PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848036

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848036

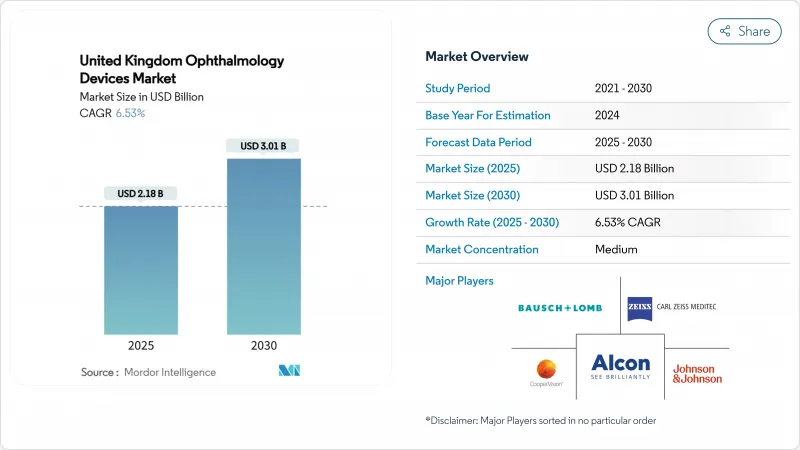

United Kingdom Ophthalmology Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom Ophthalmic Devices market size is USD 2.18 billion in 2025 and is projected to climb to USD 3.01 billion by 2030, advancing at a 6.53%CAGR throughout the period.

Robust demand for sight-saving surgery, an ageing population that expands the cataract pool, and National Health Service (NHS) framework contracts that reward outcome documentation collectively underpin sustained growth in the United Kingdom Ophthalmic Devices market. Vision-care consumables secure stable volumes through retail channels, yet heightened spending on imaging and analytics indicates a gradual pivot toward data-rich diagnostics. Private equity-funded ambulatory surgery centres (ASCs) continue to roll out modular theatres, nudging suppliers to refine value-based pricing compatible with NHS tariffs and commercial self-pay packages. NHS backlogs created during the pandemic are not expected to clear before mid-2026, locking high baseline volumes for cataract, glaucoma, and retina devices.

United Kingdom Ophthalmology Devices Market Trends and Insights

Ageing UK Population Driving Cataract and Glaucoma Burden

United Kingdom census updates published in March 2025 show that residents aged >=65 now account for 19.6 million people, or 28% of the total population, up from 26% in 2024. Royal College of Ophthalmologists (RCOphth) modelling projects that cataract operations will rise by 50% between 2025 and 2035 if service capacity keeps pace. Hospital Episode Statistics confirm the trend: cataract extractions exceeded 475,000 in financial-year 2024/25, marking a 6.2% jump on the previous year and the steepest annual increase since electronic records began in 2010. Glaucoma workload is following suit; English NHS trusts recorded 8% more trabeculectomies in 2024 than in 2023, while outpatient visits for chronic open-angle glaucoma surpassed 1.6 million for the first time. Device makers selling phaco systems, glaucoma stents and intraocular lenses are therefore locking in multiyear supply agreements as commissioners try to ring-fence inventory against a clearly visible demographic bulge.

Myopia "Epidemic" Among Under-25s Post-Pandemic Screen-Time Surge

A peer-reviewed study released by University College London in February 2025 found that 34% of British 18- to 24-year-olds are now myopic, compared with 28% in 2020, attributing the acceleration to sustained screen exposure during pandemic lockdowns. Boots Opticians reported a 22% year-on-year rise in orders for myopia-control contact lenses during calendar-year 2024, while Specsavers introduced axial-length measurement in 650 stores by December 2024 to meet demand for earlier intervention. The data resonate with the College of Optometrists' 2024 survey in which 61% of practitioners cited "more teenage myopia fittings than at any time in their careers". Device suppliers are responding with oxygen-permeable daily disposables and spectacle-lens designs that slow axial elongation, targeting a market segment with decades of lifetime value. The cascading effect is that manufacturers traditionally focused on geriatric indications are now re-tooling marketing to parents and universities, broadening the revenue base beyond post-retirement consumers.

Shortage of Ophthalmologists Limiting Surgical Throughput

General Medical Council workforce statistics released in May 2025 reveal that the ophthalmology consultant vacancy rate sits at 9.4%, up from 8.7% in 2024 and comfortably above the 7% target threshold. RCOphth's 2025 census concludes that 234 additional consultants are needed immediately to meet present demand, a figure projected to double by 2030 unless training numbers rise sharply. Workforce strain translates into theatre under-utilisation: GIRFT audit data show that 17% of cataract lists booked in 2024 were cancelled or cut short due to surgeon unavailability. Device utilisation rates therefore lag installed base growth, dampening replacement cycles and tugging down capital-equipment ROI for providers.

Other drivers and restraints analyzed in the detailed report include:

- NHS Elective-Surgery Backlog Accelerating Private Ophthalmic Investments

- Roll-out of High-Street OCT Services by Large Optical Chains

- Post-Brexit Regulatory Divergence Increasing Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision Care Devices hold roughly 60.11% of United Kingdom Ophthalmic Devices market share in 2024 and continue to anchor recurring revenue with stable contact-lens sales. Diagnostic & Monitoring Devices, however, are set to outpace with an 8.81%CAGR, aided by NHS contracts that bundle analytics services at premium prices. Interoperable OCT platforms capable of sub-second scans shorten examination cycles, letting clinics process more patients without extra chair investment. The Computer-Assisted Retinal Analysis (CARA) system's reported sensitivity above 80% for referable diabetic retinopathy exemplifies how clinical validation accelerates uptake. Suppliers retrofit legacy fundus cameras only when AI compatibility demands hardware parity, indicating a sustained refurbishment pipeline that dampens short-term unit sales but lifts aftermarket accessory revenue.

Suppliers integrating anterior-segment modules address both refractive and corneal surgery without increasing footprint, appealing to space-constrained urban theatres. Contact-lens innovation around oxygen-permeable materials sustains retail momentum but margin pressure from price competition keeps absolute revenue growth moderate. Diagnostic device vendors offset lump-sum capital expenditure concerns by offering leasing plans matched to NHS payment cycles. Such arrangements embed service contracts that expand high-margin software revenue, supporting longer product-development timelines. Data-driven monitoring functions also satisfy the MHRA's heightened evidence requirements, creating a compliance moat around connected platforms.

The United Kingdom Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson Vision Care

- Carl Zeiss

- Bausch + Lomb Corp.

- CooperVision Inc.

- EssilorLuxottica

- HOYA

- HAAG-Streit

- Topcon

- Nidek

- Iridex

- Ziemer Group

- Glaukos

- Rayner Intraocular Lenses Ltd.

- BVI Medical

- Lumenis

- Heidelberg Engineering

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing UK Population Driving Cataract and Glaucoma Burden

- 4.2.2 Myopia "Epidemic" Among Under-25s Post-Pandemic Screen-Time Surge

- 4.2.3 NHS Elective-Surgery Backlog Accelerating Private Ophthalmic Investments

- 4.2.4 Roll-out of High-Street OCT Services by Large Optical Chains

- 4.2.5 UK MHRA's Innovation Pathway Fast-Tracking Novel Implants

- 4.2.6 Surge in Adoption of Minimally Invasive Glaucoma Surgery (MIGS) Devices

- 4.3 Market Restraints

- 4.3.1 Shortage of Ophthalmologists Limiting Surgical Throughput

- 4.3.2 Post-Brexit Regulatory Divergence Increasing Compliance Costs

- 4.3.3 Reimbursement Caps on Premium IOLs

- 4.3.4 High Device Re-processing Standards Raising Cost of Ownership

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision Care

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 Bausch + Lomb Corp.

- 6.3.5 CooperVision Inc.

- 6.3.6 EssilorLuxottica SA

- 6.3.7 HOYA

- 6.3.8 HAAG-Streit Group

- 6.3.9 Topcon Corporation

- 6.3.10 Nidek Co., Ltd.

- 6.3.11 IRIDEX Corp.

- 6.3.12 Ziemer Ophthalmic Systems AG

- 6.3.13 Glaukos Corporation

- 6.3.14 Rayner Intraocular Lenses Ltd.

- 6.3.15 BVI Medical

- 6.3.16 Lumenis Ltd.

- 6.3.17 Heidelberg Engineering GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment