PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851353

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851353

Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

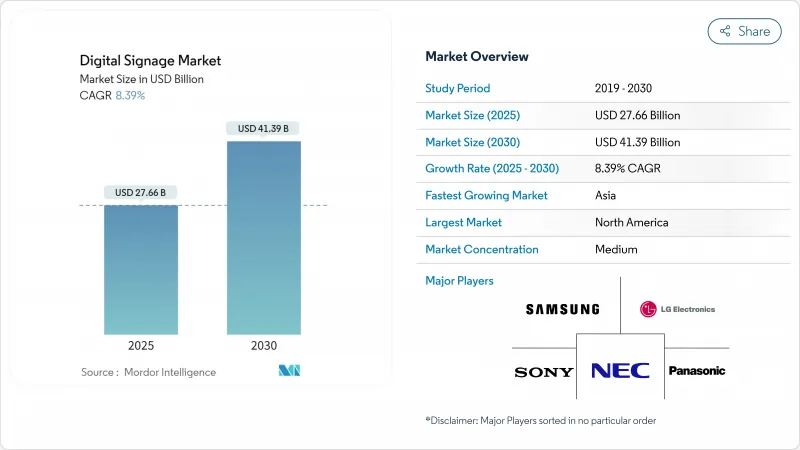

The digital signage market size stands at USD 27.66 billion in 2025 and is forecast to reach USD 41.39 billion by 2030, reflecting an 8.39% CAGR.

Consistent uptake of AI-driven content engines, 5G-enabled edge networks and energy-frugal MicroLED screens underpins this expansion. Large enterprises are using connected displays to unify communications across hybrid workplaces, while city authorities weave interactive boards into smart-city infrastructure to streamline mobility and public safety initiatives. Retailers intensify investment as audience-analytics platforms transform in-store screens into revenue-generating retail-media assets. At the same time, transportation operators deploy real-time passenger information systems that raise service quality.

Global Digital Signage Market Trends and Insights

AI-powered audience analytics boosting dynamic content personalisation

Retailers now replace one-size-fits-all loops with AI engines that adjust messaging in real time when shoppers approach. Computer-vision modules gauge age bracket, gender and engagement length, then trigger creative variants that can lift conversion by as much as 30%. Chains in the United States, United Kingdom, Germany and France link these insights with loyalty-app data to enrich omnichannel campaigns. Agencies pay premium CPMs for such precise exposure, turning store networks into high-margin media channels. Compliance with GDPR shapes rollout pace in Europe, yet vendors embed privacy-by-design workflows that anonymise video frames locally before analysis. These factors keep the digital signage market on a solid medium-term growth path.

5G + edge computing enabling real-time outdoor streaming

Transit authorities in Tokyo, Seoul, Singapore and Sydney use millimetre-wave 5G backbones to push ultra-low-latency video and emergency alerts to outdoor LED boards. On-device edge servers pre-cache high-resolution clips, cutting data transit cost and letting campaigns switch instantly when foot-traffic sensors spike. Studies for Asian transport hubs show productivity gains from 52% to 245% and cost savings up to 90% when 5G replaces legacy fibre. As more metros activate standalone 5G cores, the digital signage market receives an immediate uplift.

Fragmented CMS standards complicating multi-vendor interoperability

Global retailers often juggle screens from several brands yet find no common protocol for scheduling or analytics. The International Telecommunication Union warns that the lack of interoperability slows deployments and raises total ownership cost. Many firms therefore lock into single-vendor ecosystems, limiting competitive bids. Industry alliances are drafting APIs, but diverging roadmaps among vendors keep progress slow. This reality curbs near-term scalability for the digital signage market.

Other drivers and restraints analyzed in the detailed report include:

- EU corporate sustainability mandates accelerating energy-efficient displays

- Post-pandemic hybrid work models driving cloud dashboards

- Cyber-security vulnerabilities spotlighted by ransomware on transit displays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video walls dominated 2024 revenue with 28.1% share due to their immersive impact in control rooms and flagship retail settings. The digital signage market continues to favour their scale for brand theatre and corporate town-hall events. Demand also stays steady for digital posters in quick-serve restaurants because franchisees value simple content swaps.

Kiosks, however, offer the fastest 9.2% CAGR to 2030 as shoppers embrace self-checkout, wayfinding and loyalty enrollment on responsive touchscreens. Retailers in the digital signage market deploy AI modules that recommend add-ons at check-out, nudging ticket size. Transparent LCD enclosures carve a niche in luxury stores and automotive showrooms, merging product visibility with data overlays. Manufacturers now experiment with hybrid rigs that fuse multi-panel video walls and kiosk interaction for transit concourses.

Hardware parts generated 60.7% of 2024 turnover and remain foundational to the digital signage market, covering LED tiles, media players and mounting kits. Falling pixel costs keep capex manageable for refresh cycles every four-to-five years.

Software revenue is growing at a double-digit 10.5% CAGR as companies discover that content orchestration and analytics drive ROI. Cloud dashboards secure fleet uptime through remote diagnostics, while AI schedulers improve campaign relevance. Vendors integrate proof-of-play ledgers so advertisers can audit exposures, raising confidence in the digital signage market.

The Digital Signage Market Report is Segmented by Type (Video Wall, Video Screen, Kiosk, and More), Component (Hardware, Software, and Services), Deployment (On-Premise, Cloud-Based, and Hybrid), Screen Size (Below 32", 32"-52", and More), Location (In-store/Indoor, and Outdoor), End-Use Industry (Retail, Transportation, Hospitality, Corporate, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.4% 2024 income, anchored by United States corporate refurbishments that turned lobbies into digital-first showcases. Canadian retailers accelerate checkout modernisation, keeping regional demand steady. The digital signage market here benefits from mature cloud infrastructure that reduces deployment friction.

Asia-Pacific is on an 8.5% CAGR trajectory, propelled by China's city cluster projects, Japan's technology export push, India's mall boom and Southeast Asia's tourism recovery. An integrated supply chain for panels and ICs lowers unit costs, giving regional buyers price latitude that boosts the digital signage market's penetration.

Europe records stable gains supported by ecodesign mandates and high purchasing power. Historic-district signage caps add compliance effort, yet German and Nordic corporates adopt energy-class A displays, offsetting tourist-zone pauses. Eastern European airports compete for hub status through immersive wayfinding walls, expanding the digital signage market eastward.

- NEC Display Solutions Ltd.

- LG Display Co. Ltd.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Group Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview

- Cisco Systems Inc.

- Scala Inc.

- Broadsign International LLC

- Appspace Inc.

- BrightSign LLC

- Mvix Inc.

- Christie Digital Systems USA Inc.

- Daktronics Inc.

- Leyard Optoelectronic Co. Ltd.

- Unilumin Group Co. Ltd.

- JCDecaux SA

- E Ink Holdings Inc.

- Clear Channel Outdoor Holdings Inc.

- Sharp Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-powered audience analytics boosting dynamic content personalisation in North American and European retail and transit corridors

- 4.2.2 5G + edge computing enabling real-time outdoor streaming across major Asian and Oceanian transport hubs

- 4.2.3 EU corporate sustainability mandates accelerating adoption of energy-efficient MicroLED and e-paper signage

- 4.2.4 Post-pandemic hybrid work models driving cloud-based corporate communication dashboards in the USA

- 4.2.5 Smart-city mega-projects (NEOM, Dubai 2040) integrating large-format digital billboards across the Middle East

- 4.2.6 Retail-media monetisation strategies fuelling video-wall roll-outs by Latin-American big-box chains

- 4.3 Market Restraints

- 4.3.1 Fragmented CMS standards complicating multi-vendor interoperability for global retailers

- 4.3.2 High CAPEX and permitting hurdles for outdoor LED facades in historical European city centres

- 4.3.3 Cyber-security vulnerabilities spotlighted by ransomware on United States transit displays

- 4.3.4 Supply-chain price spikes in specialty driver-ICs for large panels

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Video Wall

- 5.1.2 Video Screen

- 5.1.3 Kiosk

- 5.1.4 Transparent LCD Screen

- 5.1.5 Digital Poster

- 5.1.6 Billboard

- 5.1.7 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 LCD/LED Display

- 5.2.1.2 OLED Display

- 5.2.1.3 MicroLED Display

- 5.2.1.4 Media Players

- 5.2.1.5 Controllers

- 5.2.1.6 Projector/Projection Screens

- 5.2.1.7 Other Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.3.1 Installation and Integration

- 5.2.3.2 Managed Services

- 5.2.3.3 Support and Maintenance

- 5.2.1 Hardware

- 5.3 By Deployment

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.3.3 Hybrid

- 5.4 By Screen Size

- 5.4.1 Below 32"

- 5.4.2 32"-52"

- 5.4.3 Above 52"

- 5.4.4 Ultra-large Above 100"

- 5.5 By Location

- 5.5.1 In-store/Indoor

- 5.5.2 Outdoor

- 5.6 By End-use Industry

- 5.6.1 Retail

- 5.6.2 Transportation

- 5.6.3 Hospitality

- 5.6.4 Corporate

- 5.6.5 Education

- 5.6.6 Healthcare

- 5.6.7 Government

- 5.6.8 Sports and Entertainment

- 5.6.9 Banking and Financial Services

- 5.6.10 Manufacturing Facilities

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 South America

- 5.7.3.1 Brazil

- 5.7.3.2 Rest of South America

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South-East Asia

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Gulf Cooperation Council Countries

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NEC Display Solutions Ltd.

- 6.4.2 LG Display Co. Ltd.

- 6.4.3 Samsung Electronics Co. Ltd.

- 6.4.4 Panasonic Corporation

- 6.4.5 Sony Group Corporation

- 6.4.6 Stratacache

- 6.4.7 Planar Systems Inc.

- 6.4.8 Hitachi Ltd.

- 6.4.9 Barco NV

- 6.4.10 Goodview

- 6.4.11 Cisco Systems Inc.

- 6.4.12 Scala Inc.

- 6.4.13 Broadsign International LLC

- 6.4.14 Appspace Inc.

- 6.4.15 BrightSign LLC

- 6.4.16 Mvix Inc.

- 6.4.17 Christie Digital Systems USA Inc.

- 6.4.18 Daktronics Inc.

- 6.4.19 Leyard Optoelectronic Co. Ltd.

- 6.4.20 Unilumin Group Co. Ltd.

- 6.4.21 JCDecaux SA

- 6.4.22 E Ink Holdings Inc.

- 6.4.23 Clear Channel Outdoor Holdings Inc.

- 6.4.24 Sharp Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment