PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849853

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849853

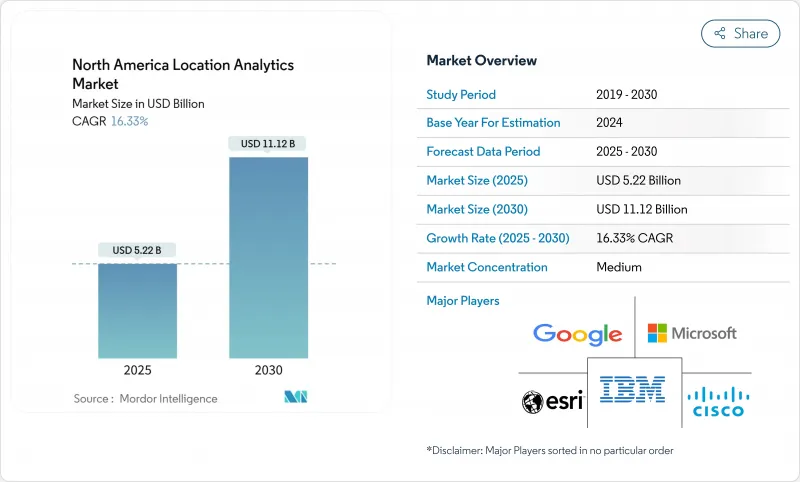

North America Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America location analytics market size is valued at USD 5.22 billion in 2025 and is projected to advance to USD 11.12 billion by 2030, expanding at a 16.33% CAGR.

Strong tailwinds come from omni-channel retail organizations demanding precise geo-marketing, the surge of IoT sensors streaming real-time spatial data, and widespread migration to cloud-native geospatial platforms that compress deployment cycles. Enterprises are moving beyond basic latitude-and-longitude tracking toward rich spatial analytics that optimize merchandising, routing, and facility throughput. Private-5G and CBRS networks shorten indoor accuracy gaps, while government investment in emergency-response geotechnology adds an institutional layer of demand. Rising privacy regulation represents the main tempering factor, yet compliant data-mining architectures are already emerging to keep momentum intact for the North America location analytics market.

North America Location Analytics Market Trends and Insights

Surge in Omni-Channel Retail Geo-Marketing Campaigns

Retailers pair geofencing tools with CRM suites to trigger real-time promotions, driving higher conversion at store level. Showroom optimization research indicates that strategic in-store product placement and geographic reach expansion lift sales and consumer confidence. As brick-and-click convergence deepens, differentiated location content becomes a loyalty lever that pure-play e-commerce cannot replicate.

Heightened Privacy and Consumer Opt-Out Regulations

California's CCPA enforcement sweep spotlights the personal nature of geolocation data, requiring explicit opt-outs and stronger consent flows. Enterprises must now embed privacy engineering into every analytics stack, sometimes trimming data granularity to stay compliant.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of IoT Sensors & Connected Devices

- Accelerated Adoption of Cloud-Native Geospatial Analytics Platforms

- Corporate Demand for Hybrid Workplace Occupancy Intelligence

- High Total Cost of Ownership for Real-Time Indoor Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor services retained 55% North America location analytics market share in 2024 as GPS/GNSS underpins transportation and logistics. Indoor positioning, however, compounds at 18.4% CAGR, powered by sub-meter accuracy from CBRS-enabled private 5G and ultra-wideband deployments. Manufacturers embed the technology for asset-level visibility, while hospitals apply it to track high-value equipment.

Growing hybrid demand obliges vendors to fuse indoor and outdoor layers into single source-of-truth dashboards. Industry 4.0 blueprints call for worker safety geozones and automated guided vehicles requiring continuous coordinate streams. The North America location analytics market therefore pivots to multi-modal engines that reconcile GPS drift outdoors with multipath corrections indoors.

On-premise systems still accounted for 60% of the North America location analytics market size in 2024, reflecting data-sovereignty priorities among heavily regulated sectors. Cloud options are scaling at a 20.1% CAGR as pay-as-you-go processing and native collaboration entice enterprises with limited capex. Hybrid architectures are also rising, combining edge inference with cloud modeling for low-latency use cases.

Private CBRS networks offer an on-site alternative that marries cloud orchestration with sovereign data paths, giving factories a route around public-cloud lock-in. Format innovations such as GeoParquet minimize ETL overhead, unlocking agile workflows that previously demanded specialist GIS scripting.

The North America Location Analytics Market Segmented by Location (Indoor, Outdoor), Deployment Model (On-Premises, Cloud and More), Component (Solutions and More), Technology (GPS / GNSS, Wi-Fi and More), End-User Vertical (Retail, Banking, Manufacturing, Government, and More), Application (Risk Management and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- SAP SE

- Esri Inc.

- Aruba Networks (HPE Development LP)

- IBM Corporation

- SAS Institute Inc.

- Pitney Bowes Inc.

- HERE Global BV

- TIBCO Software Inc.

- Ericsson Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Alteryx Inc.

- Mapbox Inc.

- CARTO

- Trimble Inc.

- Zebra Technologies Corp.

- Inpixon

- Foursquare Labs Inc.

- Precisely

- TomTom N.V.

- Mapsted Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in omni-channel retail geo-marketing campaigns

- 4.2.2 Proliferation of IoT sensors & connected devices

- 4.2.3 Accelerated adoption of cloud-native geospatial analytics platforms

- 4.2.4 Corporate demand for hybrid workplace occupancy intelligence

- 4.2.5 Availability of CBRS private-5G improving indoor location accuracy

- 4.3 Market Restraints

- 4.3.1 Heightened privacy and consumer opt-out regulations

- 4.3.2 High total cost of ownership for real-time indoor location systems

- 4.3.3 Shortage of geospatial data-science talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Location Type

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.2.4 Edge (on-device)

- 5.3 By Component

- 5.3.1 Solutions

- 5.3.2 Services

- 5.4 By Technology

- 5.4.1 GPS / GNSS

- 5.4.2 Wi-Fi

- 5.4.3 Bluetooth Low-Energy (BLE)

- 5.4.4 Ultra-Wideband (UWB)

- 5.4.5 Cellular (4G/5G incl. CBRS)

- 5.4.6 RFID & NFC

- 5.4.7 Magnetic & Other

- 5.5 By End-User Vertical

- 5.5.1 Retail & E-Commerce

- 5.5.2 Banking, Financial Services & Insurance (BFSI)

- 5.5.3 Manufacturing

- 5.5.4 Healthcare & Life Sciences

- 5.5.5 Government & Defense

- 5.5.6 Energy & Utilities

- 5.5.7 Transportation & Logistics

- 5.5.8 Telecom & IT

- 5.5.9 Real Estate & Smart Buildings

- 5.5.10 Other Verticals

- 5.6 By Application

- 5.6.1 Risk Management

- 5.6.2 Supply Chain & Inventory Optimization

- 5.6.3 Sales & Marketing Optimization

- 5.6.4 Facility & Asset Management

- 5.6.5 Workforce & Field-Force Management

- 5.6.6 Remote Monitoring & Predictive Maintenance

- 5.6.7 Emergency & Disaster Response Management

- 5.6.8 Customer Experience & Engagement

- 5.6.9 Fraud & Compliance Analytics

- 5.6.10 Others

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 SAP SE

- 6.4.3 Esri Inc.

- 6.4.4 Aruba Networks (HPE Development LP)

- 6.4.5 IBM Corporation

- 6.4.6 SAS Institute Inc.

- 6.4.7 Pitney Bowes Inc.

- 6.4.8 HERE Global BV

- 6.4.9 TIBCO Software Inc.

- 6.4.10 Ericsson Inc.

- 6.4.11 Microsoft Corporation

- 6.4.12 Google LLC

- 6.4.13 Oracle Corporation

- 6.4.14 Alteryx Inc.

- 6.4.15 Mapbox Inc.

- 6.4.16 CARTO

- 6.4.17 Trimble Inc.

- 6.4.18 Zebra Technologies Corp.

- 6.4.19 Inpixon

- 6.4.20 Foursquare Labs Inc.

- 6.4.21 Precisely

- 6.4.22 TomTom N.V.

- 6.4.23 Mapsted Corp.

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment