PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848169

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848169

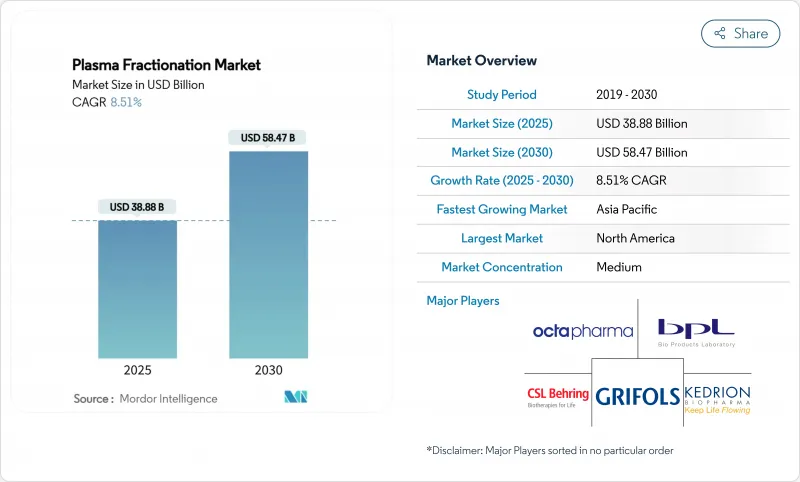

Plasma Fractionation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The plasma fractionation market size is valued at USD 38.88 billion in 2025 and is forecast to reach USD 58.47 billion by 2030, posting an 8.51% CAGR over 2025-2030.

Rising demand for plasma-derived medicinal products in neurology, immunology and critical-care medicine underpins this expansion, while supply security remains a strategic priority for manufacturers. Asia-Pacific is advancing fastest as governments and private operators build domestic plasma collection capacity; at the same time, North America continues to dominate volumes thanks to favorable donor compensation models. Product innovation is accelerating around high-concentration immunoglobulins, next-generation virus-removal filters and automated collection devices, helping companies lower cost per liter and improve manufacturing yields. Competitive intensity is shaped by vertical integration, with leading players operating hundreds of donation centers to secure raw material and cushion supply shocks in the plasma fractionation market.

Global Plasma Fractionation Market Trends and Insights

Expansion of Private Donor Plasma Collection Centers

Global operators continue to accelerate site roll-outs to secure supply, reshaping the plasma fractionation market. CSL Plasma deployed the RIKA Plasma Donation System in Houston, trimming session times by 15 minutes and improving donor throughput. Canadian Blood Services is opening new centers-including Thunder Bay in early 2025-to increase domestic collections. Emerging economies are following suit; Indonesia's first fractionation plant in Karawang will process 600,000 liters a year, converting discarded plasma into medicines. These moves collectively ease the raw-material bottleneck as global IG demand grows 8-9% annually. Larger, technology-enabled centers also allow companies to diversify sourcing and mitigate region-specific donor constraints, reinforcing supply resilience across the plasma fractionation market.

Rising Adoption of Subcutaneous Immunoglobulin (SCIG)

Patient preference for home therapy and pressure to lower infusion costs are driving rapid uptake of SCIG. XEMBIFY, the first FDA-cleared 20% SCIG for treatment-naive primary immunodeficiency patients, offers >=98% IgG purity and favorable tolerability. HYQVIA pairs 10% IG with recombinant hyaluronidase to achieve 93.3% bioavailability while requiring fewer infusion sites. These high-concentration products, alongside smart infusion pumps, facilitate self-administration and free hospital capacity. Payers view SCIG favorably because it reduces chair time and ancillary costs, supporting broader reimbursement. Consequently, specialty pharmacies and infusion centers are scaling distribution networks, reinforcing a structural shift toward decentralized care within the plasma fractionation market.

Supply Constraints Due to Donor Compensation Caps

Europe's ethical ceilings on donor payments threaten supply stability, with forecasts pointing to a 4-8 million-liter shortfall by 2025. Imports already cover 40% of European demand, underscoring vulnerability to external shocks. The proposed Substances of Human Origin regulation seeks a balance between donor protection and material sufficiency, but near-term collection gaps persist. Australia, operating on voluntary donation, imported USD 399.2 million worth of immunoglobulin in 2022-23 as domestic volumes lagged 8% annual demand growth. These limitations compel fractionators to diversify sourcing, optimize yield per liter and invest in collection technology-yet they still temper growth projections for the plasma fractionation market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Albumin Utilization in Critical Care

- Government Funding for Hemophilia Treatment Programs

- Competition from Long-Acting Recombinant Coagulation Factors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunoglobulins held 63.21% of the plasma fractionation market share in 2024, reflecting their broad therapeutic footprint in immunology and neurology. Launches of high-concentration formulations like Yimmugo are expected to lift segment revenues, with Grifols projecting USD 1 billion in U.S. sales over seven years. The plasma fractionation market benefits from stable double-digit demand for immunoglobulins, underpinned by expanding indications such as chronic inflammatory demyelinating polyneuropathy. At the same time, manufacturing upgrades-most notably Asahi Kasei Medical's Planova FG1 filter-raise throughput and lower virus breakthrough risk, supporting volume growth.

Coagulation factors, while representing a smaller revenue base, are forecast to expand at a 9.21% CAGR, the fastest among product lines. Extended prophylaxis protocols foster rising per-patient consumption, and new delivery platforms improve adherence. Nevertheless, recombinant alternatives and non-factor therapies introduce pricing pressure. Albumin retains a sizeable share due to its role in critical care, especially across Asia-Pacific where protocol updates recommend early administration in septic shock. Protease inhibitors, centred on alpha-1 antitrypsin, are gaining momentum in pulmonology as standardized pathways for severe deficiency enter clinical practice. Taken together, product diversification and technological advancement continue to define competitive positioning in the plasma fractionation market.

Neurology applications accounted for 42.12% of 2024 revenues, anchored by intravenous and subcutaneous immunoglobulin use in CIDP and multifocal motor neuropathy. HYQVIA's 93.3% bioavailability exemplifies modality evolution, offering fewer sites and lower infusion frequency. As disease awareness improves, diagnosis rates climb, further cementing neurology's primacy in the plasma fractionation market. Growth is reinforced by real-world data demonstrating sustained functional gains and reduced relapse frequency with maintenance dosing.

Pulmonology marks the fastest-growing segment, slated to post a 10.41% CAGR to 2030. Alpha-1 antitrypsin replacement therapy drives this surge, with European consensus guidelines streamlining patient selection and dosing. Research linking arterial stiffness to cardiovascular risk in deficiency patients underscores wider systemic benefits, potentially unlocking new reimbursement pathways. Immunology remains a core indication set, while hematology confronts recombinant competition. Critical-care adoption of albumin in trauma and surgical contexts bolsters cross-department utilization, broadening application diversity. Collectively, these dynamics ensure the plasma fractionation market stays responsive to shifting clinical priorities.

The Plasma Fractionation Market Report Segments the Industry Into by Product (Immunoglobulins, Platelets and Coagulation Factor Concentrates, Albumin, Other Products), by Application (Neurology, and More), by End-User (Hospitals and Clinics, and More), by Sector (Private Fractionators and Public Fractionators), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America).

Geography Analysis

North America remains the epicenter of the plasma fractionation market, holding 53.61% of revenue in 2024. The United States alone accounts for 70% of global source plasma, supported by donor compensation that sustains a dense network of nearly 1,200 centers. The Congressional Plasma Caucus spotlights bipartisan support for uninterrupted immunoglobulin access, while technological upgrades like CSL's RIKA system shorten donation times and improve throughput. Advanced regulatory processes facilitate rapid approval of next-generation filters and formulations, reinforcing the region's supply chain robustness.

Asia-Pacific represents the fastest-growing arena, anticipated to record a 9.41% CAGR to 2030. Governments in Indonesia, China and India are investing in domestic fractionation plants to reduce reliance on imports. Indonesia's Karawang facility will convert 600,000 liters annually into high-value products, exemplifying a shift toward self-sufficiency. Nonetheless, supply imbalances persist: Australia imported USD 399.2 million worth of immunoglobulin in 2022-23, with demand growing 8% each year. Strategic transactions, such as CSL's divestiture of its Wuhan plasma portfolio to Rongsheng Pharmaceutical for USD 185 million, realign footprints for better local market fit.

Europe faces structural headwinds from donor compensation caps, leading to 40% dependence on U.S. plasma. Proposed SoHO regulations aim to boost donor retention while preserving ethical standards, yet near-term scarcity remains a reality. Manufacturing expertise and established distribution channels temper risk, but capacity utilization hinges on raw material flows. Latin America, the Middle East and Africa collectively contribute a modest share today, yet rising healthcare expenditure and wider insurance coverage are opening access to plasma-derived therapies. Long-term upside lies in infrastructure investment and public-private partnerships, gradually enlarging regional slices of the plasma fractionation market.

- CSL Behring

- Grifols

- Takeda Pharmaceuticals

- Octapharma

- Kedrion Biopharma

- Biotest

- Bio Products Laboratory

- Shanghai RAAS Blood Products Co., Ltd.

- Sanquin Blood Supply Foundation

- LFB S.A.

- ADMA Biologics

- Kamada Ltd.

- Baxter

- Intas Biopharmaceuticals Ltd.

- PlasmaGen BioSciences

- Emergent Bio Solutions

- Biolife Plasma Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Private Donor Plasma Collection Centers Globally

- 4.2.2 Rising Adoption of Subcutaneous Immunoglobulin (SCIG) for Home-Based Therapy

- 4.2.3 Increasing Utilization of Albumin in Critical-Care Management in Asia-Pacific

- 4.2.4 Favourable Government Funding for Hemophilia Treatment Programs

- 4.2.5 Accelerated Regulatory Approvals for Hyperimmune Globulins Targeting Emerging Viral Threats

- 4.2.6 Growth of Contract Fractionation Services Among Small Blood Banks in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Supply Constraints Due to Donor Compensation Caps

- 4.3.2 Competition from Long-Acting Recombinant Coagulation Factors in Hemophilia

- 4.3.3 High Batch Failure Rates with Chromatography-Intensive Fractionation Lines

- 4.3.4 Limited Reimbursement for IVIG in Low-Income Asian Countries

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Immunoglobulins

- 5.1.1.1 Intravenous Immunoglobulin (IVIG)

- 5.1.1.2 Subcutaneous Immunoglobulin (SCIG)

- 5.1.1.3 Other Immunoglobulins

- 5.1.2 Coagulation Factors

- 5.1.3 Albumin

- 5.1.4 Protease Inhibitors (C1-Esterase, Alpha-1 Antitrypsin)

- 5.1.5 Other Plasma-Derived Products

- 5.1.1 Immunoglobulins

- 5.2 By Application

- 5.2.1 Neurology

- 5.2.2 Immunology

- 5.2.3 Hematology

- 5.2.4 Pulmonology

- 5.2.5 Critical Care & Trauma

- 5.2.6 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Plasma Collection Centers & Blood Banks

- 5.3.4 Other End-Users

- 5.4 By Sector

- 5.4.1 Private Fractionators

- 5.4.2 Public Fractionators

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 CSL Behring

- 6.3.2 Grifols S.A.

- 6.3.3 Takeda Pharmaceutical Company Ltd.

- 6.3.4 Octapharma AG

- 6.3.5 Kedrion S.p.A.

- 6.3.6 Biotest AG

- 6.3.7 Bio Products Laboratory Ltd.

- 6.3.8 Shanghai RAAS Blood Products Co., Ltd.

- 6.3.9 Sanquin Blood Supply Foundation

- 6.3.10 LFB S.A.

- 6.3.11 ADMA Biologics Inc.

- 6.3.12 Kamada Ltd.

- 6.3.13 Baxter International Inc.

- 6.3.14 Intas Biopharmaceuticals Ltd.

- 6.3.15 PlasmaGen BioSciences Pvt. Ltd.

- 6.3.16 Emergent BioSolutions Inc.

- 6.3.17 Biolife Plasma Services

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment