PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850016

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850016

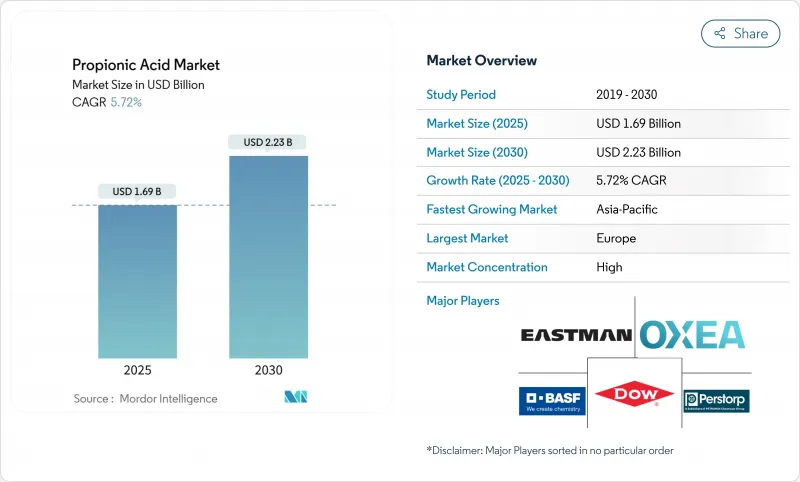

Propionic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The propionic acid market is valued at USD 1.69 billion in 2025 and is projected to reach USD 2.23 billion by 2030, advancing at a 5.72% CAGR.

Adoption gains arise from the compound's broad utility in food preservation, animal nutrition, and specialty chemicals, while regulatory support such as the United States FDA's GRAS status underpins global usage. Europe anchors demand with entrenched food-safety rules and mature grain preservation chains, whereas Asia-Pacific posts the fastest expansion on the back of livestock intensification and rising packaged-food consumption. Feed efficiency demands, zero-antibiotic livestock initiatives, and the shift toward bio-based production routes collectively shape investment flows, even as petrochemical pathways maintain scale advantages. Strategic capacity additions in China, India, and Southeast Asia indicate a pivot toward regional self-sufficiency, partly propelled by recent trade frictions that heightened supply-security concerns.

Global Propionic Acid Market Trends and Insights

Rising demand for grain and silage preservatives

Climate variability magnifies moisture-related spoilage risks in stored grain and silage, prompting wider use of propionic acid for mold control. Doses as low as 0.6% curb Aspergillus and Penicillium growth, safeguarding feed quality during long storage intervals. Buffered formulations alleviate corrosion concerns, fostering uptake by medium-sized farms previously hesitant to employ acids. Field data show that treated grain can cut dry-matter losses by 15%, translating to tangible margin protection for grain handlers. As cross-border trade lengthens logistics chains, storage stability becomes pivotal, reinforcing the propionic acid market as a core enabler of global food-security strategies.

Increasing uptake of feed-grade acids in antibiotic-free meat chains

With regulators phasing out antibiotic growth promoters, producers pivot toward organic acids that sustain feed conversion improvements. Inclusion levels of 0.2-0.4% propionic acid in broiler diets lower gastrointestinal pH and suppress Salmonella and E. coli counts, rivalling antibiotic performance outcomes. European mandates against routine antibiotics have already boosted acidifier demand, and North American retail premiums for antibiotic-free meat reinforce adoption. Feed mills thus integrate propionic acid into reformulated premixes, driving incremental volumes that underpin the long-run resilience of the propionic acid market.

Volatile petro-based feedstock prices (propylene)

Sudden swings in crude oil markets reverberate through propylene contracts, inflating production costs for petrochemical propionic acid plants. European makers, constrained by limited regional propylene output, face margin compression during price spikes. While long-term contracts dampen volatility for large players, smaller producers grapple with working-capital strain, periodically trimming operating rates to manage exposure. These episodes renew corporate interest in bio-based routes, yet fermentation economics remain challenged relative to entrenched propylene pathways. Cost turbulence, therefore, imposes a modest drag on propionic acid market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of packaged bakery in emerging Asia

- Growing requirement for food preservation products

- Health concerns over chronic consumption in ultra-processed foods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Animal feed and food preservative uses held 51.86% share of the propionic acid market in 2024, underscoring its role in mitigating spoilage and boosting feed efficiency. Within this anchor segment, buffered salts such as calcium propionate remain prevalent for operational safety and ease of handling. At the other end of the spectrum, cellulose acetate propionate, although niche, posts a 6.49% CAGR through 2030 as electronics coatings and controlled-release pharmaceutical excipients gain traction. Its higher unit price cushions volume volatility, supplying margin diversity that reinforces overall propionic acid market stability.

Derivative uses in herbicides and specialty solvents continue but face environmental scrutiny, leading formulators to emphasize biodegradability and limited residual toxicity. Plasticizer manufacturers trial bio-based propionic acid to differentiate products, aligning with circular-economy narratives. While volumes lag mainstream feed applications, such specialty niches frequently deliver double-digit contribution margins, supporting producers' balanced revenue mix. The breadth of end-use verticals thus insulates the propionic acid market against isolated demand shocks.

Agriculture captured 56.95% of propionic acid market size in 2024 as livestock producers and grain handlers prioritized loss prevention and animal-performance gains. Feed mills incorporate liquid propionic acid or its salts into mash and pelleted diets, particularly for poultry and swine. In parallel, on-farm applicators dose stored grain to suppress mold growth during increasingly variable harvest conditions. The tight linkage between propionic acid usage and core food-security metrics anchors its strategic relevance to policymakers.

Pharmaceutical demand, although smaller, advances at 6.02% CAGR, making it the fastest-growing end-use as generic NSAID production scales in South Asia and Latin America. Food-and-beverage processors sustain mid-single-digit growth, leveraging propionic acid's clean-label positioning in bakery and dairy alternatives. Cosmetics formulators explore its antimicrobial plus conditioning benefits, widening adoption in leave-on skin-care products targeting spoilage-prone botanical extracts. This progressive diversification ensures the propionic acid market bears a balanced risk-return profile.

The Propionic Acid Market Report Segments the Industry by Application (Animal Feed and Preservatives, Calcium, Ammonium, and Sodium Salts, and More), End-User Industry (Agriculture, Food and Beverage, and More), Production Route (Petrochemical and Bio-Based Fermentation), Grade (Feed Grade, Food Grade, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Europe led with 48.78% revenue in 2024, anchored by stringent feed-and-food regulations that mandate proven preservatives and by a strong pharmaceutical manufacturing base. Germany, France, and the Netherlands collectively consume sizeable volumes for silage treatment and bakery goods, while Eastern Europe's expanding swine sector offers incremental upside. Energy-price volatility pressures European margins, yet the region's push for bio-economy solutions channels grant funding to pilot fermentative propionic acid units, reinforcing its innovation leadership.

Asia-Pacific is the fastest-growing territory at 6.34% CAGR, driven by China's livestock expansion, India's processed-food boom, and ASEAN's bakery surge. The 2024 Chinese anti-dumping duty of 43.5% on United States imports redirected tonnage flows and triggered local capacity projects, including BASF-SINOPEC's Nanjing expansion. Regional producers leverage proximity to feed-grain hubs and emerging bio-based chemical clusters, ensuring supply agility that accelerates propionic acid market penetration.

North America shows steady, maturity-phase demand growth. The United States retains large-scale grain-storage needs, with Midwest cooperatives adopting automated acidification systems for corn and soybean harvests. Feedlots in the Central Plains integrate liquid propionic acid to curtail mycotoxin development, while Canadian wheat exporters similarly deploy preservatives for trans-oceanic shipments. Capacity rationalization has replaced pure expansions, focusing on energy recovery upgrades to improve cost positions amid cyclic propylene swings. Such incremental efficiencies safeguard competitiveness and support stable volumes within the regional propionic acid market.

- BASF SE

- Celanese Corporation

- Dow

- Eastman Chemical Company

- KANTO KAGAKU

- Kishida Chemical Co., Ltd

- Luxi Group

- Merck KGaA

- OXEA Gmbh

- Perstorp

- Shanghai Jianbei Organic Chemical Co., Ltd.

- Yancheng Hongtai Bioengineering Co., Ltd.

- Yancheng Huade (Dancheng) Biological Engineering Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for grain and silage preservatives

- 4.2.2 Increasing uptake of feed-grade acids in antibiotic-free meat chains

- 4.2.3 Expansion of packaged bakery in emerging Asia

- 4.2.4 Growing requirement for food preservation products

- 4.2.5 Rising Utilization in Animal Feed

- 4.3 Market Restraints

- 4.3.1 Volatile petro-based feedstock prices (propylene)

- 4.3.2 Health concerns over chronic consumption in ultra-processed foods

- 4.3.3 Environmental Concerns Regarding Use of Herbicides

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Animal Feed and Preservatives

- 5.1.2 Calcium, Ammonium and Sodium Salts

- 5.1.3 Cellulose Acetate Propionate (CAP)

- 5.1.4 Herbicides

- 5.1.5 Plasticizers and Solvents

- 5.1.6 Others

- 5.2 By End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care

- 5.2.4 Pharmaceutical

- 5.2.5 Other End user Industries

- 5.3 By Production Route

- 5.3.1 Petrochemical

- 5.3.2 Bio-based Fermentation

- 5.4 By Grade

- 5.4.1 Feed Grade

- 5.4.2 Food Grade

- 5.4.3 Pharmaceutical Grade

- 5.4.4 Industrial Grade

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Celanese Corporation

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 KANTO KAGAKU

- 6.4.6 Kishida Chemical Co., Ltd

- 6.4.7 Luxi Group

- 6.4.8 Merck KGaA

- 6.4.9 OXEA Gmbh

- 6.4.10 Perstorp

- 6.4.11 Shanghai Jianbei Organic Chemical Co., Ltd.

- 6.4.12 Yancheng Hongtai Bioengineering Co., Ltd.

- 6.4.13 Yancheng Huade (Dancheng) Biological Engineering Co.,Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Novel low-carbon processes (electro-oxidative CO capture to PA)

- 7.3 Precision-fermentation routes for customised PA salts