PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849889

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849889

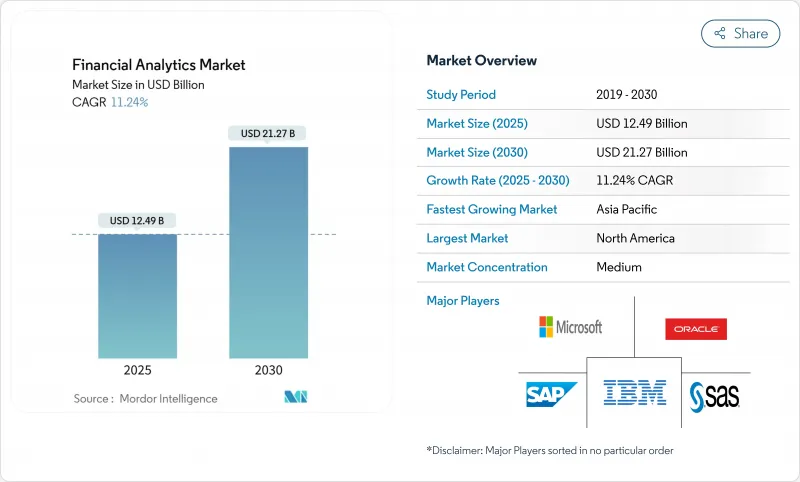

Financial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The financial analytics market is currently valued at USD 12.49 billion in 2025 and is forecast to rise to USD 21.27 billion by 2030, reflecting an 11.2% CAGR during the period.

Rapid cloud-native core conversions, real-time risk mandates, and AI-enabled decision systems are pushing adoption across banking, insurance, and corporate finance teams. North American institutions continue to optimize mature data estates, while Asia-Pacific banks leap from legacy systems to cloud stacks that deliver nanosecond transaction insights. On-premise deployments remain prevalent among risk-averse tier-1 banks, yet accelerating cloud migrations are reshaping vendor strategies as CIOs align capital outlays with operational pay-as-you-go models. Intensifying cyber resiliency requirements, multimillion-dollar breach exposures, and a shortage of data scientists are restraining the pace, but heavy investment in embedded AI is lowering the total cost of ownership and opening the financial analytics market to small and midsize enterprises.

Global Financial Analytics Market Trends and Insights

Explosion in Cloud-First Core-Banking Modernizations

Financial institutions that migrate from monolithic cores to cloud-native architectures record 45% jumps in operational efficiency and up to 40% cost savings within the first year. The shift frees budgets historically consumed by maintenance and enables microservices that stream data into analytics engines in real time. North American tier-1 banks are executing hybrid moves, while mid-tier lenders in India and Indonesia leap directly to public cloud cores. Vendor roadmaps now center on containerized analytics modules that scale elastically with intraday transaction volumes. Regulators acknowledge the resilience benefit because cloud grids allow faster disaster recovery and near-zero downtime. This momentum greatly enlarges addressable demand in the financial analytics market.

AI/ML Embedded in Finance Suites Lowers TCO

Embedding AI engines inside treasury, lending, and portfolio tools removes the need for separate data science stacks. Institutions deploying AI-infused platforms save an average of USD 1.9 million annually through automated reconciliations, hyper-accurate cash forecasts, and fewer false-positive alerts. Modern suites come pre-configured with predictive models that pull data from ERP and CRM pipes, shrinking implementation cycles for regional banks lacking deep analytics talent. Applications such as AI-guided working capital optimization reduce forecast errors by 50%, unlocking liquidity that can be redeployed into revenue-generating products. The resulting lower total cost of ownership accelerates penetration of the financial analytics market into cost-sensitive segments.

Escalating Cyber-Breach Liabilities

Banks average USD 6.08 million in loss per breach, nearly 25% above cross-sector norms. Attack dwell time often exceeds five months, amplifying theft of credentials and customer records. The 2024 ransomware strike on a leading U.S. health insurer showed how a single breach can trigger USD 22 million in payouts. Boards now divert capital from analytics upgrades to security hardening, slowing refresh cycles. Cyber insurance premiums also rise by double digits, squeezing IT budgets further. Vendors must therefore embed zero-trust controls inside analytics platforms to assuage buyer concerns and sustain growth in the financial analytics market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Risk and Capital Reporting

- Surge in Data-Driven Financial Planning and Analysis Across SMBs

- Shortage of Advanced Analytics Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise setups retained 61.2% of the financial analytics market share in 2024, underscoring the sector's cautious stance on data residency and latency control. However, public and private cloud deployments are advancing at 13.2% CAGR and will narrow the gap as regulators formalize shared-responsibility frameworks. Institutions weigh staged migrations beginning with non-core applications, such as budgeting sandboxes, before moving real-time risk engines. The financial analytics market size attributed to cloud platforms is forecast to climb markedly as vendors build sovereign cloud regions to satisfy local compliance. Banks also adopt container orchestration that allows workloads to swing between on-premise and cloud nodes based on cost or latency. Although data-egress fees and vendor lock-in fears linger, multicloud connectivity tools and portable licensing help alleviate these restraints and propel broader cloud adoption.

Once workloads shift, operating models change. Site-reliability engineers replace hardware teams, and consumption pricing aligns IT spend with transaction volumes. Smaller lenders exploit the pay-as-you-go model to access machine-learning libraries previously limited to global banks. Cloud platforms integrate threat analytics that monitor network traffic across tenants, strengthening cyber resilience. Scalable compute further enables Monte Carlo simulations for portfolio risk without large fixed investments. The resulting agility places added pressure on incumbents still anchored to mainframes, encouraging an accelerated reallocation of budgets toward cloud-based financial analytics market solutions.

Analysis and reporting suites led the 2024 landscape with 33.6% revenue share as finance teams demanded unified dashboards for faster close cycles. Financial consolidation suites exhibit 12.7% CAGR because multi-entity corporations require single-version-of-truth ledgers to meet complex IFRS and GAAP obligations. These modules automate currency translation and intercompany eliminations, reducing manual journal entries by 70%. Vendors embed AI that flags anomalous variances during group close and recommends corrective actions, shaving days off reporting timelines. The financial analytics market size associated with consolidation is projected to expand significantly as regulators intensify disclosure demands for climate and tax transparency.

Database management and planning tools form the substrate on which analytical engines run, while risk and compliance modules integrate scenario modeling with regulatory taxonomy. ESG-score analytics and quantum-ready derivatives platforms occupy the emerging "other solutions" niche. As corporations seek end-to-end financial transformation, vendors bundle adjacent capabilities such as account reconciliation and disclosure management into larger platforms. The convergence trend fuels mergers and acquisitions as providers race to offer full-stack coverage, amplifying competition within the financial analytics market.

The Financial Analytics Market Report is Segmented by Deployment Mode (On-Premise and Cloud), Solution Type (Database Management and Planning, Analysis and Reporting, and More), Application (Risk Management, Budgeting and Forecasting, and More), Analytics Type (Descriptive Analytics, and More), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (BFSI, Healthcare, and More), and Geography.

Geography Analysis

North America led with 38.7% revenue share in 2024 as well-capitalized banks invested early in AI cores, cloud resilience, and integrated compliance workbenches. U.S. regulators provide clear guidance on model risk management, allowing institutions to experiment within well-defined guardrails. Canadian banks pioneer open-banking APIs that stream enriched transaction data into third-party analytics layers. Capital markets firms in New York and Toronto deploy low-latency grids that price derivatives in microseconds. The presence of hyperscale cloud regions reduces data-sovereignty friction, sustaining dominance of the financial analytics market across the region.

Asia-Pacific is expected to post a 12.5% CAGR through 2030 on the back of aggressive digitization, supportive policy, and expanding middle-class demand for financial services. China's megabanks commit multi-billion-dollar cloud budgets, while India's public-sector banks join account-aggregator networks that unleash new data sets for credit scoring. Japan's financial giants explore quantum computing consortiums to mitigate interest-rate volatility. Southeast Asian fintechs unlock credit access for the unbanked, pushing real-time analytics workloads to the edge. Regional AI spend is forecast to hit USD 110 billion by 2028, reinforcing long-term momentum.

Europe maintains a sizeable footprint with advanced ESG reporting norms and sophisticated wholesale markets. French banks integrate carbon accounting into credit models, while German insurers deploy actuarial engines that factor climate risk. The EU Data Act elevates privacy compliance, prompting wider adoption of privacy-preserving analytics such as secure enclaves. Meanwhile, quantum readiness gains traction after the European Central Bank explored post-quantum cryptography to safeguard payment rails. South America, and Middle East, and Africa contribute smaller shares today but register double-digit growth as mobile money, digital ID, and open banking initiatives mature.

- FICO

- Hitachi Vantara

- SAS Institute

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Teradata Corporation

- Salesforce (Tableau)

- Qlik Tech

- TIBCO Software

- Alteryx

- ThoughtSpot

- Domo

- MicroStrategy

- Sisense

- Anaplan

- Workday Adaptive Planning

- Moody's Analytics

- SandP Global Market Intelligence

- BlackLine

- Infor

- Wolters Kluwer

- Datarails

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion in cloud-first core-banking modernisations

- 4.2.2 AI/ML embedded in finance suites lowers TCO

- 4.2.3 Regulatory push for real-time risk and capital reporting

- 4.2.4 Surge in data-driven financial planning and analysis across SMBs

- 4.2.5 ESG-score-linked debt issuance analytics

- 4.2.6 Quantum-ready Monte-Carlo engines for VAR

- 4.3 Market Restraints

- 4.3.1 Escalating cyber-breach liabilities

- 4.3.2 Shortage of advanced analytics talent

- 4.3.3 Rising cloud egress fees and vendor lock-in

- 4.3.4 Algorithmic bias compliance investigations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution Type

- 5.2.1 Database Management and Planning

- 5.2.2 Analysis and Reporting

- 5.2.3 Financial Consolidation

- 5.2.4 Risk and Compliance

- 5.2.5 Other Solutions

- 5.3 By Application

- 5.3.1 Risk Management

- 5.3.2 Budgeting and Forecasting

- 5.3.3 Revenue Management

- 5.3.4 Fraud Detection

- 5.3.5 Cash-flow and Treasury Analytics

- 5.3.6 Compliance and Reporting

- 5.3.7 Wealth and Portfolio Analytics

- 5.4 By Analytics Type

- 5.4.1 Descriptive Analytics

- 5.4.2 Diagnostic Analytics

- 5.4.3 Predictive Analytics

- 5.4.4 Prescriptive Analytics

- 5.5 By Organisation Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium Enterprises

- 5.6 By End-user Industry

- 5.6.1 BFSI

- 5.6.2 Healthcare

- 5.6.3 Manufacturing

- 5.6.4 Government

- 5.6.5 IT and Telecom

- 5.6.6 Retail and eCommerce

- 5.6.7 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN

- 5.7.3.6 Australia and New Zealand

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 UAE

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 FICO

- 6.4.2 Hitachi Vantara

- 6.4.3 SAS Institute

- 6.4.4 IBM Corporation

- 6.4.5 Microsoft Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 SAP SE

- 6.4.8 Teradata Corporation

- 6.4.9 Salesforce (Tableau)

- 6.4.10 Qlik Tech

- 6.4.11 TIBCO Software

- 6.4.12 Alteryx

- 6.4.13 ThoughtSpot

- 6.4.14 Domo

- 6.4.15 MicroStrategy

- 6.4.16 Sisense

- 6.4.17 Anaplan

- 6.4.18 Workday Adaptive Planning

- 6.4.19 Moody's Analytics

- 6.4.20 SandP Global Market Intelligence

- 6.4.21 BlackLine

- 6.4.22 Infor

- 6.4.23 Wolters Kluwer

- 6.4.24 Datarails

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment