PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850034

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850034

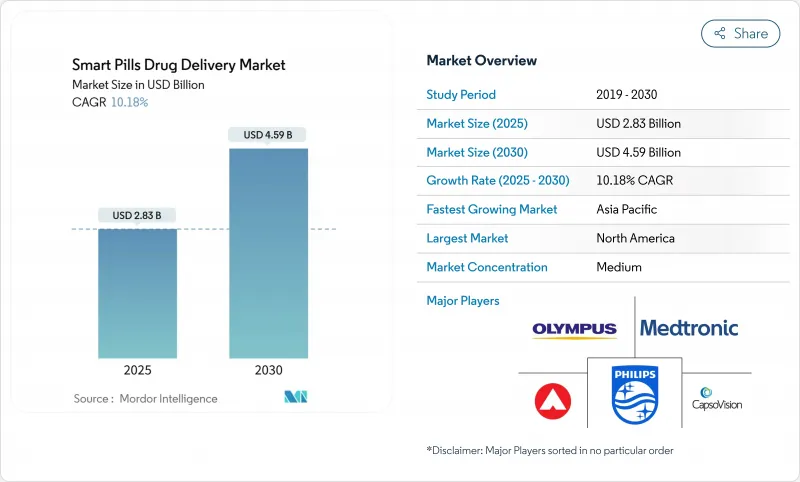

Smart Pills Drug Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart pills drug delivery market reached USD 2.83 billion in 2025 and is projected to grow to USD 4.59 billion by 2030, reflecting a 10.18% CAGR.

Growing integration of miniaturized electronics, ingestible sensors, and AI analytics positions ingestible devices as a core pillar of precision medicine. Recent FDA cybersecurity guidance and the Transitional Coverage for Emerging Technologies pathway address earlier regulatory and reimbursement barriers, clearing the way for faster commercialization. Capsule endoscopy retains a strong installed base, yet drug-delivery capsules show the highest momentum as therapeutic use cases expand. Asia-Pacific's double-digit growth rate underscores rising healthcare investment, while North America benefits from early adopter health systems and robust venture funding. Competitive intensity is increasing as large device makers add smart pill portfolios and specialized start-ups drive niche innovations.

Global Smart Pills Drug Delivery Market Trends and Insights

Rapid Adoption of Capsule Endoscopy for GI Diagnostics

Capsule endoscopy has matched traditional colonoscopy in polyp detection, reaching pooled detection rates of 0.61 in 2024 clinical trials. Patient acceptance is higher because the procedure eliminates sedation and hospital stays. AI-driven lesion recognition and magnetic steering now enable precise localization, opening a path to targeted therapy delivery. Research prototypes featuring robotic functions already combine imaging with site-specific drug release. This progression from passive imaging to autonomous intervention keeps capsule endoscopy at the center of smart pills drug delivery market innovation.

Preference for Minimally Invasive Patient Monitoring

Consumers increasingly favor noninvasive monitoring, driving uptake of ingestible sensors that map gut gases in three dimensions and flag disease biomarkers in real time. USC engineers recently demonstrated GPS-like smart pills that pair optical gas sensing with wearable magnetic coils for sub-millimeter localization. Cloud-based AI transforms raw signals into actionable alerts, widening clinical acceptance while preparing the smart pills drug delivery market for at-home deployment.

Stringent FDA & EMA Device-Drug Combination Approval Path

Smart pills often fall under Class III review, demanding lengthy clinical trials and extensive cybersecurity documentation. The FDA now also requires predetermined change-control plans for AI functions. Navigating parallel EMA rules increases costs and can delay multi-region rollouts, tempering the smart pills drug delivery market growth trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Growing Chronic-Disease Burden & Poly-Pharmacy

- Integration With Telehealth & Remote Adherence Platforms

- Cyber-Security Risks of Sensor-to-Cloud Data Flow

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drug-delivery capsules recorded the highest 14.56% CAGR, despite capsule endoscopy retaining 41.34% 2024 revenue leadership. This divergence shows the market's therapeutic shift as companies harness smart pills for precise dosing. MIT's once-weekly risperidone capsule validates sustained psychiatric dosing, underscoring new care models. Active-pumping capsules now pair biomarker sensing with on-demand release, enabling closed-loop therapy and boosting the smart pills drug delivery market's clinical value.

Drug-delivery tools answer unmet needs in inflammatory bowel disease and localized cancers. Magnetically navigated capsules allow clinicians to linger at sites of interest, overcoming historic limits of passive transit. As these devices progress through trials, healthcare providers anticipate better outcomes and lower systemic drug exposure, reinforcing adoption.

Ingestible sensors held 52.34% revenue, but AI-driven software platforms grew fastest at 14.88% CAGR. Providers seek insights rather than data, shifting value upstream to analytics that interpret ingestion patterns, lesion images, and physiological signals. FDA guidance on algorithm change-control fosters iterative updates while safeguarding safety. This regulatory clarity accelerates deployment, deepening reliance on analytics layers inside the smart pills drug delivery market.

Wearable receivers bridge capsules and clouds, ensuring uninterrupted data flow even in low-connectivity settings. As sensor miniaturization proceeds, stakeholders anticipate multi-parameter chips that integrate pH, temperature, and pressure sensing, further amplifying the role of software in deriving clinical meaning.

Smart Pills Drug Delivery Market Report is Segmented by Type (Capsule Endoscopy, Patient Monitoring Smart Pills, and More), Component (Ingestible Sensor, Wearable Receiver/Patch and More), Application (Diagnostic Imaging, Targeted Drug Delivery and More), End User (Hospitals & Clinics, Diagnostic Centers and More) Disease Indication (Oncology and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 44.56% revenue in 2024, supported by FDA pathways and strong venture funding. CMS's Transitional Coverage for Emerging Technologies expedites reimbursement for breakthrough devices, reducing payback risk. Defense budgets dedicate USD 1.66 billion to chemical and biological countermeasures, some of which fund ingestible diagnostics. These factors cement regional leadership in the smart pills drug delivery market.

Asia-Pacific is the fastest-growing region at 13.24% CAGR through 2030. Japan's Pharmaceuticals and Medical Devices Agency accelerates approvals, while China's digital-health investments integrate smart pills into chronic-care platforms. India's Medical Device Rules 2018 clarify classification and compliance, encouraging local production. Economies of scale in electronics manufacturing lower unit costs, fueling regional penetration.

Europe exhibits stable growth within a stringent data-protection context. Germany, the United Kingdom, and France showcase hospital pilots combining smart pills with AI interpretation. The EU Medical Device Regulation ensures safety but lengthens certification cycles, prompting firms to deploy North America first. South America and Middle East & Africa follow with nascent though expanding adoption as healthcare access broadens.

- Medtronic

- Olympus Corp

- Philips NV

- CapsoVision

- Jinshan Science & Tech

- Check-Cap Ltd.

- etectRx

- Otsuka Pharmaceutical Co.

- HQ

- IntroMedic Co.

- BodyCap Medical

- Proteus Digital Health

- RF Tracking Systems

- AnX Robotica

- Chongqing Science & Tech

- Pentax Medical

- Karl Storz

- Fujifilm Holdings Corp

- Boston Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption Of Capsule Endoscopy For GI Diagnostics

- 4.2.2 Preference For Minimally-Invasive Patient Monitoring

- 4.2.3 Growing Chronic-Disease Burden & Poly-Pharmacy

- 4.2.4 Integration With Telehealth & Remote Adherence Platforms

- 4.2.5 Venture-Capital Shift Toward Ingestible Bio-Electronics

- 4.2.6 Defense / Space-Medicine Funding For "Inside-Out" Vitals Sensing

- 4.3 Market Restraints

- 4.3.1 Stringent FDA & EMA Device-Drug Combination Approval Path

- 4.3.2 Adverse Events: Capsule Retention & GI Obstruction

- 4.3.3 Cyber-Security Risks Of Sensor-To-Cloud Data Flow

- 4.3.4 Reimbursement Gaps For Digital Ingestion Event Markers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Capsule Endoscopy

- 5.1.2 Patient Monitoring Smart Pills

- 5.1.3 Drug-Delivery Smart Pills

- 5.2 By Component

- 5.2.1 Ingestible Sensor

- 5.2.2 Wearable Receiver/Patch

- 5.2.3 Software & Analytics Platform

- 5.3 By Application

- 5.3.1 Diagnostic Imaging

- 5.3.2 Medication Adherence Tracking

- 5.3.3 Targeted Drug Delivery

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic Centers

- 5.4.3 Home Healthcare

- 5.4.4 Research Institutes

- 5.5 By Disease Indication

- 5.5.1 Gastro-intestinal Disorders

- 5.5.2 Oncology

- 5.5.3 Obesity & Metabolic Disorders

- 5.5.4 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Olympus Corp

- 6.3.3 Philips NV

- 6.3.4 CapsoVision Inc.

- 6.3.5 Jinshan Science & Tech

- 6.3.6 Check-Cap Ltd.

- 6.3.7 etectRx Inc.

- 6.3.8 Otsuka Pharmaceutical Co.

- 6.3.9 HQ Inc.

- 6.3.10 IntroMedic Co.

- 6.3.11 BodyCap Medical

- 6.3.12 Proteus Digital Health

- 6.3.13 RF Tracking Systems

- 6.3.14 AnX Robotica

- 6.3.15 Chongqing Science & Tech

- 6.3.16 PENTAX Medical

- 6.3.17 Karl Storz SE & Co. KG

- 6.3.18 Fujifilm Holdings Corp

- 6.3.19 Boston Scientific Corp

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment