PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848030

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848030

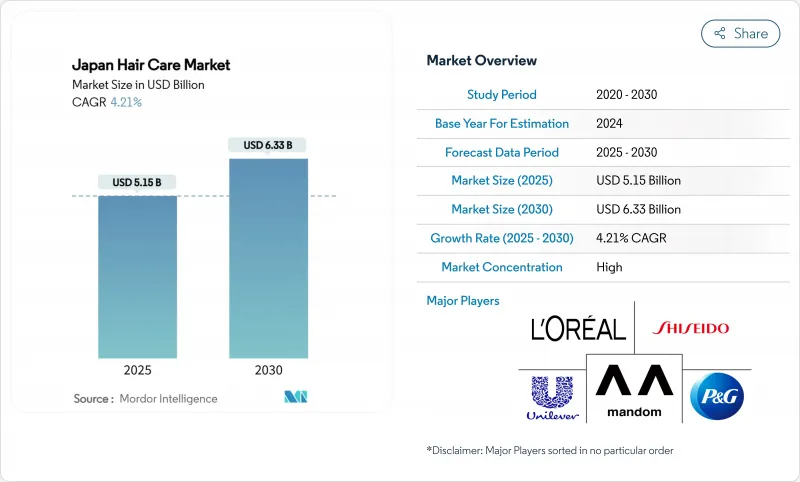

Japan Hair Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japanese hair care market size is estimated at USD 5.15 billion in 2025 and is anticipated to reach USD 6.33 billion by 2030, registering a 4.21% CAGR over the forecast period.

The steady expansion is propelled by a super-aging population that seeks targeted scalp health and anti-thinning remedies, premiumization that rewards technology-driven formulations, and a regulatory framework that steers brands toward safer, plant-based ingredients. Demand splits between mass and premium lines; mass lines still dominate store shelves, yet premium products grow faster as older consumers use discretionary income on specialist solutions. Digital commerce reshapes the Japanese hair care market as heritage companies enhance direct-to-consumer platforms, while specialty stores retain influence through in-person consultation. Innovation remains brisk: lamella-technology shampoos, non-chemical permanent-style creators, and AI-guided personalization all allow companies to justify higher price points and shorten product-development cycles.

Japan Hair Care Market Trends and Insights

Aging-Population Demand for Anti-Thinning and Scalp-Health Solutions

Japan's aging population is transforming the market, creating a growing need for specialized hair care solutions. According to the World Health Organization article published in October 2024, 30% of the population is already over 60 years old . Research highlights that thinning hair is a significant concern for individuals in their 30s and 40s, with 65% of women in these age groups expressing this issue. According to Companies are stepping up with tailored innovations to address these needs. For example, Nakano Seiyaku's LADULLA brand focuses on women aged 50-70 who experience reduced hair volume, using Bond-Fix Complex technology to strengthen hair structure. This demographic shift is driving consistent market growth, supported by the increasing number of older consumers with stable disposable incomes. The focus is no longer just on basic hair care but on overall scalp health. Companies like Kracie are leading the way by developing advanced ingredients, such as Glyceryl Glutamido Glycine Na, to improve internal hair cross-link density and combat the effects of aging on hair.

Shift Towards Natural and Organic Products

Consumers in Japan are increasingly drawn to natural and organic hair care products, reflecting their growing concern about the safety of chemical ingredients and a renewed appreciation for traditional Japanese beauty practices. Ingredients like camellia oil, or tsubaki, are gaining popularity for their ability to deeply moisturize, reduce frizz, and enhance shine. Supporting this shift, Japan's Ministry of Health, Labour and Welfare (MHLW) has banned synthetic ingredients such as hydroquinone and formaldehyde, encouraging manufacturers to innovate with plant-based alternatives and natural preservatives. Companies are responding by offering premium products that align with these preferences. For example, Doshisha's Biorica Botanical series features non-silicone hair oils and shampoos infused with botanical extracts, catering to value-conscious consumers who seek effective, natural solutions.

Health Concerns Over Chemical Ingredients

In Japan, growing consumer awareness about the safety of chemical ingredients is creating challenges for traditional hair care products. This is particularly evident as Japan's Ministry of Health, Labour and Welfare (MHLW) enforces stricter standards compared to many global markets . The MHLW has banned certain ingredients, such as hydroquinone, chlorphenesin, and several coal tar dyes, due to concerns over toxicity and potential cancer risks. As a result, manufacturers are under pressure to reformulate their products and find safer alternatives. While these regulations prioritize consumer safety, they also drive up development costs and delay the launch of new products. Companies must navigate complex approval processes and conduct extensive safety testing, which adds to the burden. At the same time, Japanese consumers are becoming more selective, carefully examining ingredient lists and favoring products with natural, recognizable components. To meet these expectations, companies are investing in plant-based preservatives and other natural alternatives. However, these ingredients often come with higher costs and require new formulation approaches, impacting profit margins and pricing strategies.

Other drivers and restraints analyzed in the detailed report include:

- Technological Innovations in Product Formulations

- Demand for Multi-Functional and Damage Control Product

- Complex Distribution System with Traditional Retail Dominance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Japanese consumers rely heavily on shampoo products, which account for 35.46% of the hair care market in 2024. This significant market share reflects how deeply embedded shampoo is in daily hair care routines across Japan. The hair styling segment is experiencing notable momentum, with a projected growth rate of 4.72% CAGR through 2030. This growth is particularly evident in products like Mandom's Gatsby Metarubber Bubble Perm Style Creator, which offers consumers chemical-free styling alternatives.

The Japanese hair care market demonstrates distinct consumer preferences across different segments. Conditioner sales remain robust as consumers adapt to the challenges posed by Japan's humid climate. The hair colorant segment is expanding steadily, primarily due to two key consumer groups: older consumers seeking gray coverage solutions and younger buyers exploring diverse color trends. This market structure highlights how Japanese consumers balance traditional hair care needs with modern innovation, creating opportunities for companies that effectively address both aspects.

Japanese consumers continue to favor mass hair care products, which account for 75.54% of the market share in 2024. This preference stems from the practical need for reliable, everyday hair care solutions at accessible price points. However, the premium segment is experiencing notable growth at 5.53% CAGR through 2030, driven by an aging population that has both the means and the desire to invest in advanced hair care solutions.

The market's evolution is visible through strategic product launches and positioning. Nakano Seiyaku's LADULLA brand has successfully connected with women aged 50-70 by offering specialized Bond-Fix Complex technology at premium price points. Similarly, established players like Shiseido adapt to market demands through their Tsubaki line, which spans both premium and standard offerings. This dual-market approach reflects Japan's economic landscape, where urban consumers increasingly gravitate toward premium products, while rural markets maintain their preference for mass market solutions.

The Japan Hair Care Market Report is Segmented by Product Type (Shampoo, Conditioner, Hair Colorants, Hair Styling Products, and Others), Category (Premium Products and Mass Products), Ingredient Type (Natural and Organic and Conventional/Synthetic), and Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, and Other Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal S.A.

- Procter & Gamble Company

- Shiseido Company, Limited

- Unilever PLC

- Milbon Co., Ltd.

- Hoyu Co., Ltd.

- Kose Corporation

- Henkel AG & Co. KGaA

- Kenvue Inc.

- Kao Corporation

- Coty Inc.

- Amorepacific Corporation

- The Estee Lauder Companies Inc.

- Napla Co., Ltd.

- Mandom Corporation

- Lion Corporation

- Fancl Corporation

- Arimino Co., Ltd.

- Nakano Seiyaku Co., Ltd.

- Takara Belmont Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging-population demand for anti-thinning and scalp-health solutions

- 4.2.2 Shift towards natural and organic products

- 4.2.3 Technological innovations in product formulations

- 4.2.4 Demand for multi-functional and damage control product

- 4.2.5 Male grooming culture expanding rapidly

- 4.2.6 Premiumization trend with high-end product offering

- 4.3 Market Restraints

- 4.3.1 Health concerns over chemical ingredients

- 4.3.2 Adoption of traditional at-home hair care solutions

- 4.3.3 High regulatory standards and ingredient restrictions

- 4.3.4 Complex distribution system with traditional retail dominance

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Shampoo

- 5.1.2 Conditioner

- 5.1.3 Hair Colorants

- 5.1.4 Hair Styling Products

- 5.1.5 Other Product Types

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredient Type

- 5.3.1 Natural & Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Procter & Gamble Company

- 6.4.3 Shiseido Company, Limited

- 6.4.4 Unilever PLC

- 6.4.5 Milbon Co., Ltd.

- 6.4.6 Hoyu Co., Ltd.

- 6.4.7 Kose Corporation

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Kenvue Inc.

- 6.4.10 Kao Corporation

- 6.4.11 Coty Inc.

- 6.4.12 Amorepacific Corporation

- 6.4.13 The Estee Lauder Companies Inc.

- 6.4.14 Napla Co., Ltd.

- 6.4.15 Mandom Corporation

- 6.4.16 Lion Corporation

- 6.4.17 Fancl Corporation

- 6.4.18 Arimino Co., Ltd.

- 6.4.19 Nakano Seiyaku Co., Ltd.

- 6.4.20 Takara Belmont Corporation

7 Market Opportunities & Future Outlook