PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849822

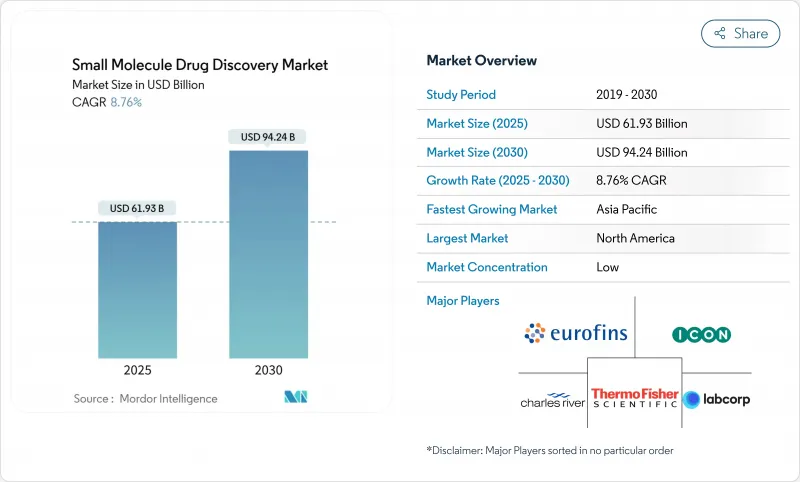

Small Molecule Drug Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The small molecule drug discovery market size stands at USD 61.93 billion in 2025 and is forecast to reach USD 94.24 billion by 2030, advancing at an 8.76% CAGR.

Sustained reliance on orally delivered therapeutics, expanding use of AI-enabled design tools, and steady outsourcing to discovery-focused CROs keep small molecules central to pharmaceutical pipelines despite rising investment in biologics. North America leads in the adoption of advanced computational chemistry methods, while Asia-Pacific is scaling R&D capacity fastest. Oncology remains the largest therapeutic outlet and continues to attract precision-medicine programs, yet infectious-disease projects are growing even faster as antimicrobial resistance sharpens global health priorities. Competitive intensity is increasing as technology specialists, virtual biotechs, and traditional drug makers jostle for differentiated expertise and first-in-class intellectual property.

Global Small Molecule Drug Discovery Market Trends and Insights

Growing Global Burden of Chronic & Age-Related Diseases Sustaining Demand for Oral Small-Molecule Therapeutics

Population ageing and lifestyle-linked disorders are fueling long-term use of oral agents, anchoring the small-molecule drug discovery market in chronic care. Oral tablets remain easier to transport, store, and administer than injectable biologics, a decisive advantage in health systems with limited cold-chain capacity. Several brain-penetrant agents approved in 2024 for neurodegenerative conditions illustrate how small molecules reach targets that biologics cannot, reinforcing their relevance in central nervous system therapy . Payers also view orally dosed drugs as a route to manage therapy costs for widespread diseases such as diabetes and hypertension.

Superior Manufacturability and Cost Efficiency of Chemical Synthesis vs. Biologics Steering Pharma R&D Investment

Chemical synthesis platforms can produce kilogram quantities of drug substance at costs that are often 10-100 times lower than cell-culture-based biologics manufacturing. Predictable scale-up and long shelf life help companies serve broad patient populations without straining logistics budgets. As pricing pressure intensifies, executives maintain or elevate small molecule allocations within discovery portfolios because lower COGS support sustainable gross margins in competitive categories such as antihypertensives.

Escalating Clinical Development Costs and Late-Stage Failure Rates in Complex Indications

Phase 2 attrition for neurodegenerative programs remains high despite advances in disease-relevant models, pushing the total outlay to bring one agent to market toward USD 2.8 billion once failures are included. Smaller firms holding single-asset pipelines face existential risk from a single disappointing readout, leading many to seek risk-sharing alliances earlier in development. Sponsors increasingly incorporate translational biomarkers and adaptive design trials yet still struggle to predict human efficacy in multifactorial diseases.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Maturation of AI-Driven Computational Chemistry and Predictive Modeling Compressing Hit-to-Lead Timelines

- Integrated End-to-End CRO/CDMO Service Models Enabling Capital-Light Virtual Biotech Discovery Programs

- Surging Pipeline Focus on Biologics, Cell & Gene Therapies Diverting Capital from Small-Molecule Programs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oncology generated 33.25% of 2024 revenue within the small molecule drug discovery market and continues to benefit from mutation-specific inhibitors that combine well with immunotherapy backbones. Programs directed at KRAS, RET, and FGFR mutations are expanding into earlier-line settings, sustaining medicinal-chemistry demand. Infectious-disease discovery, though smaller, is accelerating off a projected 9.65% CAGR as public-private partnerships bankroll antibiotic and antiviral pipelines targeting resistance threats. Central nervous system candidates leverage improved blood-brain-barrier penetration chemistry, while metabolic and cardiovascular diseases maintain steady activity through next-generation enzyme modulators. Gastrointestinal and respiratory disorders attract niche companies applying targeted mechanisms to chronic inflammatory pathways .

A rebound in pandemic-era surveillance infrastructure is expected to reinforce screening initiatives for broad-spectrum antivirals, raising long-term opportunities for chemistry that sidesteps resistance mechanisms. Oncology's strong intellectual-property landscape continues to justify premium pricing and venture backing, keeping its share prominent. However, competition from antibody-drug conjugates may temper growth beyond 2030 as combination regimens shift therapy budgets. The evolving pathogen landscape suggests infectious-disease share could inch upward relative to historical baselines if reimbursement frameworks reward stewardship-friendly agents.

Lead optimization absorbed 29.74% of 2024 spending across the small molecule drug discovery market size because iterative chemistry cycles, SAR analytics, and parallel ADME-Tox studies demand the largest labor and reagent budgets. New physics-informed generative models propose analogs with tuned potency and selectivity, yet medicinal chemists still perform multi-step synthesis and scaffold hopping to achieve clinical-grade profiles. Target identification and validation is on track for a 9.5% CAGR thanks to CRISPR gene-editing screens, single-cell omics, and network biology that expand the universe of druggable proteins.

Hit generation now blends DNA-encoded libraries with virtual docking to sift immense chemical space. Fragment-based campaigns supply starting points for otherwise intractable targets, evidenced by recent approvals of FBDD-derived compounds. The pre-clinical candidate-selection step benefits from improved in-silico toxicology that removes liabilities earlier, but definitive animal studies remain compulsory. End-to-end platform providers that integrate bioinformatics, chemistry, and IND consultancy gain share as sponsors look for speed and de-risked workflows.

The Small Molecule Drug Discovery Market is Segmented by Therapeutic Area (Oncology, Cardiovascular, and More), Process/Phase (Target Identification & Validation and More), Drug Type (Synthetic Small Molecules and More), Technology (High-Throughput Screening (HTS) and More), End User (Pharmaceutical Companies, and More) and Geography (North America and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.23% of 2024 revenue in the small molecule drug discovery market owing to mature venture ecosystems, world-class academic institutions, and a regulatory framework that supports expedited reviews through Breakthrough and Orphan designations. The Inflation Reduction Act introduces reimbursement uncertainty for small molecules, yet technology-rich hubs like Boston, San Diego, and Toronto continue to incubate AI-enabled discovery startups. Many global companies base computational chemistry teams in the United States to access cross-disciplinary talent and capital.

Asia-Pacific is forecast to expand at a 9.67% CAGR from 2025 to 2030. Chinese biotech firms now launch first-in-class programs, with 31% of 2024 global in-licensing deals involving assets sourced from China. Government incentives, local venture funds, and rapidly scaling CRO capacity underpin the region's rise. Japan leverages decades of medicinal-chemistry excellence, while India builds discovery-oriented CRO clusters benefitting from strong synthetic-chemistry education and cost advantages.

Europe blends long-standing pharmaceutical headquarters with vibrant biotech corridors in the United Kingdom, Germany, and Switzerland. Horizon Europe funding and public-private initiatives sustain cross-border consortia that marry AI modeling with structural biology. Continental regulators are heightening scrutiny of environmental waste from chemical synthesis, prompting greener process-chemistry techniques. Emerging markets in the Middle East and South America are channeling petrodollar and bio-commodity revenues into research parks, though talent shortages and regulatory maturation remain limiting factors.

- ICON

- Charles River

- Promega

- Eurofins

- Schrodinger Inc.

- LabCorp

- Thermo Fisher Scientific

- Jubilant Group

- Syngene International Ltd.

- Curia Global Inc.

- Evotec

- WuXi App Tec

- GenScript Biotech

- ChemPartner

- Domainex Ltd.

- Benevolent AI

- Insilico Medicine

- AstraZeneca

- Pfizer

- BioDuro-Sundia

- HitGen Inc.

- Atomwise Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing global burden of chronic & age-related diseases sustaining demand for oral small-molecule therapeutics

- 4.2.2 Superior manufacturability and cost efficiency of chemical synthesis vs. biologics steering pharma R&D investment

- 4.2.3 Rapid maturation of AI-driven computational chemistry and predictive modeling compressing hit-to-lead timelines

- 4.2.4 Integrated end-to-end CRO/CDMO service models enabling capital-light virtual biotech discovery programs

- 4.2.5 Regulatory fast-track designations (Breakthrough, Orphan, Priority Review) increasing approval velocity for novel small molecule drugs

- 4.2.6 Growing emergence of targeted and precision small-molecule therapies for genetically defined patient populations

- 4.3 Market Restraints

- 4.3.1 Escalating clinical development costs and late-stage failure rates in complex indications

- 4.3.2 Surging pipeline focus on biologics, cell & gene therapies diverting capital from small-molecule programs

- 4.3.3 Heightened global regulatory scrutiny over off-target toxicity and environmental impact of chemical intermediates

- 4.3.4 Supply-chain vulnerability for key starting materials and advanced intermediates, amplifying timeline risk

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapeutic Area

- 5.1.1 Oncology

- 5.1.2 Central Nervous System

- 5.1.3 Cardiovascular

- 5.1.4 Respiratory

- 5.1.5 Metabolic Disorders

- 5.1.6 Gastrointestinal

- 5.1.7 Infectious Diseases

- 5.1.8 Autoimmune Disorders

- 5.1.9 Other Therapeutic Areas

- 5.2 By Process/Phase

- 5.2.1 Target Identification & Validation

- 5.2.2 Hit Generation & Selection

- 5.2.3 Lead Identification

- 5.2.4 Lead Optimization

- 5.2.5 Pre-clinical Candidate Selection

- 5.3 By Drug Type

- 5.3.1 Synthetic Small Molecules

- 5.3.2 Natural-Product Derivatives

- 5.3.3 Peptide Mimetics

- 5.3.4 PROTACs & Molecular Glues

- 5.3.5 Nucleoside Analogues

- 5.4 By Technology

- 5.4.1 High-Throughput Screening (HTS)

- 5.4.2 Fragment-Based Drug Discovery (FBDD)

- 5.4.3 Structure-Based Drug Design (SBDD)

- 5.4.4 Computational / AI-Driven Design

- 5.4.5 DNA-Encoded Library Screening

- 5.4.6 CRISPR-Based Target Validation

- 5.4.7 Bioassay Development & Cell-based Platforms

- 5.5 By End User

- 5.5.1 Pharmaceutical Companies

- 5.5.2 Biotechnology Companies

- 5.5.3 Academic & Research Institutes

- 5.5.4 Contract Research Organizations (CROs)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.3.1 ICON plc

- 6.3.2 Charles River Laboratories

- 6.3.3 Promega Corporation

- 6.3.4 Eurofins Discovery

- 6.3.5 Schrodinger Inc.

- 6.3.6 Labcorp Drug Development

- 6.3.7 Thermo Fisher Scientific Inc.

- 6.3.8 Jubilant Biosys Ltd.

- 6.3.9 Syngene International Ltd.

- 6.3.10 Curia Global Inc.

- 6.3.11 Evotec SE

- 6.3.12 WuXi AppTec

- 6.3.13 GenScript Biotech

- 6.3.14 ChemPartner

- 6.3.15 Domainex Ltd.

- 6.3.16 BenevolentAI

- 6.3.17 Insilico Medicine

- 6.3.18 AstraZeneca

- 6.3.19 Pfizer Inc.

- 6.3.20 BioDuro-Sundia

- 6.3.21 HitGen Inc.

- 6.3.22 Atomwise Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment