PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849806

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849806

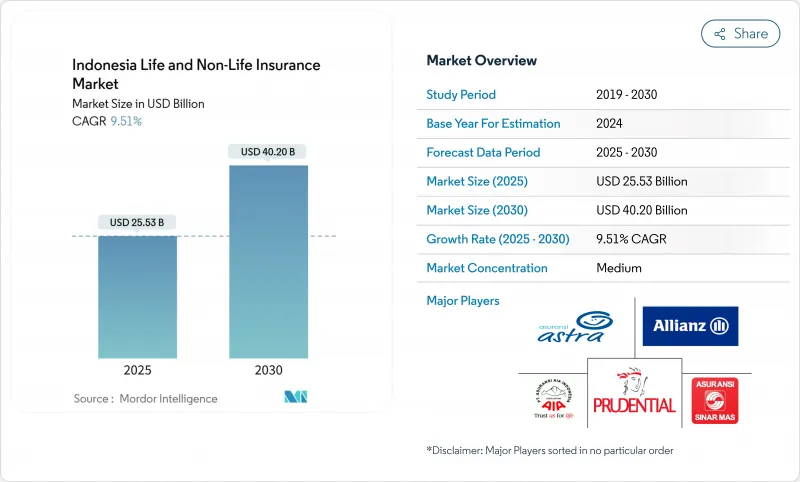

Indonesia Life And Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia life and non-life insurance market is valued at USD 25.53 billion in 2025 and is projected to reach USD 40.2 billion by 2030, reflecting a healthy 9.51% CAGR.

Indonesia life and non-life insurance markets are on a growth trajectory, spurred by digital distribution, stricter capital regulations, and a rising awareness of climate-related risks. In 2024, life insurance commands a dominant 70.1% share of total premiums, yet the non-life segment is gaining traction, especially in property, motor, and health coverage. Reforms pushing for mandatory health insurance, the expanding reach of bancassurance, and the rise of Syariah-compliant products are broadening the insured demographic. On the regulatory front, capital mandates from POJK 14/2020 are driving market consolidation, bolstering solvency but squeezing profit margins. While Java remains the hub for premium collection, regions like Papua and Maluku are witnessing the swiftest growth, supported by infrastructure advancements and the evolution of micro-insurance distribution.

Indonesia Life And Non-Life Insurance Market Trends and Insights

Digital Bancassurance Adoption Surging post-OJK POJK No 38/2020

OJK Regulation No. 38/2020 has catalyzed a surge in digital bancassurance across Indonesia. By facilitating direct links between bank apps and insurer systems, the regulation has driven a notable 16% uptick in bancassurance premiums in 2024. Digital transactions now account for 27% of the channel, a significant leap from a mere 8% in 2022. Stricter transparency mandates have curbed mis-selling, restoring consumer confidence and prompting banks to pair simple insurance products with credit services. Notably, Bank Syariah Indonesia and Prudential are at the forefront, digitally offering Syariah-compliant policies and reaching out to historically overlooked Muslim demographics. With a staggering 110 million mobile banking users, banks have solidified their role as trusted conduits, enabling insurers to provide affordable and seamless policy experiences, especially to Indonesia's burgeoning middle-income bracket.

Mandatory BPJS Reforms Spurring Supplemental Health Policies

In Indonesia, households are increasingly turning to supplemental health coverage in light of mandatory reforms to the BPJS system. These reforms include the introduction of the KRIS hospital class standard and a looming projected deficit of IDR 20 trillion in 2024. As a result, there's a growing demand for top-up insurance, which now encompasses private room coverage, outpatient services, and treatments for non-communicable diseases. This rising demand is underscored by a notable 29.3% year-on-year surge in individual health claims, reaching USD 0.48 billion in the first half of 2024. Insurers, keen to tap into this burgeoning market, are introducing modular riders, reducing waiting periods, and streamlining claims processes to be fully digital. This flurry of activity has positioned health insurance as the fastest-growing segment, boasting a projected CAGR of 13.4% from 2025 to 2029. While urban areas have been the initial hotspots for adoption, a broader awareness of the KRIS reforms is igniting interest nationwide.

Low Insurance Literacy in Eastern Provinces

In eastern Indonesia, persistently low insurance literacy acts as a structural barrier to market growth. While the national insurance penetration rate stands at a mere 1.4%, regions such as Papua and Maluku fall even further behind. This lag is attributed to limited financial inclusion, a sparse branch infrastructure, and a general lack of awareness regarding risk protection. Nationwide, 29.77 million micro-insurance policies have been recorded, yet rural participation remains tepid. Insurers are making strides to bridge this gap, launching community outreach programs and mobile enrollment initiatives. However, the uptake has been sluggish. Consequently, this gap in literacy and access poses a long-term constraint on the growth of both life and non-life insurance sectors throughout Indonesia.

Other drivers and restraints analyzed in the detailed report include:

- Climate-induced Catastrophe Risk Elevating Property Cover Demand

- Syariah Finance Boom Catalyzing Takaful Uptake Outside Java

- POJK 14/2020 Solvency Hikes Pressuring Small Domestic Players

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Indonesia life and non-life insurance market size allocated to life products accounted for 70.1% of premiums in 2024, driven by savings-linked policies and growing middle-class incomes. Premium momentum is now moderating as stricter PAYDI rules shift focus to protection-led designs, yet life insurers still benefit from deep agency forces and bancassurance bundling.

Non-life premiums are on an 11.21% CAGR path from 2025-2030, led by health, property and motor. Greater catastrophe awareness, pending mandatory motor liability regulation and embedded health riders on fintech apps broaden demand beyond corporates. Large global reinsurers continue to back Indonesian risk, helping local carriers absorb higher catastrophe exposure and innovate with parametric triggers.

Regular premium contracts supply predictable cash inflows that smooth investment planning. Traditional life savings products still rely on monthly or quarterly payments collected via auto-debit, sustaining persistency ratios in uncertain economic times. Rising inflation reinforces the appeal of disciplined, smaller contributions over lump-sum risk.

Single-premium business is more cyclical, influenced by capital-market sentiment and high-net-worth investors' asset-allocation shifts. After a contraction in early 2024, insurers redesigned single-premium wrappers with clearer risk statements and liquidity options, gradually reviving appetite.

The Indonesia Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance (Product (Term, Whole and More), Purchase Mode (Individual, Group), Non-Life Insurance (Line of Business (Motor, Health and More)), Distribution Channel (Direct, and More), Premium Type (Single, Regular), Policy Term (Short, Long), End Users (Individual and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Prudential Life Assurance

- PT AIA Financial

- PT Manulife Indonesia

- PT Allianz Life Indonesia

- PT AXA Financial Indonesia

- PT Sun Life Financial Indonesia

- PT Great Eastern Life Indonesia

- PT BNI Life Insurance

- PT Sequis Life

- PT Asuransi Jiwasraya (Persero)

- PT Asuransi Astra Buana

- PT Asuransi Sinar Mas

- PT Zurich Insurance Indonesia

- PT Tokio Marine Indonesia

- PT Adira Dinamika Insurance

- PT Sompo Insurance Indonesia

- PT Chubb General Insurance Indonesia

- PT Asuransi Jasindo (Persero)

- PT KB Insurance Indonesia

- PT AXA Mandiri General Insurance

- PT Asuransi Central Asia

- PT Tugu Pratama Indonesia

- PT Asuransi Kredit Indonesia (Askrindo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Bancassurance Adoption Surging Post-OJK POJK No 38/2020

- 4.2.2 Mandatory BPJS Reforms Spurring Supplemental Health Policies

- 4.2.3 Climate-Induced Catastrophe Risk Elevating Property Cover Demand

- 4.2.4 Syariah Finance Boom Catalyzing Takaful Product Uptake Outside Java

- 4.2.5 PAYDI (Investment-Linked) Regulation Unlocking Unit-Linked Growth

- 4.2.6 E-commerce & Ride-Hailing Micro-insurance Expanding Risk Pools

- 4.3 Market Restraints

- 4.3.1 Low Insurance Literacy in Eastern Provinces

- 4.3.2 POJK 14/2020 Solvency Hikes Pressuring Small Domestic Carriers

- 4.3.3 Motor Claims Fraud & Data-Quality Gaps Eroding Margins

- 4.3.4 IDR Volatility Complicating ALM & Capital Buffers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.1.1 By Product

- 5.1.1.1.1 Term Life

- 5.1.1.1.2 Endowment

- 5.1.1.1.3 Whole Life

- 5.1.1.1.4 Unit-Linked (PAYDI)

- 5.1.1.1.5 Takaful Life

- 5.1.1.2 By Purchase Mode

- 5.1.1.2.1 Individual Policies

- 5.1.1.2.2 Group Policies

- 5.1.2 Non-Life Insurance

- 5.1.2.1 By Line of Business

- 5.1.2.1.1 Motor

- 5.1.2.1.2 Property (Home & Commercial)

- 5.1.2.1.3 Health

- 5.1.2.1.4 Personal Accident & Travel

- 5.1.2.1.5 Marine, Aviation & Cargo

- 5.1.2.1.6 Liability

- 5.1.2.1.7 Credit & Guarantee

- 5.1.2.1.8 Crop & Livestock

- 5.1.2.1.9 Others

- 5.1.1 Life Insurance

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Agency Channel

- 5.2.2.1 Tied Agents

- 5.2.2.2 Independent Agents

- 5.2.3 Bancassurance

- 5.2.3.1 Bank Branch

- 5.2.3.2 Digital Banking & E-Wallet Partnerships

- 5.2.3.3 Affinity Programs

- 5.2.4 Brokers

- 5.2.5 Digital / Online Platforms

- 5.2.6 Peer-to-Peer & Insurtech Marketplaces

- 5.3 By Premium Type

- 5.3.1 Single Premium

- 5.3.2 Regular Premium

- 5.4 By Policy Term

- 5.4.1 Short-Term (<1 Year)

- 5.4.2 Long-Term (>1 Year)

- 5.5 By End-User

- 5.5.1 Individual Consumers

- 5.5.2 Micro, Small & Medium Enterprises (MSMEs)

- 5.5.3 Large Corporations

- 5.5.4 Government & Public Sector

- 5.6 By Region

- 5.6.1 Java (Jakarta, West, Central, East, Banten)

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Bali & Nusa Tenggara

- 5.6.6 Papua & Maluku Islands

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 PT Prudential Life Assurance

- 6.4.2 PT AIA Financial

- 6.4.3 PT Manulife Indonesia

- 6.4.4 PT Allianz Life Indonesia

- 6.4.5 PT AXA Financial Indonesia

- 6.4.6 PT Sun Life Financial Indonesia

- 6.4.7 PT Great Eastern Life Indonesia

- 6.4.8 PT BNI Life Insurance

- 6.4.9 PT Sequis Life

- 6.4.10 PT Asuransi Jiwasraya (Persero)

- 6.4.11 PT Asuransi Astra Buana

- 6.4.12 PT Asuransi Sinar Mas

- 6.4.13 PT Zurich Insurance Indonesia

- 6.4.14 PT Tokio Marine Indonesia

- 6.4.15 PT Adira Dinamika Insurance

- 6.4.16 PT Sompo Insurance Indonesia

- 6.4.17 PT Chubb General Insurance Indonesia

- 6.4.18 PT Asuransi Jasindo (Persero)

- 6.4.19 PT KB Insurance Indonesia

- 6.4.20 PT AXA Mandiri General Insurance

- 6.4.21 PT Asuransi Central Asia

- 6.4.22 PT Tugu Pratama Indonesia

- 6.4.23 PT Asuransi Kredit Indonesia (Askrindo)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment