PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850000

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850000

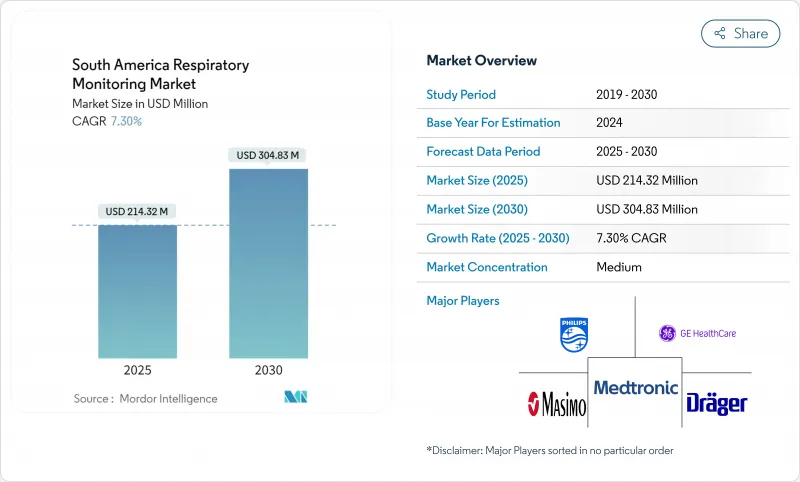

South America Respiratory Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American respiratory monitoring market stands at USD 214.32 million in 2025 and is on track to reach USD 304.83 million by 2030, advancing at a 7.3% CAGR.

Digitization lessons learned during the pandemic, supportive regulatory shifts, and an aging population living longer with chronic respiratory diseases jointly underpin this steady expansion. Governments are simplifying device approvals, broadband penetration is enabling real-time data transfer, and patients are seeking continuous, home-based care that blends hardware with cloud analytics. Together, these trends are accelerating product rollout, broadening clinical applications, and opening new commercial pathways across the region. Brazil's health ministry confirmed the lowest COVID-19 case load since 2020 in early 2025, yet national agendas still prioritize respiratory readiness, screening, and surveillance programs. Colombia's 192% surge in respiratory telecare visits during the pandemic left a lasting digital foundation. COPD prevalence in Greater Sao Paulo sits at 15.8%, with 87.5% of cases undiagnosed, underscoring a large latent market for screening equipment. Capnographs, AI-enabled wearables, and cloud-connected platforms are gaining momentum, while home-care services record double-digit growth as reimbursement frameworks widen.

South America Respiratory Monitoring Market Trends and Insights

Rising COPD and Asthma Prevalence

Chronic respiratory conditions remain the region's most persistent health challenge. COPD affects 15.8% of adults over 40 in Sao Paulo, and 48.4% of diagnosed patients across Argentina, Brazil, and Colombia recorded at least one severe exacerbation during a five-year follow-up, raising hospital readmission rates and costs. Mining-linked pneumoconiosis reaches 42.3% among underground workers in Cundinamarca, Colombia, reinforcing the need for continuous occupational monitoring. South America's demographic shift toward older age groups, compounded by urban pollution, ensures COPD and asthma remain primary growth engines for the South American respiratory monitoring market.

Increasing Adoption of Home-Based Respiratory Monitoring

Telemonitoring first scaled during COVID-19 and has since matured into a standard care pathway. The Brazilian Association of Sleep Medicine formalized tele-PAP guidelines that improved equipment adherence and lowered clinic load.Home sleep tests validated by the ELSA-Brasil cohort showed strong diagnostic concordance, proving that reliable results do not require lab settings. Chile's chronic respiratory home-care pilots reported higher patient satisfaction and better quality-of-life scores, bolstering payer confidence. With broadband and smartphone penetration climbing, clinicians can now supervise treatment plans remotely, fueling growth in the South American respiratory monitoring market.

High Capital Cost of Advanced Devices

State hospitals and rural clinics struggle to fund AI-ready platforms that cost multiples of basic spirometers. Cheaper pulse oximeters often lack clinical validation, while premium sensors remain out of reach for many facilities, delaying technology refresh cycles. Supply-chain constraints and currency volatility add further pressure, tempering immediate penetration rates inside the South American respiratory monitoring market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Shift Toward Wearable/Connected Devices

- Expansion of Tele-Pulmonology Reimbursement in South America

- Limited Reimbursement for Diagnostic Procedures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spirometers remain the cornerstone of pulmonary evaluation, accounting for 33.3% of 2024 revenues. Rigorous guidelines from the Latin American Thoracic Association standardize test protocols and secure ongoing purchases for primary and secondary care centers. Peak-flow meters support routine self-management, whereas full polysomnography systems address a growing sleep-disorder workload.

Capnographs post the fastest 14.3% CAGR thanks to integrations within multi-parameter monitors that visualize ventilation in real time. Partnerships such as Masimo and Philips expand installed bases in ICUs and surgical suites, reinforcing networked care models. Pulse oximetry continues to spread through home-care packs, while niche research sensors cater to specialized procedures.

Conventional table-top hardware held 34.5% of the South American respiratory monitoring market share in 2024. Hand-held devices add portability for outpatient screening, and wireless adapters streamline data uploads to electronic records. Yet the momentum clearly favors intelligent, cloud-connected systems, which exhibit a 16.9% CAGR. Smart masks and AI-driven ventilator algorithms convert high-frequency data into forecasts of decompensation, allowing timely intervention. Vendors that combine firmware updates, analytics dashboards, and secure cloud storage continue to outpace pure hardware rivals in the South American respiratory monitoring market.

The South America Respiratory Monitoring Market is Segmented by Device Type (Spirometers, Peak Flow Meters, and More), Technology (Conventional Table-Top, Hand-Held, Wearable, and More), End User (Hospitals & ICUs, Ambulatory Clinics, and More), Application (COPD, Asthma, Sleep Apnea, and More), and Country (Brazil, Argentina, and Rest of South America). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Medtronic

- Dragerwerk

- Koninklijke Philips

- Resmed

- GE HealthCare Technologies Inc.

- Nihon Kohden

- Beckton Dickinson

- Hamilton Medical

- Masimo

- Nonin Medical

- Mindray Bio-Medical Electronics Co., Ltd.

- Fisher & Paykel Healthcare

- Smiths Group

- Vyaire Medical

- Hillrom / Baxter International Inc.

- Schiller

- WEINMANN Emergency Medical Technology

- LivaNova

- Aerogen Ltd.

- Nihon Kohden

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising COPD And Asthma Prevalence

- 4.2.2 Increasing Adoption Of Home-Based Respiratory Monitoring

- 4.2.3 Technological Shift Toward Wearable/Connected Devices

- 4.2.4 Expansion Of Tele-Pulmonology Reimbursement In South America

- 4.2.5 Stricter Occupational-Safety Norms In Mining And Agribusiness

- 4.2.6 Government Programs For Early COPD Detection

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Advanced Devices

- 4.3.2 Limited Reimbursement For Diagnostic Procedures

- 4.3.3 Poor Last-Mile Logistics In Amazon And Andean Interiors

- 4.3.4 Shortage Of Trained Pulmonary Technicians

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Spirometers

- 5.1.2 Peak Flow Meters

- 5.1.3 Sleep Test/Polysomnography Devices

- 5.1.4 Gas Analyzers

- 5.1.5 Pulse Oximeters

- 5.1.6 Capnographs

- 5.1.7 Other Devices

- 5.2 By Technology

- 5.2.1 Conventional Table-top

- 5.2.2 Hand-held

- 5.2.3 Wearable / Patch-based

- 5.2.4 Wireless-enabled (Bluetooth/Wi-Fi)

- 5.2.5 AI-integrated & Cloud-connected

- 5.3 By End-user

- 5.3.1 Hospitals & ICUs

- 5.3.2 Ambulatory Surgical & Specialty Clinics

- 5.3.3 Sleep Laboratories & Diagnostic Centres

- 5.3.4 Home-Care Settings

- 5.3.5 Occupational Health & Industrial Sites

- 5.4 By Application

- 5.4.1 COPD

- 5.4.2 Asthma

- 5.4.3 Sleep Apnea

- 5.4.4 Pulmonary Fibrosis & ILD

- 5.4.5 Respiratory Infections (incl. COVID-19)

- 5.4.6 Others

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Dragerwerk AG & Co. KGaA

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 ResMed Inc.

- 6.3.5 GE HealthCare Technologies Inc.

- 6.3.6 Nihon Kohden Corporation

- 6.3.7 Becton, Dickinson and Company

- 6.3.8 Hamilton Medical AG

- 6.3.9 Masimo Corporation

- 6.3.10 Nonin Medical Inc.

- 6.3.11 Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.12 Fisher & Paykel Healthcare Ltd.

- 6.3.13 Smiths Medical (ICU Medical)

- 6.3.14 Vyaire Medical Inc.

- 6.3.15 Hillrom / Baxter International Inc.

- 6.3.16 Schiller AG

- 6.3.17 WEINMANN Emergency Medical Technology

- 6.3.18 LivaNova PLC

- 6.3.19 Aerogen Ltd.

- 6.3.20 Nihon Kohden

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment