PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848099

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848099

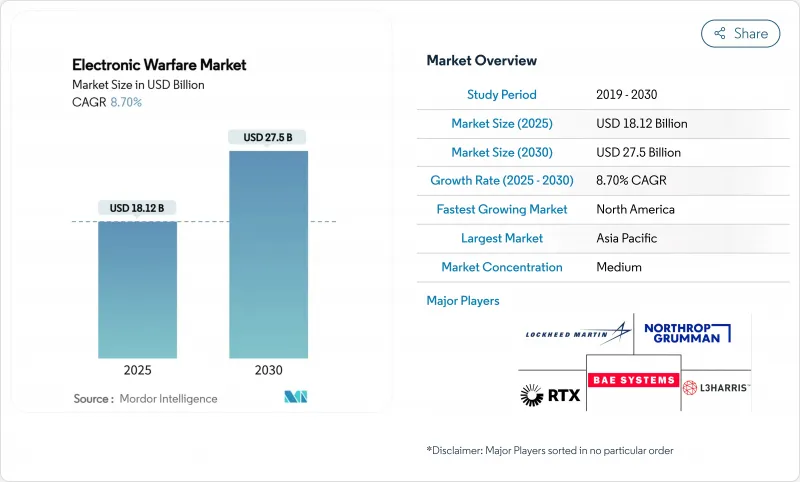

Electronic Warfare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The electronic warfare (EW) market size is USD 18.12 billion in 2025 and is forecasted to reach USD 27.50 billion by 2030, translating into an 8.70% CAGR.

Demand is lifted by rapid defense-modernization cycles, the spread of gallium-nitride semiconductors, artificial-intelligence-driven cognitive jamming, and the first operational moves toward space-based electronic-warfare constellations. Heightened geopolitical tension in Eastern Europe and the Indo-Pacific accelerates procurement programs as armed forces race to secure spectrum dominance. Airborne platforms remain the prime battleground, yet directed-energy payloads and counter-unmanned aerial system (counter-UAS) suites open additional value pools. Supply-chain risks around gallium and tightening semiconductor export rules inject volatility and stimulate reshoring strategies across North America and Europe. Competitive intensity is moderate, with legacy primes defending incumbent positions while smaller entrants exploit open-architecture mandates to field software-defined products that cut size, weight, and power (SWaP).

Global Electronic Warfare Market Trends and Insights

Escalating Geopolitical Tensions and Defense Modernization

Electronic warfare (EW) proved decisive during the Russia-Ukraine conflict, prompting NATO members to realign budgets toward spectrum-dominance programs. Germany is converting 15 Eurofighters and an A400M variant for dedicated electronic-attack duties. Parallel pressure in the South China Sea spurred Japan and South Korea to accelerate indigenous electronic-warfare roadmaps. Procurement now follows an urgent cadence independent of traditional multi-year cycles. Defense ministries increasingly bundle cyber and electronic-warfare line items to secure joint funding, cementing a demand pathway through 2030. Governments also prioritize sovereign supply chains to mitigate gallium scarcity, channeling grants into domestic semiconductor fabs.

Surge in Unmanned Platforms Requiring EW Payloads

Medium-altitude long-endurance (MALE) UAVs fly with modular pods such as Angry Kitten, enabling real-time jamming against peer threats. Commercial gallium-nitride chips allow high-power output without breaching strict weight envelopes, opening the electronic warfare market to small-unmanned-aerial-vehicle classes. Loyal-wingman concepts generate an installed-base multiplier effect because each crewed fighter may team with several autonomous escorts, all needing self-protect suites. Asia-Pacific operators field swarms for maritime surveillance, compelling equivalent counter-programs among US and Australian forces under AUKUS. The trend compresses development cycles, shifting value from hardware to agile firmware updates delivered over secure links.

High Program Cost and Long Development Cycles

Complex multi-band architectures demand decade-long R&D to pass electromagnetic-compatibility tests across air, sea, land, and space. Subsystems often outlive semiconductor production runs, forcing mid-life component re-designs that inflate total ownership cost. Smaller defense ministries struggle to fund full-spectrum solutions, opting for incremental retrofits that dilute capability. Consequently, the electronic warfare market tilts toward modular open-systems approaches to shorten certification loops and rein in budgets.

Other drivers and restraints analyzed in the detailed report include:

- Evolution of Radar and Communication Threats

- COTS GaN Enabling Low-SWaP EW on Small Drones

- Spectrum Management and Regulatory Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic support generated 47.24% of 2024 revenue and will expand at an 8.39% CAGR, the most significant slice of the electronic warfare market size for capabilities. The segment's growth is anchored in AI-enabled detection arrays that geolocate emitters in complex urban canyons. Demand also benefits from joint-all-domain concepts that fuse radio-frequency data with cyber-intelligence feeds for unified situational awareness.

Electronic attack follows as the next-largest slice, fueled by cognitive jammers able to retune in microseconds when adversaries hop frequencies. Electronic protection gains renewed relevance because forces must harden communications against noise jamming and deceptive spoofing. Together, the three pillars create a virtuous upgrade cycle that sustains wider electronic warfare market expansion through 2030.

Air platforms generated 48.12% of 2024 revenue, confirming fixed-wing aircraft as the prime theater for spectrum dominance initiatives. Fleet upgrades now favor lighter, software-defined pods that link directly with active-electronically-scanned-array radars and share threat libraries across joint networks. Rotary-wing fleets follow suit, adopting low SWaP self-protect suites to survive short-range air-defense ambushes.

Although still nascent, space assets post the highest 11.80% CAGR as mega-constellations move electronic-support receivers into low-Earth orbit (LEO) for global geolocation coverage. Sea and land platforms keep procurement steady: navies focus on submarine electronic-support masts that police littorals. At the same time, armies field truck-mounted counter-UAS jammers to protect maneuver brigades against low-cost drone swarms.

The Electronic Warfare (EW) Market Report is Segmented by Capability (Electronic Attack, Electronic Protection, and Electronic Support), Platform (Air, Sea, Land, and Space), Equipment (Jammer Systems, Radar Warning Receivers, and More), End-User (Air Force, Navy, and Army), Fit (OEM and Retrofit/Upgrades), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40.33% of 2024 revenue, anchored by the United States' USD 21 billion five-year outlay and a FY 2025 RDT&E budget of USD 141 billion. Canada's NORAD modernization and Mexico's nascent defense upgrades provide ancillary lift, but US procurements dominate regional totals. Robust local industrial capacity ensures secure supply chains, though gallium sourcing remains an external vulnerability.

Asia-Pacific is the fastest-growing geography, with a 9.91% CAGR between 2025 and 2030. China's satellite-rich Guowang network and EW deployments in the South China Sea encourage countermoves from Japan, South Korea, Australia, and India. Regional collaborations, including AUKUS technology exchanges, accelerate indigenous capability while diversifying supplier bases. Combined, these dynamics broaden the electronic warfare market in a region where maritime disputes set high operational stakes.

Europe registers steady expansion as NATO acknowledges capability gaps exposed in Ukraine. Germany's Eurofighter conversions and the United Kingdom's acquisitions, such as Kirintec, push sovereign development, while Franco-Italian frigate programs integrate new jamming suites. EU initiatives to pool procurement funds further stabilize demand amid fiscal constraints. The Middle East and Africa add supplemental growth; Gulf states lifted defense budgets 21.8% to USD 195.4 billion in 2024, emphasizing counter-missile and UAV defenses.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- L3Harris Technologies, Inc.

- BAE Systems plc

- Saab AB

- Thales Group

- Leonardo S.p.A.

- Israel Aerospace Industries Ltd.

- Elbit Systems Ltd.

- HENSOLDT AG

- ASELSAN A.S.

- General Dynamics Corporation

- Rohde & Schwarz USA, Inc.

- Mercury Systems, Inc.

- Bharat Electronics Limited

- Indra Sistemas S.A.

- CACI International Inc.

- Textron Systems Corporation (Textron Inc.)

- Tata Advanced Systems Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating geopolitical tensions and defence modernization

- 4.2.2 Surge in unmanned platforms requiring EW payloads

- 4.2.3 Evolution of radar/comm threats necessitating advanced EW

- 4.2.4 COTS GaN enabling low-SWaP EW on small drones

- 4.2.5 AI/ML-driven cognitive EW for adaptive jamming

- 4.2.6 Orbital opportunities from satellite mega-constellations

- 4.3 Market Restraints

- 4.3.1 High program cost and long development cycles

- 4.3.2 Spectrum management and regulatory hurdles

- 4.3.3 Cyber-enabled spoofing vulnerability of EW suites

- 4.3.4 Tightening export controls on advanced semiconductors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Capability

- 5.1.1 Electronic Attack

- 5.1.2 Electronic Protection

- 5.1.3 Electronic Support

- 5.2 By Platform

- 5.2.1 Air

- 5.2.2 Sea

- 5.2.3 Land

- 5.2.4 Space

- 5.3 By Equipment

- 5.3.1 Jammer Systems

- 5.3.2 Radar Warning Receivers

- 5.3.3 Directed Energy Weapons

- 5.3.4 Counter-UAS EW Suites

- 5.3.5 Other Equipments

- 5.4 By End-User

- 5.4.1 Air Force

- 5.4.2 Navy

- 5.4.3 Army

- 5.5 By Fit

- 5.5.1 OEM

- 5.5.2 Retrofit/Upgrades

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 France

- 5.6.2.3 Germany

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Lockheed Martin Corporation

- 6.4.2 Northrop Grumman Corporation

- 6.4.3 RTX Corporation

- 6.4.4 L3Harris Technologies, Inc.

- 6.4.5 BAE Systems plc

- 6.4.6 Saab AB

- 6.4.7 Thales Group

- 6.4.8 Leonardo S.p.A.

- 6.4.9 Israel Aerospace Industries Ltd.

- 6.4.10 Elbit Systems Ltd.

- 6.4.11 HENSOLDT AG

- 6.4.12 ASELSAN A.S.

- 6.4.13 General Dynamics Corporation

- 6.4.14 Rohde & Schwarz USA, Inc.

- 6.4.15 Mercury Systems, Inc.

- 6.4.16 Bharat Electronics Limited

- 6.4.17 Indra Sistemas S.A.

- 6.4.18 CACI International Inc.

- 6.4.19 Textron Systems Corporation (Textron Inc.)

- 6.4.20 Tata Advanced Systems Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment