PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848111

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848111

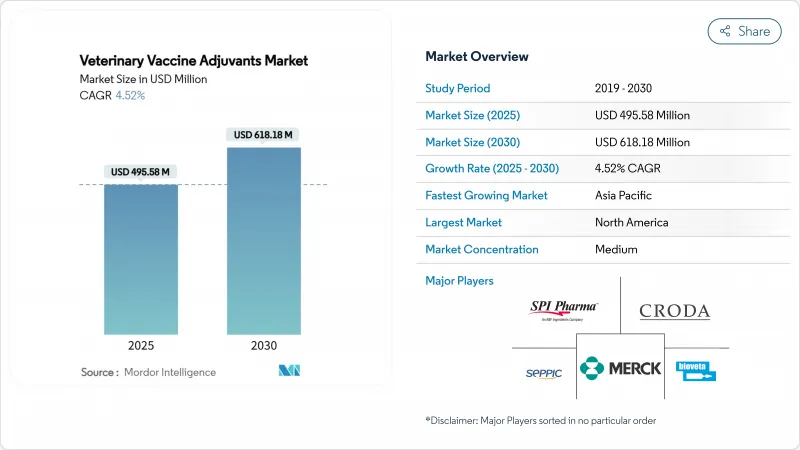

Veterinary Vaccine Adjuvants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The veterinary vaccine adjuvants market size stands at USD 495.58 million in 2025 and is forecast to reach USD 618.18 million by 2030, advancing at a 4.52% CAGR.

Sustained growth rests on precision immunology, rapid biotechnology advances and post-H5N1 emergency policies that mandate higher vaccine potency. The sector benefits from mRNA and nanoparticle innovations that shorten immune-priming times and lower dose volumes, while oil-emulsion safety issues steer manufacturers toward polymer and carbomer systems. Livestock density, global protein demand and One Health funding in India and China accelerate technology adoption, whereas fragmented approvals and supply risks for QS-21 and specialized lipids curb velocity. Competitive intensity grows as Zoetis, Merck Animal Health and Elanco defend share against saponin-, TLR- and VLP-focused newcomers positioning for accelerated approvals during outbreak conditions.

Global Veterinary Vaccine Adjuvants Market Trends and Insights

Expanding Global Animal Protein Consumption

Intensive livestock systems scaling across India, Brazil and China elevate infection risks, so producers favor adjuvants that cut revaccination frequency while preserving high titers. Polymer microspheres that meter antigen over weeks appeal to tropical operators wrestling with cost and cold-chain gaps. India's livestock push, now targeting 20% annual protein output gains, shapes federal grants that absorb part of adjuvant costs for mass cattle and poultry drives. Thermostable carbomer blends hence show strong tender success in South and Southeast Asia.

Rising Incidence of Emerging and Re-Emerging Livestock Diseases

The 2024 H5N1 dairy outbreak across 16 U.S. states, and bluetongue flare-ups in European sheep flocks, highlight the urgency for adjuvants enabling cross-protective, rapid immunity. Trials using NS1-deficient live vectors plus TLR-4 agonist adjuvants delivered protection within five days, which has pushed regulators to issue rolling reviews for comparable candidates.

Adverse Reactions and Safety Concerns with Oil-Based Adjuvants

Companion-animal injections containing shark-sourced squalene prompted site swelling alerts that trimmed U.S. distributor orders by double digits in 2024. Croda's sugarcane-derived squalene now supplies reformulation programs aimed at removing marine inputs and easing scrutiny. Reformulation, stability, and re-licensing cycles can delay launches 12-18 months and inflate cost of goods sold.

Other drivers and restraints analyzed in the detailed report include:

- Strengthening Government Immunization Mandates and Subsidies

- Shift Toward High-Value Subunit and mRNA Veterinary Vaccines

- Complex and Fragmented Regulatory Approval Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Particulate and nanoparticle technologies accounted for a dominant 38.43% slice of the veterinary vaccine adjuvants market in 2024, while polymer and carbomer systems are set to clock the fastest 6.32% CAGR through 2030. The sustained rise reflects the premium producers attach to precise antigen release and dose-sparing functionality, especially in regions seeking to suppress repeated handling of large herds. Nanoparticles sized 60-150 nm improve dendritic-cell uptake, meaning fewer booster shots and slimmer labor bills. Native alum remains popular where cost ceilings are strict, yet its inability to spark strong T-cell responses limits future revenue potential. Saponin derivatives, notably plant-based QS-21, gain favor as botanical extraction and tissue-culture methods secure supply, lessening pressure on Chilean soapbark trees and improving ESG scores.

Combination emulsions that integrate MPLA TLR-4 agonism with squalene microdroplets enhance IgA secretion, making them attractive for respiratory poultry vaccines. Pathogen-derived CpG oligonucleotides surface in emergency kits where cross-species influenza spillover threatens food security. The long regulatory databank surrounding alum and calcium phosphate still secures inclusion in value-priced formulations, especially for state-funded bovine brucellosis drives across sub-Saharan Africa. In contrast, nano-particles and polymer microspheres, despite higher COGS, gain share in export-oriented swine operations in Denmark and Spain where zero-antibiotic branding justifies premium inputs. Competition will likely intensify as universities spin out VLP-enabled adjuvants that promise virus-neutralizing titers at one-third the antigen load, a compelling metric when supply shocks raise bulk antigen prices.

The Veterinary Vaccine Adjuvants Market Report is Segmented by Type (Alum & Calcium Salts, and More), Route of Administration (Intramuscular, Subcutaneous, Intradermal, Intranasal/Mucosal, Oral), Animal Type (Livestock, Poultry, Companion Animals, Aquaculture), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 40.43% share in 2024 is anchored by USDA licensing rigor that rewards clinically vetted adjuvants and by an extensive cold-chain grid reaching remote feedlots. Federal grants such as the USD 7 million Kansas State Biomanufacturing Initiative catalyze domestic adjuvant pilot-lot capacity, mitigating dependence on overseas saponin extraction. Canada benefits from data reciprocity with the U.S., letting suppliers amortize studies across both markets, while Mexico's mixed-scale ranch landscape absorbs economical alum-oil hybrids where margin pressures loom.

Asia-Pacific posts the steepest 5.45% CAGR outlook as India's One Health Mission injects consistent budget lines into state veterinary labs and as China channels subsidies toward FMD-resistant herds. Regional demand collocates with local bottling plants that cut freight on chilled finished vaccines. Japan's companion animal segment rewards needle-free intradermal patches that shrink clinic dwell time, and Australia's extensive pastoral operations prize thermostable carbomers fit for infrequent muster schedules.

Europe stresses green chemistry and welfare norms; the Veterinary Medicines Regulation harmonizes dossier formats, but carbon-footprint metrics exert extra screening on solvent use. Brazil and Argentina expand dual-use cattle-poultry sites, with adjuvant selection driven by the need to satisfy both halal export auditors and antibiotic reduction pledges. Middle East and Africa markets look to shelf-stable blends-often carbomer-based-that tolerate 40 °C transit, opening lanes for suppliers with proven ambient-stability claims.

- Zoetis

- Merck

- SEPPIC (Air Liquide)

- Croda Intl (Avanti / Brenntag Biosector)

- Phibro Animal Health

- SPI Pharma

- Bioveta

- InvivoGen

- OZ Biosciences

- VaxLiant

- Novavax

- Agenus

- GSK Animal Health

- Ceva Sante Animale

- Boehringer Ingelheim

- Elanco

- Vaxine Pty

- Thermo Fisher Scientific

- Montanide ISA (Seppic brand)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Global Animal Protein Consumption

- 4.2.2 Rising Incidence of Emerging And Re-Emerging Livestock Diseases

- 4.2.3 Strengthening Government Immunization Mandates And Subsidies

- 4.2.4 Shift Toward High-Value Subunit and mRNA Veterinary Vaccines

- 4.2.5 Growing Focus on One Health And Zoonosis Prevention

- 4.2.6 Intensifying Commercial Livestock Intensification in Developing Regions

- 4.3 Market Restraints

- 4.3.1 Adverse Reactions and Safety Concerns with Oil-Based Adjuvants

- 4.3.2 Complex and Fragmented Regulatory Approval Pathways

- 4.3.3 High Development and Scale-Up Costs For Novel Adjuvants

- 4.3.4 Dependency on Limited Sources For Critical Raw Materials

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Alum & Calcium Salts

- 5.1.2 Oil-Emulsion Adjuvants (W/O, O/W, W/O/W)

- 5.1.3 Saponin-based (Quil A, QS-21, flavonoid)

- 5.1.4 Pathogen-derived (MPLA, CpG, TLR agonists)

- 5.1.5 Particulate / Nanoparticle (liposomes, Nano-11, VLPs)

- 5.1.6 Polymer & Carbomer Systems

- 5.1.7 Combination / Next-Gen Emulsions

- 5.1.8 Other Types

- 5.2 By Route of Administration

- 5.2.1 Intramuscular

- 5.2.2 Subcutaneous

- 5.2.3 Intradermal

- 5.2.4 Intranasal / Mucosal

- 5.2.5 Oral

- 5.3 By Animal Type

- 5.3.1 Livestock

- 5.3.1.1 Cattle & Buffalo

- 5.3.1.2 Sheep & Goat

- 5.3.1.3 Swine

- 5.3.2 Poultry

- 5.3.3 Companion Animals

- 5.3.3.1 Canine

- 5.3.3.2 Feline

- 5.3.3.3 Equine

- 5.3.4 Aquaculture

- 5.3.1 Livestock

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Zoetis

- 6.3.2 Merck Animal Health

- 6.3.3 SEPPIC (Air Liquide)

- 6.3.4 Croda Intl (Avanti / Brenntag Biosector)

- 6.3.5 Phibro Animal Health

- 6.3.6 SPI Pharma

- 6.3.7 Bioveta AS

- 6.3.8 InvivoGen

- 6.3.9 OZ Biosciences

- 6.3.10 VaxLiant

- 6.3.11 Novavax

- 6.3.12 Agenus

- 6.3.13 GSK Animal Health

- 6.3.14 Ceva Sante Animale

- 6.3.15 Boehringer Ingelheim Vetmedica

- 6.3.16 Elanco Animal Health

- 6.3.17 Vaxine Pty

- 6.3.18 Thermo Fisher Scientific, Inc.

- 6.3.19 Montanide ISA (Seppic brand)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment