PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848325

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848325

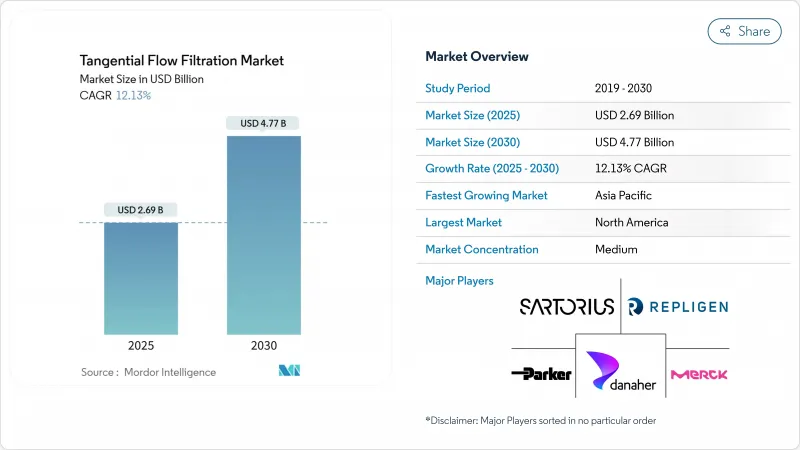

Tangential Flow Filtration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The tangential flow filtration market size reached USD 2.69 billion in 2025 and is on course to attain USD 4.77 billion by 2030, advancing at a 12.13% CAGR.

Sustained investment in process-intensified, continuous biomanufacturing lines, the rapid scale-up of gene therapy plants, and an accelerated shift toward single-use equipment all underpin this double-digit expansion. Contract development organizations in Asia are commissioning large-footprint greenfield plants, while incumbent North American and European producers are retrofitting legacy facilities to boost throughput without expanding cleanroom space. Ongoing integration of inline analytics with filtration skids shortens process-development cycles and lowers failure rates, pushing end users to favor fully integrated system packages. At the same time, supply-chain friction in GMP-grade membranes and tightening rules on plastic waste are sharpening vendor focus on material innovation and recycling programs.

Global Tangential Flow Filtration Market Trends and Insights

Single-Use Systems Slash Change-Over Time

Single-use tangential flow filtration systems eliminate the 4-8-hour cleaning validation windows that previously limited multiproduct facilities, delivering a documented 27% uplift in development-stage productivity. Adoption has broadened beyond traditional monoclonal antibody plants to cell and gene therapy suites, where dedicated run campaigns heighten contamination concerns. Regulators increasingly guide toward disposable assemblies because sterility assurance is inherent and validation files are slimmer, a position mirrored across recent FDA facility inspection trends. Yet the sustainability conversation is intensifying; life-cycle assessments now inform purchasing decisions, spurring suppliers to advance biodegradable membranes and closed-loop plastic reclamation schemes.

Growing Adoption of Continuous Bioprocessing

Continuous bioprocessing repositions tangential flow filtration as a permanently online operation that maintains steady-state production for weeks, cutting the typical facility footprint by 50-70% while tightening quality variance among lots. Perfusion cultures running above 100 million cells/mL require robust cell-retention modules, a capability strongly favored by gene therapy producers because shorter residence times curb vector degradation. Digital-twin modeling now fine-tunes flux, shear, and trans-membrane pressure in real time, as demonstrated by Samsung Biologics' pilot lines.

Shear-Sensitive Modalities Limit Flux Rates

Complex biologics such as viral vectors cannot tolerate high shear, forcing operators to run filters at throughput levels that are 50-75% lower than monoclonal antibody norms. Even with surface-modified membranes that reduce stress points, core physics restrict the ability to accelerate flows without risking capsid rupture, thus prolonging cycle times and squeezing facility capacity.

Other drivers and restraints analyzed in the detailed report include:

- High-Throughput Screening Cassettes for Gene-Therapy Vectors

- Biopharma Shift to High-Cell-Density Perfusion

- Scarcity of GMP-Grade Hollow-Fiber Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Systems accounted for a 46.34% tangential flow filtration market share in 2024, reflecting user preference for turnkey assemblies that couple pumps, controllers, and real-time sensors under a single validation envelope. Demand remains resilient because multinationals routinely upgrade installed skids to align with tightening data-integrity and automation mandates. In parallel, the tangential flow filtration market size allocated to membrane filters is climbing at a 14.67% CAGR to 2030 as single-use programs require fresh cassettes for each campaign. Disposable membrane uptake is particularly sharp in gene therapy suites, where cross-contamination risk is less acceptable and changeover speed carries premium value.

Accessories such as pre-conditioners, flow-path sensors, and disposable conductivity probes are the smallest dollar segment yet record steady, mid-single-digit growth. Suppliers bundle these add-ons with service agreements, expanding revenue beyond hardware. Repligen's recently launched SoloVPE Plus system exemplifies the push toward integrated analytics, shortening concentration tests by 70% and feeding back to automated filter-control loops. This convergence of hardware and analytics delivers higher margins to vendors while reducing batch-failure risk for users.

Ultrafiltration retained 57.53% revenue in 2024 given its entrenchment in buffer-exchange and concentration steps for classical biologics. Nevertheless, microfiltration is projected to expand at a 14.83% CAGR through 2030, propelled by high-cell-density perfusion cultures that depend on tight cell-retention cutoffs. The tangential flow filtration market size apportioned to microfiltration modules is therefore growing faster than the macroscale figure, stimulated by viral vector facilities that demand precise pore distribution for debris removal.

Breakthroughs in polymer chemistry, specifically polyethersulfone blends and regenerated-cellulose coatings, are boosting flux stability and fouling resistance during long perfusion runs. Innovations are also surfacing in gradient-pore architectures that pair high retentate selectivity with low trans-membrane pressure, features that align with the shear-sensitivity of new biologic entities. Reverse osmosis and nanofiltration remain niche, handling mainly utility water polishing, and their share is unlikely to budge materially across the forecast window.

The Tangential Flow Filtration Market Report is Segmented by Product Type (Systems, Membrane Filters, and Accessories), Technology (Ultrafiltration, Microfiltration, and Reverse Osmosis/ Nanofiltration), Application (Vaccines & MAbs), End-User (Biopharma Manufacturers, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.62% of 2024 revenue in the tangential flow filtration market, supported by advanced R&D clusters, a well-defined FDA validation pathway, and deep installed capacity across vaccines, antibodies, and viral vectors. Mergers such as Thermo Fisher Scientific's USD 4.1 billion purchase of Solventum's purification business underscore the region's role as the gravitational center for technology consolidation. Persistent talent shortages and raw-material lead-time spikes, however, are prompting some producers to weigh dual-continental supply chains.

Asia-Pacific is on track to post a 13.56% CAGR through 2030, translating into the fastest regional expansion worldwide. Several headline projects, including Samsung Biologics' USD 6 billion "Plant 5" build and Lotte Biologics' USD 3.3 billion greenfield complex, are raising local demand for high-capacity filtration skids. Chinese CDMOs such as WuXi Biologics and Chime Biologics are similarly scaling viral-vector suites, further inflating order books. Favorable tax incentives, comparatively low labor costs, and short shipping lanes for polymer resins amplify the region's competitiveness, although lingering IP and regulatory alignment challenges moderate uptake among some multinational sponsors.

Europe enjoys steady mid-single-digit growth owing to a robust pharmaceutical base and strict environmental statutes that encourage water-reuse and biodegradable filter elements. Brexit-related cross-border friction and high energy prices inflate operating costs but simultaneously bolster the case for continuous processing that squeezes more product out per kilowatt consumed. Middle East & Africa and South America are nascent yet viewable growth pockets; both benefit from government life-science funding programs but still lack the dense supplier and talent ecosystems found in mature markets.

- Danaher

- Merck

- Sartorius

- Repligen Corp.

- Parker Hannifin

- Alfa Laval

- Andritz Group

- Meissner Filtration

- Sterlitech Corp.

- Solaris Biotechnology

- Thermo Fisher Scientific

- 3M

- Cytiva

- GE Healthcare

- Asahi Kasei

- Koch Membrane Systems

- Donaldson Company

- Miltenyi Biotec

- Graver Technologies

- Cobetter Filtration

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Single-Use Systems Slash Change-Over Time

- 4.2.2 Growing Adoption of Continuous Bioprocessing

- 4.2.3 High-Throughput Screening Cassettes for Gene-Therapy Vectors

- 4.2.4 Biopharma Shift to High-Cell-Density Perfusion

- 4.2.5 CAPEX-Light CDMO Build-Outs in Emerging Asia

- 4.2.6 ESG-Driven Water-Recycling Mandates

- 4.3 Market Restraints

- 4.3.1 Shear-Sensitive Modalities Limit Flux Rates

- 4.3.2 Scarcity Of GMP-Grade Hollow-Fiber Supply

- 4.3.3 Learning-Curve Risk in Process-Automation Adoption

- 4.3.4 Export-Control Rules on Single-Use Plastics

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Systems

- 5.1.1.1 Single-use Tangential Flow Filtration Systems

- 5.1.1.2 Re-usable Tangential Flow Filtration Systems

- 5.1.2 Membrane Filters

- 5.1.2.1 Polyethersulfone

- 5.1.2.2 Regenerated Cellulose

- 5.1.2.3 Other Membranes

- 5.1.3 Accessories

- 5.1.1 Systems

- 5.2 By Technology

- 5.2.1 Ultrafiltration

- 5.2.2 Microfiltration

- 5.2.3 Reverse Osmosis / Nanofiltration

- 5.3 By Application

- 5.3.1 Vaccines & mAbs

- 5.3.2 Cell & Gene-Therapy Vectors

- 5.3.3 Plasma-derived Proteins

- 5.3.4 Other Applications

- 5.4 By End-User

- 5.4.1 Biopharma Manufacturers

- 5.4.2 Contract Development & Manufacturing Organisations (CDMOs)

- 5.4.3 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Danaher Corporation

- 6.3.2 Merck KGaA

- 6.3.3 Sartorius AG

- 6.3.4 Repligen Corp.

- 6.3.5 Parker Hannifin Corporation

- 6.3.6 Alfa Laval

- 6.3.7 Andritz Group

- 6.3.8 Meissner Filtration

- 6.3.9 Sterlitech Corp.

- 6.3.10 Solaris Biotechnology

- 6.3.11 Thermo Fisher Scientific

- 6.3.12 3M Company

- 6.3.13 Cytiva

- 6.3.14 GE HealthCare

- 6.3.15 Asahi Kasei

- 6.3.16 Koch Membrane Systems

- 6.3.17 Donaldson Company

- 6.3.18 Miltenyi Biotec

- 6.3.19 Graver Technologies

- 6.3.20 Cobetter Filtration

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment