates, spurring demand for companion confirmatory tests. Canada's provincial health agencies are funding CKD screening in Indigenous communities, broadening addressable volume, while Mexico's Seguro Popular upgrades include public dialysis centers that integrate on-site creatinine testing.

Asia-Pacific constitutes the fastest-expanding geography, projected at an 8.57% CAGR through 2030. China approved MediBeacon's transdermal GFR monitor in 2025, marking the region's openness to advanced diagnostics. India's national dialysis scheme finances three weekly treatments for below-poverty-line patients and automatically triggers pre-dialysis creatinine checks, driving reagent volumes. Rising diabetes prevalence, coupled with expanding private insurance penetration, positions Indonesia, Thailand, and Vietnam as high-growth sub-markets within the kidney function tests market.

Europe maintains stable expansion as the KDIGO 2024 guidelines plus European Renal Best Practice commentary harmonize CKD management pathways. Nova Biomedical's CE-marked Max Pro meter delivers creatinine and eGFR in 30 seconds at POC sites across the European Union, illustrating regulatory momentum toward decentralized diagnostics. Eastern European countries leverage EU structural funds to upgrade nephrology labs, balancing regional disparities. The Middle East and Africa face infrastructural constraints, yet Gulf Cooperation Council states are investing in dialysis centers that incorporate on-site urinalysis rooms. African union development grants are earmarked for portable creatinine readers that operate without continuous power. South America's urbanization and lifestyle shifts fuel CKD prevalence; Brazil's public health agency recently piloted pharmacy-based albumin-creatinine strip testing in Sao Paulo clinics. Collectively these regional vectors ensure the kidney function tests market continues its balanced growth narrative, combining volume uptake in emerging economies with technology-driven value expansion in mature ones.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Sysmex

- Beckton Dickinson

- Nova Biomedical

- Thermo Fisher Scientific

- Arkray

- 77 Elektronika Kft

- Acon Laboratories

- Randox Laboratories

- Quest Diagnostics

- LabCorp

- URIT Medical Electronic

- bioMerieux

- Alfa Wassermann Diagnostic Technologies

- Bio-Rad Laboratories

- Ortho Clinical Diagnostics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic kidney disease (CKD)

- 4.2.2 Growing diabetes & hypertension burden

- 4.2.3 Government-backed CKD screening programs

- 4.2.4 Automation & POC technology advances

- 4.2.5 Multi-omics + AI early-diagnosis biomarker panels

- 4.2.6 Adoption of wearable & home-monitoring kidney sensors

- 4.3 Market Restraints

- 4.3.1 High cost of analyzers & consumables

- 4.3.2 Stringent regulatory & reimbursement hurdles

- 4.3.3 Lack of clinical standardisation for novel biomarkers

- 4.3.4 Supply-chain fragility for critical reagents in LMICs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Dipsticks

- 5.1.2 Disposables

- 5.1.3 Reagents

- 5.2 By Test Type

- 5.2.1 Urine Tests

- 5.2.1.1 Urine Protein Tests

- 5.2.1.2 Creatinine Clearance Tests

- 5.2.1.3 Micro-albumin Tests

- 5.2.2 Blood Tests

- 5.2.2.1 Serum Creatinine Tests

- 5.2.2.2 eGFR / Glomerular Filtration Rate Tests

- 5.2.2.3 Blood Urea Nitrogen Tests

- 5.2.1 Urine Tests

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Diagnostic Laboratories

- 5.3.3 Home and Point-of-Care Settings

- 5.3.4 Others

- 5.4 By Testing Setting

- 5.4.1 Central-Lab Based

- 5.4.2 Point-of-Care

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche Ltd.

- 6.3.3 Siemens Healthineers

- 6.3.4 Sysmex Corporation

- 6.3.5 Beckman Coulter Inc. (Danaher Corporation)

- 6.3.6 Nova Biomedical

- 6.3.7 Thermo Fisher Scientific

- 6.3.8 Arkray Inc.

- 6.3.9 77 Elektronika Kft

- 6.3.10 ACON Laboratories Inc.

- 6.3.11 Randox Laboratories

- 6.3.12 Quest Diagnostics

- 6.3.13 Laboratory Corporation of America Holdings

- 6.3.14 URIT Medical Electronic Co. Ltd

- 6.3.15 bioMerieux SA

- 6.3.16 Alfa Wassermann Diagnostic Technologies

- 6.3.17 Bio-Rad Laboratories

- 6.3.18 Ortho-Clinical Diagnostics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment