PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849834

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849834

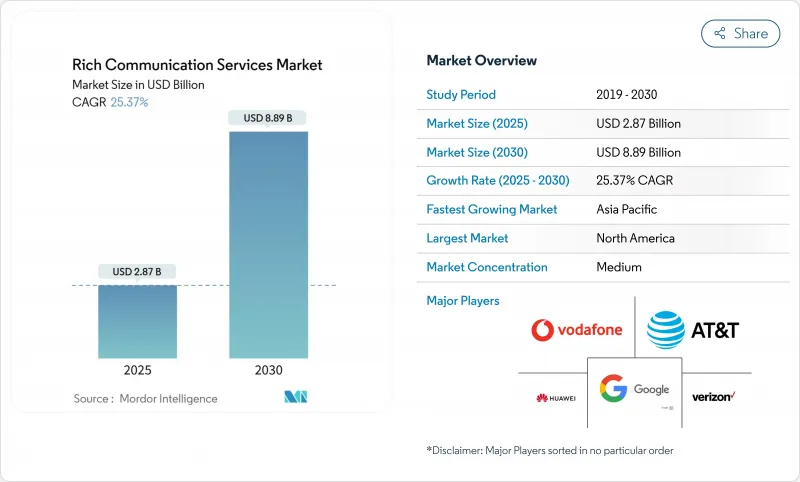

Rich Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The rich communication services market reached USD 2.87 billion in 2025 and is projected to grow to USD 8.89 billion by 2030, reflecting a 25.37% CAGR.

Growing enterprise appetite for media-rich, branded customer engagement is pushing businesses to migrate from plain SMS to interactive messaging that supports images, video, and actionable buttons. Expanded carrier support, the inclusion of RCS in iOS 18, and Google's report of more than 1 billion U.S. RCS messages per day underscore a tipping point in mainstream adoption. Large enterprises remain the principal revenue source, yet cloud-native CPaaS platforms are lowering entry barriers for small and medium businesses. Geographic momentum is strongest in Asia-Pacific as regional operators use 5G networks to support rich media traffic, while North America holds its lead on the back of long-standing carrier interoperability. Regulatory moves toward verified sender IDs are creating additional pull for enterprises that need secure, authenticated channels for customer contact.

Global Rich Communication Services Market Trends and Insights

Enterprise Demand for A2P RCS Business Messaging

A2P campaigns deliver markedly higher conversion and click-through rates than legacy SMS, encouraging brands in banking and retail to shift considerable spend to the channel. Multi-media cards and suggested replies let marketers guide shoppers from awareness to purchase within a single threaded conversation, generating 6.2 times the ROI of basic text pushes. CPaaS vendors have responded by embedding low-code templates, compliance workflows, and real-time analytics that quantify lift against email and app-push programs. Early adopters such as global banks report 10% conversion from personalized loan-upsell chats, validating the revenue upside. As more enterprises witness the impact, A2P usage is set to underpin overall rich communication services market expansion during the forecast window.

iOS-18 Support and Expanding Android OEM Pre-installs

Apple's decision to embed RCS in iOS 18 removes the historic interoperability gap that steered traffic to OTT apps; nearly 900 million active iPhones instantly become reachable via operator-grade rich messaging. Samsung's default adoption of Messages by Google on Galaxy devices further amplifies global reach. The unified experience eliminates pixelated images, broken group chats, and green/blue chat fragmentation that deterred consumers. Enterprises gain predictable reach across operating systems, unlocking larger addressable audiences without maintaining parallel OTT channels. This network effect is already visible in pilot campaigns that recorded 25% higher engagement after Apple rollout.

Fragmented Global Operator Interoperability

Only 57 carriers have aligned with GSMA Universal Profile 3.0, creating gaps that degrade cross-border experience. Enterprises sending campaigns into multiple regions must maintain fallback SMS or OTT channels, raising cost and operational complexity. While hubs such as Google's Jibe and GSMA's Interconnect projects are intended to streamline routing, uneven implementation throttles scale. Multinationals continue to lobby for consistent SLAs before migrating high-value traffic, delaying revenue realignment toward RCS.

Other drivers and restraints analyzed in the detailed report include:

- 5G Roll-outs Boosting High-Resolution Rich Media Traffic

- Regulatory Shift Toward Verified Sender ID and Anti-Spam Rules

- Absence of Full End-to-End Encryption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

A2P traffic delivered 61.8% of 2024 revenue, making it the backbone of the rich communication services market. Banks, retailers, and airlines use multimedia cards and quick replies to convert routine notifications into conversational touchpoints that drive incremental sales. Person-to-Application conversations, though currently smaller, are expanding 31.5% annually as AI chatbots mature and consumers grow comfortable completing transactions inside a thread. This uptick will increase the rich communication services market size for P2A flows at a double-digit clip through 2030.

Enterprises are documenting conversion jumps of 8-10 percentage points when migrating loyalty promotions from SMS to RCS. Case studies in India show a 358% traffic surge for CPaaS provider Gupshup after integrating Vertex AI chatbots. Person-to-Person usage also climbs in markets with seamless iOS-Android interconnect, though monetization is operator-driven rather than enterprise-driven. High-engagement sectors such as gaming and ticketing rely on P2A flows to manage waitlists and authentication, signaling an evolving mix within the communication-type hierarchy.

Cloud-hosted platforms generated 72.9% of 2024 revenue, mirroring broader enterprise moves to eliminate cap-ex-heavy, on-premise messaging gateways. Multinational brands favor public-cloud RCS because it dovetails with existing CRM, CDP, and marketing-automation stacks via REST APIs.

On-premise environments remain non-trivial in sectors such as defense, healthcare, and government where data-residency laws require local processing. Those deployments stand to benefit from hybrid architectures in which sensitive content is rendered behind the firewall while global reach rides public-cloud interconnects. Twilio's public beta underscores the vendor push to abstract carrier complexity behind SDKs, letting developers spin up RCS alongside SMS, WhatsApp, and email within one dashboard.

Rich Communication Services Market is Segmented by Communication Type (A2P (Application-To-Person), P2P (Person-To-Person), and More), Deployment Mode (Cloud and On-Premise), End-User Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (BFSI, Media and Entertainment and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.5% of 2024 revenue, underpinned by early universal profile adoption across Verizon, ATandT, and T-Mobile. Google's disclosure of more than 1 billion daily RCS messages in the U.S. illustrates mature consumer uptake. Regulatory clarity also helps: the FCC now recognizes RCS for emergency 911 texts, encouraging municipalities and enterprises alike to adopt authenticated channel. The region's high ARPU lets carriers capture incremental revenue through business messaging fees.

Asia-Pacific is the fastest-growing geography at a 30.4% CAGR, stimulated by ultra-high smartphone penetration and government digitization programs. India records 50 million monthly enterprise messages on a single CPaaS platform and is projected to eclipse North America in traffic volume by 2027. Japan and South Korea exhibit plus-70% RCS user ratios, proving how 5G density correlates with rich-media adoption. Despite fragmented operator landscapes, initiatives such as the GSMA Interconnect Hub aim to streamline cross-border routing, further boosting the rich communication services market in the region.

Europe posts steady expansion as data-protection regulations and Digital Markets Act interoperability rules favor verified, operator-controlled messaging over unregulated OTT apps. Deutsche Telekom's EUR 115.8 billion 2024 revenue includes a growing slice from RCS-enabled value-added services. Conversely, the UK debate over lawful interception vis-a-vis Apple's encrypted RCS shows that regulatory uncertainty can temporarily dampen deployment, yet enterprises continue pilot projects to gauge engagement lift. Latin America remains early-stage but is notable for outsized conversational commerce usage, especially in Brazil where tier-one carriers completed their first large-scale campaigns during 2024.

- ATandT Inc.

- Verizon Communications Inc.

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Mavenir Systems, Inc.

- Sinch AB

- Global Message Services AG

- Juphoon System Software Co., Ltd.

- Summit Tech

- T-Mobile USA, Inc.

- SK Telecom Co., Ltd.

- Telstra Corporation Limited

- Vodafone Group plc

- Orange S.A.

- Deutsche Telekom AG

- Twilio Inc.

- Infobip Ltd.

- Gupshup Technology India Pvt. Ltd.

- Route Mobile Limited

- MessageBird B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enterprise demand for A2P RCS business messaging

- 4.2.2 iOS-17 support and expanding Android OEM pre-installs

- 4.2.3 5G roll-outs boosting high-resolution rich media traffic

- 4.2.4 Regulatory shift toward verified sender ID and anti-spam rules

- 4.2.5 CPaaS integration unlocking omni-channel orchestration

- 4.2.6 In-message payments (RCS MaaP) enabling conversational commerce

- 4.3 Market Restraints

- 4.3.1 Fragmented global operator interoperability

- 4.3.2 Absence of full end-to-end encryption

- 4.3.3 OTT super-apps cannibalising enterprise wallet share

- 4.3.4 Unclear operator monetisation models delaying pricing

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 RCS Evolution and Implementation

- 4.9.1 Evolution of RCS

- 4.9.2 Use-Cases and Implementation Studies

- 4.9.3 Major Applications

- 4.10 Impact of RCS on Native SMS

- 4.10.1 A2P vs OTT traffic trend analysis

- 4.10.2 Digital advertising revenue share implications

- 4.10.3 Anticipated P2P migration patterns

- 4.11 RCS Roadmap for Major MNOs

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Type

- 5.1.1 A2P (Application-to-Person)

- 5.1.2 P2P (Person-to-Person)

- 5.1.3 P2A (Person-to-Application)

- 5.1.4 Others

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-user Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Media and Entertainment

- 5.4.3 Retail and E-commerce

- 5.4.4 Travel and Hospitality

- 5.4.5 Healthcare

- 5.4.6 IT and Telecom

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview)

- 6.4.1 ATandT Inc.

- 6.4.2 Verizon Communications Inc.

- 6.4.3 Telefonaktiebolaget LM Ericsson

- 6.4.4 Google LLC

- 6.4.5 Huawei Technologies Co., Ltd.

- 6.4.6 Samsung Electronics Co., Ltd.

- 6.4.7 ZTE Corporation

- 6.4.8 Mavenir Systems, Inc.

- 6.4.9 Sinch AB

- 6.4.10 Global Message Services AG

- 6.4.11 Juphoon System Software Co., Ltd.

- 6.4.12 Summit Tech

- 6.4.13 T-Mobile USA, Inc.

- 6.4.14 SK Telecom Co., Ltd.

- 6.4.15 Telstra Corporation Limited

- 6.4.16 Vodafone Group plc

- 6.4.17 Orange S.A.

- 6.4.18 Deutsche Telekom AG

- 6.4.19 Twilio Inc.

- 6.4.20 Infobip Ltd.

- 6.4.21 Gupshup Technology India Pvt. Ltd.

- 6.4.22 Route Mobile Limited

- 6.4.23 MessageBird B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment