PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848023

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848023

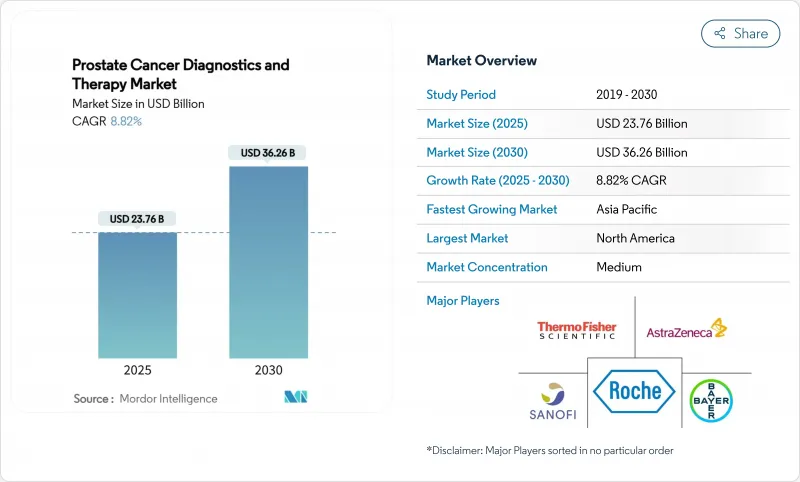

Prostate Cancer Diagnostics And Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Prostate Cancer Diagnostics And Therapy Market size is estimated at USD 23.76 billion in 2025, and is expected to reach USD 36.26 billion by 2030, at a CAGR of 8.82% during the forecast period (2025-2030).

Demographic ageing, rapid uptake of precision-medicine workflows, and steady therapeutic innovation collectively underpin this expansion. Robust reimbursement for next-generation imaging such as PSMA-PET, coupled with wider Medicare coverage for multi-gene urine and blood tests, is accelerating early detection in high-income settings. Asia-Pacific supplies additional momentum as China, India, and Japan modernize oncology infrastructure, which raises diagnostic volumes and broadens access to advanced hormone and radioligand therapies. Competitive strategies centre on radioligand therapy roll-outs, biomarker-guided drug-diagnostic combinations, and cross-border licensing deals that secure regional footholds. At the same time, payers continue scrutinizing high-ticket regimens, favouring technologies that shorten diagnostic cascades or delay transition to costly late-line treatments.

Global Prostate Cancer Diagnostics And Therapy Market Trends and Insights

Rising Ageing Population and High Prevalence

Longevity gains have lifted global male life expectancy, creating larger cohorts at risk for prostate malignancy. Incidence now varies more than 13-fold between regions, with the highest rates in Australia/New Zealand, North America, and Northern Europe. Mortality remains disproportionately high across sub-Saharan Africa and parts of Latin America where de novo metastatic presentations exceed 20%, underscoring gaps in screening infrastructure. Over the past five years, 11 middle-income countries have documented double-digit incidence growth, reflecting both improved PSA testing coverage and demographic ageing. These structural shifts sustain baseline demand for the Prostate Cancer Diagnostics and Therapy market worldwide. Health ministries in the Middle East are re-evaluating age-based screening cut-offs to curb advanced stage presentations, signalling regulatory tailwinds for widespread diagnostic adoption.

Growing Adoption of Precision-Medicine Workflows & Companion Diagnostics

Regulatory approvals for biomarker-guided treatments, notably olaparib plus abiraterone for BRCA-mutated metastatic disease, have validated routine genomic testing. Economic models place germline BRCA screening at USD 26,657 per quality-adjusted life year, well within acceptability thresholds for high-income systems. Medicare reimbursement for urine-based MyProstateScore 2.0 and 18-gene panels is cutting avoidable biopsy rates, thereby curbing downstream overtreatment costs. The Prostatype P-score further enhances active-surveillance triage, delivering incremental QALY gains at a lower overall spend. Collectively, these tools bolster physician confidence in individualized care, accelerating revenue growth for the Prostate Cancer Diagnostics and Therapy market within the diagnostics segment.

High Aggregate Cost of Diagnosis-to-Treatment Pathway

Cost-of-illness studies in Iran pegged average per-patient expenditure at USD 2,613, while national burden estimates hit USD 217 million, figures that crowd payer budgets in resource-stressed settings. In Germany, 177Lu-PSMA-617 radioligand therapy adds EUR 27,200 per patient, nudging cost-utility ratios toward EUR 69,418 per QALY, a level only marginally inside negotiated thresholds. Caribbean hospitals record sharp out-of-pocket spikes for surgical care, often steering patients toward sub-optimal hormone monotherapy. Generic abiraterone in Mexico has trimmed costs by USD 6,251 per case, illustrating how pricing reforms can widen therapeutic reach. Persistently high aggregate spend dampens near-term uptake of cutting-edge modalities, tempering Prostate Cancer Diagnostics and Therapy market velocity, especially in low- and middle-income economies.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Minimally-Invasive Surgery and Image-Guided Radiotherapy

- Robust R&D Pipeline of Prostate Cancer Therapies

- Limited Accessibility of Advanced Imaging and Genomic Testing in Low-Resource Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Prostatic adenocarcinoma continues to dominate, holding 87.28% of Prostate Cancer Diagnostics and Therapy market value in 2024, buoyed by standardized care pathways and robust evidence-based guidelines. Precision biomarker panels are refining risk stratification within this broad cohort, enabling more granular treatment roadmaps and sustaining diagnostic test growth. Small cell carcinoma, while only a sliver of overall incidence, is charting a 7.14% CAGR as genomic profiling and targeted chemotherapeutic regimens improve survival in this aggressive phenotype. The Prostate Cancer Diagnostics and Therapy industry has responded by earmarking R&D budgets for rare histologies, anticipating reimbursement differentiation that rewards specialized therapeutics. Benign prostatic hyperplasia remains clinically distinct yet exerts indirect pull on imaging volumes when PSA levels trigger further work-up, fostering cross-referral synergies inside comprehensive urology centres.

Heightened recognition of transitional cell and sarcomatoid variants, coupled with academic-centre registry initiatives, forecasts incremental lift in niche subsegments. However, the sheer scale of adenocarcinoma anchors manufacturing economies across hormone-therapy APIs and biopsy devices, conferring cost advantages that smaller-scale indications struggle to replicate. This volume dynamic reinforces the centrality of adenocarcinoma management within the Prostate Cancer Diagnostics and Therapy market template.

Localized T1-T2 disease delivered 61.52% of 2024 procedure volumes, reflecting widespread PSA screening and insurance-funded MRI triage in North America and parts of Europe. Yet distant/metastatic tumours outpaced all others with an 8.91% CAGR forecast, propelled by improved imaging sensitivity that converts biochemical recurrence into earlier metastatic confirmation. The Prostate Cancer Diagnostics and Therapy market size for metastatic interventions is projected to grow in the coming years, mirroring escalating use of novel hormonal combinations and radioligand therapies.

Regional T3 disease sits between these poles, benefiting from dose-escalated image-guided radiotherapy and MR-targeted focal ablation that preserves functional outcomes. Data from the Mexican Can.Prost registry confirms that early detection programs elevate radical treatment eligibility to 67%, shrinking future metastatic burden. Conversely, Middle Eastern registries cite de novo metastatic rates above 20%, signalling lost screening opportunities that inflate high-cost systemic therapy demand. Such contrasts illustrate how stage migration dictates revenue mix inside the Prostate Cancer Diagnostics and Therapy market.

The Prostate Cancer Diagnostics and Therapy Market Report is Segmented by Disease Type (Benign Prostatic Hyperplasia, Prostatic Adenocarcinoma, and More), Stage (Localized T1-T2, Regional T3, Distant/Metastatic T4 & M1), Modality (Diagnostics, Treatment), End User (Hospitals, Specialty Cancer Centers & Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated with a 42.25% share of 2024 global revenues, reflecting universal coverage of guideline-endorsed diagnostics, early integration of PSMA-PET, and rapid uptake of androgen receptor pathway inhibitors. Medicare's expansion of molecular test reimbursement has amplified biopsy triage accuracy, while the Veterans Affairs system continues to refine active-surveillance protocols to guard against overtreatment. United States oncology networks employ health-technology assessments to align formulary inclusion with real-world outcomes, generating data transparency that sustains payer confidence. Canada reinforces fiscal discipline through sequence-based cost-effectiveness models that optimize therapy order and duration. As a result, market growth in the region is driven more by innovation cycling than demographic expansion. Yet, absolute spend per patient remains at the global peak, anchoring manufacturer launch strategies inside the Prostate Cancer Diagnostics and Therapy market.

Europe leverages harmonized screening frameworks under European Commission guidance, providing consistent baseline demand despite heterogeneous reimbursement climates. Germany's Federal Joint Committee rigorously evaluates cost-utility profiles, yet approved radioligands and advanced imaging quickly secure DRG-linked payment once value is demonstrated. Eastern European states, however, face higher mortality and lower PSA screening coverage, pointing to inequities that represent latent growth pockets. Collaborative procurement for radiotracers and genomic kits is gaining momentum, promising cross-border volume aggregation that could narrow access gaps.

Asia-Pacific supplies the fastest regional CAGR at 10.43% through 2030, underpinned by ageing demographics and health-system modernization. China's tiered hospital reform is funnelling complex oncology procedures to tertiary centres where PSMA-PET scanners and linear accelerators cluster, rapidly lifting diagnostic and radiotherapy volumes. Japan's national insurance already lists darolutamide and olaparib combinations, aiding swift diffusion of premium therapeutics. In India, private urology groups partner with tele-pathology providers to extend biomarker testing beyond metros. Rezvilutamide's favourable USD 26,657 per QALY profile has swayed Chinese payers, illustrating readiness to reimburse cost-effective innovations. Strong growth therefore reflects both rising incidence and escalating technology penetration, cementing Asia-Pacific as the pivotal demand engine for the Prostate Cancer Diagnostics and Therapy market.

- Johnson & Johnson Services Inc. (Janssen)

- AstraZeneca

- Bayer

- Pfizer

- Astellas Pharma

- Merck

- Sanofi

- Roche

- Thermo Fisher Scientific

- Koninklijke Philips

- Exact Sciences Corp.

- Lantheus Holdings, Inc.

- Myriad Genetics

- Illumina

- Siemens Healthineers

- Accuray

- Intuitive Surgical, Inc.

- Ipsen

- Novartis

- Telix Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Aging Population and High Prevalence Rate of Prostate Cancer

- 4.2.2 Growing Adoption of Precision-Medicine Workflows & Companion Diagnostics

- 4.2.3 Technological Advances in Minimally-Invasive Surgery and Image-Guided Radiotherapy

- 4.2.4 Increasing Government Initiatives for Prostate Cancer Awareness

- 4.2.5 Robust R&D Pipeline of Prostate Cancer Therapies

- 4.2.6 Shift Toward Personalized Medicine and Relevant Improved Patient Experience

- 4.3 Market Restraints

- 4.3.1 High Aggregate Cost of Diagnosis-To-Treatment Pathway Strains Payers and Patients

- 4.3.2 Limited Accessibility of Advanced Imaging and Genomic Testing in Low-Resource Settings

- 4.3.3 Stringent Regulatory Requirements & Lengthy Clinical Development Timelines for Novel Agents

- 4.3.4 Concerns Regarding Drug Resistance and Relapse

- 4.4 Pipeline Analysis for Drugs

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Disease Type

- 5.1.1 Benign Prostatic Hyperplasia

- 5.1.2 Prostatic Adenocarcinoma

- 5.1.3 Small Cell Carcinoma

- 5.1.4 Other Types

- 5.2 By Stage

- 5.2.1 Localized (T1-T2)

- 5.2.2 Regional (T3)

- 5.2.3 Distant/Metastatic (T4 & M1)

- 5.3 By Modality

- 5.3.1 Diagnostics

- 5.3.1.1 Tissue Biopsy

- 5.3.1.2 Transrectal Ultrasound

- 5.3.1.3 Clinical Laboratory Examination

- 5.3.1.3.1 Prostate-specific Antigen Testing

- 5.3.1.3.2 Urine Biomarker Testing

- 5.3.1.4 Diagnostic Imaging

- 5.3.2 Treatment

- 5.3.2.1 Surgery (Radical, Laparoscopic, Robotic)

- 5.3.2.2 Radiation Therapy (EBRT, Brachytherapy)

- 5.3.2.3 Therapeutics

- 5.3.2.3.1 Hormone / Androgen-Deprivation Therapy

- 5.3.2.3.2 Chemotherapy

- 5.3.2.3.3 Immunotherapy / Targeted Therapy

- 5.3.2.3.4 Other Treatments (HIFU, Cryotherapy)

- 5.3.1 Diagnostics

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Cancer Centers & Clinics

- 5.4.3 Diagnostic Laboratories

- 5.4.4 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson Services Inc. (Janssen)

- 6.3.2 AstraZeneca PLC

- 6.3.3 Bayer AG

- 6.3.4 Pfizer Inc.

- 6.3.5 Astellas Pharma Inc.

- 6.3.6 Merck & Co., Inc.

- 6.3.7 Sanofi SA

- 6.3.8 F. Hoffmann-La Roche Ltd

- 6.3.9 Thermo Fisher Scientific Inc.

- 6.3.10 Koninklijke Philips NV

- 6.3.11 Exact Sciences Corp.

- 6.3.12 Lantheus Holdings, Inc.

- 6.3.13 Myriad Genetics, Inc.

- 6.3.14 Illumina Inc.

- 6.3.15 Siemens Healthineers AG

- 6.3.16 Accuray Incorporated

- 6.3.17 Intuitive Surgical, Inc.

- 6.3.18 Ipsen Pharma

- 6.3.19 Novartis AG

- 6.3.20 Telix Pharmaceuticals Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment