PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848085

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848085

Spain Ophthalmology Drugs & Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

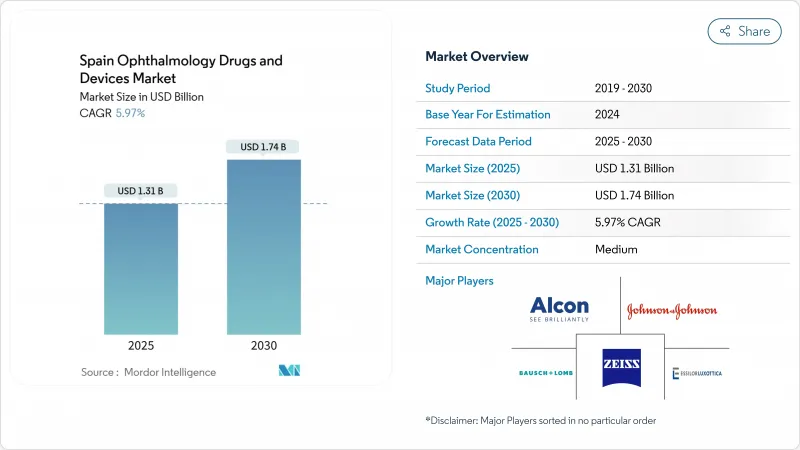

The Spain ophthalmic devices market is valued at USD 1.31 billion in 2025 and is projected to reach USD 1.74 billion by 2030, advancing at a 5.97% CAGR.

Vision-care products such as spectacles and soft contact lenses still dominate unit sales, yet demand is rapidly widening for premium intra-ocular lenses, spectral-domain OCT units, and AI-enhanced fundus cameras. Catalysts include a population in which 20.3% of residents already exceed 65 years of age, a diabetic-retinopathy prevalence of 15.28% among people with diabetes, and a national push to channel tele-ophthalmology into sparsely served provinces. Tight public-sector capital budgets cap large-hospital spending, but higher private-insurance uptake in urban zones is translating into stronger price tolerance for premium implants and diagnostic technologies. Multinational suppliers are accelerating local launches while private specialty clinics in Barcelona and Madrid bundle refractive procedures with travel experiences, reshaping the Spain ophthalmic devices market around cash-pay and privately insured customers.

Spain Ophthalmology Drugs & Devices Market Trends and Insights

Aging Population Accelerating Cataract Incidence in Spain

Twenty-plus percent of Spaniards are already seniors, and this proportion is forecast to climb to 26.5% by 2035. Ophthalmology therefore became the nation's second-busiest specialty in 2024, recording 463,275 cataract extractions and still leaving 118,450 individuals on waiting lists. Average public-sector wait time reached 67.8 days, exceeding 90 days in several autonomous communities. Evidence compiled by the Spanish Society of Ophthalmology links cataract removal to a 30% ten-year dementia-risk reduction, intensifying calls to accelerate operating-room throughput. Hospitals and ambulatory centers are investing in next-generation phaco systems and femtosecond lasers, a spending trajectory that benefits suppliers of advanced capital equipment within the Spain ophthalmic devices market.

Expansion of Private Insurance Cover for Premium IOLs

Urban residents increasingly rely on private insurance to sidestep public wait lists. Policies that reimburse premium intra-ocular lenses grew 14.7% in 2024, and private funding now represents roughly one-third of health expenditures in Madrid and Barcelona. Multifocal and toric optics captured 13.8% of the 463,275 lenses implanted last year and their share is still climbing. Global vendors therefore scale surgeon-training programs and co-marketing campaigns, propelling higher average selling prices inside the Spain ophthalmic devices market.

Public Healthcare CAPEX Constraints on Capital Equipment

Despite total health outlays hitting 11.2% of GDP in 2024, capital expenditure on medical technology fell 3.8%. Two-thirds of public hospitals delayed planned eye-device purchases, pushing procurement cycles for wide-field angiography and adaptive-optics OCT into later budgets. Only 7.3% of a EUR 1.25 billion primary-care fund was earmarked for specialty diagnostics, curbing the fleet-replacement curve for older platforms. Vendors reliant on public tenders face elongated sales funnels, which tempers the near-term expansion of the Spain ophthalmic devices market.

Other drivers and restraints analyzed in the detailed report include:

- Government-Led AI Screening Pilots Boosting Diagnostic Device Uptake

- Rising Diabetic-Retinopathy from Increasing Obesity Prevalence

- Persistent Ophthalmologist Shortage Curbing Device Utilization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision-care products retained a 62.10% Spain ophthalmic devices market share in 2024 due to entrenched spectacle and daily-wear contact-lens demand. Yet diagnostic and monitoring devices are on track for an 8.08% CAGR to 2030, propelled by AI-enabled OCT upgrades and handheld fundus-camera rollouts. Regulatory submissions for new phacoemulsification consoles and combined-platform lasers surged 16.3% in 2024, widening the surgical-device funnel. Specialty-contact-lens fittings advanced 7.8% as optometrists embraced ortho-k and scleral designs, indicating premiumization even within commoditized vision care. The Spain ophthalmic devices market size for diagnostic hardware is benefitting directly from government pilot data linking fast triage to sight-saving interventions, incentivizing regional procurement councils to prioritize modern imaging suites.

Sales of smart tonometers and portable perimeters also climbed because ophthalmologists seek compact tools that fit tight outpatient footprints. Vendors now bundle devices with cloud licenses, reducing upfront hardware barriers and locking in subscription revenues. This as-a-service pivot helps smooth the capital-budget friction that usually dampens public-hospital investment cycles, underpinning steady diagnostic-device penetration across the Spain ophthalmic devices market.

The Spain Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson Vision Care

- Carl Zeiss

- EssilorLuxottica

- Bausch + Lomb Corp.

- Topcon Corp.

- Nidek

- Ziemer Group

- STAAR Surgical

- HOYA

- Reichert Technologies

- Heidelberg Engineering

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population Accelerating Cataract Incidence in Spain

- 4.2.2 Expansion of Private Insurance Cover for Premium IOLs

- 4.2.3 Government-Led AI Screening Pilots Boosting Diagnostic Device Uptake

- 4.2.4 Refractive Surgery Tourism Growth in Barcelona & Madrid Corridors

- 4.2.5 Rising Diabetic Retinopathy from Increasing Obesity Prevalence

- 4.2.6 Rapid Adoption of Tele-ophthalmology in Rural Castilla-La Mancha

- 4.3 Market Restraints

- 4.3.1 Public Healthcare CAPEX Constraints on Capital Equipment

- 4.3.2 High CE-MDR Compliance Costs for Spanish SMEs

- 4.3.3 Persistent Ophthalmologist Shortage Curbing Device Utilisation

- 4.3.4 Macroeconomic Uncertainty Dampening Elective LASIK Demand

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.5.1 Excimer Lasers

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.6.1 Femtosecond Lasers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.1.7.1 YAG Lasers

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision Care

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 EssilorLuxottica SA

- 6.3.5 Bausch + Lomb Corp.

- 6.3.6 Topcon Corp.

- 6.3.7 Nidek Co. Ltd

- 6.3.8 Ziemer Group AG

- 6.3.9 STAAR Surgical Company

- 6.3.10 Hoya Corporation

- 6.3.11 Reichert Technologies

- 6.3.12 Heidelberg Engineering GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment