PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849817

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849817

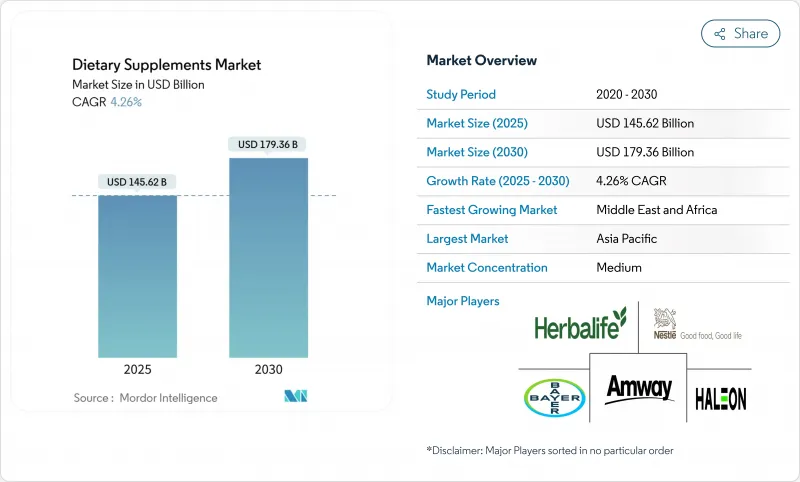

Dietary Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Dietary Supplements market size measured USD 145.62 billion in 2025 and is projected to reach USD 179.36 billion by 2030, growing at a CAGR of 4.26%.

The market is experiencing substantial transformation due to increasing consumer emphasis on preventive healthcare and wellness management. Several factors drive this growth, including rising health consciousness, aging populations, and increasing disposable income in developing economies. The demand has intensified for supplements targeting immune system enhancement, digestive health optimization, and nutritional deficiency prevention. The industry has progressed from conventional pills and capsules to incorporate advanced delivery formats, including gummies, liquid shots, and functional beverages. These innovations address consumer preferences for consumption convenience while enhancing supplement efficacy through improved bioavailability and palatability.

Global Dietary Supplements Market Trends and Insights

Increased Focus on Preventive Healthcare

The healthcare paradigm is undergoing a fundamental transformation from reactive to preventive care methodologies, as substantiated by comprehensive data from the Centers for Disease Control and Prevention (CDC) in April 2023, which indicates that 58.5% of adults and 34.8% of children in the United States incorporated dietary supplements into their health regimens . This significant shift in consumer behavior has generated substantial market demand for dietary supplements specifically formulated for proactive health maintenance rather than conventional deficiency treatment. Market analysis demonstrates a pronounced increase in consumer preferences toward supplements engineered for targeted health functions, encompassing immune system fortification, stress management optimization, and sleep quality enhancement. The systematic implementation of preventive healthcare measures by global healthcare systems, primarily aimed at minimizing long-term medical expenditures, has established a highly conducive environment for sustained dietary supplement market expansion and penetration.

Supplements Targeting Women Consumers Fueling Growth

The women's health supplements market demonstrates substantial expansion within the dietary supplements industry, characterized by the diversification of products addressing female-specific health requirements beyond conventional prenatal supplementation. The market encompasses specialized nutritional formulations targeting menopause management, hormonal equilibrium, and reproductive wellness. Product development increasingly focuses on multifunctional dietary supplements that integrate various health benefits, incorporating stress management components with beauty enhancement properties and hormonal regulation with energy optimization elements. Given that women frequently function as primary healthcare decision-makers within household units, their supplement preferences significantly influence market dynamics. According to the 2024 Women's Health Innovation Opportunity Map Progress Report, while the sector exhibits progress through enhanced funding allocations and innovation centers, female-specific conditions outside oncology receive only 1% of global healthcare research and development funding .

Presence of Counterfeit Products Hampering the growth

The proliferation of counterfeit and adulterated supplements constitutes a substantial impediment to market growth by fundamentally compromising consumer confidence and generating significant safety concerns among prospective consumers. This impediment manifests with particular severity in emerging markets, where insufficient regulatory oversight enables counterfeit products to establish a substantial market presence. The ramifications transcend direct revenue losses, encompassing reputational damage and elevated regulatory compliance expenditures for legitimate manufacturing entities. Additionally, the digital marketplace environment exacerbates this challenge through third-party vendor platforms that facilitate the distribution of counterfeit products. In 2023, European Union customs authorities intercepted counterfeit merchandise with an estimated value of EUR 3.4 billion, demonstrating a 77% increase from the preceding year .

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Clean-label, Plant-based, and Vegan Formulas

- Healthy-Ageing Focus Accelerating Multivitamin Uptake Among Consumers

- Tighter Regulations on Dietary Supplements and Borderline Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The vitamins segment holds 27.11% of the market share in 2024, representing the largest segment by type. This leadership position is attributed to vitamins' proven effectiveness and consistent endorsement by healthcare professionals. Multivitamin supplements remain the primary entry product for new consumers, while individual vitamins, particularly Vitamin D and C, show increased growth due to their immune-boosting properties.

The prebiotics and probiotics segment is expected to grow at 9.61% CAGR from 2025-2030, exceeding the market's overall growth rate. The prebiotics and probiotics segment expansion is driven by increased scientific evidence supporting the gut-brain connection and the microbiome's importance in health. These supplements demonstrate benefits for gastrointestinal health, immune function, and various medical conditions. When combined as synbiotics, they improve gut health and show potential in managing obesity, diabetes, and mental health conditions. Moreover, minerals, fatty acids, and protein supplements maintain a consistent market presence, while herbal supplements show varying growth patterns across regions based on local traditional medicine practices. Enzyme supplements focus primarily on digestive health applications, and blended supplements gain popularity by delivering multiple health benefits in a single formulation.

Capsules and softgels hold a dominant 38.00% market share in 2024, primarily due to their ability to protect sensitive ingredients and provide precise dosing. This format remains prevalent in pharmaceutical-adjacent categories where ingredient stability and controlled release are essential for product effectiveness. The gummies segment is experiencing significant growth, with a projected CAGR of 12.01% from 2025-2030, surpassing all other delivery formats. This growth stems from consumer preferences for palatable consumption methods and the format's effectiveness in masking bitter ingredients.

The vitamin gummies market shows significant growth potential, driven by rising health consciousness and demand for functional foods. Trade data indicates steady expansion over the past decade, particularly in Nigeria and the United States. While tablets provide manufacturing efficiency and cost benefits, consumer perception of their dissolution speed remains a challenge. Similarly, powders maintain their importance in sports nutrition and protein supplements due to dosage flexibility. Liquid formats continue to grow in applications requiring rapid absorption and among consumers who struggle with pill consumption, especially the elderly and children.

The Dietary Supplements Market is Segmented Into Product Type (Vitamins, Minerals, Enzymes, and More), Form (Tablets, Powder, and More), Source (Plant-Based, Animal-Based, and More), Consumer Group (Men, Women, and More), Health Application (General Health and Wellness, Eye Health, and More), Distribution Channel (Supermarkets/Hypermarkets, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

The Asia-Pacific region holds 49.48% of the global dietary supplements market in 2024, making it the dominant geographic segment. This position results from large population bases, rising disposable incomes, and cultural traditions emphasizing preventive health practices. China and India function as the primary growth drivers, while Japan maintains a mature market focused on healthy aging solutions. E-commerce expansion has increased access to premium supplement brands across the region's markets.

North America stands as the second-largest market, with high per-capita consumption and a structured regulatory environment that enables product innovation. According to the Council for Responsible Nutrition's 2023 survey, 74% of U.S. adults use supplements regularly, with 92% viewing them as essential for health. Europe ranks as the third-largest market, with an emphasis on scientific validation and regulatory compliance for health claims. The European market growth reflects aging demographics and healthcare systems that recognize supplementation in preventive health.

The Middle East and Africa region is expected to grow at 7.83% CAGR from 2025-2030, the highest among all regions. This growth stems from increased health awareness, expanding middle-class populations, and improved retail infrastructure. South America's market growth concentrates in Brazil, Argentina, and Chile, driven by rising health consciousness and expanding retail networks across consumer segments.

- Amway Corporation

- Herbalife Ltd.

- Nestle S.A.

- Bayer AG

- Haleon plc

- Abbott Laboratories

- Suntory Holdings Ltd.

- Otsuka Holdings Co. Ltd.

- Glanbia PLC

- Church and Dwight Co. Inc.

- Now Health Group Inc.

- Vitabiotics Ltd.

- H&H Group (Swisse)

- Reckitt Benckiser Group PLC

- Vital Health Foods (Pty) Ltd

- 21st Century HealthCare, Inc.

- Kirin Holdings Company, Limited.

- Jamieson Wellness Inc.

- Harbin Pharmaceutical Group

- Dr. Willmar Schwabe GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Focus on Preventive Healthcare

- 4.2.2 Supplements Targeting Women Consumers Fueling Growth

- 4.2.3 Growing Preference for Clean-label, Plant-based and Vegan Formulas

- 4.2.4 Healthy-ageing Focus Accelerating Multivitamin Uptake Among Consumers

- 4.2.5 E-commerce Growth Enhances Supplement Accessibility and Market Reach

- 4.2.6 Research and Development Investments Drive Innovative Product Development and Targeted Solutions

- 4.3 Market Restraints

- 4.3.1 Presence of Counterfeit Products Hampering the Growth

- 4.3.2 Rising Consumer Scepticism Toward Synthetic Additives and Mega-dose Safety Concerns

- 4.3.3 Tighter Regulations on Dietary Supplements and Borderline Products

- 4.3.4 Price Wars from Local Producers Reduce Profit Margins

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD BILLION)

- 5.1 By Product Type

- 5.1.1 Vitamins

- 5.1.1.1 Vitamin A

- 5.1.1.2 Vitamin C

- 5.1.1.3 Vitamin D

- 5.1.1.4 Vitamin B (Includes B6, B7 / Biotin, B9/ Folic, B12, etc.)

- 5.1.1.5 Other Vitamin Supplements

- 5.1.1.6 Multivitamin Supplements

- 5.1.2 Minerals

- 5.1.2.1 Iron Supplements

- 5.1.2.2 Calcium Supplements

- 5.1.2.3 Magnesium and Zinc Supplements

- 5.1.2.4 Multi-Mineral Supplements

- 5.1.2.5 Other Minerals

- 5.1.3 Fatty Acids

- 5.1.4 Protein and Amino Acids

- 5.1.5 Prebiotic and Probiotic Supplements

- 5.1.6 Herbal Supplements

- 5.1.7 Enzymes

- 5.1.8 Blended Supplements

- 5.1.9 Others

- 5.1.1 Vitamins

- 5.2 By Form

- 5.2.1 Tablets

- 5.2.2 Capsules and Softgels

- 5.2.3 Powders

- 5.2.4 Gummies

- 5.2.5 Liquids

- 5.2.6 Others

- 5.3 By Source

- 5.3.1 Plant-based

- 5.3.2 Animal-based

- 5.3.3 Synthetic/Fermentation-derived

- 5.4 By Consumer Group

- 5.4.1 Men

- 5.4.2 Women

- 5.4.3 Kids/Children

- 5.5 By Health Application

- 5.5.1 General Health and Wellness

- 5.5.2 Bone and Joint Health

- 5.5.3 Energy and Weight Management

- 5.5.4 Gastrointestinal and Gut Health

- 5.5.5 Immunity Enhancement

- 5.5.6 Cardiovascular Health

- 5.5.7 Diabetes Management

- 5.5.8 Cognitive and Mental Health

- 5.5.9 Skin, Hair and Nail Care

- 5.5.10 Eye Health

- 5.5.11 Other Health Applications

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets/Hypermarkets

- 5.6.2 Specialty Stores

- 5.6.3 Online Retail Channels

- 5.6.4 Direct Selling

- 5.6.5 Other Distribution Channels

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 France

- 5.7.2.3 United Kingdom

- 5.7.2.4 Spain

- 5.7.2.5 Netherlands

- 5.7.2.6 Italy

- 5.7.2.7 Sweden

- 5.7.2.8 Poland

- 5.7.2.9 Belgium

- 5.7.2.10 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Indonesia

- 5.7.3.7 Thailand

- 5.7.3.8 Singapore

- 5.7.3.9 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Chile

- 5.7.4.4 Colombia

- 5.7.4.5 Peru

- 5.7.4.6 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 South Africa

- 5.7.5.3 Nigeria

- 5.7.5.4 Saudi Arabia

- 5.7.5.5 Egypt

- 5.7.5.6 Morocco

- 5.7.5.7 Turkey

- 5.7.5.8 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Amway Corporation

- 6.4.2 Herbalife Ltd.

- 6.4.3 Nestle S.A.

- 6.4.4 Bayer AG

- 6.4.5 Haleon plc

- 6.4.6 Abbott Laboratories

- 6.4.7 Suntory Holdings Ltd.

- 6.4.8 Otsuka Holdings Co. Ltd.

- 6.4.9 Glanbia PLC

- 6.4.10 Church and Dwight Co. Inc.

- 6.4.11 Now Health Group Inc.

- 6.4.12 Vitabiotics Ltd.

- 6.4.13 H&H Group (Swisse)

- 6.4.14 Reckitt Benckiser Group PLC

- 6.4.15 Vital Health Foods (Pty) Ltd

- 6.4.16 21st Century HealthCare, Inc.

- 6.4.17 Kirin Holdings Company, Limited.

- 6.4.18 Jamieson Wellness Inc.

- 6.4.19 Harbin Pharmaceutical Group

- 6.4.20 Dr. Willmar Schwabe GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK