PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850047

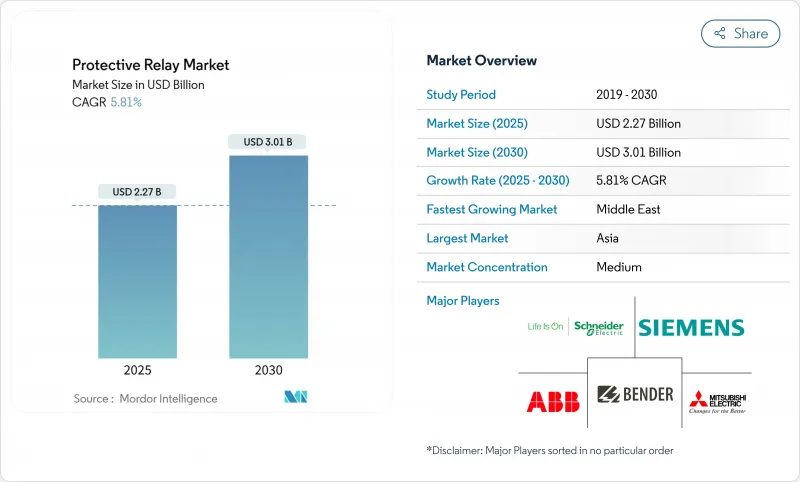

Protective Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global protective relay market stood at USD 2.27 billion in 2025 and is forecast to attain USD 3.01 billion by 2030, advancing at a 5.81% CAGR over 2025-2030.

Rising grid-modernization capital programs across developed economies, rapid renewable-energy integration, and accelerating digital-substation roll-outs continue to stimulate large-scale deployments of microprocessor-based relays that can manage bidirectional power flows, execute self-diagnostics, and exchange data over IEC 61850 protocols. High-voltage investments, especially China's +-800 kV UHVDC corridors and North America's long-haul transmission build-outs, are lifting demand for high-speed distance devices that respond in under two cycles and withstand harsh environments. Meanwhile, utilities and industrial owners are prioritizing retrofit upgrades on aging switchyards where more than 70% of transmission lines exceed 25 years of service, creating a sizeable aftermarket for drop-in digital replacements. Finally, cybersecurity mandates such as NERC CIP in North America and NIS-2 in Europe are reshaping product specifications toward embedded intrusion detection and secure firmware, giving vendors with strong software capabilities a competitive.

Global Protective Relay Market Trends and Insights

Grid-modernization investments surging in North America's T&D infrastructure

Utility capex on United States transmission equipment reached USD 27.7 billion in 2024, almost triple the levels recorded at the start of the last decade, and the Department of Energy's Grid Resilience and Innovation Partnerships is allocating USD 2.2 billion to harden networks across 18 states, directly driving new protective relay market deployments. The National Transmission Planning Study shows required transfer capability must double or triple by 2050, creating sustained demand for devices that coordinate long-distance, low-inertia power corridors. With more than 70% of high-voltage lines older than 25 years, utilities are replacing electromechanical relays with numerical units that support synchrophasor inputs and high-speed peer-to-peer messaging for adaptive protection.

.These upgrades are concentrated in renewable-rich regions where variable generation and reverse power flows require distance, under-frequency, and out-of-step functionality in the same housing. As a result, the protective relay market is seeing multi-year framework agreements that bundle hardware, secure firmware, and analytics into performance-based service contracts

Rapid digital-substation roll-outs across EU to meet Fit-for-55 objectives

European network operators are replacing copper-wired secondary systems with fiber-optic process buses that cut substation construction costs by up to 30% and shrink outage windows during brownfield retrofits. National Grid has committed to 40 fully digital yards over the next decade, illustrating how Fit-for-55 decarbonization targets translate into large protective relay market orders that specify strict IEC 61850 Edition 2 interoperability.

Mandated cybersecurity under NIS-2 is elevating demand for relays with hardware-root-of-trust, tenant-based access controls, and encrypted GOOSE messaging, turning secure firmware updates into a key purchase criterion. In addition, Europe's rising offshore-wind capacity requires differential schemes tuned for long AC export cables that exhibit high capacitance, leading manufacturers to integrate traveling-wave fault-location into distance platforms . Vendors able to certify end-to-end solutions-from optical current transformers to station-level engineering workstations-are capturing a premium on turnkey projects funded through EU green-bond allocations

Counterfeit low-cost relays flooding emerging Asian markets

Price-driven procurement in several South and Southeast Asian utilities has enabled grey-market vendors to supply devices that visually mimic legitimate units yet fail acceptance tests under multistage faults, undermining grid security and eroding trust in upgrades . China Quality Certification Centre has expanded type-test services to include spectral analysis of printed-circuit materials and destructive firmware audits in an attempt to curb counterfeit influx . However, enforcement remains uneven and utility engineers often lack resources to trace serial numbers back to factory batches, exposing networks to hidden failure modes that can trip large sections of the grid. The resulting reputational risk slows legitimate purchasing cycles and suppresses protective relay market growth until stronger anti-counterfeit frameworks are adopted

Other drivers and restraints analyzed in the detailed report include:

- Renewable-rich micro-grids in Pacific Island nations driving islanding protection demand

- Chinese ultra-high-voltage (UHV) projects necessitating high-speed distance relays

- Supply-chain lead-time volatility for ASIC and FPGA components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-voltage devices targeting 100 kV and above delivered the fastest 6.9% CAGR and captured a growing slice of the protective relay market in 2025 as China, the United States, and the Gulf Cooperation Council prioritized long-haul corridors that move renewable energy to load centers. Medium-voltage remains the anchor with 47.1% of protective relay market share in 2024 because distribution feeders, industrial campuses, and data centers require standardized overcurrent and earth-fault schemes that vendors ship in high volumes. Next-generation distance platforms integrate time-domain traveling-wave and line-differential logic to speed fault clearing on UHVDC lines, while optical current transformers reduce CT saturation risk at high burden, cutting footprint in compact GIS bays.

Enhanced power-quality monitoring bundled with synchrophasor publishing is becoming mandatory on transmission relays so that system operators can flag subsynchronous oscillations from large inverter parks, deepening penetration of multifunction units in the protective relay market. In parallel, low-voltage applications below 1 kV keep steady demand in building automation, where arc-fault and residual-current functions are integrated into molded-case breakers that ship with embedded Bluetooth commissioning suppor

Feeder models held 28.3% of protective relay market share in 2024 because utilities deploy thousands of identical units per network, yet generator protection is advancing at an 8.4% CAGR through 2030 as solar PV and battery storage introduce fast-ramping dynamics that challenge legacy negative-sequence and loss-of-field logic. Manufacturers are embedding phase-locked loops that track weak-grid frequency and algorithms that distinguish fault current from inverter control responses, meeting evolving grid codes and securing incremental sales.

Motor, transformer, and busbar relays continue to form a stable mid-tier revenue block, but niche microgrid and process-bus relays featuring IEC 61850 -9-2 sampled-value inputs are emerging in petrochemical and semiconductor fabs seeking fibre-optic galvanic isolation. The protective relay market is therefore bifurcating: volume-driven feeder units optimized for pricing and high-function premium devices aimed at complex generation or process assets

The Protective Relay Market Report is Segmented by Voltage Range (Low-Voltage (Less Than 1 KV), Medium-Voltage (1-69 KV), and High-Voltage (Above 69 KV)), Product Type (Transformer Protection Relays, Feeder Protection Relays, and More), End User Industry (Utilities, Industrial, and More), Installation Type (New Build, and Retrofit/Upgrade), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific delivered 34.4% of protective relay market share in 2024 as China invested CNY 500 billion (USD 68.5 billion) in UHV transmission and India accelerated renewable integration, prompting relay orders for both distance and differential schemes. Japan's reconductoring projects and Southeast Asia's data-center boom added steady medium-voltage demand, while local suppliers leveraged cost advantages and regional manufacturing incentives.

North America remains a technology test-bed where utilities pilot synchrophasor-based adaptive protection and vendor-agnostic process-bus architectures, pushing higher ASPs within the protective relay market. Canada's hydro-export corridors and Mexico's cross-border renewable projects further underpin high-voltage deployments. NERC CIP requirements compel purchase of devices with tamper-proof logging and multifactor authentication, raising the software content per unit.

The Middle East is forecast to post the fastest 6.8% CAGR through 2030 as Gulf states commit USD 54 billion for renewable portfolios and smart grid automation, spurring protective relay market growth in solar parks, hydrogen electrolyzers, and HVDC subsea links to trading partners. Dubai's automatic grid-restoration platform demonstrates regional ambition for fully digital operations that integrate restoration logic into central EMS, elevating relay specification levels. Europe maintains mid-single-digit gains under Fit-for-55, with emphasis on cybersecurity certification and interoperability. South America offers upside tied to wind corridors in Brazil and cross-Andes interconnects but faces currency and political risks that delay approvals

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- General Electric Co.

- Mitsubishi Electric Corp.

- Eaton Corp. PLC

- Schweitzer Engineering Laboratories Inc.

- Toshiba Corp.

- Rockwell Automation Inc.

- Littelfuse Inc.

- Bender GmbH and Co. KG

- Larsen and Toubro Electrical and Automation

- NR Electric Co. Ltd.

- Fanox Electronics

- Basler Electric Co.

- NARI Technology Co. Ltd.

- Hitachi Energy Ltd.

- Omron Corp.

- CG Power and Industrial Solutions Ltd.

- Arteche Group

- Alstom Grid (SEG Electronics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Grid-Modernization Investments Surging in North America's T&D Infrastructure

- 4.2.2 Rapid Digital Substation Roll-outs Across EU to Meet Fit-for-55 Objectives

- 4.2.3 Renewable-Rich Micro-grids in Pacific Island Nations Driving Islanding Protection Demand

- 4.2.4 Chinese Ultra-High-Voltage (UHV) Projects Necessitating High-Speed Distance Relays

- 4.2.5 Industrial IoT-based Predictive Maintenance Enhancing Demand for Self-diagnostic Relays

- 4.3 Market Restraints

- 4.3.1 Counterfeit Low-cost Relays Flooding Emerging Asian Markets

- 4.3.2 Supply-chain Lead-time Volatility for ASIC and FPGA Components

- 4.3.3 Complex Cyber-security Certification Delays in EU

- 4.3.4 Skilled Workforce Gap for IEC 61850 Engineering in Africa

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Cyber-secure Relay Firmware Mandates (NERC CIP-013, EU NIS2)

- 4.5.2 Transition from Electromechanical to IEC 61850-based Digital Relays

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Voltage Range

- 5.1.1 Low-Voltage (Less than 1 kV)

- 5.1.2 Medium-Voltage (1-69 kV)

- 5.1.3 High-Voltage (Above 69 kV)

- 5.2 By Product Type

- 5.2.1 Transformer Protection Relays

- 5.2.2 Feeder Protection Relays

- 5.2.3 Motor Protection Relays

- 5.2.4 Generator Protection Relays

- 5.2.5 Busbar and Process Protection Relays

- 5.3 By End-user

- 5.3.1 Utilities (Transmission, Distribution)

- 5.3.2 Industrial (Oil and Gas, Metals and Mining, Chemicals, Manufacturing)

- 5.3.3 Commercial and Infrastructure

- 5.3.4 Transportation (Rail, Airports, Marine)

- 5.4 By Installation Type

- 5.4.1 New Build

- 5.4.2 Retrofit/Upgrade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Schneider Electric SE

- 6.4.3 Siemens AG

- 6.4.4 General Electric Co.

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Eaton Corp. PLC

- 6.4.7 Schweitzer Engineering Laboratories Inc.

- 6.4.8 Toshiba Corp.

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 Littelfuse Inc.

- 6.4.11 Bender GmbH and Co. KG

- 6.4.12 Larsen and Toubro Electrical and Automation

- 6.4.13 NR Electric Co. Ltd.

- 6.4.14 Fanox Electronics

- 6.4.15 Basler Electric Co.

- 6.4.16 NARI Technology Co. Ltd.

- 6.4.17 Hitachi Energy Ltd.

- 6.4.18 Omron Corp.

- 6.4.19 CG Power and Industrial Solutions Ltd.

- 6.4.20 Arteche Group

- 6.4.21 Alstom Grid (SEG Electronics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment