PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849855

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849855

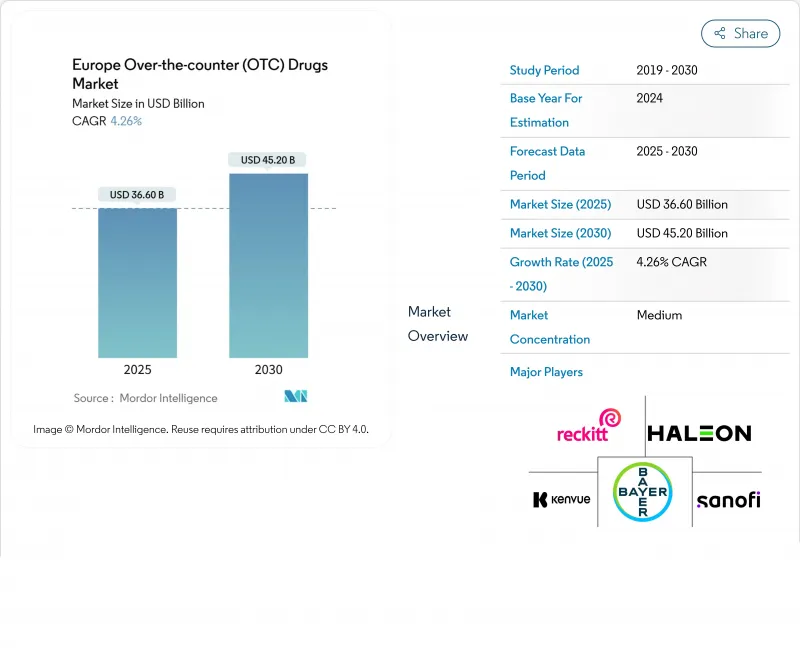

Europe Over-the-counter (OTC) Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The market size of the European OTC Drugs market is valued at USD 36.6 billion in 2025 and is forecast to reach USD 45.2 billion by 2030, translating into a CAGR of 4.26 %.

The market growth seemingly steady climb hides a shift toward premium vitamins, minerals, and supplements as well as a growing acceptance of private-label analgesics in price-sensitive economies. Retail pharmacies keep the largest share of revenue, yet online pharmacies are outpacing physical outlets and forcing every manufacturer to master an omnichannel playbook. Germany and the United Kingdom have rolled out e-prescription frameworks that shorten the path from digital symptom check to online purchase, a pattern that other member states are likely to replicate. As a result, producers that can pivot quickly to digital merchandising and data-driven inventory planning are quietly pulling ahead of less agile rivals.

Europe Over-the-counter (OTC) Drugs Market Trends and Insights

Rise in Digital-First Symptom-Checker Apps Steering Self-Medication

Digital triage platforms now guide many Europeans from symptom search to checkout in a matter of minutes. After users answer a short questionnaire, the software supplies a ranked list of suitable OTC drugs and even highlights loyalty-discounted options. Because these algorithms optimize recommendations in real time, brands that feed credible clinical data into the engine earn a place on the coveted "top three" list that drives most clicks. The sprint from perceived need to confirmed order compresses what used to be a pharmacist conversation into a thirty-second interface, nudging consumers toward categories such as migraine and seasonal allergy relief. Over time, this flow of behavioral data allows both retailers and manufacturers to gauge tissue shortages, pollen spikes, and viral waves earlier than traditional sell-through reports would allow.

Rapid Switch-to-OTC Reclassifications for Allergy and Migraine Molecules

The United Kingdom's Department of Health and Social Care invited companies in February 2025 to submit dossiers for switching prescription medicines to OTC status in areas such as gastrointestinal care, women's health, and allergy management, with officials forecasting savings of EUR 1.4 billion (USD 1.6 billion) a year for the National Health Service. Similar initiatives from medicines agencies elsewhere in Europe signal that regulators now see responsible self-care as a cost-containment tool. Every successful reclassification instantly enlarges the European OTC Drugs market size, shortening investment payback periods and intensifying competition during the first twelve to eighteen months after launch. Early mover brands that secure pharmacist endorsement typically lock in repeat-purchase loyalty before generic and private-label challengers arrive. Yet portfolio concentration risk rises when too much revenue rests on a handful of newly switched molecules, so prudent firms balance switch candidates with slower-burning nutraceutical lines.

Stringent Country-Specific Advertising Bans

The European Directorate for the Quality of Medicines & HealthCare reported in 2024 that close to half of the region's regulators split non-prescription medicines into sub-classes, each carrying its own marketing rules. These fragmented requirements force marketers to create separate ads, pack warnings, and even taglines for each jurisdiction, turning a pan-European campaign into an expensive choreography of micro-versions. Digital-first brands versed in social media find themselves re-editing influencer videos or geo-blocking content to avoid non-compliance fines. To reduce risk, many companies shift spending toward pharmacy education kits and doctor-detailing leaflets, where the compliance hurdles are lower. The result is a quiet re-empowerment of healthcare professionals as gatekeepers to consumer awareness, particularly in categories such as weight management, where education is critical.

Other drivers and restraints analyzed in the detailed report include:

- Ageing European Population Boosting Chronic Self-Care Demand

- Post-COVID Consumer Trust in Pharmacies Driving Premium VMS Uptake

- Retailer Private-Label Push on Price-Sensitive Analgesics in Central and Eastern Europe

- Rising Pharmacovigilance Alerts on NSAID Misuse

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cold, cough, and flu remedies hold 28.1% of the European OTC Drugs market share in 2025, retaining their lead even as sub-segments multiply. Demand spikes no longer follow only winter patterns; micro-peaks align with school term openings and sudden weather swings, forcing supply chains to react in near real time. Immune-support additives such as zinc and vitamin D appear in decongestants and lozenges, merging preventive and symptomatic care in a single sachet. Private labels clone these hybrids within months, compressing the window of differentiation for pioneer brands. Success now rests on age-specific SKUs-sugar-free options for children, honey-ginger infusions for adults, lower-dose night formulas for seniors.

Tablets and caplets own 47.8% of the European OTC Drugs market size in 2024. Yet, gummies, lozenges, and dissolvable films are growing at 11.4 % a year, reflecting the appetite for water-free, flavored formats. Micro-encapsulation technology lets each gummy meet therapeutic dosages without breaching nutrient limits, while layered-release films boost bioavailability. Grocery and convenience stores place these products near confectionery, capturing incremental shoppers who might never walk through the traditional health aisle. Because such formats fetch higher units sold per visit, retailers happily grant secondary placement to maintain velocity. The trend also spurs new regulatory conversations about packaging similarity between sweets and medicines, likely setting the stage for stricter child-safety labeling rules.

The European OTC Drugs Market is Segmented by Product Type (Cough, Cold and Flu Products, Analgesics, and More), Formulation (Tablets and Caps, and More), Age Group (Pediatric (0-14 Yrs), and More), Sales Format (Branded, Generic, and Private-Label OTC), Distribution Channel (Hospital Pharmacies, and More), and Geography (Germany, United Kingdom, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer

- GlaxoSmithKline

- Johnson & Johnson

- Sanofi

- Reckitt Benckiser Group

- Perrigo Company

- Stada Arzneimittel

- Teva Pharmaceutical Industries

- Boehringer Ingelheim Intl. GmbH

- Novartis

- Pfizer

- Cardinal Health

- Procter & Gamble

- Walgreens Boots Alliance Inc.

- HRA Pharma (Perrigo)

- Almirall S.A.

- Angelini Pharma

- Ipsen

- Sun Pharmaceuticals Industries

- Boiron SA

- Omega Pharma NV

- Viatris

- MENARINI Group

- Grunenthal GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Digital-First, Symptom-Checker Apps Steering Self-Medication

- 4.2.2 Rapid Switch-to-OTC Reclassifications by EMA for Non-Rx Allergy & Migraine Molecules

- 4.2.3 Ageing European Population Boosting Chronic Self-Care Demand

- 4.2.4 Post-COVID Consumer Trust in Pharmacies Driving Premium VMS Uptake

- 4.2.5 Retailer Private-Label Push on Price-Sensitive Analgesics in CEE

- 4.2.6 EMA keeps Reclassifying Allergy & Migraine Drugs from Rx to OTC

- 4.3 Market Restraints

- 4.3.1 Stringent Country-Specific Advertising Bans

- 4.3.2 Rising Pharmacovigilance Alerts on NSAID Misuse Dampening Repeat Sales

- 4.3.3 High Parallel-Trade Leakage from Low-Price Markets (ES, PT) Eroding Margins

- 4.3.4 Supply Chain Disruptions in APIs from India & China Impacting European Stock

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Cough, Cold & Flu Products

- 5.1.2 Analgesics

- 5.1.3 Dermatology Products

- 5.1.4 Gastrointestinal Products

- 5.1.5 Vitamins, Minerals & Supplements (VMS)

- 5.1.6 Allergy & Respiratory Care

- 5.1.7 Smoking-Cessation Aids

- 5.1.8 Weight-Loss / Dietary Products

- 5.1.9 Ophthalmic Products

- 5.1.10 Sleep Aids

- 5.1.11 Other Product Types

- 5.2 By Formulation

- 5.2.1 Tablets & Caplets

- 5.2.2 Liquids & Syrups

- 5.2.3 Topical Creams & Ointments

- 5.2.4 Powders & Granules

- 5.2.5 Sprays & Inhalers

- 5.2.6 Gummies, Lozenges & Dissolvable Films

- 5.3 By Age Group

- 5.3.1 Pediatric (0-14 yrs)

- 5.3.2 Adult (15-64 yrs)

- 5.3.3 Geriatric (65+ yrs)

- 5.4 By Sales Format

- 5.4.1 Branded OTC

- 5.4.2 Generic OTC

- 5.4.3 Private-Label OTC

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.5.4 Supermarkets & Hypermarkets

- 5.5.5 Convenience Stores

- 5.5.6 Other Channels

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Bayer AG

- 6.3.2 GlaxoSmithKline plc

- 6.3.3 Johnson & Johnson

- 6.3.4 Sanofi SA

- 6.3.5 Reckitt Benckiser Group plc

- 6.3.6 Perrigo Company plc

- 6.3.7 Stada Arzneimittel AG

- 6.3.8 Teva Pharmaceutical Industries Ltd.

- 6.3.9 Boehringer Ingelheim Intl. GmbH

- 6.3.10 Novartis AG

- 6.3.11 Pfizer Inc.

- 6.3.12 Cardinal Health Inc.

- 6.3.13 Procter & Gamble Co.

- 6.3.14 Walgreens Boots Alliance Inc.

- 6.3.15 HRA Pharma (Perrigo)

- 6.3.16 Almirall S.A.

- 6.3.17 Angelini Pharma

- 6.3.18 Ipsen Pharma

- 6.3.19 Sun Pharmaceutical Industries Ltd.

- 6.3.20 Boiron SA

- 6.3.21 Omega Pharma NV

- 6.3.22 Viatris Inc.

- 6.3.23 MENARINI Group

- 6.3.24 Grunenthal GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment