PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849964

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849964

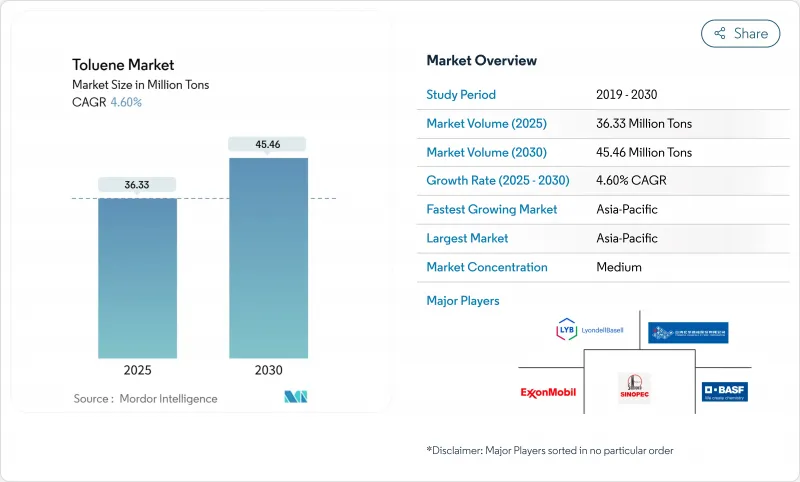

Toluene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Toluene Market size is estimated at 36.33 Million Tons in 2025, and is expected to reach 45.46 Million Tons by 2030, at a CAGR of 4.60% during the forecast period (2025-2030).

Demand growth reflects the chemical's versatility as an aromatic hydrocarbon used in downstream products such as benzene, xylene, and toluene diisocyanate (TDI), which feed diverse sectors from construction to electronics. Regulatory initiatives to reduce emissions accelerate process upgrades that improve energy efficiency and cut volatile organic compound (VOC) releases, supporting long-term competitiveness. Together, these trends underscore a shift toward integrated, sustainability-oriented supply chains that favor producers able to balance cost leadership with technology investments in cleaner processes.

Global Toluene Market Trends and Insights

Robust Polyurethane Foam Build-out in ASEAN Elevates TDI Consumption

Surging output of flexible foam for furniture, bedding, and vehicle seats is driving incremental TDI demand in Malaysia, Vietnam, and Thailand. Regional investments, such as Petronas' RAPID complex, increase local access to toluene-based intermediates, limiting import reliance. Producers are elevating crude-to-chemicals yields to expand aromatics output, placing toluene at the heart of regional polyurethane supply.

Octane-Boost Mandates in India and China Boost Reformate Toluene Intake

India's Bharat Stage VI and China 6 fuel norms demand higher anti-knock components, prompting refiners to raise reformate volumes enriched with toluene. Numaligarh Refinery's upgrade to 9 MTPA consolidates local supply, while Chinese integrated complexes channel more aromatics into gasoline blending pools. These moves absorb incremental toluene streams that might otherwise face oversupply, creating a cushion for refinery margins and lifting solvent-grade prices across Asia Pacific.

Tightening EU REACH VOC Restrictions on Aromatics

The European Union has intensified VOC thresholds, prompting paint, coating, and adhesive producers to reformulate away from aromatic solvents. Compliance costs rise through investment in abatement equipment and substitution with higher-priced low-VOC carriers. Market fragmentation emerges as multinational formulators rationalize product lines to accommodate EU and the United Kingdom limits, dampening regional toluene demand in consumer-facing applications

Other drivers and restraints analyzed in the detailed report include:

- Electronics-Grade Solvents Demand in Taiwan and South Korea

- Substitution of Methylene Chloride by Toluene in US Adhesives

- Volatility in Naphtha and Crude Spreads Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Benzene and xylene retained a 38% share of derivative consumption in 2024, underscoring their entrenched role in polyester, nylon, and specialty chemical chains. That leadership secures steady throughput for reformers and aromatics extractors even as margins fluctuate. Meanwhile, the toluene market size tied to TDI is projected to expand at a 5.45% CAGR from 2025-2030, reflecting robust furniture and bedding demand across emerging economies.

Benzaldehyde, benzoic acid, TNT, and niche derivatives carve specialized outlets, but collectively they account for a modest share of the toluene market volumes. Integrated producers balance this portfolio, leveraging economies of scale to supply both commodity and specialty customers.

The Toluene Market Report Segments the Industry by Derivative (Benzene and Xylene, Gasoline Additives, Toluene Diisocyanates (TDI), and Others), Application (Paints and Coatings, Adhesives and Inks, Chemical Industry, and Others), End-User Industry (Automotive, Construction, Oil and Gas, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons)

Geography Analysis

Asia Pacific controlled 55% of global volumes in 2024, and the region's 5.61% CAGR cements its status as the primary growth engine for the toluene market. Urbanization, construction booms, and rising vehicle penetration sustain derivative demand throughout ASEAN and South Asia.

North America is a mature yet innovative arena where regulatory decisions ripple globally. The United States is spearheading the phaseout of high-toxicity solvents, inadvertently favoring toluene in specific reformulations. Europe grapples with the strictest VOC rules, trimming solvent demand but stimulating research and development toward low-emission process chemistry.

The Middle East adds new barrels through world-scale mixed-xylene facilities in Saudi Arabia and the United Arab Emirates, positioning the region as a swing supplier for Asia. South America accounts for a smaller slice, yet Brazil's industrial recovery lifts regional appetite, especially for construction windows tied to major events and infrastructure drives.

- BASF

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- CPC Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corp

- Indian Oil Corporation Ltd

- INEOS

- LyondellBasell Industries Holdings B.V.

- Mangalore Refinery and Petrochemicals Limited

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Reliance Industries Limited

- SABIC

- Shell plc

- SK innovation Co., Ltd

- TotalEnergies

- Valero

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Polyurethane Foam Build-out in ASEAN Elevates TDI Consumption

- 4.2.2 Octane-Boost Mandates in India and China Boost Reformate Toluene Intake

- 4.2.3 Electronics-Grade Solvents Demand in Taiwan and South Korea

- 4.2.4 Substitution of Methylene Chloride by Toluene in US Adhesives

- 4.2.5 Rapid Capacity Addition of Aromatics Units in GCC Region

- 4.3 Market Restraints

- 4.3.1 Tightening EU REACH VOC Restrictions on Aromatics

- 4.3.2 Volatility in Naphtha and Crude Spreads Compressing Margins

- 4.3.3 Growing Bio-Based Solvent Adoption in North America

- 4.4 Value Chain Analysis

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Regulatory Analysis

- 4.8 Trade Analysis

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Degree of Competition

- 4.10 Price Index

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Benzene and Xylene

- 5.1.2 Gasoline Additives

- 5.1.3 Toluene Diisocyanates (TDI)

- 5.1.4 Other Derivatives (Benzoic Acid, Trinitrotoluene (TNT), Benzaldehyde)

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Inks

- 5.2.3 Chemical Industry

- 5.2.4 Explosives

- 5.2.5 Other Applications (Pharmaceuticals, Solvents and Degreasers, Dyes and Pigments)

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Oil and Gas

- 5.3.4 Military and Defense

- 5.3.5 Other End-user Industries (Electronics, Consumer Products)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Braskem

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 CNPC

- 6.4.6 CPC Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Formosa Chemicals & Fibre Corp

- 6.4.9 Indian Oil Corporation Ltd

- 6.4.10 INEOS

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Mangalore Refinery and Petrochemicals Limited

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Mitsui Chemicals, Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 SABIC

- 6.4.17 Shell plc

- 6.4.18 SK innovation Co., Ltd

- 6.4.19 TotalEnergies

- 6.4.20 Valero

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment