PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850027

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850027

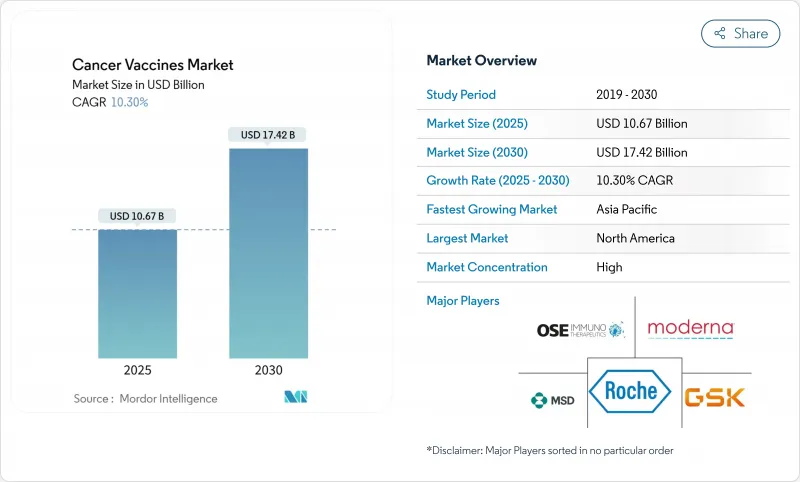

Cancer Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cancer vaccines market reached USD 10.67 billion in 2025 and is forecast to climb to USD 17.42 billion by 2030, advancing at a 10.30% CAGR during 2025-2030.

Accelerated growth reflects the pivot from conventional prophylaxis toward personalized mRNA-based immunotherapies that encode patient-specific neoantigens, underpinned by artificial-intelligence antigen prediction and modular micro-factory manufacturing that shortens scale-up cycles. Regulatory harmonization-evident in FDA breakthrough designations and EMA PRIME approvals-lowers cross-border trial friction, while partnership-heavy business models channel capital toward platform differentiation rather than stand-alone products. North America retains leadership yet Asia-Pacific shows the fastest uptake as Chinese developers deliver mRNA vaccines at costs 99% below Western levels.

Global Cancer Vaccines Market Trends and Insights

Growing Global Cancer Incidence

Cancer diagnoses are projected to rise 47% between 2020 and 2040, with the sharpest increases in regions lacking comprehensive oncology infrastructure; this demographic shift expands the addressable population for both preventive and therapeutic vaccines. Aging societies bring higher mutation loads, while earlier diagnostic practices enlarge the pool of patients eligible for tailored immunotherapies. Outpatient-friendly vaccine regimens align with the transition away from inpatient oncology care, trimming system costs that can exceed USD 150,000 per patient in high-income markets. Payers therefore see vaccines as cost-containment tools when compared with prolonged systemic therapies.

Increasing R&D Investments & Government Funding

Public-private partnership structures increasingly supplant traditional grants, sharing risk and compressing timelines. CEPI's CMC framework now guides quality standards for cancer vaccine manufacturing, smoothing multi-jurisdictional filings . European patent applications for cancer technologies climbed more than 70%, with universities filing a rising share, signaling collaborative innovation momentum. The UK's BioNTech program pledges personalized vaccines to 10,000 patients by 2030, illustrating how national health systems invest directly in commercialization pathways. Venture capital flows remain skewed toward oncology, leaving a gap that government funds increasingly fill.

Stringent Regulatory Timelines & Complexity

Personalized batch release protocols and AI-algorithm validation stretch approval cycles by 18-24 months beyond standard biologics. Smaller firms lacking global regulatory teams face disproportionate burdens, even though EMA's PRIME gives accelerated status once clinical data mature. Absence of common standards on AI model transparency further clouds review processes, adding compliance costs that erode margins.

Other drivers and restraints analyzed in the detailed report include:

- Advances in mRNA & Neoantigen Platforms

- AI-Driven Antigen Prediction Lowering Cost

- Availability of Alternative Immunotherapies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recombinant platforms retained a 43.33% share of the cancer vaccines market in 2024. Their installed manufacturing base and well-known safety records keep them relevant, yet mRNA/neoantigen vaccines are accelerating at an 11.21% CAGR through 2030 as developers prioritize multiplex antigen encoding and rapid customization. Self-amplifying constructs reduce dose volume tenfold and ease cold-chain stress, improving economics for resource-constrained settings. Viral-vector and DNA modalities continue to address niche populations where thermostability is paramount, especially in emerging markets. Whole-cell and dendritic vaccines, though smaller in volume, play specialized roles in highly personalized regimens; Diakonos Oncology's USD 20 million raise for glioblastoma underscores investor interest.

The technology spectrum is converging toward platform ecosystems that allow antigen swapping within weeks, a key differentiation for first movers. Shared-neoantigen libraries expand addressable populations beyond bespoke products, cutting per-patient costs and shortening regulatory reviews. As a result, the cancer vaccines market size attributed to mRNA constructs is forecast to widen its lead, especially once room-temperature formulations enter late-stage trials.

Cervical cancer accounted for 72.21% of the cancer vaccines market size in 2024, a legacy of widespread HPV immunization campaigns. Melanoma vaccines, however, are advancing at an 11.02% CAGR as robust biomarkers facilitate precise patient matching and regulators grant breakthrough designations. Prostate and glioblastoma programs build on dendritic-cell platforms, while shared-neoantigen strategies open doors for colorectal and gastric cancers. Positive melanoma results reduce risk perceptions for adjacent solid tumors, drawing capital toward multi-cancer platform trials.

The transition from single-tumor success stories to platform-based multi-cancer solutions is expected to dilute cervical dominance over time, distributing the cancer vaccines market share more evenly across indications by 2030.

The Cancer Vaccines Market is Segmented by Technology (Recombinant Vaccines, and More), Treatment Method (Preventive Vaccines and Therapeutic Vaccines), Cancer Type (Cervical Cancer (HPV), Melanoma and More), Delivery Route (Intramuscular, Intravenous, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 46.21% share in 2024 stems from mature regulatory pathways, extensive trial networks, and steady public funding such as the National Cancer Institute's USD 2.5 million translational grants. USMCA streamlines cross-border studies, drawing Canadian and Mexican stakeholders into joint manufacturing ventures. Venture investment culture sustains high-risk R&D, keeping the cancer vaccines market growth in the region well above global averages despite mounting cost pressures.

Europe leverages coordinated public-private initiatives; the UK-BioNTech partnership targeting 10,000 patients by 2030 exemplifies how national health systems deploy purchasing power to spur innovation. EMA PRIME accelerates late-stage reviews, while Germany, France, and Italy supply academic expertise and GMP capacity. Reimbursement frameworks that value patient-centric outcomes favor adoption of personalized solutions, maintaining Europe's competitive weight.

Asia-Pacific posts the fastest 11.38% CAGR owing to state-sponsored biotech programs and low-cost manufacturing that erodes Western price advantages. China funds modular micro-factories and free HPV drives, while Japan and South Korea export advanced process technologies. India's contract-manufacturing depth and expansive patient base make it a pivotal trial hub. Australia's regulatory alignment with ICH standards positions it as a bridge market for trans-Pacific commercialization.

- Merck

- GlaxoSmithKline

- Moderna

- Bristol-Myers Squibb

- AstraZeneca

- F. Hoffmann-La Roche AG (Genentech)

- BioNTech

- Gritstone bio, Inc.

- Vaccitech plc

- OSE Immunotherapeutics SA

- Anixa Biosciences

- Dendreon Pharmaceuticals

- Providence Therapeutics Holdings

- eTheRNA Immunotherapies NV

- Imugene Ltd.

- Transgene

- OncoSec Medical Incorporated

- NantKwest Inc.

- Ultimovacs ASA

- ISA Pharmaceuticals BV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing global cancer incidence

- 4.2.2 Increasing R&D investments & government funding

- 4.2.3 Advances in mRNA & neoantigen platforms

- 4.2.4 AI-driven antigen prediction lowering cost

- 4.2.5 Modular micro-factory manufacturing hubs

- 4.2.6 Combination regimens with CPIs de-risking trials (under-reported)

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory timelines & complexity

- 4.3.2 Availability of alternative immunotherapies

- 4.3.3 Cold-chain gaps for personalised logistics

- 4.3.4 Neoantigen IP clustering limiting entrants

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Recombinant Vaccines

- 5.1.2 Viral Vector & DNA Vaccines

- 5.1.3 mRNA/Neoantigen Personalised Vaccines

- 5.1.4 Whole-cell & Dendritic Cell Vaccines

- 5.1.5 Other Technologies

- 5.2 By Treatment Method

- 5.2.1 Preventive Vaccines

- 5.2.2 Therapeutic Vaccines

- 5.3 By Cancer Type

- 5.3.1 Cervical Cancer (HPV)

- 5.3.2 Prostate Cancer

- 5.3.3 Melanoma

- 5.3.4 Other Cancers

- 5.4 By Delivery Route

- 5.4.1 Intramuscular

- 5.4.2 Intradermal / Sub-cutaneous

- 5.4.3 Intravenous

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Merck & Co., Inc.

- 6.3.2 GlaxoSmithKline plc

- 6.3.3 Moderna Inc.

- 6.3.4 Bristol Myers Squibb Co.

- 6.3.5 AstraZeneca plc

- 6.3.6 F. Hoffmann-La Roche AG (Genentech)

- 6.3.7 BioNTech SE

- 6.3.8 Gritstone bio, Inc.

- 6.3.9 Vaccitech plc

- 6.3.10 OSE Immunotherapeutics SA

- 6.3.11 Anixa Biosciences Inc.

- 6.3.12 Dendreon Pharmaceuticals LLC

- 6.3.13 Providence Therapeutics Holdings

- 6.3.14 eTheRNA Immunotherapies NV

- 6.3.15 Imugene Ltd.

- 6.3.16 Transgene SA

- 6.3.17 OncoSec Medical Incorporated

- 6.3.18 NantKwest Inc.

- 6.3.19 Ultimovacs ASA

- 6.3.20 ISA Pharmaceuticals BV

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment