PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849976

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849976

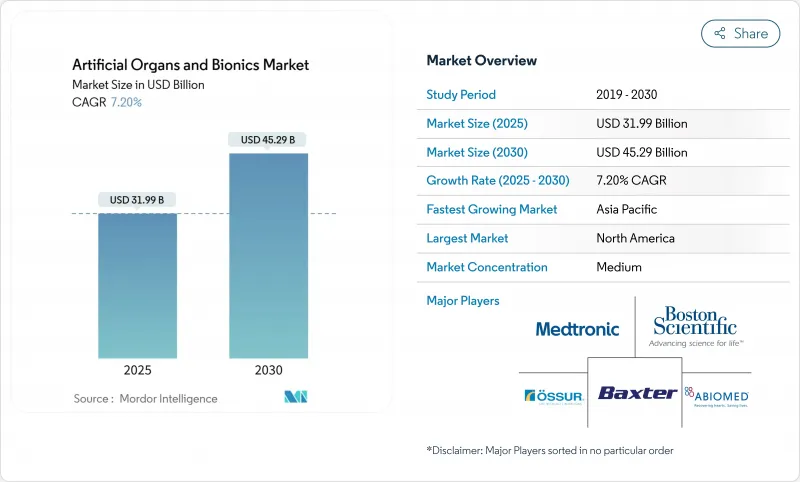

Artificial Organs And Bionics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The artificial organs and bionics market is worth USD 31.99 billion in 2025 and is forecast to reach USD 45.29 billion in 2030, advancing at a 7.20% CAGR.

Size expansion is being shaped by converging breakthroughs in biomaterials, miniaturized electronics, and 3-D bioprinting, all of which compress development timelines and lift clinical adoption of cardiovascular, renal, and neuro-prosthetic devices. Stretched transplant waiting lists and fast-track regulatory programs are spurring investment in total artificial hearts, wearable artificial kidneys, and next-generation brain-computer interfaces. Defense-funded limb-restoration programs have unlocked neural-interface know-how that is flowing into civilian solutions, while insurers' gradual acceptance of home-based bionic therapies broadens the treated population. Supply-chain fragilities surrounding rare-earth sensors and high-end chips remain a watchpoint, yet growing regional manufacturing footprints in Asia-Pacific are easing part of that exposure.

Global Artificial Organs And Bionics Market Trends and Insights

Rising Incidence of Chronic Organ Failure & Disabilities

Degenerative ailments are swelling the addressable pool for cardiac assist devices, renal replacements, and neuro-prosthetics. Cardiovascular disease affects 49 million people in the EU, energising demand for mechanical circulatory support systems. Japan's insulin-producing iPS-cell trials underscore momentum behind a bioartificial pancreas for 139,000 local type 1 diabetes patients. Ageing populations translate into rising stroke-related motor deficits, setting the stage for brain-computer interfaces that restore communication and mobility. The U.S. Department of Veterans Affairs is backing 25 prosthetics-oriented projects in FY 2025, signalling continuing long-term demand.

Scarcity of Donor Organs

More than 103,000 Americans wait for transplants; in Japan, fewer than 3% of organ-failure patients receive brain-dead donations, reinforcing demand for alternatives. FDA-sanctioned pig-organ trials in 2025 are emblematic of the shift toward xenotransplantation. Bridge-to-transplant devices such as the Carmat Aeson artificial heart have kept 30 European patients alive for an average of 156 days. China's 45-gram pediatric artificial heart answers an acute need in children's cardiac support.

High Procedure & Device Cost

Robotic knees can reach USD 51,000, and private insurers often cap prosthetic reimbursement, leaving patients exposed to six-figure out-of-pocket bills. Colorado's Medicare-parity law illustrates patchy progress on coverage mandates. Total artificial heart therapy, including surgery and follow-up, can surpass USD 500,000 per person, restricting uptake to high-resource centers. The cost barrier is sharper in emerging markets, where reimbursement rates lag device prices.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Biomaterial, Micro-Electronics & 3-D Bio-Printing Advances

- Defence-Funded Limb-Restoration Programmes (Post-2024)

- Biocompatibility Issues & Device Malfunctions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Artificial organs commanded 70.26% of the artificial organs and bionics market in 2024 as transplant shortages sustained demand for ventricular assist devices and emerging bioartificial kidneys. Bionics is tracking an 8.25% CAGR to 2030, aided by miniaturised brain-computer interfaces that now facilitate speech and fine-motor control. The artificial organs and bionics market size for heart devices alone is projected to expand at 7.8% CAGR, supported by FDA breakthrough tags for titanium total artificial hearts.

Clinical momentum is evident in renal assist systems where Roivios obtained breakthrough designation and is preparing U.S. pivotal trials. Bio-printed liver constructs and gene-edited pig livers are progressing through early-phase studies, signalling pipeline depth. Neuro-bionics growth is amplified by AI-driven control algorithms that adapt in milliseconds to user intent. Collectively, these innovations anchor long-term revenue visibility across the artificial organs and bionics market.

The Artificial Organs and Bionics Market Report is Segmented by Device Type (Artificial Organs [Artificial Heart, Artificial Kidney, and More] and Bionics [Vision Bionics, Ear Bionics, and More]), Technology (Implantable Devices and Wearable Devices), End User (Hospitals & Surgical Centres, Home-Care and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.82% share of the artificial organs and bionics market in 2024 on the back of an established FDA fast-track framework and robust venture funding. Investors topped USD 2 billion in disclosed U.S. deals during 2024, half of which went to cardiac and neuro-prosthesis start-ups. The region's mature reimbursement infrastructure continues to favour early adoption, yet price sensitivity is rising as payers scrutinise cost-effectiveness.

Asia-Pacific is the fastest-growing region with a 10.62% CAGR, catalysed by Japan's universal artificial blood that maintains two-year shelf life across all blood types. China's triple-integrated brain-spine interface enabled paraplegic patients to regain over-ground walking within weeks, positioning domestic players at the cutting edge of neuro-prosthetics. Pediatric device innovation is also notable: a 45-gram artificial heart designed for small children filled a vital niche, reinforcing regional clinical leadership.

Europe sustains a technology leadership role through companies such as Carmat, whose Aeson artificial heart received CE marking as a bridge-to-transplant therapy. German transplant centres reported the first fully implantable artificial-heart discharge to home care, broadening real-world validation. Parallel initiatives in organ-preservation perfusion systems further tighten the supply-demand gap for donor organs, keeping Europe firmly inside the high-innovation quadrant of the artificial organs and bionics market.

- Abbott Laboratories

- Abiomed

- Asahi Kasei Medical

- Baxter

- Berlin Heart

- Boston Scientific

- Cochlear

- CYBERDYNE

- Ekso Bionics

- Edward Lifesciences

- Getinge

- MED-EL

- Medtronic

- Ossur

- Ottobock

- Second Sight Medical Products

- SynCardia Systems

- Sonova

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Chronic Organ Failure & Disabilities

- 4.2.2 Scarcity Of Donor Organs

- 4.2.3 Rapid Biomaterial, Micro-Electronics & 3-D Bio-Printing Advances

- 4.2.4 Defence-Funded Limb-Restoration Programmes (Post-2024)

- 4.2.5 Fast-Track Regulatory Pathways (FDA BTD, EU MDR Art 117)

- 4.3 Market Restraints

- 4.3.1 High Procedure & Device Cost

- 4.3.2 Biocompatibility Issues & Device Malfunctions

- 4.3.3 Supply-Chain Fragility Of Rare-Earth Sensors & Chips

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Artificial Organs

- 5.1.1.1 Artificial Heart

- 5.1.1.2 Artificial Kidney

- 5.1.1.3 Artificial Lungs

- 5.1.1.4 Artificial Liver

- 5.1.1.5 Artificial Pancreas

- 5.1.1.6 Others

- 5.1.2 Bionics

- 5.1.2.1 Vision Bionics

- 5.1.2.2 Ear Bionics

- 5.1.2.3 Orthopedic Bionics

- 5.1.2.4 Cardiac Bionics

- 5.1.2.5 Neural Bionics

- 5.1.1 Artificial Organs

- 5.2 By Technology

- 5.2.1 Implantable Devices

- 5.2.2 Wearable / Extracorporeal Devices

- 5.3 By End User

- 5.3.1 Hospitals & Surgical Centres

- 5.3.2 Specialty & Rehabilitation Clinics

- 5.3.3 Home-care & Ambulatory Settings

- 5.3.4 Military & Veterans Care Systems

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Abiomed

- 6.3.3 Asahi Kasei Medical

- 6.3.4 Baxter International

- 6.3.5 Berlin Heart

- 6.3.6 Boston Scientific Corporation

- 6.3.7 Cochlear Ltd

- 6.3.8 CYBERDYNE

- 6.3.9 Ekso Bionics

- 6.3.10 Edwards Lifesciences

- 6.3.11 Getinge AB

- 6.3.12 MED-EL

- 6.3.13 Medtronic plc

- 6.3.14 Ossur

- 6.3.15 Ottobock

- 6.3.16 Second Sight Medical

- 6.3.17 SynCardia Systems

- 6.3.18 Sonova

- 6.3.19 Zimmer Biomet

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment