PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849996

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849996

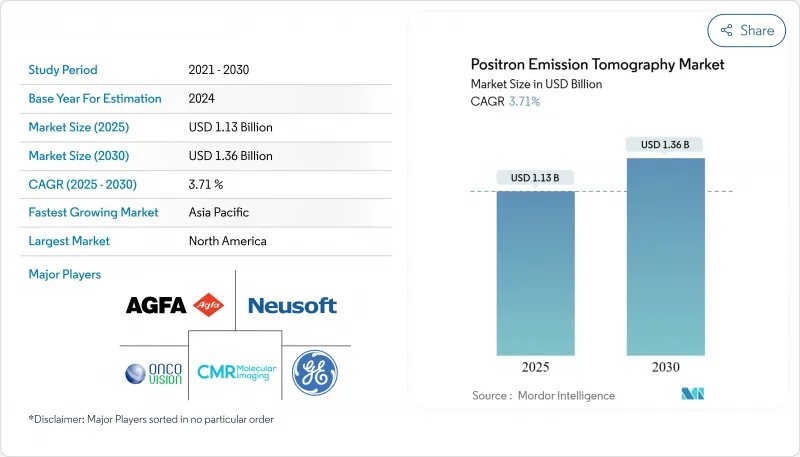

Positron Emission Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Positron Emission Tomography Market Size in 2025 stands at USD 1.13 billion, and it is projected to advance to USD 1.36 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.71 %.

Robust demand for high-sensitivity molecular imaging and accelerating adoption in precision oncology explain the steady expansion.

The Positron Emission Tomography market size edges upward because health systems view molecular imaging as indispensable for precision oncology, dementia care, and ischemic-heart disease protocols. Mature hospitals are swapping decade-old scanners for total-body units whose 194 cm axial field of view multiplies detector sensitivity tenfold, enabling whole-body scans in under a minute and slashing tracer dose by 80 % . Emerging economies, meanwhile, use concessional loans to establish their first cyclotrons, ensuring isotope supply that underpins equipment orders. Vendors reinforce uptake by structuring pay-per-use service contracts that minimize upfront capital exposure for outpatient chains.

Artificial-intelligence integration creates a second growth pillar. Cloud-hosted algorithms now identify six cancer types on PET/CT in seconds, relieving radiologist bottlenecks and raising diagnostic confidence . Providers infer that software-bundled scanners unlock throughput gains without extra staff, which aligns with pressure to keep imaging reimbursements flat. As a result, procurement teams assess lifetime-value metrics that combine detector performance with algorithm update road maps, reshaping competitive bids.

Global Positron Emission Tomography Market Trends and Insights

Rising Global Burden of Cancer and Neurodegenerative Diseases

Cancer incidence keeps climbing, and the numbers are stark. In the United States alone, the American Cancer Society estimated 1,918,030 new cancer diagnoses for 2022, encompassing 290,560 new breast-cancer cases, 268,490 prostate-cancer cases, and 151,030 colorectal-cancer diagnoses . PET's strength in detecting metabolic changes ahead of structural abnormalities positions it as an indispensable tool for early staging and therapy monitoring. On the neurology front, researchers at Fudan University validated tracers that visualize a-synuclein aggregates in Parkinson's disease, raising expectations for earlier interventions. Increasing clinical familiarity with these capabilities keeps scanner utilization rates high and underpins hospital commitments to periodic technology refreshes.

Growing Technological Advancements

Total-body scanners such as the 194 cm-long uEXPLORER deliver ten-fold sensitivity improvements, enabling whole-body acquisitions in under one minute while cutting tracer dose by more than 80%. Providers infer that such gains translate into higher patient throughput without additional staff hours, boosting economic justification for upgrades. Furthermore, the NeuroEXPLORER achieves 1.64 mm spatial resolution, allowing visualization of brain structures previously below detection thresholds. Integration of these platforms with AI tumor-detection tools is shortening report turnaround times, an operational benefit that health systems increasingly quantify when approving capital budgets.

Shorter Half-Life of Radioisotopes

The 110-minute half-life of 18F limits transport distances, creating service gaps in rural markets. Solutions range from compact cyclotrons like GE HealthCare's MINItrace Magni to newer tracers such as 61Cu-PSMA with a 3.33-hour half-life, which broaden distribution radii. Providers interpret these developments as early evidence that dependency on centralized production may gradually loosen, reshaping competitive dynamics among isotope suppliers.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for PET Analysis in Radiopharmaceuticals

- Shift Towards Image-Guided Interventions

- Government Reimbursement for 68Ga-PSMA PET in Prostate Cancer

- Stringent Regulatory Framework

- Limited Skilled Nuclear Medicine Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full-ring scanners hold 71% Positron Emission Tomography market share in 2024, and their market size advantage stems from unmatched sensitivity and whole-body coverage. Sites count on premium image quality to support difficult oncology cases, which reinforces the purchasing rationale despite higher upfront costs. A logical corollary is that facilities aiming for research prestige almost invariably opt for full-ring designs.

Partial-ring systems exhibit a 4.5% CAGR through 2030 as they target neurologic and orthopedic subspecialties needing compact footprints. Cost savings and focused field-of-view translate into lower break-even procedure volumes, making these units attractive to ambulatory surgical centers. The rise of dedicated brain PET iterates how specialized hardware can coexist with flagship whole-body systems inside the same network, diversifying revenue sources without cannibalizing existing assets.

PET/CT accounts for 81% of the Positron Emission Tomography market size in 2024 because its fusion of metabolic and anatomical detail underpins standardized cancer staging protocols. The modality benefits from a large installed base, which supports service revenue for vendors.

PET/MRI posts the fastest growth at 4.9% CAGR as radiation-sensitive cohorts like pediatrics gravitate toward lower dose options. Evidence showing superior soft-tissue contrast for gastric cancers further consolidates its value proposition. Hospitals thus weigh PET/MRI as an investment that simultaneously advances clinical outcomes and ESG-linked radiation-exposure objectives.

The Positron Emission Tomography Market Report Segments the Industry Into by Product Type (Full Ring PET Scanners, Partial Ring PET Scanners), by Application (Cardiology, Neurology, Oncology, Other Applications), by End-User (Hospitals, Diagnostic Centers, Other End-Users), and by Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America).

Geography Analysis

North America remains the largest regional contributor, holding 38.9 % Positron Emission Tomography market share in 2024. U.S. fixed PET sites recorded a 10.2 % year-on-year scan increase, averaging 1,495 studies per system. Domestic manufacturing of the Omni Legend PET/CT in Wisconsin underscores policy momentum favoring on-shore supply chains. A policy-induced inference is that localized production buffers the market against geopolitical shocks affecting component flow.

Asia-Pacific posts the fastest regional CAGR at 5.2 % through 2030, buoyed by government infrastructure investments and rising chronic-disease burdens. China's Mid- and Long-Term Development Plan for medical isotopes catalyzes domestic tracer innovation, and Sun Yat-sen University Cancer Center has already logged over 30,000 total-body PET/CT studies. Such volume density suggests that economies of scale may soon tilt radiopharmaceutical pricing downward, enhancing affordability for neighboring markets.

Europe delivers steady demand anchored by research collaborations like the €25.3 million Thera4Care consortium led by GE HealthCare. However, heterogeneous rules governing in-house tracer production create compliance overheads that fragment supplier strategies. The PRISMAP radionuclide-production alliance aims to harmonize supply, and its progress will likely influence scanner-procurement timelines as centers align purchases with anticipated isotope availability.

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Canon

- United Imaging Healthcare Co. Ltd.

- Mediso

- CMR Naviscan

- Bruker

- Positron

- Spectrum Dynamics Medical Ltd.

- Agfa HealthCare NV

- Segami

- SOFIE Biosciences, Inc.

- Eckert & Ziegler Strlzg AG

- Neusoft Medical Systems Co. Ltd.

- Hitachi

- Hyperfine, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global burden of cancer and neurodegenerative diseases

- 4.2.2 Growing technological advancements

- 4.2.3 Expansion of cyclotron and centralized radiopharmacy networks

- 4.2.4 Increasing demand for PET analysis in radiopharmaceuticals

- 4.2.5 Shift towards image-guided interventions

- 4.2.6 Government Reimbursement for 68Ga-PSMA PET in Prostate Cancer (Australia, Germany)

- 4.3 Market Restraints

- 4.3.1 Shorter half life of radioisotopes

- 4.3.2 Stringent regulatory guide

- 4.3.3 Limited Skilled Nuclear Medicine Workforce in Sub-Saharan Africa

- 4.3.4 Delayed FDA Approval Pathways for Novel Alpha-Emitter Tracers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter-s Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Full-Ring PET Scanners

- 5.1.2 Partial-Ring PET Scanners

- 5.2 By Modality

- 5.2.1 Stand-Alone PET

- 5.2.2 PET/CT

- 5.2.3 PET/MRI

- 5.3 By Radiotracer / Isotope

- 5.3.1 18F-Fluorodeoxyglucose (18F-FDG)

- 5.3.2 68Ga-Based Tracers (DOTATATE, PSMA)

- 5.3.3 82Rb & 13N-Ammonia (Cardiac)

- 5.3.4 64Cu & Zirconium-89 Immuno-PET

- 5.4 By Application

- 5.4.1 Oncology

- 5.4.2 Cardiology

- 5.4.3 Neurology

- 5.4.4 Inflammation & Other

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Diagnostic Imaging Centers

- 5.5.3 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 GE HealthCare

- 6.4.2 Siemens Healthineers AG

- 6.4.3 Koninklijke Philips N.V.

- 6.4.4 Canon Medical Systems Corp.

- 6.4.5 United Imaging Healthcare Co. Ltd.

- 6.4.6 Mediso Ltd.

- 6.4.7 CMR Naviscan Corporation

- 6.4.8 Bruker Corporation

- 6.4.9 Positron Corporation

- 6.4.10 Spectrum Dynamics Medical Ltd.

- 6.4.11 Agfa HealthCare NV

- 6.4.12 Segami Corporation

- 6.4.13 SOFIE Biosciences, Inc.

- 6.4.14 Eckert & Ziegler Strlzg AG

- 6.4.15 Neusoft Medical Systems Co. Ltd.

- 6.4.16 Hitachi Ltd.

- 6.4.17 Hyperfine, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment