PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848075

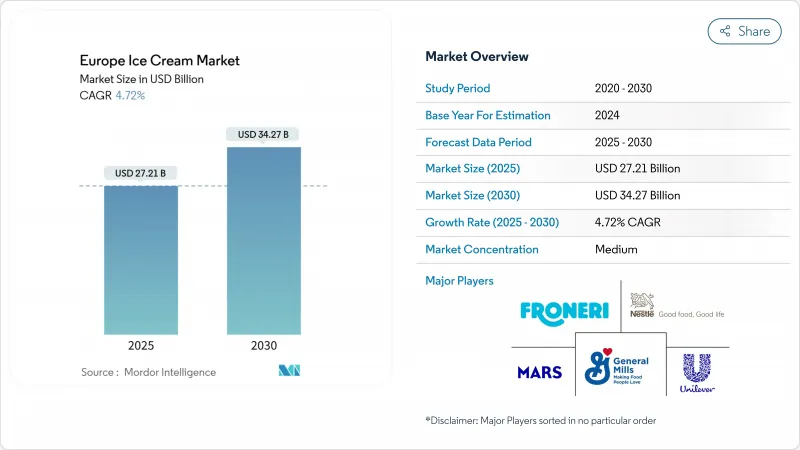

Europe Ice Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe ice cream market size stands at USD 27.21 billion in 2025 and is forecast to register a CAGR of 4.72% to reach USD 34.27 billion by 2030.

Despite facing inflationary challenges, the market is buoyed by several key trends. Premiumization is driving demand as consumers increasingly seek high-quality, indulgent products. The shift towards plant-based options is gaining momentum, catering to the growing vegan and health-conscious population. Adventurous flavor experimentation is also attracting consumers looking for unique and innovative taste experiences. Additionally, a strong emphasis on sustainability is shaping purchasing decisions, with eco-friendly packaging and transparent labeling becoming critical factors. Consumers are willing to pay a premium for products that align with these values. In response, established brands are actively renovating their portfolios to include such offerings while leveraging cost-efficient scales to maintain competitiveness and defend their market share.

Europe Ice Cream Market Trends and Insights

Rising demand for premium, high-end, and artisan ice cream products

Consumers increasingly seek premium, high-end, and artisan ice cream products, driving growth in the market. For instance, the rising popularity of gelato and sorbet, known for their rich flavors and natural ingredients, reflects this trend. Additionally, brands are introducing innovative offerings, such as organic, dairy-free, and low-calorie options, to cater to health-conscious consumers while maintaining a premium appeal. This shift is further supported by the growing preference for unique and indulgent flavors, such as salted caramel, pistachio, and exotic fruit blends, which resonate with the evolving tastes of European consumers. Furthermore, the increasing focus on sustainability and ethical sourcing has led to the introduction of ice creams made with locally sourced ingredients and eco-friendly packaging. Premium brands, such as Haagen-Dazs and Magnum, continue to dominate the market by offering limited-edition flavors and collaborating with renowned chefs to create exclusive products. The rise of artisanal ice cream parlors across Europe, emphasizing small-batch production and handcrafted quality, also contributes to this growing demand.

Increasing consumer preference for low-calorie, low-sugar, and vegan options

The increasing consumer preference for low-calorie, low-sugar, and vegan ice cream options is a significant market driver fueling growth and innovation within the market. Consumers today are more health-conscious and environmentally aware, seeking treats that align with lifestyle choices centered on wellness, sustainability, and ethical consumption. Low-calorie and low-sugar ice creams appeal to those managing diets and conditions like diabetes or those simply wishing to indulge guilt-free, while vegan ice creams attract a broader demographic concerned with animal welfare, lactose intolerance, and reducing carbon footprints. Vegan ice cream innovation is thriving with brands introducing diverse flavor profiles and improved textures to satisfy consumers without compromising on indulgence. Popular bases like almond milk are favored for their creamy texture and lower calorie content compared to dairy, while flavors such as caramel and chocolate are reformulated to deliver richness that parallels traditional ice creams. Notable examples include companies like Over The Moo in the UK, which introduced new dairy-free chocolate, vanilla, and caramel flavors in 2024, further expanding the market's appeal. This trend is supported by increased availability in supermarkets, specialty stores, and e-commerce platforms, making these healthier and ethical choices increasingly accessible.

Increasing awareness and concerns about sugar and fat content impacting sales

Rising awareness of sugar and fat content is affecting sales in the European ice cream market. Consumers are increasingly prioritizing healthier dietary choices, leading to a decline in the demand for traditional ice cream products that are high in sugar and fat. In 2024, the International Diabetes Federation reports that approximately 66 million individuals in Europe are grappling with diabetes . This alarming statistic highlights the growing health concerns among the population, further influencing purchasing decisions. Additionally, the increasing prevalence of obesity and related health conditions has amplified the demand for low-sugar, low-fat, or alternative dessert options. As a result, manufacturers are under pressure to reformulate their products and introduce healthier alternatives to cater to this shifting consumer preference. However, the reformulation process often involves higher production costs and challenges in maintaining the taste and texture of traditional ice cream, which can hinder market growth.

Other drivers and restraints analyzed in the detailed report include:

- Continuous flavor innovation and introduction of novel textures and formats

- Seasonal demand peaks in warmer months enhancing sales

- Competition from alternative frozen desserts and snacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Impulse ice cream dominated the European ice cream market in 2024, capturing a substantial 45.94% share. This leadership is largely fueled by the widespread presence of convenience stores, which provide easy access and encourage spontaneous purchases. The format's strength lies in its ability to cater to quick, on-the-go consumption, appealing to a broad demographic that values accessibility and immediate gratification. Impulse ice cream products typically include single-serve options such as cones, bars, and sandwiches, making them highly suitable for busy lifestyles. Retailers leverage prominent shelf placement and frequent promotions to drive volume sales within this segment across Europe's diverse retail environments. Despite increasing competition from premium and artisanal offerings, impulse ice cream remains a cornerstone of market volume due to its convenience and affordability.

Conversely, artisanal ice cream represents the fastest-growing segment in the European market, expanding at an impressive CAGR of 6.82% through 2030. This growth mirrors consumer trends toward premiumization, where shoppers increasingly prioritize authentic, high-quality experiences over basic convenience. Artisanal ice cream appeals especially to discerning consumers who seek craftsmanship, unique and sophisticated flavor profiles, and often locally sourced or organic ingredients. This segment benefits from growing consumer interest in natural, less processed products as well as elevated packaging and storytelling that enhance perceived value. Premium artisanal brands typically focus on small-batch production and innovative recipes, differentiating themselves from mass-market offerings.

The Europe Ice Cream Market Report is Segmented by Product Type (Artisanal Ice Cream, Impulse Ice Cream, Take-Home Ice Cream), Category (Dairy, Non-Dairy), Distribution Channel (On-Trade, Off-Trade Including Supermarkets/Hypermarkets, Specialist Retailers, Convenience Stores, Online Retail, Others), and Geography (Germany, UK, France, Italy, Spain, Russia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Unilever PLC

- Froneri International Limited

- Nestle S.A.

- General Mills Inc.

- Mars, Incorporated

- Wells Enterprises Inc.

- Lotte Corporation

- Lotus Bakeries NV

- Inspire Brands Inc. (Baskin-Robbins)

- Glacio NV

- Pasticceria Veneta SpA

- R&R Ice Cream Poland

- Sammontana S.p.A

- DMK Group

- Ardo NV (plant-based frozen desserts)

- GB Glace

- Mlekovita

- Orkla ASA (Panda, Diplom-Is)

- Gelati Roberto SRL

- TipTop Ice Cream

- Guestrower Milcheis GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for premium, high-end, and artisan ice cream products

- 4.2.2 Increasing consumer preference for low-calorie, low-sugar, and vegan options

- 4.2.3 Continuous flavor innovation and introduction of novel textures and formats

- 4.2.4 Seasonal demand peaks in warmer months enhancing sales

- 4.2.5 Indulgence-led snacking culture and premiumization

- 4.2.6 Growing emphasis on eco-friendly and sustainable packaging

- 4.3 Market Restraints

- 4.3.1 Increasing awareness and concerns about sugar and fat content impacting sales

- 4.3.2 Competition from alternative frozen desserts and snacks

- 4.3.3 Supply chain disruptions affecting raw material availability and costs

- 4.3.4 Volatile dairy commodity prices and supply shocks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Artisanal Ice Cream

- 5.1.2 Impulse Ice Cream

- 5.1.3 Take-home Ice Cream

- 5.2 By Category

- 5.2.1 Dairy

- 5.2.2 Non-Dairy (Plant-based)

- 5.3 Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Specialist Retailers

- 5.3.2.3 Convenience Stores

- 5.3.2.4 Online Retail Stores

- 5.3.2.5 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Netherlands

- 5.4.8 Belgium

- 5.4.9 Poland

- 5.4.10 Sweden

- 5.4.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Unilever PLC

- 6.4.2 Froneri International Limited

- 6.4.3 Nestle S.A.

- 6.4.4 General Mills Inc.

- 6.4.5 Mars, Incorporated

- 6.4.6 Wells Enterprises Inc.

- 6.4.7 Lotte Corporation

- 6.4.8 Lotus Bakeries NV

- 6.4.9 Inspire Brands Inc. (Baskin-Robbins)

- 6.4.10 Glacio NV

- 6.4.11 Pasticceria Veneta SpA

- 6.4.12 R&R Ice Cream Poland

- 6.4.13 Sammontana S.p.A

- 6.4.14 DMK Group

- 6.4.15 Ardo NV (plant-based frozen desserts)

- 6.4.16 GB Glace

- 6.4.17 Mlekovita

- 6.4.18 Orkla ASA (Panda, Diplom-Is)

- 6.4.19 Gelati Roberto SRL

- 6.4.20 TipTop Ice Cream

- 6.4.21 Guestrower Milcheis GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK