PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822567

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822567

U.S. Blood Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

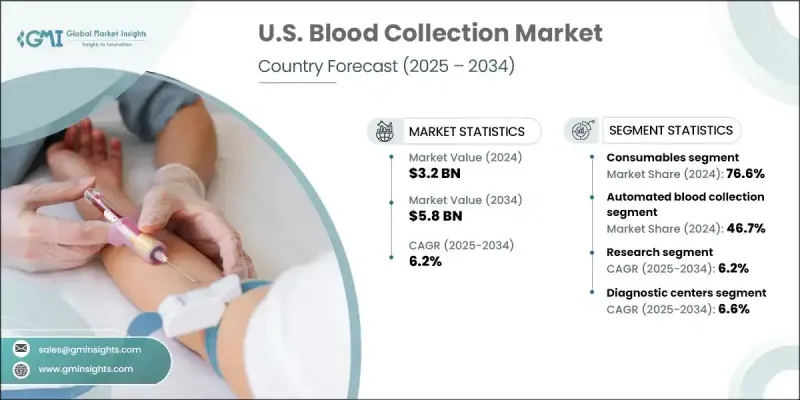

U.S. Blood Collection Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 5.8 billion by 2034.

The expansion of this industry is closely tied to the increase in surgical interventions, rising cases of both chronic and infectious diseases, and continued innovation in blood collection tools and techniques. As conditions like cancer, cardiovascular disease, HIV, diabetes, and tuberculosis become more prevalent, there is a rising need for reliable diagnostic and transfusion systems. Healthcare providers across hospitals, clinics, labs, and blood banks rely heavily on advanced blood collection technologies to ensure safety, precision, and patient comfort. The integration of modern devices that support quick and clean sample collection is becoming increasingly critical in clinical operations across the country. The industry's upward trajectory is also supported by enhanced awareness of blood donation and a strong demand for transfusions, which are essential in managing trauma, surgeries, and a wide range of medical treatments. Products such as vacuum tubes, lancets, needles, blood bags, and syringes are vital components of this ecosystem and are seeing increased adoption for both diagnostic and therapeutic use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 6.2% |

In 2024, the consumables segment held a 76.6% share, driven by their widespread use and essential role in single-use blood sampling. These disposable items are designed to maintain sterility, safeguard health workers, and preserve sample accuracy, supporting various healthcare applications from basic testing to complex diagnostics. Their role is fundamental in laboratory settings and continues to grow in step with the expansion of the U.S. diagnostic and treatment landscape.

The automated blood collection systems segment held a 46.7% share in 2024, bolstered by the need for operational efficiency and digital transformation in healthcare services. With increasing pressure to minimize human error, improve throughput, and standardize procedures, healthcare providers are rapidly adopting automated tools like robotic venipuncture and component separation technologies. These innovations help accelerate workflows while ensuring consistency and reducing the risk of contamination or improper sampling, particularly in high-volume environments such as blood banks and clinical laboratories.

The diagnostic centers segment will grow at a CAGR of 6.6% through 2034. These facilities play a crucial role in preventive healthcare and chronic disease management by performing a significant portion of outpatient blood testing. As diagnostic infrastructure expands nationwide, the need for high-quality, efficient blood collection systems continues to rise. This trend reflects a broader move toward early detection, faster turnaround times, and accessible care, further reinforcing the central role of diagnostic labs in the nation's healthcare delivery model.

Major industry leaders shaping the U.S. Blood Collection Market include Thermo Fisher Scientific, Medline Industries, Sarstedt AG & Co, Terumo Corporation, McKesson Corporation, Becton, Dickinson and Company, QIAGEN, Haemonetics Corporation, Siemens Healthineers, Nipro Corporation, Greiner, Cardinal Health, Abbott Laboratories, Fresenius SE & Co, and Streck. Companies operating in the U.S. blood collection market are adopting multiple strategies to expand their market presence and enhance customer trust. Key players are investing in research and development to introduce next-generation blood collection systems that offer enhanced safety, automation, and ease of use. Collaborations with hospitals, diagnostic labs, and blood banks help create long-term distribution networks and customer loyalty. Mergers and acquisitions are used to expand technological capabilities and enter untapped segments. Manufacturers are also optimizing product portfolios to meet regulatory requirements while maintaining high clinical standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Method

- 2.2.3 Application

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic and infectious diseases in U.S.

- 3.2.1.2 Rising government initiatives and awareness campaigns

- 3.2.1.3 Increasing demand for blood transfusions

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory challenges

- 3.2.2.2 Risk of contamination and needlestick injuries

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of point-of-care testing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 System

- 5.2.1 Automated systems

- 5.2.2 Manual systems

- 5.3 Consumables

- 5.3.1 Venous

- 5.3.1.1 Needles and syringes

- 5.3.1.1.1 Double-ended needles

- 5.3.1.1.2 Winged blood collection sets

- 5.3.1.1.3 Standard hypodermic needles

- 5.3.1.1.4 Other blood collection needles

- 5.3.1.2 Blood collection tubes

- 5.3.1.2.1 Serum-separating

- 5.3.1.2.2 EDTA

- 5.3.1.2.3 Heparin

- 5.3.1.2.4 Plasma-separating

- 5.3.1.3 Blood bags

- 5.3.1.4 Other venous products

- 5.3.1.1 Needles and syringes

- 5.3.2 Capillary

- 5.3.2.1 Lancets

- 5.3.2.2 Micro-container tubes

- 5.3.2.3 Micro-hematocrit tubes

- 5.3.2.4 Warming devices

- 5.3.2.5 Other capillary products

- 5.3.1 Venous

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual blood collection

- 6.3 Automated blood collection

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Treatment

- 7.4 Research

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 1.1 Key trends

- 1.2 Hospitals and clinics

- 1.3 Diagnostic centers

- 1.4 Blood banks

- 1.5 Academic and research institutes

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Becton, Dickinson, and Company

- 9.3 Cardinal Health

- 9.4 Fresenius SE & Co

- 9.5 Greiner

- 9.6 Haemonetics Corporation

- 9.7 McKesson Corporation

- 9.8 Medline Industries

- 9.9 Nipro Corporation

- 9.10 QIAGEN

- 9.11 Sarstedt AG & Co

- 9.12 Siemens Healthineers

- 9.13 Streck

- 9.14 Terumo Corporation

- 9.15 Thermo Fisher Scientific