PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836470

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836470

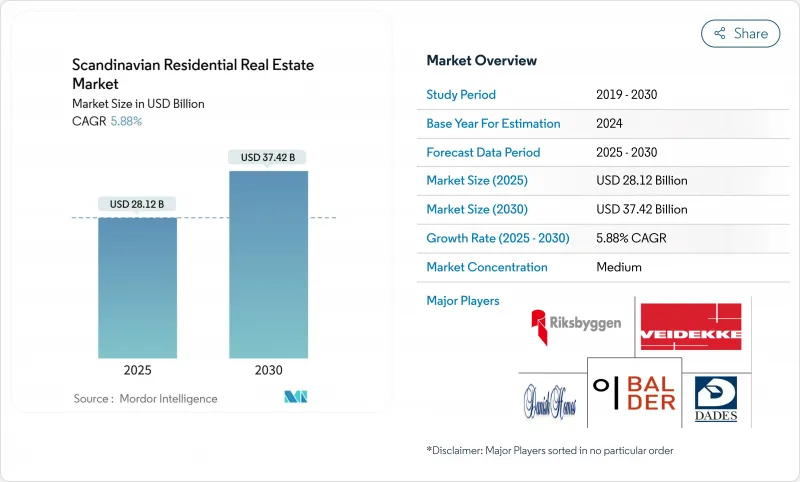

Scandinavian Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Scandinavian residential real estate market size stands at USD 28.12 billion in 2025 and is projected to reach USD 37.42 billion in 2030, reflecting a 5.88% CAGR.

Normalized interest rates, a surge of institutional capital and demographic shifts toward renting underpin this growth trajectory. Sweden's rapid rate-cut cycle, Denmark's consistent 4.2% annual price gains through 2026 and Norway's looser lending terms collectively expand transaction volumes and bolster pricing power. Tight urban land supply intensifies demand for high-density apartments, while EU-aligned green-building rules accelerate new-build activity across the Scandinavian residential real estate market. Institutional investors, lured by predictable rental cash flows and ESG credentials, now treat housing as a core allocation alongside logistics and infrastructure.

Scandinavian Residential Real Estate Market Trends and Insights

Interest-Rate Normalisation & Expected Cuts

The Riksbank's key rate is set to slide to 2.25% by 2025, while Norges Bank guides toward a 3.25% base rate, lowering mortgage servicing costs and boosting loan approvals. Sweden saw investment volumes rebound 66% year-over-year to SEK 138.5 billion in 2024, with residential assets representing 28% of deal flow. Danish mortgage coupons stabilised near 3.5%, opening regional arbitrage opportunities for cross-border capital. First-time buyers already make up half of new Norwegian home loans after down-payment rules eased, signalling rising proprietorship demand. Cheaper credit also galvanises institutional allocations, a structural boon for the Scandinavian residential real estate market.

Rapid Urbanisation & Shrinking Household Size

Population concentration and smaller household units intensify demand for compact apartments in Stockholm, Copenhagen and Oslo. Average household size is falling, prompting developers to prioritize micro-units, coworking lounges and shared amenities that raise per-square-meter revenue while preserving affordability. Oslo's central districts posted 6% price growth in 2024, underscoring how urban cores command a premium despite flexible work trends. The Scandinavian residential real estate market therefore pivots toward high-density projects that limit commute times and offer lifestyle convenience. Remote workers still gravitate to lively neighborhoods, reinforcing the value proposition of centrally located apartments.

High Household Indebtedness

Norwegian households allocate a significant share of disposable income to mortgages, with 14.5% experiencing acute strain during 2023's rate spike. Sweden and Denmark likewise face elevated debt-to-income ratios, prompting warnings from the European Systemic Risk Board about variable-rate exposure. Heavy leverage curbs upgrade activity and dampens speculative demand across the Scandinavian residential real estate market. Younger buyers juggling student loans and rising living costs delay ownership, sustaining rental demand but clipping sales momentum. Banks respond with tougher underwriting, preserving asset-quality ratios at the expense of loan-book growth.

Other drivers and restraints analyzed in the detailed report include:

- Institutional Capital Inflow & REIT Expansion

- Green-Housing Incentives & EPC Regulation

- Macro-Prudential Lending Caps (LTV/DSI)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums secured 59% of Scandinavian residential real estate market share in 2024 and register the fastest 6.09% CAGR through 2030. Villas hold the remaining 41%, appealing to families favoring private outdoor space in commuter belts. High land costs, zoning limits and mass-timber modular systems give apartments superior build-economics, supporting sustained outperformance in the Scandinavian residential real estate market.

Stockholm Wood City's 2,000 units illustrate how embedded coworking, EV charging and neutral-carbon credentials unlock premiums among eco-conscious urbanites. Developers also exploit density bonuses offered by municipalities to integrate public transport nodes and mixed-use podiums. Energy-sharing heat grids cut operating bills, reinforcing occupancy stability for institutional landlords and underpinning the segment's contribution to Scandinavian residential real estate market size.

Mid-market homes represented 46% of Scandinavian residential real estate market size in 2024, balancing quality and cost for dual-income households. Yet policy-backed affordable stock is expanding at 6.16% CAGR, aided by municipal land-release auctions and favourable VAT waivers.

Danish schemes permitting shared-equity mortgages have widened the buyer base, creating tailwinds for affordable builders and cooperative housing associations. Luxury residences remain niche, battling a smaller demand pool and higher capital-gains taxes. The mid-market must therefore differentiate via smart-home packages and flexible layouts to retain wallet share in the increasingly competitive Scandinavian residential real estate market.

Scandinavian Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums, and Villas & Landed Houses), by Price Band (Affordable, Mid-Market, and Luxury), by Business Model (Sales and Rental), by Mode of Sale ( Primary (New-Build) and Secondary (Existing-Home Resale)), and by Country (Norway, Sweden, and Denmark). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fastighets AB Balder

- Heimstaden AB

- OBOS BBL

- Riksbyggen

- Akelius Residential Property AB

- Skanska AB

- JM AB

- Veidekke ASA

- Peab AB

- NCC AB

- Bonava AB

- HSB

- L E Lundbergforetagen AB

- Selvaag Bolig ASA

- Oscar Properties Holding AB

- Danish Homes

- EDC Maeglerne

- Eiendomsmegler Krogsveen AS

- Utleiemegleren

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Residential Market

- 4.2 Residential Real Estate Buying Trends - Socio-economic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Focus on Technology Innovation, Start-ups, and PropTech in Real Estate

- 4.7 Insights into Rental Yields in Residential Segment

- 4.8 Real Estate Lending Dynamics

- 4.9 Insights into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.10 Market Drivers

- 4.10.1 Rapid Urbanisation & Shrinking Household Size

- 4.10.2 Interest-rate Normalisation & Expected Cuts

- 4.10.3 Green-housing Incentives & EPC Regulation

- 4.10.4 Institutional Capital Inflow & REIT Expansion

- 4.10.5 Cross-border Remote-worker Inflow

- 4.10.6 Municipal Land-release Reforms Boosting Build-to-Rent

- 4.11 Market Restraints

- 4.11.1 High Household Indebtedness

- 4.11.2 Macro-prudential Lending Caps (LTV/DSI)

- 4.11.3 Skilled-labour Shortage in Modern Timber Construction

- 4.11.4 Climate-adaptation Cost for Coastal Homes

- 4.12 Value / Supply-Chain Analysis

- 4.12.1 Overview

- 4.12.2 Real-estate Developers & Contractors - Key Quantitative and Qualitative Insights

- 4.12.3 Real-estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.12.4 Property-management Companies - Key Quantitative and Qualitative Insights

- 4.12.5 Insights on Valuation Advisory and Other Real-estate Services

- 4.12.6 State of the Building-materials Industry & Partnerships with Key Developers

- 4.12.7 Insights on Key Strategic Real-estate Investors/Buyers in the Market

- 4.13 Porter's Five Forces

- 4.13.1 Bargaining Power of Suppliers

- 4.13.2 Bargaining Power of Buyers

- 4.13.3 Threat of New Entrants

- 4.13.4 Threat of Substitutes

- 4.13.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Business Model

- 5.3.1 Sales

- 5.3.2 Rental

- 5.4 By Mode of Sale

- 5.4.1 Primary (New-build)

- 5.4.2 Secondary (Existing-home Resale)

- 5.5 By Country

- 5.5.1 Norway

- 5.5.2 Sweden

- 5.5.3 Denmark

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Land-bank Acquisitions, IPOs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Fastighets AB Balder

- 6.4.2 Heimstaden AB

- 6.4.3 OBOS BBL

- 6.4.4 Riksbyggen

- 6.4.5 Akelius Residential Property AB

- 6.4.6 Skanska AB

- 6.4.7 JM AB

- 6.4.8 Veidekke ASA

- 6.4.9 Peab AB

- 6.4.10 NCC AB

- 6.4.11 Bonava AB

- 6.4.12 HSB

- 6.4.13 L E Lundbergforetagen AB

- 6.4.14 Selvaag Bolig ASA

- 6.4.15 Oscar Properties Holding AB

- 6.4.16 Danish Homes

- 6.4.17 EDC Maeglerne

- 6.4.18 Eiendomsmegler Krogsveen AS

- 6.4.19 Utleiemegleren

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment (Senior-Living, Green-Certified Homes, Co-Living)