PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849950

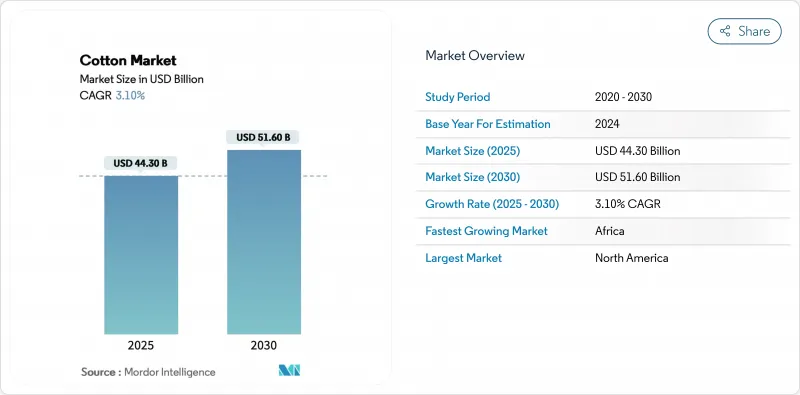

Cotton - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cotton Market size is estimated at USD 44.30 billion in 2025 and is projected to reach USD 51.60 billion by 2030, at a CAGR of 3.1% during the forecast period.

Ongoing sustainability mandates are encouraging growers to adopt precision agriculture tools, from satellite-guided seed placement to sensor-driven irrigation scheduling, to protect profitability while lowering resource footprints. The rise of traceability regulations, especially the Uyghur Forced Labor Prevention Act, is reshaping global sourcing maps and pushing merchants toward end-to-end digital visibility. Simultaneously, Better Cotton Initiative (BCI) certification is becoming a default procurement requirement among mass-market apparel retailers, shifting bargaining power toward compliant producers. Competitive pressure from cellulosic fibers remains a structural headwind, yet climate-smart irrigation upgrades and AI-enabled yield-forecasting systems are improving margin resilience for growers in developed economies.

Global Cotton Market Trends and Insights

Persistent Demand from Major Textile-Importing Hubs for High-Grade Lint

Bangladesh is poised to become the world's largest lint importer by 2025, with inbound volumes projected to touch 8 million bales as vertically integrated mills seek uniform fiber length and strength to meet premium yarn contracts. This concentration of demand in a handful of Asian manufacturing clusters supports stable price premiums for growers able to certify fiber characteristics with bale-level data. Vietnam remains a top destination despite tariff uncertainties, leveraging competitive labor costs and mature port logistics to offset policy risks. West African lint now satisfies a growing share of Bangladeshi consumption, 39% in fiscal 2022-23, driven by its high micronaire values and the ability of African merchants to guarantee pesticide-residue compliance at origin. These purchasing patterns help diversify global trade flows away from historical US-to-East-Asia corridors, reducing freight risk for mills and merchants alike.

Accelerating Shift to Better Cotton Initiative (BCI) Sourcing

More than 2.13 million farmers across 22 countries now operate under BCI protocols, making the program agriculture's largest independently verified sustainability scheme. Global retailers increased purchases of BCI-equivalent lint by 40% over the latest reporting cycle, turning what began as a voluntary commitment into a non-negotiable line item in supplier contracts. Beyond lower water and pesticide footprints, the standard embeds social safeguards such as gender-inclusion metrics, unlocking incremental development funding for smallholders in India and Pakistan. The mass-balance chain-of-custody model lets traders blend certified and conventional cotton while keeping transaction costs low, a feature that accelerates retailer adoption. Corporate announcements from H&M, Target, and Inditex to source 100% of cotton from verified sustainable programs by 2030 ensure durable forward-demand visibility for compliant ginners and merchants.

Escalating Pink-Bollworm Resistance to GM Traits

Research confirms that pink bollworm populations in India have developed multigenic resistance to dual-toxin Bt varieties, reducing field-level efficacy and driving up insecticide use. In China, resistance allele frequencies to Cry1Ac are rising, prompting regulators to mandate structured refuges and alternative gene stacking. Laboratory assays show retrotransposon-induced mutations in chitin synthase pathways, producing more than 5,000-fold resistance to Vip3Aa toxins in some strains. Scientists advocate seed mixtures containing 25% non-Bt seed to slow selection pressure, a practice now piloted across Gujarat under public-private extension programs. Biotechnology firms are experimenting with RNA-interference constructs and CRISPR-enabled edits that silence pest gut-enzyme synthesis, but commercial deployment remains at least five seasons away, leaving growers dependent on integrated pest-management protocols in the interim.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Recycled-Cotton Blend Adoption by Global Apparel Majors

- Climate-Smart Irrigation Investments in Developed Countries

- Tightening Traceability and Forced-Labor Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Cotton Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America accounts for 38.9% of global cotton value in 2024, the largest regional share worldwide. The region's dominance rests on precision-planting equipment, sensor-driven irrigation, and fully digitized classing offices that compress lead times from harvest to export vessel. Technology depth supports consistent fiber quality, enabling mills to minimize downtime and meet tighter tolerance specifications. Advanced traceability schemes such as permanent bale IDs improve compliance with forced-labor regulations, positioning North American lint as a low-risk choice for brands facing heightened scrutiny.

Africa's 5.60% CAGR projection embodies the continent's broader agricultural modernization narrative. Government subsidy programs covering seed, fertilizer, and insect-control inputs are paired with concessional-rate ginner financing, encouraging smallholders to expand acreage beyond staple grains. IMF field reports credit Benin's Special Economic Zone with catalyzing local yarn-spinning projects, a shift that captures more value domestically and hedges growers against raw-lint-price swings. Egypt continues to prioritize long-staple exports, but water constraints force policymakers to balance cotton with food-crop imperatives, prompting the adoption of high-efficiency drip networks and salt-tolerant cultivars to safeguard yield potential. As West African lint secures higher offtake in Bangladesh, merchants diversify sales portfolios, reducing exposure to single-buyer concentration risks.

Asia-Pacific still accounts for a substantial share of global output, yet structural hurdles temper its growth velocity. India's escalating pest-resistance cycle pushes research institutes toward stacked-trait seeds and mandatory refuge compliance, while Pakistan's climate-smart pilot plots record better returns driven by meter-level irrigation scheduling and integrated nutrient management. Australia's adoption of IoT-enabled deficit-irrigation strategies maintains lint yields despite tightening water allocations, sustaining export reliability into East-Asian markets. China remains a unique case: domestic consumption absorbs most of its harvest, and policymakers apply import-quota levers to manage price stability inside the textile sector. In contrast, Bangladesh's role as a top importer rather than a producer underscores the cotton market's realignment toward vertically specialized economies.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Persistent demand from major textile-importing hubs for high-grade lint.

- 4.2.2 Accelerating shift to Better Cotton Initiative (BCI) sourcing

- 4.2.3 Surge in recycled-cotton blend adoption by global apparel majors

- 4.2.4 Climate-smart irrigation investments in the developed countries

- 4.2.5 AI-enabled yield-forecasting tools lowering merchant risk

- 4.2.6 Rising import demand from emerging manufacturing clusters

- 4.3 Market Restraints

- 4.3.1 Escalating pink-bollworm resistance to GM traits

- 4.3.2 Tightening traceability and forced-labor regulations

- 4.3.3 Volatile ocean-freight rates impacting merchant margins

- 4.3.4 Competition from cellulosic fibers in fast fashion

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 South America

- 5.1.2.1 Brazil

- 5.1.2.2 Argentina

- 5.1.3 Europe

- 5.1.3.1 Germany

- 5.1.3.2 France

- 5.1.3.3 Russia

- 5.1.3.4 Greece

- 5.1.3.5 Italy

- 5.1.4 Asia-Pacific

- 5.1.4.1 China

- 5.1.4.2 India

- 5.1.4.3 Pakistan

- 5.1.4.4 Bangladesh

- 5.1.4.5 Australia

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Iran

- 5.1.5.3 Israel

- 5.1.6 Africa

- 5.1.6.1 Egypt

- 5.1.6.2 South Africa

- 5.1.6.3 Benin

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

7 Market Opportunities and Future Outlook