PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850167

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850167

MEA Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

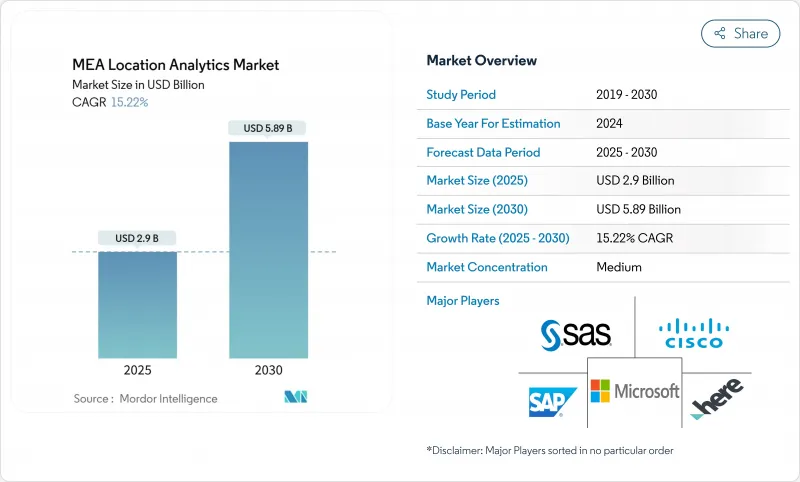

The MEA location analytics market size is valued at USD 2.9 billion in 2025 and is forecast to advance at a 15.22% CAGR, reaching USD 5.89 billion by 2030.

Surging smart-city investments across the Gulf Cooperation Council (GCC) are expanding demand for spatial intelligence, while 5G deployments and sovereign cloud rollouts improve the speed and security of data gathering and processing. Outdoor analytics remains dominant because large-scale mobility and infrastructure projects require continuous geodata feeds for traffic, safety, and urban-services optimization. At the same time, the fusion of indoor and outdoor tracking is reshaping e-commerce logistics, and digital twin initiatives for mega-projects such as NEOM are pushing vendors to deliver higher-frequency data and real-time visualization. Regulatory focus on data sovereignty is guiding architecture choices toward local or sovereign clouds, and mounting skills shortages in geospatial analytics are elevating the role of specialized service providers.

MEA Location Analytics Market Trends and Insights

Proliferation of IoT Sensors in GCC Smart-City Programmes

Ubiquitous sensor networks in Riyadh, Dubai, and Doha generate continuous geotagged streams that demand powerful analytics platforms capable of real-time ingestion and visualization. Dubai has implemented more than 200 smart services, while Makkah is integrating LoRa-enabled devices to maintain connectivity in mountainous terrain during the Hajj season. Municipal agencies use these data flows to predict traffic density, optimize waste collection, and monitor public safety incidents. The resulting data volume pushes city authorities to adopt edge processing and AI algorithms that filter and analyze information at the source, accelerating decision-making. As pilot deployments shift to full production, municipal tenders increasingly specify open APIs and multi-protocol compatibility, encouraging a broader supplier ecosystem.

Accelerated 5G Small-Cell Rollout Enabling Real-Time Analytics

Widespread 5G coverage in GCC capitals delivers sub-10-millisecond latency, allowing advanced applications such as autonomous shuttles, drone-based inspection, and augmented-reality wayfinding. Operators collaborate with municipal planners to embed small cells in street furniture, which improves signal density for high-resolution tracking and video analytics. The new bandwidth permits live streaming of high-definition 3D maps to control rooms, enhancing emergency response coordination. Enterprises across oil, utilities, and logistics verticals are aligning network upgrades with analytics roadmaps, citing the need for uninterrupted data flows from mobile assets. Early adopters report operational cost savings from predictive maintenance once edge AI processes sensor alerts locally.

Data-Sovereignty and Privacy Regulations

Saudi Arabia's Personal Data Protection Law and the UAE's Federal Decree-Law on Data Protection oblige processors to store sensitive location attributes within national borders. Healthcare, finance, and defense projects face strict consent and audit trails, prompting on-premises or sovereign cloud deployments. Multinational vendors respond by launching local cloud regions and offering data-localization tiers that segregate personally identifiable information. Compliance checks elevate project timelines and costs, often requiring legal reviews, encryption key management, and local incident-response protocols.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-First GIS/BI Adoption Across Retail and Government

- Mandatory ESG Geo-Reporting for Large Energy Projects

- High CAPEX and Skills Gap for Indoor Positioning

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor solutions represented 72% of the MEA location analytics market in 2024 as ministries of transport and public works digitized highways, ports, and metro systems. Camera feeds combined with geofencing algorithms support dynamic tolling and traffic-signal optimization, cutting congestion on flagship corridors. The MEA location analytics market size for outdoor deployments is forecast to climb steadily through 2030, benefiting from city-wide mobility-as-a-service platforms. Indoors, malls, airports, and hospitals deploy beacons and LiDAR to gain customer-journey and asset-utilization insights. Uptake is strongest in tier-one malls where operational gains offset hardware and calibration costs. Near-field tracking bridges the gap between store apps and loyalty programs, enhancing campaign conversion.

Emerging use cases blend indoor and outdoor datasets to track assets across supply-chain nodes without signal drop. Logistics operators map cross-dock warehouses and final-mile routes on a single platform, improving hand-off accuracy and reducing misplacement incidents. Facility managers integrate building information modeling with GIS dashboards to visualize maintenance tickets in spatial context. This convergence draws new vendors that bundle floor-plan digitization, Wi-Fi heat-mapping, and global navigation satellite system (GNSS) correction services into unified offerings, positioning them for double-digit gains within the broader MEA location analytics industry.

Cloud platforms owned 66% of the MEA location analytics market in 2024 and continue to outpace on-premises systems with a 19.50% CAGR. Telecom operators, retailers, and public agencies rely on regional data centers operated by hyperscalers to elastically store and process terabytes of geospatial records. The MEA location analytics market size for cloud-hosted workloads is projected to surpass on-premises spending before 2027 as data-sovereignty-compliant regions multiply. Region-specific security certifications and low-latency edge zones encourage migration of latency-sensitive applications such as autonomous shuttle control and real-time crowd monitoring.

On-premises solutions remain essential for classified projects and installations disconnected from public networks. Defense and critical-infrastructure operators deploy ruggedized servers and private clouds to meet stringent performance and confidentiality targets. Hybrid architectures gain traction, integrating edge appliances that process streaming data locally before offloading aggregated insights to sovereign clouds for long-term analytics. Vendors differentiate through pre-built connectors, zero-trust frameworks, and pay-as-you-go pricing to ease budget constraints, illustrating how deployment flexibility underpins purchasing decisions across the MEA location analytics industry.

Middle East and Africa Location Analytics Market Segmented by Location (Outdoor, Indoor), Deployment Model (On-Premise, On-Demand (Cloud)), Application (Remote Monitoring, Asset Management, and Facility Management), Component (Software and Services), Vertical (Retail, Manufacturing, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems

- Microsoft Corporation

- HERE Technologies

- SAS Institute Inc.

- Oracle Corporation

- SAP SE

- Esri

- Tibco Software Inc.

- Pitney Bowes

- Galigeo

- Hexagon AB

- TomTom

- Trimble Inc.

- Mapbox

- Alteryx

- CARTO

- Foursquare

- Splunk Inc.

- Ubisense

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IoT sensors in GCC smart-city programmes

- 4.2.2 Accelerated 5G small-cell rollout enabling real-time analytics

- 4.2.3 Cloud-first GIS/BI adoption across retail and government

- 4.2.4 Mandatory ESG geo-reporting for large energy projects

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and privacy regulations

- 4.3.2 High CAPEX and skills gap for indoor positioning

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Location

- 5.1.1 Outdoor

- 5.1.2 Indoor

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 On-demand (Cloud)

- 5.3 By Application

- 5.3.1 Remote Monitoring

- 5.3.2 Asset Management

- 5.3.3 Facility Management

- 5.4 By Vertical

- 5.4.1 Retail

- 5.4.2 Manufacturing

- 5.4.3 Healthcare

- 5.4.4 Government

- 5.4.5 Energy and Power

- 5.4.6 Other Verticals

- 5.5 By Component

- 5.5.1 Software

- 5.5.2 Services

- 5.6 By Country

- 5.6.1 United Arab Emirates

- 5.6.2 Saudi Arabia

- 5.6.3 Israel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems

- 6.4.2 Microsoft Corporation

- 6.4.3 HERE Technologies

- 6.4.4 SAS Institute Inc.

- 6.4.5 Oracle Corporation

- 6.4.6 SAP SE

- 6.4.7 Esri

- 6.4.8 Tibco Software Inc.

- 6.4.9 Pitney Bowes

- 6.4.10 Galigeo

- 6.4.11 Hexagon AB

- 6.4.12 TomTom

- 6.4.13 Trimble Inc.

- 6.4.14 Mapbox

- 6.4.15 Alteryx

- 6.4.16 CARTO

- 6.4.17 Foursquare

- 6.4.18 Splunk Inc.

- 6.4.19 Ubisense

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment