PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848158

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848158

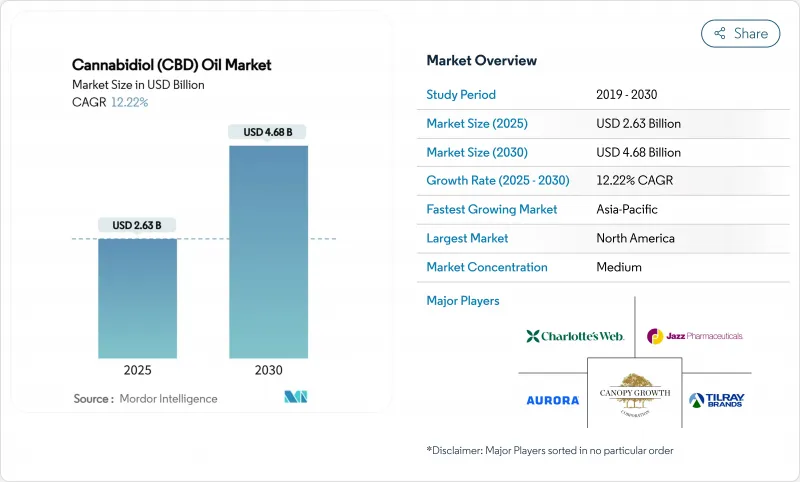

Cannabidiol (CBD) Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cannabidiol (CBD) Oil market size is valued at USD 2.63 billion in 2025 and is projected to reach USD 4.68 billion by 2030, registering a forecast compound annual growth rate (CAGR) of 12.22 %.

Regulatory harmonization, rising clinical validation, and sustained consumer interest in plant-based wellness products are pushing the Cannabidiol (CBD) Oil market beyond niche status toward mainstream therapeutic adoption. Companies are ramping capital spending on extraction lines that meet pharmaceutical Good Manufacturing Practice (GMP) requirements, signaling confidence that both prescription and over-the-counter channels will expand. Clinical-trial disclosures show consistent focus on chronic pain and refractory epilepsy, while beverage formulators invest in water-soluble nano-emulsions that widen usage occasions. In parallel, the cost base is falling as high-yield hemp cultivars and large-volume supercritical CO2 systems improve output per acre and lower unit costs.

Global Cannabidiol (CBD) Oil Market Trends and Insights

Harmonization of Hemp-friendly Legislation Accelerating Adoption

Policymakers on both sides of the Atlantic are aligning hemp statutes, lowering the compliance burden and giving national health agencies leeway to approve Cannabidiol (CBD) Oil market formulations that meet quality norms. The proposed U.S. re-schedule to Schedule III could neutralize Internal Revenue Code Section 280E expenses, which currently absorb up to 70 % of gross profit for vertically integrated firms. Comparable momentum in Germany has already lifted unit sales of GMP-certified tinctures, a data point firms cite when forecasting European rollouts. Country-level law changes shorten product-registration timelines, letting brands launch standardized SKUs across multiple markets rather than tailoring labels for every jurisdiction. This convergence prompts batch-size increases that drive production economies of scale, thereby dampening prices and boosting consumption.

Expanding Clinical Evidence Validating CBD for Chronic Pain & Epilepsy

A systematic review covering 40 studies confirmed that THC-free cannabidiol activates TRPV-1 and 5HT-1A pathways, substantiating its analgesic impact on osteoarthritis and neuropathic pain. U.S. oncologists now reference cannabidiol adjunct therapy in 2024 supportive-care guidelines, especially for intractable chemotherapy-induced nausea. This growing dossier enables drug developers to justify randomized controlled trials that may secure insurance reimbursement. The Cannabidiol (CBD) Oil market therefore benefits from dual credibility-familiar consumer perception and hard clinical data-creating cross-over demand from both wellness shoppers and prescribers.

Regulatory Ambiguity on THC Limits and Labeling Standards

A peer-reviewed assessment of 53 hemp items found labeling inaccuracies in 66 % of samples, exposing buyers to unintentional psychotropic intake. Such findings erode trust and force responsible producers to shoulder higher quality-assurance costs, which in turn compress margins. Retailers now demand certificates of analysis with QR codes, adding friction to listings and eliminating low-budget newcomers from key platforms.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Migration Toward Plant-based, Non-opioid Therapeutics

- Omnichannel Distribution Boom Boosting Accessibility

- Supply-chain Bottlenecks in Organic-certified Hemp Seeds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hemp-derived oils make up the majority of Cannabidiol (CBD) Oil market revenue because 0.3 % THC compliance eases interstate commerce, financial-service access, and mainstream-retailer placements. National pharmacy groups prefer hemp SKUs for risk mitigation, documenting a 30 % reorder increase within six months of initial shelf launches. Margin architecture benefits from scale: a single extraction batch often supplies cosmetic, nutraceutical, and tincture fill lines, spreading overhead across multiple revenue streams. Despite hemp leadership today, marijuana-sourced oils are gaining favor among experienced users who equate trace cannabinoid diversity with stronger symptom relief. Licensed dispensaries report that full-spectrum oils command 35-50 % price premiums yet maintain high turn rates, suggesting value-perception rather than price alone guides purchase decisions. Vertical integrators weigh these dynamics by operating dual lines, isolating hemp flows for big-box retail and full-spectrum lines for medical dispensaries, thereby hedging regulatory risk while meeting diverse demand.

Marijuana-derived oils notch a 13.67 % CAGR forecast, powered by dispensary expansion in U.S. adult-use states and Germany's personal-use law. Patients with chronic pain often pivot from isolates to full-spectrum blends after experiencing what they describe as enhanced efficacy, a switch that raises average monthly spend by 22 %. Compliance, however, involves potency caps and tamper-proof packaging, boosting cost-of-goods. Operators that integrate in-house testing and date-coded serialization mitigate these burdens and secure listing priority in regulated markets. On the supply side, indoor cultivators increasingly use LED spectra fine-tuning to boost minor cannabinoid ratios, aligning crop profiles with formulation demand in the Cannabidiol (CBD) Oil market.

Oils remain the backbone of the Cannabidiol (CBD) Oil market thanks to dose flexibility, sublingual onset of 15-45 minutes, and easy pairing with flavors like peppermint to mask hemp's terpene bitterness. Clinicians favor calibrated droppers when titrating seizure-control regimens, and pharmacists often lock oils behind counters alongside prescription items, reinforcing their medical-grade perception. Conversion analytics reveal cross-selling dynamics: 28 % of oil buyers add topical rollers in the same basket, inflating unit economics without extra acquisition cost. Bottlers embrace lightweight recyclable glass, trimming freight weight by 7 %, a logistics gain that flows directly to gross margin.

Edibles and gummies are on a growth tear, advancing faster than any other form factor as they offer single-serve convenience and longer systemic windows of 4-8 hours. Vegan pectin versions attract flexitarians, while sugar-free SKUs serve diabetic customers, expanding addressable pools. The Cannabidiol (CBD) Oil market benefits because edible-first users often graduate to oils once familiarity sets in, increasing lifetime value. Skin-contact products such as balms and transdermal patches harness cannabidiol's anti-inflammatory traits for localized support, appealing to athletes and mature adults. Though these segments remain smaller by volume, innovation pipelines suggest higher SKU diversity ahead.

The Cannabidiol (CBD) Oil Market Report is Segmented by Source Type (Hemp-Derived, Marijuana-Derived), Product Form (Capsules & Softgels and More), Sales Type (B2B, B2C [Offline Retail Pharmacies and More]), End-Use Sector (Cosmetics & Beauty and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes nearly half of global revenue in the Cannabidiol (CBD) Oil market and features mature retail networks, cross-border cultivation clusters, and advanced clinical research centers. U.S. operators anticipate that a Schedule III re-classification will allow standard tax deductions, potentially improving net margins by 10-15 % [FDA.GOV]. Canadian issuers supply pharmaceutical-grade isolate to Europe and Australia, illustrating how a clear national framework unlocks export capital. Mexico's draft bill outlines a federal registry for CBD producers, hinting at new North-South supply corridors that could leverage low-cost labor while serving 130 million residents once final rules publish.

Asia-Pacific is expanding the Cannabidiol (CBD) Oil market fastest, gaining traction in Australia's Special Access Scheme, Japan's zero-THC cosmetic aisle, and South Korea's monitored prescription program. Chinese hemp acreage covers more than half the planet's total, and processors run GMP plants dedicated to export because domestic rules limit ingestible use. Start-ups in Singapore pursue blockchain compliance engines to serve as regional quality hubs, anticipating wider liberalization. Investors see an upside in blending local cultivation with Australian-style clinical rigor to serve rising middle-class consumers.

Europe advances under Germany's April 2024 personal-use law, which has already lifted vaporizer sales and medical-prescription renewals. The United Kingdom's Food Standards Agency weighs novel-food applications and signals dosage caps that most exporters can meet with minor label edits. Italy debates expansion of its medical program, Spain explores pilot cultivation licenses, and France tracks a gradual shift from resin toward herbal formats-a movement that nudges policymakers toward modernizing rules. Harmonization remains slow, yet pharmaceutical distributors hold pan-EU contracts that accelerate cross-border shipments once clearances emerge.

Middle East & Africa post mid-teen growth as Israel's clinical-trial ecosystem draws global pharmaceutical partnerships, while South Africa prototypes a regulated supply chain after its decriminalization milestone. South America rides competitive agronomy and favorable sunlight. Brazil allows personal imports of 0.2 % THC oils via prescription, and domestic labs are honing good-manufacturing standards in anticipation of broader reforms. Colombia's licensed bank covers both cultivation and manufacturing, supporting EU-GMP certification that draws European buyers. Argentina's new medical regulations include local cultivation incentives aiming to reduce reliance on imports. The Cannabidiol (CBD) Oil market thus benefits from low-cost biomass but confronts currency volatility that complicates multi-year pricing agreements.

- Aurora Cannabis Inc.

- Canopy Growth

- CBD American Shaman LLC

- Charlotte's Web Holdings Inc.

- ConnOils

- CV Sciences

- Diamond CBD

- Elixinol Wellness Ltd.

- ENDOCA BV

- Gaia Herbs

- Green Roads

- Hempstrol

- Honest Paws

- Irwin Naturals (IRIE CBD)

- Jazz Pharmaceuticals plc

- Medical Marijuana

- Medipharm Labs

- MedReleaf Australia

- Mile High Labs

- NuLeaf Naturals LLC

- Pet Releaf

- Tilray Brands Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Harmonization of Hemp-friendly Legislation Accelerating Adoption

- 4.2.2 Expanding Clinical Evidence Validating CBD for Chronic Pain & Epilepsy

- 4.2.3 Consumer Migration Toward Plant-based, Non-opioid Therapeutics

- 4.2.4 Omnichannel Distribution Boom Boosting Accessibility

- 4.2.5 Cost Declines from Large-scale Hemp Cultivation & Extraction Technology

- 4.2.6 Widespread Integration of CBD into Functional Beverages and Ready-to-Drink Formats

- 4.3 Market Restraints

- 4.3.1 Regulatory Ambiguity on THC Limits and Labeling Standards

- 4.3.2 Supply-chain Bottlenecks in Organic-Certified Hemp Seeds

- 4.3.3 Quality Inconsistency Owing to Lack of Unified Global GMP Protocols

- 4.3.4 Inconsistent Customs Enforcement Across Borders

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Source Type

- 5.1.1 Hemp-derived

- 5.1.2 Marijuana-derived

- 5.2 By Product Form

- 5.2.1 Capsules & Softgels

- 5.2.2 Edibles & Gummies

- 5.2.3 Oils

- 5.2.4 Topicals & Creams

- 5.2.5 Other Forms

- 5.3 By Sales Type

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.2.1 Offline Retail Pharmacies

- 5.3.2.2 Online / E-commerce

- 5.3.2.3 Others

- 5.4 By End-Use Sector

- 5.4.1 Cosmetics & Beauty

- 5.4.2 Medical & Pharmaceuticals

- 5.4.3 Nutraceuticals & Functional Foods

- 5.4.4 Veterinary Products

- 5.4.5 Wellness & Personal Care

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Netherlands

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Israel

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aurora Cannabis Inc.

- 6.4.2 Canopy Growth Corporation

- 6.4.3 CBD American Shaman LLC

- 6.4.4 Charlotte's Web Holdings Inc.

- 6.4.5 ConnOils LLC

- 6.4.6 CV Sciences Inc.

- 6.4.7 Diamond CBD

- 6.4.8 Elixinol Wellness Ltd.

- 6.4.9 ENDOCA BV

- 6.4.10 Gaia Herbs

- 6.4.11 Green Roads

- 6.4.12 Hempstrol

- 6.4.13 Honest Paws

- 6.4.14 Irwin Naturals (IRIE CBD)

- 6.4.15 Jazz Pharmaceuticals plc

- 6.4.16 Medical Marijuana Inc.

- 6.4.17 Medipharm Labs

- 6.4.18 MedReleaf Australia

- 6.4.19 Mile High Labs

- 6.4.20 NuLeaf Naturals LLC

- 6.4.21 Pet Releaf

- 6.4.22 Tilray Brands Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment