PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906906

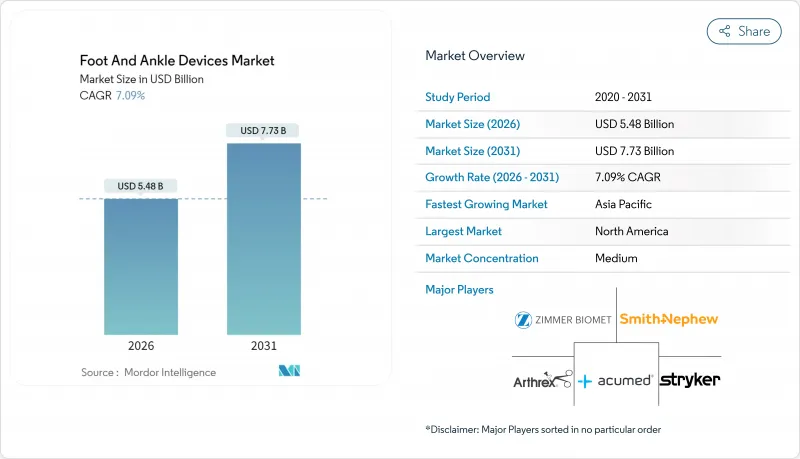

Foot And Ankle Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Foot And Ankle Devices Market was valued at USD 5.12 billion in 2025 and estimated to grow from USD 5.48 billion in 2026 to reach USD 7.73 billion by 2031, at a CAGR of 7.09% during the forecast period (2026-2031).

Growing clinical acceptance of patient-matched 3D-printed implants, rising volumes of outpatient procedures, and continued innovation in fixation materials are expanding both procedure counts and average selling prices. Singular device launches that mimic natural bone architecture are reshaping surgeon expectations, while strong demand linked to sports trauma and diabetes-related complications keeps unit growth steady. Regulatory clearances for customized devices now arrive faster than in the past, encouraging smaller innovators to commercialize niche solutions. Large orthopedic companies are responding by acquiring specialized players so they can offer end-to-end treatment platforms across the ankle and foot devices market.

Global Foot And Ankle Devices Market Trends and Insights

Escalating Sports- and Road-Injury Incidence

High-energy ankle fractures in adolescent and adult athletes keep surgical volumes elevated year-round. Surgeons actively stratify patients by comorbidity risk, directing smokers and individuals with chronic obstructive pulmonary disease toward reinforced fixation constructs that resist early failure. Sports medicine programs are also standardizing post-operative weight-bearing protocols, which accelerates the transition from in-hospital recovery to home-based rehabilitation and indirectly boosts higher-margin outpatient device sales. Collectively, these factors strengthen pricing power for next-generation devices designed for rigorous athletic demands across the ankle and foot devices market.

Surge in Diabetic Foot Ulcer & Charcot Arthropathy Cases

Rising diabetes prevalence drives long-term demand for limb-saving hardware. Diabetic foot ulcers strike 15-25% of all diabetes patients, with treatment outlays that start at USD 8,000 and climb beyond USD 63,100 per case. Clinical follow-up confirms that 34% of diabetic patients face a lifetime risk of ulceration, positioning this comorbidity as a leading cause of non-traumatic amputations in the United States. Specialized locking plates, circular external fixators, and titanium fusion cages that tolerate osteopenic bone are now standard for Charcot reconstructions. Payers increasingly support preventive surgical interventions because data show earlier fixation shortens hospital stays and limits severe infection episodes, feeding steady, long-duration growth for the ankle and foot devices market.

Reimbursement Gaps for Bio-Integrative Fixation

Coverage pathways lag behind the science. Traditional metallic screws and plates benefit from well-defined billing codes, but newer bioresorbable composites incorporating B-tricalcium phosphate lack consistent payer recognition. As a result, surgeons often forgo these implants unless patients have supplemental insurance or self-pay capacity. Hospitals remain cautious because delayed reimbursement jeopardizes razor-thin outpatient margins. Policy uncertainty slows volume ramp-up even though randomized trials confirm that resorbable constructs eliminate later removal procedures and reduce infection risk. Bridging this gap requires coordinated lobbying and robust cost-effectiveness data to ensure sustainable uptake across the ankle and foot devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Patient-Matched 3D-Printed Ankle Implants

- Shift to Outpatient Foot & Ankle Surgeries

- Stringent Regulatory Guidelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The plates segment secured 20.68% of the ankle and foot devices market share in 2025 and remains the revenue anchor because fracture repair volumes dominate trauma rooms. However, the ankle replacement cohort, which held a smaller base, is projected to register a 9.29% CAGR, outpacing every other device class. The continued publication of 9-year survivorship rates of nearly 88.3% fuels surgeon confidence that total ankle arthroplasty can emulate hip and knee replacement success. Exactech's roll-out of its 3D-printed tibial implant, built to replicate trabecular bone, embodies this shift toward biomimicry. The design promotes early fixation, reducing micromotion that historically limited ankle component longevity and bolstering adoption rates throughout the ankle and foot devices market.

Suppliers now allocate R&D budgets toward lattice design optimization, fatigue testing under cyclic load, and surface treatments that accelerate osseointegration. Plates still evolve, with nitinol staples and antibiotic coatings entering standard kits to combat infection risk observed in high-risk comorbidity cases. Hybrid plate-nail systems address complex peri-ankle fractures in geriatric bones, closing treatment gaps documented by trauma registries. High durability metrics matter because active retirees demand earlier weight bearing and rapid return to golf, hiking, and low-impact sports. Competitive pricing wars persist in commodity screw sets, but premium ankle replacement systems continue to command margin because they remain differentiated. These dynamics support expanding revenue contribution from reconstruction implants without eroding the established foundation that plates provide to the ankle and foot devices market.

The Foot and Ankle Devices Market Report Segments the Industry Into by Device Type (Ankle Replacement Systems, Plates, Screws and More), Procedure (Osteotomy, Fracture Repair, Fusion / Arthrodesis, Other Procedures), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes 35.74% of the ankle and foot devices market revenue in 2025, anchored by high procedure density and generous coverage policies that reimburse advanced implants in both hospital and ASC settings. The United States drives an outsized share of unit sales because strong trauma networks feed reliable plate demand, and widespread diabetes management creates steady Charcot reconstruction case flow. FDA clearances for patient-specific implants frequently set global safety benchmarks; once the agency approves a device such as the restor3D Total Talus Replacement, many non-US regulators reference those findings, shortening subsequent review cycles. Regional training programs also attract international fellows who carry device preferences back to their home markets, reinforcing North American influence on worldwide consumption patterns.

Europe commands a robust clinical research infrastructure that speeds evidence generation for new biomaterials. Germany, the United Kingdom, and France each maintain well-supported orthopedic registries, enabling real-time surveillance of implant survivorship and helping surgeons refine indications. Patient advocacy for motion-preserving solutions spurs rapid endorsement of total ankle replacements in Scandinavian health systems, where joint registries have long improved outcomes for hip and knee implants. Europe's rigorous but transparent regulatory framework rewards companies that demonstrate biocompatibility and mechanical endurance, pushing the line between incremental and truly novel design improvements. These factors maintain a steady revenue base while stimulating selective adoption of bioresorbable screws, antibiotic-coated plates, and 3D-printed fusion cages.

Asia records the fastest expansion, with an 9.14% CAGR projected from 2026 to 2031 as rising disposable incomes and broader insurance coverage lift elective procedure volumes. China leads implant unit growth after provincial drug-device bulk procurement schemes begin to include orthopedic hardware, lowering average prices yet creating larger addressable populations. India follows, boosted by medical tourism that draws Western patients seeking cost-effective ankle replacement while training local surgeons on premium implants. Nonetheless, medtech firms must tailor sales tactics to frugal spending habits and infrastructure gaps; for instance, small community hospitals often lack autoclaves capable of processing complex instrument trays, prompting suppliers to prioritize single-use sterile sets. Regulatory diversity, stretching from Japan's PMDA to China's NMPA and India's CDSCO, complicates regional launches, though harmonization initiatives show progress. Despite these challenges, demographic momentum ensures Asia remains pivotal to the long-term expansion of the ankle and foot devices market.

- Stryker

- Johnson & Johnson

- Zimmer Biomet

- Medtronic

- Conmed

- B. Braun

- Arthrex

- Smiths Group

- De Soutter Medical Ltd.

- MicroAire

- Ortho Life Systems Pvt. Ltd.

- Brasseler USA

- NSK Nakanishi Inc.

- Acumed LLC (OsteoMed)

- Adeor Medical

- Peter Brehm GmbH

- Medicon eG

- Shanghai Bojin Medical

- IndoSurgicals Private Limited

- Zimmer Surgical (Exactech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Musculoskeletal Disease Burden Elevating Surgical Volumes

- 4.2.2 Ambulatory and Day-Case Orthopedics Driving Compact Tool Demand

- 4.2.3 Robotics + Navigation Convergence Accelerating Power-Tool Upgrades

- 4.2.4 Rise in Aging Population Across the World

- 4.2.5 Preference for Single-Use Sterile Handpieces to Curb SSIs

- 4.2.6 E-Bike & Road-Traffic Trauma Surge Boosting Large-Bone Volumes

- 4.3 Market Restraints

- 4.3.1 High Capital & Service Costs Versus Manual Alternatives

- 4.3.2 Stringent Sterilization/Reprocessing Validation Requirements

- 4.3.3 Lithium-Ion Battery Disposal Regulations Raising Lifecycle Costs

- 4.3.4 Reprocessing Validation Standards Slowing Approvals

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Device Type

- 5.1.1 Large-Bone Power Tools

- 5.1.2 Small-Bone Power Tools

- 5.1.3 High-Speed Power Tools

- 5.1.4 Orthopedic Reamers

- 5.1.5 Surgical Drills

- 5.1.6 Surgical Saws

- 5.1.7 Accessories (Blades, Burs, Batteries)

- 5.2 By Technology

- 5.2.1 Electric-Powered Systems

- 5.2.2 Battery-Powered Systems

- 5.2.3 Pneumatic-Powered Systems

- 5.2.4 Hybrid Modular Systems

- 5.3 By Usage Modality

- 5.3.1 Reusable Systems

- 5.3.2 Single-Use / Disposable Systems

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Orthopedic Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Stryker Corporation

- 6.4.2 Johnson & Johnson (DePuy Synthes)

- 6.4.3 Zimmer Biomet

- 6.4.4 Medtronic

- 6.4.5 Conmed Corporation

- 6.4.6 B. Braun Melsungen AG

- 6.4.7 Arthrex Inc.

- 6.4.8 Smith & Nephew plc

- 6.4.9 De Soutter Medical Ltd.

- 6.4.10 MicroAire Surgical Instruments

- 6.4.11 Ortho Life Systems Pvt. Ltd.

- 6.4.12 Brasseler USA

- 6.4.13 NSK Nakanishi Inc.

- 6.4.14 Acumed LLC (OsteoMed)

- 6.4.15 Adeor Medical AG

- 6.4.16 Peter Brehm GmbH

- 6.4.17 Medicon eG

- 6.4.18 Shanghai Bojin Medical

- 6.4.19 IndoSurgicals Private Limited

- 6.4.20 Zimmer Surgical (Exactech)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment