PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849860

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849860

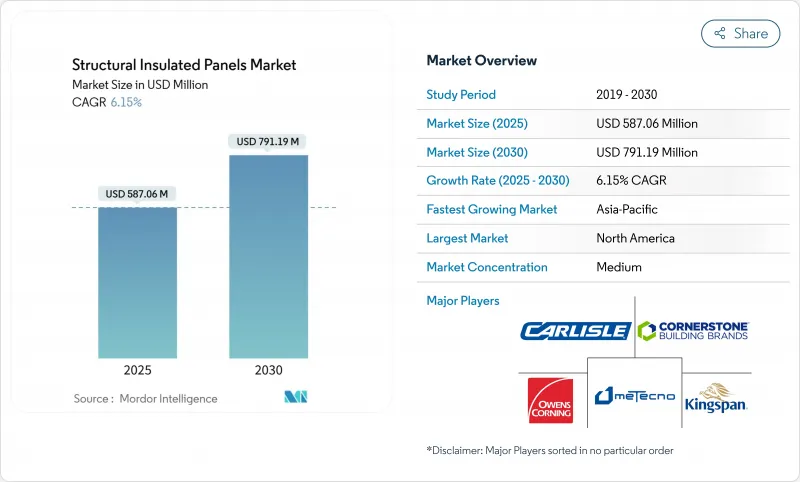

Structural Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The structural insulated panels market is valued at USD 587.06 million in 2025 and is forecast to reach USD 791.19 million by 2030, advancing at a 6.15% CAGR.

Strong momentum stems from tighter energy-efficiency codes, accelerating prefabrication adoption, and expanding cold-chain infrastructure. North America retains regulatory leadership, while Asia-Pacific posts the fastest volume gains due to rapid urbanization. Data-center construction and temperature-controlled logistics open premium niches that spur product innovation. Meanwhile, supply-chain volatility for oriented strand board (OSB) and higher upfront costs remain near-term brakes on broad adoption.

Global Structural Insulated Panels Market Trends and Insights

Energy-Efficiency Regulations Accelerating Adoption

Global building codes now prioritize lower operational carbon, and the 2021 International Energy Conservation Code (IECC) raises performance thresholds by 34.4% for federally financed housing in the United States. Structural insulated panels market participants benefit because SIP wall and roof assemblies cut air infiltration while meeting prescriptive R-values without additional framing changes. Colorado's early IECC adoption demonstrates how state mandates trigger immediate material shifts, with its Energy Code Board highlighting SIPs as a turnkey compliance route. Commercial developers also lean on SIP envelopes to secure LEED points, extending demand beyond single-family housing.

Expansion of Global Cold-Chain Infrastructure

Cold stores, vaccine depots, and last-mile fulfillment centers require high-R-value continuous insulation. PUR and PIR-core SIPs offer the dimensional stability and vapor-barrier integrity needed for temperatures well below freezing, enabling 25% energy savings against conventional panels. Modular cold rooms leverage factory-fabricated SIPs to slash installation time by 40% and support rapid scalability for grocery, pharma, and seafood logistics across Asia-Pacific.

Higher Upfront Costs vs. Conventional Framing

EPS-core SIPs average USD 10-18 per ft2, translating to a 2-3% premium on total build cost, which can deter budget-driven projects despite life-cycle payback within five years through lower energy bills. Misconceptions persist because only 1-2% of U.S. homes currently use panels, keeping installer familiarity low. Federal tax incentives under the Inflation Reduction Act now offset part of that delta, but price sensitivity in emerging markets still restrains volume.

Other drivers and restraints analyzed in the detailed report include:

- Rising Affordable-Housing & Residential Remodeling

- Growing Preference for Rapid, Off-Site Construction

- OSB Supply Volatility (Beetle Infestation & Mill Outages)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

EPS panels held 79.87% of 2024 revenue, underlining the material's cost-performance balance as builders adopt SIP shells to comply with stricter codes. This dominant slice of the structural insulated panels market size aligns with widespread EPS manufacturing capacity, which ensures stable pricing and supply in North America and Asia-Pacific. Lightweight boards also reduce freight, letting developers tap rural lots with limited crane access.

Over 2025-2030, the structural insulated panels market expects EPS volumes to grow at 6.29% CAGR, supported by flame-retardant grades and recycled content innovations. PUR/PIR panels protect cold rooms and cleanrooms where lower k-values and closed-cell rigidity justify higher cost. Vacuum-insulated and aerogel-core concepts show promise in net-zero prototypes yet remain niche due to price and handling complexity. In parallel, glass-wool cores attract acoustic projects, broadening the structural insulated panels industry toolkit for architects seeking multifunctional assemblies.

OSB skins accounted for 57.28% of structural insulated panels market share in 2024, leveraging familiarity among framing crews and compatibility with fasteners used in conventional stick-built walls. Builders appreciate OSB's screw-withdrawal strength that supports direct cladding attachment without furring strips.

However, beetle-related fiber shortages and mill fires have spotlighted supply risk, nudging designers toward steel, fiber-cement, and magnesium-oxide skins growing at 7.06% CAGR through 2030. Metal facings serve data-center envelopes where non-combustibility and electromagnetic shielding matter, while MgO boards provide mold resistance in humid climates. These alternatives diversify procurement, although retrofit crews must adjust tooling and fastener choices, extending learning curves in the structural insulated panels market.

The Structural Insulated Panels Market Report Segments the Industry by Product (EPS (Expanded Polystyrene) Panels, Glass-Wool Panels, and More), Skin Material (Oriented Strand Board (OSB), Plywood, and More), Application (Building Wall, Building Roof, and More), End-User Industry (Residential, Commerical, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 37.12% of global revenue in 2024, anchored by the United States where IECC 2021 adoption for federally backed mortgages effectively makes SIP-level performance mainstream for new housing. Canadian manufacturers supply both domestic framers and U.S. projects despite trade-tariff friction, and the cold regional climate reinforces the need for high-R assemblies. Rapid data-center construction in Virginia, Texas, and Quebec injects a premium commercial stream into the structural insulated panels market.

Asia-Pacific logs the fastest regional CAGR at 7.28% to 2030. China's new-build floor-area quotas include green-building ratios that elevate SIP use in apartment blocks, while India's Smart Cities program funds modular affordable housing where panels accelerate site turnover. Local EPS resin capacity and competitive labor help keep delivered panel cost low, encouraging uptake even among smaller developers. Japan's seismic codes spur hybrid timber-steel SIP designs that pair light weight with moment-frame resilience, widening architectural acceptance.

Europe maintains stable demand underpinned by the Energy Performance of Buildings Directive, which increasingly channels renovation budgets into envelope first strategies. Scandinavian builders integrate cross-laminated timber skins with EPS cores to produce carbon-negative modular cottages, whereas Germany and the Netherlands drive public procurement toward low-embodied-carbon materials. Outside the big three regions, the Middle East funds cold-store capacity for regional food security, and Chile experiments with SIP social-housing prototypes that withstand seismic events.

- Alubel SpA

- ArcelorMital

- Balex-Metal

- Carlisle Companies Inc.

- Cornerstone Building Brands, Inc.

- DANA Group of Companies

- Italpannelli SRL

- Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- Kingspan Group

- Manni Group

- Metecno

- Multicolor Steels (India) Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- Rautaruukki Corporation (Ruukki Construction)

- Structall Building Systems

- Tata Steel

- Thermocore Structural Insulated Panel Systems

- Zamil Steel Buildings India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations accelerating adoption

- 4.2.2 Expansion of global cold-chain infrastructure

- 4.2.3 Rising affordable-housing & residential remodeling

- 4.2.4 Growing preference for rapid, off-site construction

- 4.2.5 Carbon-credit monetisation for timber-based SIPs

- 4.3 Market Restraints

- 4.3.1 Higher upfront costs vs. conventional framing

- 4.3.2 Substitution threat from advanced prefab wall systems

- 4.3.3 OSB supply volatility (beetle infestation & mill outages)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 EPS (Expanded Polystyrene) Panels

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panels

- 5.1.3 Glass-wool Panels

- 5.1.4 Other Products (e.g., Vacuum-insulated, etc.)

- 5.2 By Skin Material

- 5.2.1 Oriented Strand Board (OSB)

- 5.2.2 Plywood

- 5.2.3 Other Skin Materials (Fibre-cement Board, Galvanised Steel Sheet), etc.)

- 5.3 By Application

- 5.3.1 Building Wall

- 5.3.2 Building Roof

- 5.3.3 Cold Storage

- 5.3.4 Other Modular Structures (e.g., Data Centres, Floor and Deck, etc.)

- 5.4 By End-User Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial and Institutional

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.1.1 South Africa

- 5.5.5.1.2 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Alubel SpA

- 6.4.2 ArcelorMital

- 6.4.3 Balex-Metal

- 6.4.4 Carlisle Companies Inc.

- 6.4.5 Cornerstone Building Brands, Inc.

- 6.4.6 DANA Group of Companies

- 6.4.7 Italpannelli SRL

- 6.4.8 Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- 6.4.9 Kingspan Group

- 6.4.10 Manni Group

- 6.4.11 Metecno

- 6.4.12 Multicolor Steels (India) Pvt. Ltd.

- 6.4.13 Nucor Building Systems

- 6.4.14 Owens Corning

- 6.4.15 Premium Building Systems

- 6.4.16 Rautaruukki Corporation (Ruukki Construction)

- 6.4.17 Structall Building Systems

- 6.4.18 Tata Steel

- 6.4.19 Thermocore Structural Insulated Panel Systems

- 6.4.20 Zamil Steel Buildings India Private Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment