PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849911

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849911

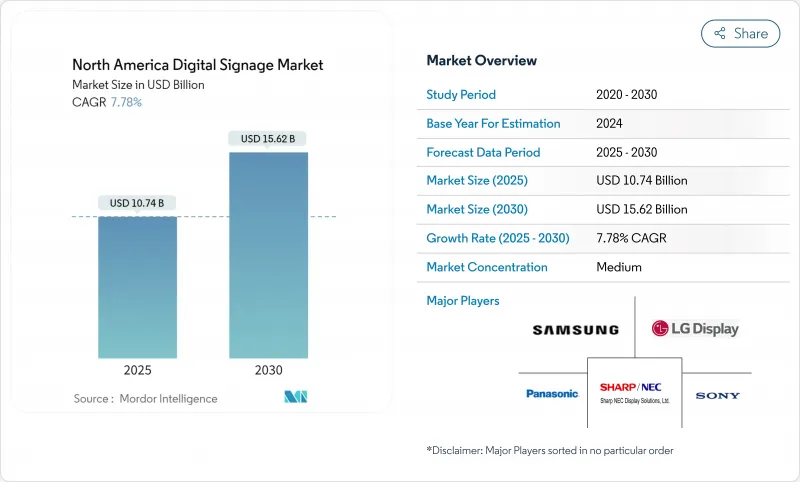

North America Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America digital signage market is valued at USD 10.74 billion in 2025 and is forecast to climb to USD 15.62 billion by 2030, reflecting a steady 7.78% CAGR.

Growth comes from retailers, transportation hubs and corporate campuses that now treat screens as data-rich customer-engagement tools rather than passive billboards. Hardware still anchors most projects, yet cloud software and analytics subscriptions are expanding margins for vendors and easing roll-outs for end-users.Interactive formats, transparent LED facades and programmatic buying are reshaping return-on-investment calculations, while declining LCD panel costs and bundled "hardware-plus-software" offers are pulling small businesses into the upgrade cycle. Tariff shifts, energy-efficiency rules and localized manufacturing are redrawing supplier maps, but sustained capital spending by multi-site brands keeps the demand curve intact.

North America Digital Signage Market Trends and Insights

Evolution of Turnkey Solutions Accelerating Deployment Across U.S. Retail Chains

Bundled offerings that merge screens, media players, software, content templates and remote monitoring have shortened national roll-outs by 37% since 2023. Retail groups now standardize experiences across hundreds of stores while tailoring promotions to local inventory levels. Subscription pricing, rather than capital outlay, encourages adoption: 60% of enterprises without digital signage intend to subscribe within two years. Chains adopting this model report 22% higher engagement and 18% uplift in average basket value, confirming the pivot from cost center to revenue driver.

Context-Aware Advertising Leveraging Mobile Data Enhances ROI for Canadian Advertisers

Anonymized cellphone signals now feed real-time audience estimates into content schedulers. Canadian pilots show ROI gains of 41% over traditional out-of-home buying, plus 27% higher engagement and 19% conversion lifts in retail settings. Geofencing lets brands retarget exposed passers-by on their phones, knitting together physical impressions and digital follow-ups without storing personal identifiers.

Privacy Concerns Regarding Location-Based Targeting & Facial Analytics

State-level U.S. bills and Canada's Digital Charter are tightening consent rules, forcing vendors to shift from face recognition to anonymous demographic counts. Surveys indicate 68% of Canadian youth oppose facial analysis in commerce, prompting retailers to weigh reputational risk against personalization benefits.

Other drivers and restraints analyzed in the detailed report include:

- Integration of 4K/8K Video Walls Powers Experiential Venues in Major U.S. Airports

- Smart-City Initiatives Driving Outdoor Digital Signage Roll-outs in Mexican Urban Centers

- Rising Energy-Efficiency Regulations for Large-Format Displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 56.9% of North America digital signage market share in 2024, anchored by capital-intensive screens and media players. Despite this lead, the software slice is advancing at an 8.8% CAGR as cloud dashboards, AI scheduling engines and audience analytics shift buyer focus from one-time installs to lifetime value. Subscription bundles now comprise 43% of platform revenue, aligning vendor incentives with continuous content optimisation. Hardware makers increasingly pre-load licenses and managed services, creating seamless procurement and freeing retailers from juggling multiple suppliers.

The services tier-covering planning, cabling, calibration, on-site maintenance and creative design-expands steadily because end-users lack in-house bandwidth to refresh campaigns across sprawling estates. Integrators that manage networks end-to-end win multi-year contracts, locking in predictable annuities while keeping failure rates below service-level thresholds. Edge-AI features embedded in modern media players reduce bandwidth costs and enable localised decisions-such as muting audio during quiet hours or flagging malfunctioning LEDs for proactive repairs.

LCD and conventional LED kept 46.8% share in 2024, anchoring mainstream projects thanks to cost efficiency and mature supply chains. Transparent LED now unlocks storefront windows without blocking sightlines, delivering more than 80% transparency and lifting foot traffic by double-digit percentages.Their dominance secures bulk-procurement economies and simplified spares inventory. Transparent LED sheets, however, are rewriting architectural norms with over 80% light transmission, allowing retailers to animate shop windows without blocking sight-lines. Forecast 11.2% CAGR positions the format as the fastest-growing slice of North America digital signage market, particularly in luxury retail, automotive showrooms and experiential pop-ups.

OLED enters premium arenas where near-infinite contrast ratios and off-axis clarity justify higher ticket prices. Narrow pixel-pitch LEDs fill control rooms and broadcast sets that view screens at arm's length, while ruggedised projectors still serve irregular facades and temporary events. Media players graduate from passive playback boxes to miniature edge servers capable of on-device analytics, buffering against connectivity outages and preserving playback integrity.

The North America Digital Signage Market Report is Segmented by Component (Hardware, Software, Services), Hardware (LCD/LED Display, OLED Display, and More), Location (Indoor, and Outdoor), Display Size (Sub 32 Inches, 32 - 52 Inches, and More), Installation Location (In-Store, and Out-of-Store/Roadside), End-User Vertical (Retail, Transportation, and More), and Country. The Market Forecasts are Provided in Terms of Value in (USD).

List of Companies Covered in this Report:

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- SHARP NEC Display Solutions, Ltd.

- Sony Group Corporation

- Panasonic Corporation

- Cisco Systems, Inc.

- Planar Systems, Inc. (Leyard)

- Barco NV

- Daktronics, Inc.

- BrightSign LLC

- STRATACACHE Inc. (Scala)

- Broadsign International, LLC

- Christie Digital Systems USA, Inc.

- AOPEN Inc.

- Goodview Electronics

- Hitachi, Ltd.

- Peerless-AV

- Elo Touch Solutions, Inc.

- Mvix Digital Signage

- Four Winds Interactive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Evolution of Turnkey Solutions Accelerating Deployment Across United States Retail Chains

- 4.2.2 Context-Aware Advertising Leveraging Mobile Data Enhances ROI for Canadian Advertisers

- 4.2.3 Integration of 4K/8K Video Walls Powers Experiential Venues in Major United States Airports

- 4.2.4 Smart-City Initiatives Driving Outdoor Digital Signage Roll-outs in Mexican Urban Centers

- 4.2.5 Decline in LCD Panel Prices Expands Adoption Among SMBs Across North America

- 4.2.6 Programmatic DOOH Platforms Increasing Advertiser Spend and Screen Utilisation

- 4.3 Market Restraints

- 4.3.1 Privacy Concerns Regarding Location-Based Targeting and Facial Analytics

- 4.3.2 Rising Energy-Efficiency Regulations for Large-Format Displays

- 4.3.3 Supply-Chain Volatility for High-Brightness LED Components

- 4.3.4 Capex Barriers for Independent QSRs in Rural Areas

- 4.4 Industry Ecosystem Analysis

- 4.5 Distribution Channel Analysis

- 4.6 Regulatory Landscape - Data-Privacy and Environmental Display Standards

- 4.7 Technology Snapshot

- 4.7.1 Evolution of Digital Signage Solutions in the United States

- 4.7.2 Key Technological Trends - Video Walls, 4K/8K, POS and Social Media Integration

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Hardware Type

- 5.2.1 LCD/LED Display

- 5.2.2 OLED Display

- 5.2.3 Media Players

- 5.2.4 Projectors/Projection Screens

- 5.2.5 Transparent LED Displays

- 5.2.6 Other Hardware

- 5.3 By Location

- 5.3.1 Indoor

- 5.3.2 Outdoor

- 5.4 By Display Size

- 5.4.1 Below 32 Inches

- 5.4.2 32 - 52 Inches

- 5.4.3 Above 52 Inches

- 5.5 By Installation Location

- 5.5.1 In-Store

- 5.5.2 Out-of-Store/Roadside

- 5.6 By End-user Vertical

- 5.6.1 Retail

- 5.6.2 Transportation

- 5.6.3 Hospitality

- 5.6.4 Corporate

- 5.6.5 Education

- 5.6.6 Healthcare

- 5.6.7 Government

- 5.6.8 Sports and Entertainment Venues

- 5.6.9 Other End-users

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 SHARP NEC Display Solutions, Ltd.

- 6.4.4 Sony Group Corporation

- 6.4.5 Panasonic Corporation

- 6.4.6 Cisco Systems, Inc.

- 6.4.7 Planar Systems, Inc. (Leyard)

- 6.4.8 Barco NV

- 6.4.9 Daktronics, Inc.

- 6.4.10 BrightSign LLC

- 6.4.11 STRATACACHE Inc. (Scala)

- 6.4.12 Broadsign International, LLC

- 6.4.13 Christie Digital Systems USA, Inc.

- 6.4.14 AOPEN Inc.

- 6.4.15 Goodview Electronics

- 6.4.16 Hitachi, Ltd.

- 6.4.17 Peerless-AV

- 6.4.18 Elo Touch Solutions, Inc.

- 6.4.19 Mvix Digital Signage

- 6.4.20 Four Winds Interactive

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment