PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849886

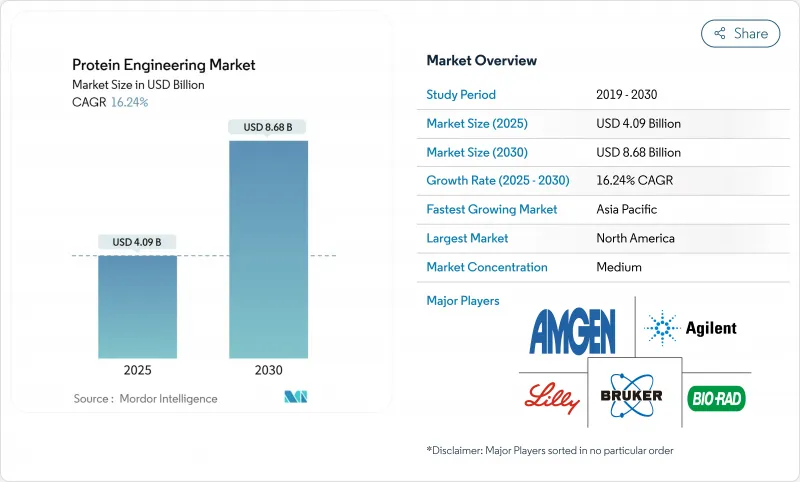

Protein Engineering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global protein engineering market is currently valued at USD 4.09 billion in 2025 and is forecast to climb to USD 8.68 billion by 2030, translating into a 16.24% CAGR.

This strong expansion reflects a decisive move away from traditional trial-and-error methods toward AI-enabled design platforms, faster regulatory pathways for biologics, and sustained public-sector funding. Rapid advances in in-silico modeling, exemplified by Google DeepMind's AlphaProteo system that delivers binding affinities up to 300-fold better than earlier techniques, are compressing development cycles and widening the addressable opportunity for therapeutics. Demand also benefits from chronic-disease prevalence, the success of mRNA technology in prophylactic and therapeutic vaccines, and growing outsourcing to contract research organizations that can provide specialized expertise without heavy capital requirements. Competitive dynamics are shifting as incumbent instrument suppliers strengthen digital capabilities while AI-native startups enter with significant venture funding and billion-dollar collaborations, signalling an ecosystem in flux yet rich in partnership opportunities.

Global Protein Engineering Market Trends and Insights

Surge in Monoclonal Antibody Commercialization

Monoclonal antibodies continue to headline late-stage pipelines, with forecasts pointing to USD 315 billion in annual sales by 2025, propelled by accelerated FDA approvals and expanded indications beyond oncology. Bispecific formats now comprise a notable share of new filings, and recent clearances such as Merck's clesrovimab for RSV prevention underscore the therapeutic breadth. Manufacturing innovation is lowering cost-of-goods, exemplified by Sutro Biopharma's commercial-scale cell-free expression of an antibody-drug conjugate. These gains improve patient access and reinforce the revenue base for the protein engineering market.

AI-Driven In-Silico Protein Design Platforms

Artificial intelligence is compressing discovery timelines from years to months. AlphaProteo has shown 300-fold affinity improvements over legacy techniques. Generate:Biomedicines' Chroma validated 310 experimentally tested proteins with favorable properties, underpinning a USD 1 billion multi-target deal with Novartis. Technical University of Munich researchers extended AlphaFold2 to 1,000-amino-acid designs, bridging a gap between prediction and custom sequence generation. Collective advances position AI as a primary engine of growth for the protein engineering market.

High Cost of Instruments and Specialty Reagents

Sophisticated equipment, single-cell proteomics workflows and proprietary reagents keep capital intensity high. Single-cell protein analysis can range from under USD 2 to more than USD 50 per cell depending on throughput. Industry estimates point to multibillion-dollar investment needs to bring novel proteins to scale, a burden that smaller firms often mitigate by outsourcing or sharing facilities. Robotics-enabled, low-cost enzyme discovery pipelines are beginning to narrow cost gaps by automating tedious tasks. While these innovations ease pressure, high upfront spending remains a moderating force on the protein engineering market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Chronic-Disease Burden Demanding Biologics

- Government and VC Funding for Synthetic-Biology Start-Ups

- Complex IP and Freedom-to-Operate Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monoclonal antibodies retained 40.35% of 2024 revenue, securing the largest slice of the protein engineering market. Sustained regulatory approvals, broadening indications and manufacturing advances such as cell-free expression keep entry barriers high while cementing commercial predictability. Vaccines are set to register an 18.25% CAGR through 2030, leveraging mRNA versatility to deliver rapid antigen design and robust immunogenicity. Continued investment in bispecifics and antibody-drug conjugates further fortifies the segment's pipeline resilience.

The vaccine opportunity gains momentum from pandemic preparedness spending, with AI-directed antigen design accelerating candidate selection. Insulin and coagulation factors remain mature but evolve through long-acting formulations and gene-therapy alternatives. Growth factors and fusion proteins address regenerative medicine and metabolic disease niches, supported by regulatory initiatives such as the FDA's rapid glycan-profiling method that improves quality oversight. Collectively, these developments reinforce the expansion trajectory of the protein engineering market.

Consumables generated 52.53% of 2024 revenue, underscoring the recurring demand for reagents and kits across laboratory workflows. Yet software and services are projected to scale fastest at a 19.85% CAGR, signifying an industry pivot toward AI-enabled modeling and cloud-based collaboration. The protein engineering market size for software and services is expected to outpace hardware budgets as algorithms replace brute-force screening.

Compute-rich approaches lower the barrier for smaller entities to participate. Generate:Biomedicines' billion-dollar alliance with Novartis and Cradle's USD 73 million Series B reflect confidence that algorithmic design can shorten discovery timelines. Instruments still see steady upgrades, highlighted by Thermo Fisher's USD 3.1 billion Olink acquisition that deepens next-generation proteomics. As hardware integrates with digital platforms, synergy will drive the next efficiency leap within the protein engineering market.

The Protein Engineering Market Report is Segmented by Protein Type (Insulin, Monoclonal Antibodies, Vaccines, and More), Product & Service (Instruments, Consumables, and Software & Services), Technology (Irrational Design, Rational Design, and Hybrid Design), End User (Pharmaceutical and Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the protein engineering market with a 44.82% revenue contribution in 2024, anchored by the United States' mature venture ecosystem, premier academic research and FDA policies that reward innovation. Federal programs such as DARPA's Switch initiative and the NSF's USD 40 million protein-design grant pool amplify the regional advantage. Biopharma manufacturers are reinforcing supply chains through large domestic builds; Eli Lilly and Novo Nordisk together earmarked USD 6.1 billion for new facilities in North Carolina that will support GLP-1 production. The protein engineering market benefits from proximity between discovery labs, regulators and scalable production capacity.

Asia-Pacific is forecast to grow at 19.61% CAGR, the fastest regional clip through 2030. China's commitment to biotech self-sufficiency yielded USD 471 million in 2024 start-up funding despite capital-market headwinds. South Korea is pairing fermentation expertise with agricultural innovation, while Australia's CSIRO projects a USD 30 billion synthetic-biology industry by 2040 supported by USD 44.5 million in recent grants. Japan's ecosystem lags due to pricing pressures, yet domestic champions such as Chugai delivered record 2024 revenue on the strength of proprietary antibody technologies. These developments collectively sharpen Asia-Pacific's stake in the protein engineering market.

Europe remains an influential node, supported by coordinated policy and a strong academic network. The EU's 2024 "Building the Future with Nature" blueprint promotes biotechnology sovereignty and sustainability. The United Kingdom's GBP 100 million (USD 125 million) engineering-biology program accelerates pandemic readiness, while Nuclera's GBP 1.14 million (USD 1.4 million) Innovate UK grant exemplifies seed-stage support for rapid protein expression tools. The Netherlands' EUR 60 million (USD 65 million) cellular-agriculture fund extends biotech principles into food systems. These initiatives maintain Europe's competitiveness and diversify the global footprint of the protein engineering market.

- Agilent Technologies

- Amgen

- Bruker

- Bio-Rad Laboratories

- Eli Lilly and Company

- Merck

- Novo Nordisk

- PerkinElmer

- Thermo Fisher Scientific

- Waters Corporation

- GenScript Biotech

- GE Healthcare

- Lonza Group

- Abzena

- Codexis

- Takara Bio

- AbCellera

- Johnson & Johnson

- Genentech (Roche)

- Sangamo Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Monoclonal Antibody (Mab) Commercialization

- 4.2.2 AI-Driven In-Silico Protein Design Platforms

- 4.2.3 Growing Chronic-Disease Burden Demanding Biologics

- 4.2.4 Government & VC Funding For Synthetic-Biology Start-Ups

- 4.2.5 Cell-Free Protein Synthesis Enabling Rapid Prototyping

- 4.3 Market Restraints

- 4.3.1 High Cost Of Instruments & Specialty Reagents

- 4.3.2 Complex IP & Freedom-To-Operate Hurdles

- 4.3.3 Sustainability & Regulatory Scrutiny Of Bioprocess Waste

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Protein Type

- 5.1.1 Monoclonal Antibodies

- 5.1.2 Insulin

- 5.1.3 Coagulation Factors

- 5.1.4 Vaccines

- 5.1.5 Growth Factors

- 5.1.6 Other Protein Types

- 5.2 By Product & Service

- 5.2.1 Instruments

- 5.2.2 Consumables (Reagents & Kits)

- 5.2.3 Software & Services

- 5.3 By Technology

- 5.3.1 Rational Protein Design

- 5.3.2 Irrational / Directed-Evolution Design

- 5.3.3 Hybrid / Semi-Rational Design

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Academic & Research Institutions

- 5.4.3 Contract Research Organizations

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agilent Technologies Inc.

- 6.3.2 Amgen Inc.

- 6.3.3 Bruker Corporation

- 6.3.4 Bio-Rad Laboratories

- 6.3.5 Eli Lilly and Company

- 6.3.6 Merck KGaA

- 6.3.7 Novo Nordisk

- 6.3.8 PerkinElmer

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Waters

- 6.3.11 GenScript Biotech

- 6.3.12 GE HealthCare

- 6.3.13 Lonza Group AG

- 6.3.14 Abzena

- 6.3.15 Codexis

- 6.3.16 Takara Bio

- 6.3.17 AbCellera

- 6.3.18 Johnson & Johnson (Janssen)

- 6.3.19 Genentech (Roche)

- 6.3.20 Sangamo Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment