PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849913

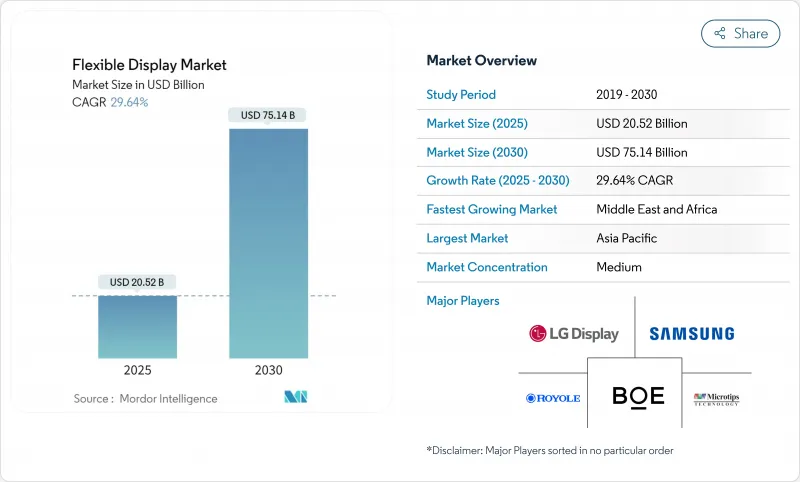

Flexible Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The flexible display market size stands at USD 20.52 billion in 2025 and is forecast to reach USD 75.14 billion by 2030, translating into a powerful 29.64% CAGR over the period.

The valuation leap signals a turning point in which scale economies, material breakthroughs and product design freedom converge to shift flexible panels from niche concepts into mainstream interfaces across consumer electronics, mobility and industrial environments. Production investments in Gen-8.6 OLED fabs, rapid rollable innovation and the migration of micro-LED into wearables are widening the addressable base, while regulatory pushes for glass-free modules spur fresh applications in Europe. Competitive intensity is rising as Chinese manufacturers expand capacity faster than Korean incumbents, challenging established cost structures and accelerating price declines. Simultaneously, integrated players that secure polyimide, encapsulation and hinge know-how are insulating themselves from supply shocks and litigation risk.

Global Flexible Display Market Trends and Insights

Rollable and foldable smartphone launch momentum in China and Korea

Shipments of flexible OLED smartphone panels climbed 26% in 2024 to 784 million units, underscoring how fresh form factors stimulate replacement demand.New tri-fold designs slated for late 2025 bring 360-degree rotation and ultra-thin glass that lowers crease visibility, intensifying brand differentiation. Chinese entrants scale quickly by matching hinge durability targets and shortening design-to-launch cycles, pressuring incumbents on price and innovation tempo. Component ecosystems around hinges, temperature-resistant polyimide and transparent cover films benefit directly. The upturn also spills into accessory and repair markets, creating incremental service revenue streams.

Premium-EV curved OLED cockpit adoption across Europe

Luxury electric vehicles elevate interior experience through expansive curved dashboards such as the EQS SUV Hyper-screen, which merges multiple displays under a continuous glass cover.Automotive OEMs prefer flexible OLED for its thin profile, uniform luminance and design latitude, leading to a surge in display-area per vehicle. Tier-1 suppliers deepen partnerships with panel makers to co-develop cockpit platforms, while software-defined vehicle strategies demand displays that support continuous over-the-air upgrades. As autonomous functionality matures, multi-modal interaction and stretchable pillar-to-pillar screens are set to multiply display square-meter consumption per car.

Gen-8+ polyimide yield losses elevating scrap costs

Scaling to larger mother-glass intensifies thermal stress on flexible PI substrates, driving defect-induced yield drops that inflate per-unit cost. Research on aerogel-reinforced PI fibers shows promise in lifting thermal stability yet industrial adoption remains nascent, leaving fabs exposed to expensive scrap during ramp-up.Yield recovery programmes now focus on real-time in-line metrology and AI-based predictive maintenance to shave defect density before mass output begins.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight AR/VR micro-OLED demand in North America

- Cost reduction from Gen-8.6 flexible OLED fabs in China

- Encapsulation material supply crunch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OLED held an 85% share of the flexible display market in 2024, leveraging emissive pixels that enable thinner, curve-friendly modules without backlights. Cost erosion from Chinese fabs and evaporator throughput gains have kept OLED the panel of choice for smartphones, watches and curved infotainment clusters. At the same time, micro-LED shipments are scaling from pilot to early mass production, posting a 36% forecast CAGR as quantum-dot colour converters, mass-transfer accuracy and repair yields improve. Automotive head-up displays and rugged wearables benefit first because micro-LED pushes brightness to 10,000 nits and delivers long lifetimes even under high thermal load, as evidenced by Tianma's 8-inch prototype. E-paper holds a niche in low-power signage and logistics tags, while quantum-dot LCD hybrids continue bridging price and colour-gamut gaps for mid-range devices.

OLED dominance faces three pressure points. First, inorganic micro-LED material longevity dilutes OLED's burn-in risk narrative. Second, Gen-8.6 cost advantages narrow the ASP gap between rigid and flexible OLED, nudging budget segments toward flexible form factors. Third, quantum-dot on-chip approaches are now compatible with roll-to-roll plastic substrates, seeding future competition in ultra-large transparent windows. Even so, ecosystem maturity, equipment depreciation and abundant supply keep OLED firmly in charge through the mid-term.

Foldable devices captured 71% of the flexible display market in 2024 and remain the volume engine as smartphone vendors race to iterate bi-fold, tri-fold and wrap-around formats. Patent barricades on hinge geometry and UTG lamination reinforce the lead of first movers yet do not preclude rivals that licence or innovate alternative kinematic stacks. Rollable screens, forecast to expand at a 39% CAGR, unlock spatial efficiency by retracting into compact housings, aligning with consumer demand for pocket-friendly yet expansive displays. Early notebook and tablet rollables demonstrate that motorised spools and stretch-limiting lamination can achieve repeatability over 30,000 actuations.

Bendable and conformable displays remain staples in curved edge phones, fitness bands and automotive radars thanks to their simpler mechanical loads. A nascent "form-factor free" class, enabled by stretchable substrate meshes and serpentine circuit patterns, is under active exploration for skin-adhesive health patches and soft robots. Academic output on stretchable displays jumped from 17 papers in 2014 to 197 in 2023, mirroring heightened R&D investment. While commercialisation lags, the progress sets the stage for ubiquitous ambient display surfaces later in the decade.

The Flexible Display Market Report is Segmented by Display Type (OLED, -Paper Display, and More), Form Factor (Foldable, Rollable, Bendable, Micro-LED, and More), Substrate Material (Glass, Plastic - Polyimide (PI), Plastic - PET/PEN, Metal Foil, and More), Application (Smartphones and Tablets, Smart Wearables, Televisions and Digital Signage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated with 57% revenue in 2024, propelled by dense manufacturing ecosystems in Korea, China and Taiwan that span PI resin synthesis to module assembly. China alone is adding 8% annual flexible OLED capacity through 2028 against Korea's 2% run-rate, lifting its share of global panel output from 68% to 74%. Regional policy incentives grant favourable land, tax and power terms to local champions, while domestic smartphone OEMs provide ready demand. This virtuous cycle cements supply-chain self-sufficiency and accelerates time-to-yield for new lines.

North America commands technology pull on account of its leadership in AR/VR, high-performance computing and premium notebook segments. US brands source OLED MacBook-class panels for 2026, compelling suppliers to qualify oxide TFT and tandem stack architectures that lengthen lifetime under static UI loads. Legal exposure arising from hinge patents remains a watch-item; however, players often settle or cross-licence to safeguard launch windows. Government grants for microelectronic reshoring may redirect portions of the ecosystem stateside, particularly in backplane and glass-free encapsulation tooling.

Europe exerts regulatory influence through the Ecodesign Regulation and the upcoming Digital Product Passport, pushing the industry toward recyclable structures and full material disclosure. Automotive clusters in Germany, Sweden and the United Kingdom adopt curved OLED clusters at a brisk pace, stimulating local integration, bonding and test partners. The continent's circular material use target of 24% by 2030 drives R&D into solvent-reduced PI, biodegradable adhesives and mechanical fasteners that enable easy separation.

The Middle East and Africa, while comparatively small, records the fastest growth at a 32% CAGR off expanding digital signage in transport hubs, sports arenas and leisure venues. Flexible LED film screens that conform to glass facades exemplify the architectural appetite for novel form factors. Government-backed smart-city projects and high ambient-light conditions make high-brightness micro-LED an attractive option. South America follows with rising smartphone penetration and automotive assembly plants beginning to specify flexible clusters for export models.

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- ROYOLE Corporation

- E Ink Holdings Inc.

- AU Optronics Corp.

- Sharp Corporation

- Innolux Corporation

- TCL CSOT

- Visionox Co., Ltd.

- Tianma Micro-electronics Co., Ltd.

- Truly International Holdings

- Japan Display Inc.

- Microtips Technology

- FlexEnable Technology Ltd.

- Plastic Logic Germany

- Chunghwa Picture Tubes Ltd.

- Shenzhen China Star Optoelectronics Technology

- Huawei Technologies Co., Ltd. (Panel R&D)

- Guangzhou OED Technologies Co., Ltd.

- Universal Display Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rollable and Foldable Smartphone Launch Momentum in China and Korea

- 4.2.2 Premium-EV Curved OLED Cockpit Adoption Across Europe

- 4.2.3 Demand Spike for Lightweight AR/VR Micro-OLED Panels in North America

- 4.2.4 Cost Reduction from Gen-8.6 Flexible OLED Fabs in China

- 4.2.5 EU Circular-Economy Push for Glass-Free Modules

- 4.2.6 Growth in Flexible Medical Wearables in Japan and South Korea

- 4.3 Market Restraints

- 4.3.1 Gen-8+ Polyimide Yield Losses Elevating Scrap Costs

- 4.3.2 Encapsulation Material Supply Crunch

- 4.3.3 US-Centric Patent Litigation on Foldable Hinges

- 4.3.4 Cold-Climate Reliability Issues of Plastic-LCD Signage

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Display Type

- 5.1.1 OLED

- 5.1.2 LCD

- 5.1.3 E-Paper Display (EPD)

- 5.1.4 Micro-LED

- 5.1.5 Quantum-Dot and Other Emerging Types

- 5.2 By Form Factor

- 5.2.1 Foldable

- 5.2.2 Rollable

- 5.2.3 Bendable

- 5.2.4 Conformable (Curved/Wrap-around)

- 5.3 By Substrate Material

- 5.3.1 Glass

- 5.3.2 Plastic - Polyimide (PI)

- 5.3.3 Plastic - PET/PEN

- 5.3.4 Metal Foil

- 5.3.5 Others (Polycarbonate, Ultra-thin Glass)

- 5.4 By Application

- 5.4.1 Smartphones and Tablets

- 5.4.2 Smart Wearables (Watches, Patches)

- 5.4.3 Televisions and Digital Signage

- 5.4.4 Personal Computers and Laptops

- 5.4.5 Automotive Cockpit and Infotainment

- 5.4.6 AR/VR Head-Mounted Displays

- 5.4.7 Industrial and Public Transport Displays

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 South East Asia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Display Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 BOE Technology Group Co., Ltd.

- 6.4.4 ROYOLE Corporation

- 6.4.5 E Ink Holdings Inc.

- 6.4.6 AU Optronics Corp.

- 6.4.7 Sharp Corporation

- 6.4.8 Innolux Corporation

- 6.4.9 TCL CSOT

- 6.4.10 Visionox Co., Ltd.

- 6.4.11 Tianma Micro-electronics Co., Ltd.

- 6.4.12 Truly International Holdings

- 6.4.13 Japan Display Inc.

- 6.4.14 Microtips Technology

- 6.4.15 FlexEnable Technology Ltd.

- 6.4.16 Plastic Logic Germany

- 6.4.17 Chunghwa Picture Tubes Ltd.

- 6.4.18 Shenzhen China Star Optoelectronics Technology

- 6.4.19 Huawei Technologies Co., Ltd. (Panel R&D)

- 6.4.20 Guangzhou OED Technologies Co., Ltd.

- 6.4.21 Universal Display Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment