PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849887

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849887

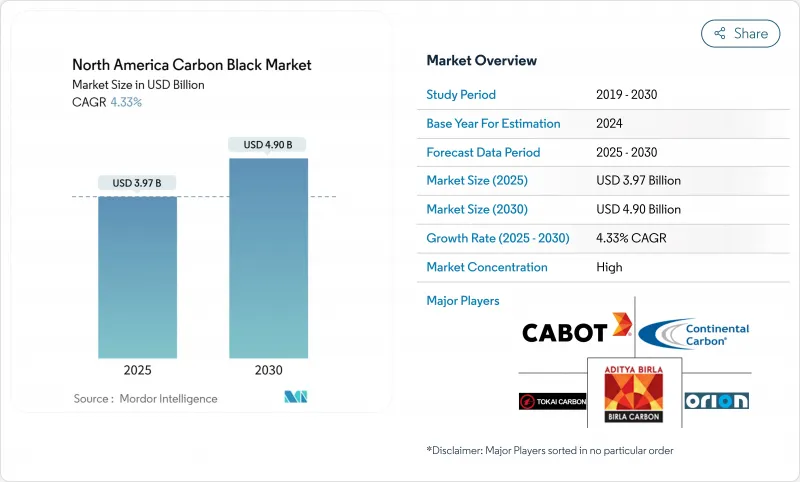

North America Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America carbon black market stands at USD 3.97 billion in 2025 and is projected to advance at a 4.33% CAGR to reach USD 4.90 billion by 2030.

This growth trajectory reflects a mature but resilient sector that benefits from the tire industry's ongoing shift toward electric mobility, steady plastics demand, and continued infrastructure spending in the region. Robust feedstock availability along the United States Gulf Coast and process improvements that lower energy intensity are bolstering producer margins and enabling targeted investments in specialty grades. Meanwhile, regulatory tailwinds in Canada and construction-led demand in Mexico are driving premiumization and end-use diversification, respectively. Competitive strategies increasingly center on recovered carbon black scale-up, proprietary surface modifications, and integrated supply agreements with tire and battery makers, positioning the North America carbon black market for balanced growth through 2030.

North America Carbon Black Market Trends and Insights

Surging Demand for Wide-Base EV Tires Requiring High-Surface-Area Furnace Blacks

Wide-base electric vehicle tires use more carbon black per unit than standard passenger tires because higher torque and heavier battery loads accelerate tread wear. Tire makers are deploying high-surface-area furnace blacks that maintain durability while lowering rolling resistance, a balance essential for extending battery range. Goodyear's demonstration tires that blend sustainable carbon black precursors achieved reduced rolling resistance without sacrificing grip, validating this material strategy. OEM fitment targets for EV-specific tires are forecast to accelerate specialty black penetration, enhancing average selling prices across the North America carbon black market. Suppliers with advanced particle-size control technologies are therefore positioned to secure long-term supply contracts with leading EV tire producers. The premium segment created by EV performance standards is expected to lift gross margins even as traditional tire volumes plateau.

Low-Cost Decant Oil Availability from U.S. Gulf Coast Refiners Enhancing Producer Margins

Crude production growth to 13.5 million b/d in 2025 ensures a steady stream of decant oil, the principal feedstock for furnace black manufacturing. Producers near Gulf Coast refineries enjoy lower delivered-feedstock costs than European or Asian peers, creating a durable cost advantage. This differential affords North American suppliers the capital flexibility to retrofit reactors with energy recovery systems and to finance pilot lines for recovered carbon black without eroding near-term profitability. As a result, capacity rationalization pressure remains low, and the North America carbon black market continues to benefit from a competitive but stable pricing environment that favors efficient operators. The cost cushion also underwrites research into bio-based and circular feedstocks, keeping regional producers at the forefront of sustainability innovation.

Feedstock Price Volatility amid Gulf-Coast Supply Disruptions

Hurricane activity and refinery maintenance outages periodically constrain decant oil flow, driving spot price spikes that erode margins for non-integrated carbon black producers. The U.S. Energy Information Administration notes that even brief Gulf Coast disruptions ripple rapidly through regional feedstock markets, forcing some plants to run at reduced rates. Suppliers are expanding storage tanks and adopting commodity hedging programs to buffer volatility, but inventory build-ups raise working capital needs. Smaller firms lacking balance-sheet capacity face higher operating-cost dispersion, potentially accelerating consolidation in the North America carbon black market. Over time, investment in multi-feedstock flexibility, enabling the use of alternative slurry oils, should temper price swings, yet in the near term, unpredictability remains a headwind.

Other drivers and restraints analyzed in the detailed report include:

- Canadian Tire-Label Regulations Boosting Specialty Grade Adoption

- Recovered Carbon Black (rCB) Uptake Driven by OEM ESG Targets

- Silica-Silane Substitution in Passenger-Car Tread Compounds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Furnace black retained an 85% share of the North America carbon black market in 2024, leveraging flexible reactor configurations that accommodate diverse feedstocks and yield consistent quality across high-volume applications. The segment's 85% shares translates to a 4.71% CAGR outlook, outpacing the overall North America carbon black market size growth, supported by energy recovery upgrades that lower unit costs and emissions. Thermal black, gas black, and lamp black collectively occupy niche segments, supplying specialized plastics, inks, and battery components where unique particle size or purity is essential. Capacity expansions remain concentrated in furnace technology, underpinned by strong demand from tire and mechanical rubber goods producers.

Continued reactor innovation enables tighter particle size distribution and custom surface chemistry, allowing producers to tailor grades for advanced batteries and lightweight composite parts. Circular feedstocks such as tire pyrolysis oil are being piloted to decarbonize furnace operations without sacrificing throughput. These advancements reinforce furnace black's structural advantage, ensuring the process maintains leadership as the North America carbon black industry integrates sustainability imperatives with performance requirements.

Standard grades accounted for 78% of 2024 volume, but specialty grades generated a disproportionate share of profit, aided by a 5.22% CAGR projection that exceeds baseline market growth. Conductive and electrostatic-dissipative grades, while still a smaller slice, are scaling rapidly thanks to their critical role in lithium-ion batteries where conductivity dictates charge rates and cycle life.

Research in the Journal of Power Sources links optimal conductive carbon black micro-structure to higher battery energy density, prompting battery makers to lock in long-term supply contracts. This technical dependency elevates switching barriers and fortifies pricing resilience. As OEMs pursue higher recycled content, hybrid formulations that blend rCB with virgin specialty blacks are poised to extend value creation across the North America carbon black industry.

The North America Carbon Black Market Report Segments the Industry by Process Type (Furnace Black, Gas Black, Lamp Black, and Thermal Black ), Grade (Standard Grade Carbon Black, Specialty Carbon Black, and More), Application (Tires and Industrial Rubber Products, Toners and Printing Inks, and More), End-User Industry (Automotive and Transportation, Packaging, and More), and Geography (United States, Canada, and Mexico).

List of Companies Covered in this Report:

- Cabot Corporation

- Birla Carbon

- Orion Engineered Carbons S.A.

- Continental Carbon Company

- Tokai Carbon Co., Ltd. (incl. Cancarb)

- Mitsubishi Chemical Corporation

- OMSK Carbon Group

- PCBL Limited

- Imerys

- Monolith Inc.

- Pyrolyx AG

- Koppers Inc.

- Sid Richardson Carbon & Energy Co.

- International China Rubber Investment Holding Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Wide-Base EV Tires Requiring High-Surface-Area Furnace Blacks

- 4.2.2 Low-Cost Decant Oil Availability from U.S. Gulf Coast Refiners Enhancing Producer Margins

- 4.2.3 Canadian Tire-Label Regulations Boosting Specialty Grade Adoption

- 4.2.4 Recovered Carbon Black (rCB) Uptake Driven by OEM ESG Targets

- 4.2.5 Infrastructure-Led Construction Rebound in Mexico Spurring Plastics and Coatings Demand

- 4.3 Market Restraints

- 4.3.1 Feedstock Price Volatility Amid Gulf-Coast Supply Disruptions

- 4.3.2 Silica-Silane Substitution in Passenger-Car Tread Compounds

- 4.3.3 Competition from Tire-Pyrolysis Derived Fillers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 By Grade

- 5.2.1 Standard Grade Carbon Black

- 5.2.2 Specialty Carbon Black

- 5.2.3 Conductive and ESD Carbon Black

- 5.3 By Application

- 5.3.1 Tires and Industrial Rubber Products

- 5.3.2 Plastics

- 5.3.3 Toners and Printing Inks

- 5.3.4 Coatings

- 5.3.5 Textile Fibers

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Packaging

- 5.4.3 Building and Construction

- 5.4.4 Electrical and Electronics

- 5.4.5 Textile and Apparel

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cabot Corporation

- 6.4.2 Birla Carbon

- 6.4.3 Orion Engineered Carbons S.A.

- 6.4.4 Continental Carbon Company

- 6.4.5 Tokai Carbon Co., Ltd. (incl. Cancarb)

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OMSK Carbon Group

- 6.4.8 PCBL Limited

- 6.4.9 Imerys

- 6.4.10 Monolith Inc.

- 6.4.11 Pyrolyx AG

- 6.4.12 Koppers Inc.

- 6.4.13 Sid Richardson Carbon & Energy Co.

- 6.4.14 International China Rubber Investment Holding Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growth in the Adoption of Electric Cars